Polarization of markets isn& #39;t a bug but rather a feature. And it turns out, if your performance is horrible, you can blame it on polarization in the markets.

It& #39;s like using "traffic", "weather" or "health issues" excuse whenever you& #39;re late to office or need to skip it. https://twitter.com/anishteli/status/1252570497424019456">https://twitter.com/anishteli...

It& #39;s like using "traffic", "weather" or "health issues" excuse whenever you& #39;re late to office or need to skip it. https://twitter.com/anishteli/status/1252570497424019456">https://twitter.com/anishteli...

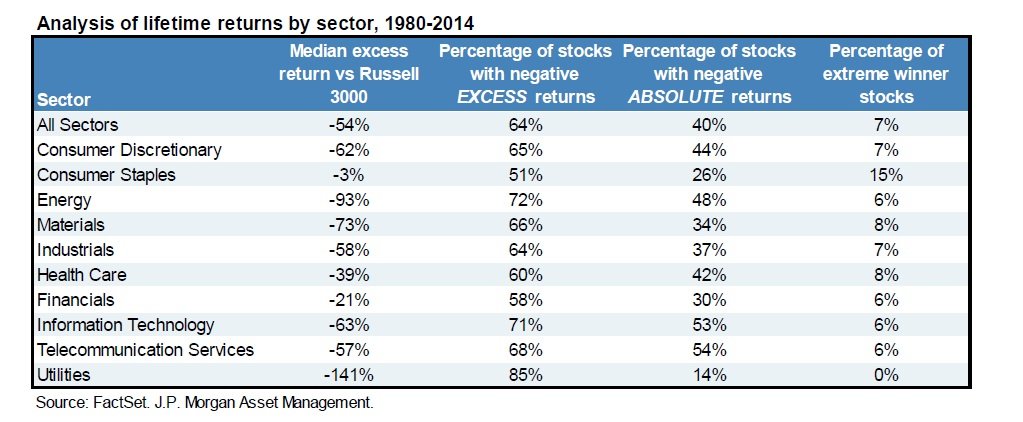

A small % of stocks will always drive returns. It& #39;s the same across the world.

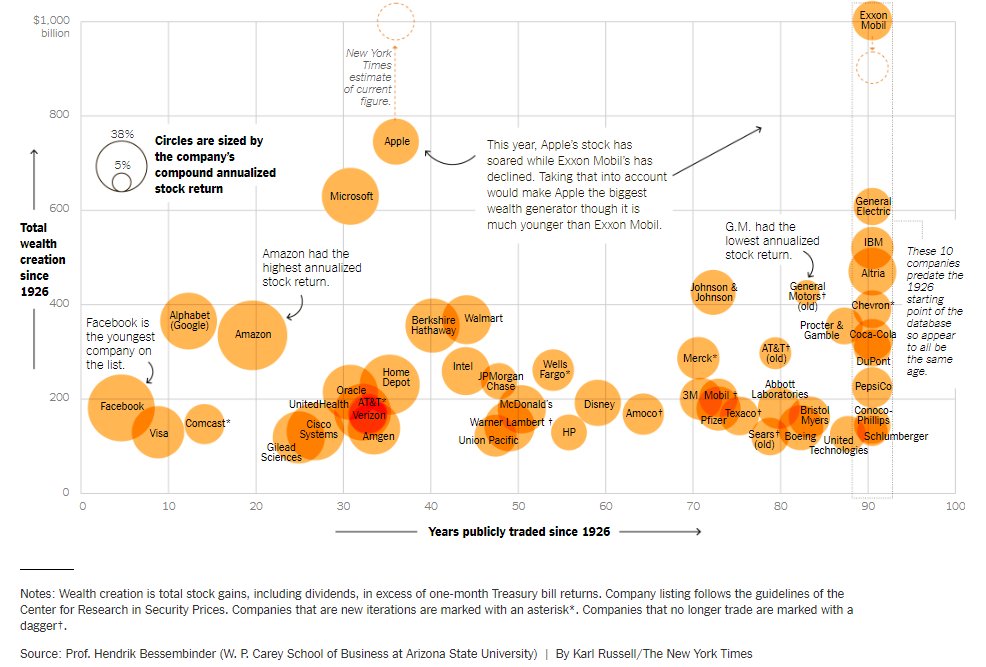

Professor Hendrik Bessembinder& #39;s study found:

"Only 4 percent of all publicly traded stocks account for all of the net wealth earned by investors in the stock market since 1926"

The other stocks don& #39;t even outperform a T-bill!

https://papers.ssrn.com/sol3/Papers.cfm?abstract_id=2900447">https://papers.ssrn.com/sol3/Pape...

"Only 4 percent of all publicly traded stocks account for all of the net wealth earned by investors in the stock market since 1926"

The other stocks don& #39;t even outperform a T-bill!

https://papers.ssrn.com/sol3/Papers.cfm?abstract_id=2900447">https://papers.ssrn.com/sol3/Pape...

On this https://twitter.com/passivefool/status/1226125573971251200?s=20">https://twitter.com/passivefo...

This why cap-weighted indices work pretty well over the long run. They pretty much ensure, the winners are rewarded and losers are rid of like a bad smell. It& #39;s the easiest way to get exposure to innovation and change. Mr. Market is pretty decent fund manager.

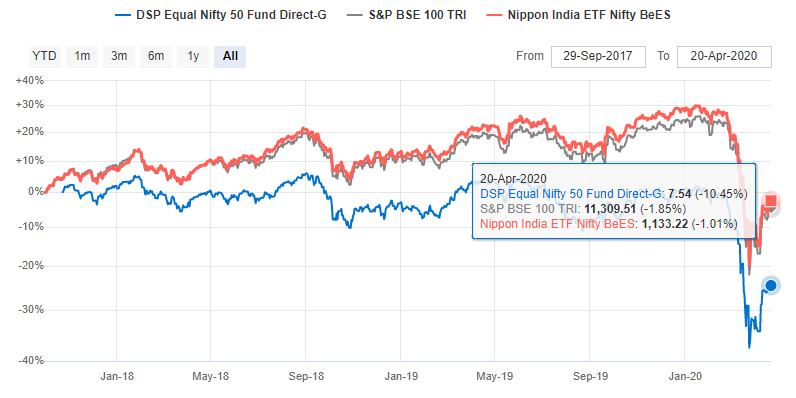

Before you ask why cap-weight and not equal weight, it has been a horrible Idea in India so far? Will the performance remain bad - I don& #39;t know! Will equal weight do better in the future? I don& #39;t know! But best not to complicate things, in my view.

There& #39;s an insane amount of data on equal weighting in this thread, in case you& #39;re curious. https://twitter.com/ShyamNation/status/1250295230747688961?s=20">https://twitter.com/ShyamNati...

Next time you see someone whining about polarization, put a chilli in their mouth and run away. Or take a look at that particular manager& #39;s performance and odds are he or she would have under permed the benchmark or maybe even a FD :p

Read on Twitter

Read on Twitter