A quick Twitter thread on news the USO has been halted because it has run out of its buffer of pre-registered shares, which now makes it impossible for the fund to maintain any semblance of tracking.

2. This is possibly worth a read https://ftalphaville.ft.com/2010/09/18/346406/can-an-etf-collapse/">https://ftalphaville.ft.com/2010/09/1...

3. The way ETFs work is that the managers pre-register potential shares that might end up outstanding. If and when they run out of those buffers, as per any stock, they would have to go through a regulatory process to register new shares.

4. It& #39;s not dissimilar to how some ICOs hold back coin supply at the origination point.

5. What has in essence happened is that demand for USO creations was so extreme, it ate through the buffer of pre-registered shares before the fund could register new ones.

The USO filed a note intending to register 4bn shares. That seems like a lot to do pre-emptively! Obviously the regulatory process of registering bears some expense so it& #39;s worth to overshoot your current needs, but the size of the request implies the USO is expecting big demand

6. The fund will suspend creations as a result, but redemptions will continue to be possible. If it continues to trade (trade has now resumed) this would imply the ETF could become highly overpriced to its indicative NAV. A.k.a begin trading at an exceptional premium.

7. This would have the impact of reducing the buying pressure on front month WTI futures, while decreasing the selling pressure on the USO ETF.

8. Current shares outstanding are 1,188,000,000, so that puts the 4bn in nice context.

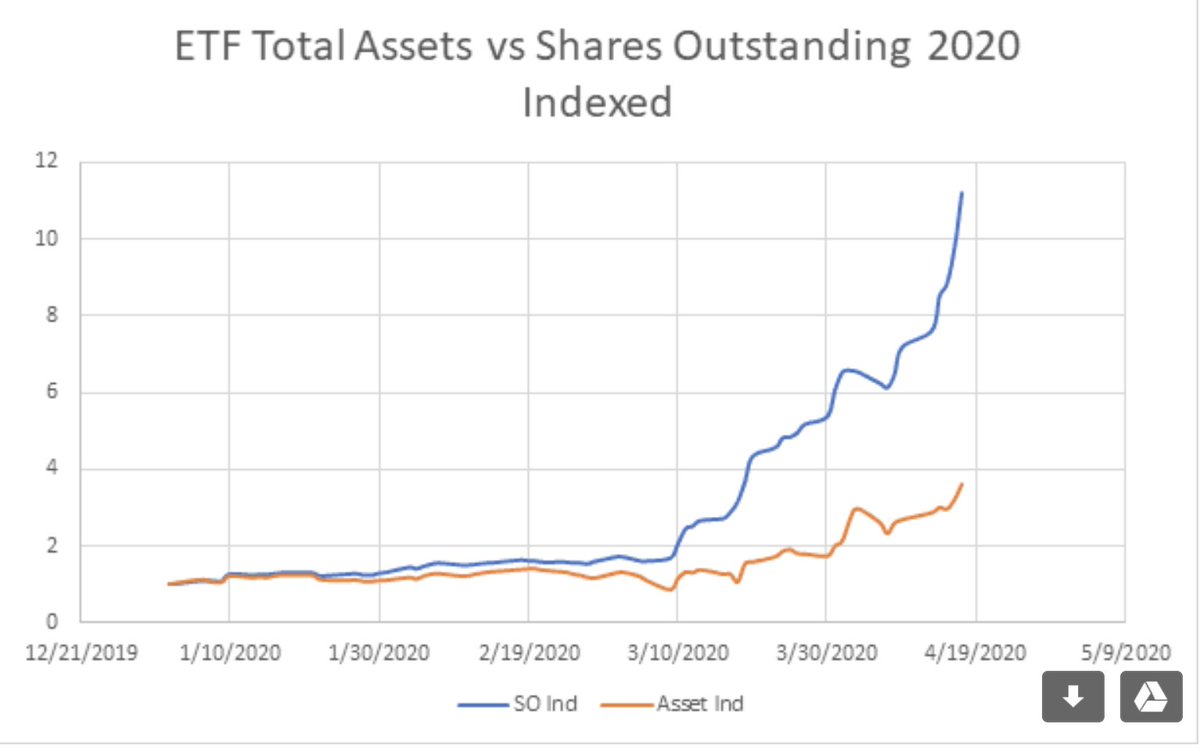

Now the interesting thing about shares outstanding is that it has been growing MORE quickly in recent weeks than AUM. I have indexed the relative performance here (for ETF read USO ETF):

So what would be behind that? One possibility (and this is theoretical) is if due to internalisation by APs/market makers, and offsetting arb impact, previous short positioning did not manifest in the increased supply of shares it should have otherwise done.

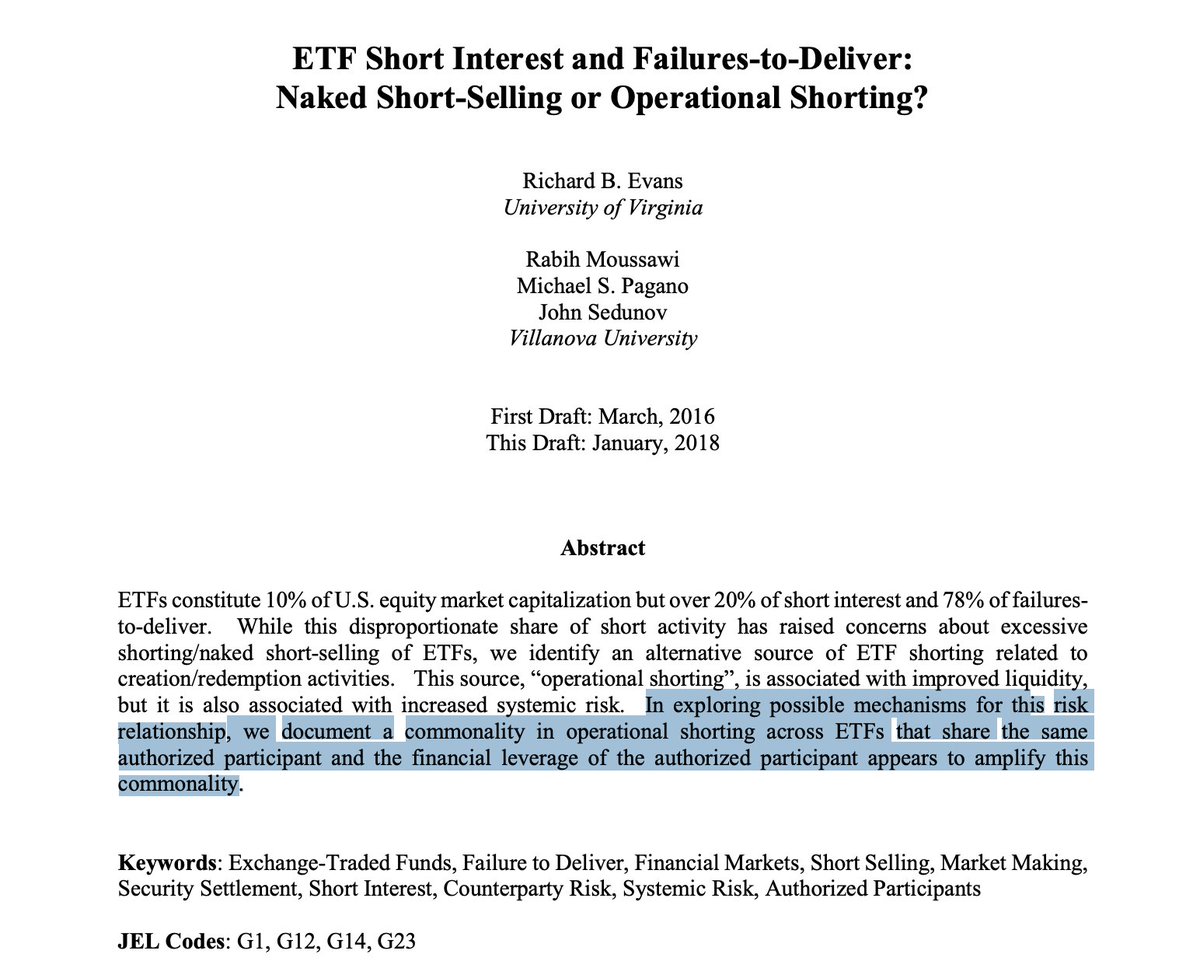

That is to say an element of rehypothecation was at play. Again do read this 2010 piece which explores some of these issues. https://ftalphaville.ft.com/2010/09/18/346406/can-an-etf-collapse/">https://ftalphaville.ft.com/2010/09/1... but also this paper (abstract highlighted beloe) https://jacobslevycenter.wharton.upenn.edu/wp-content/uploads/2018/08/ETF-Short-Interest-and-Failures-to-Deliver.pdf">https://jacobslevycenter.wharton.upenn.edu/wp-conten...

Read on Twitter

Read on Twitter