I’m doing this thread in response to the numerous posts that made rounds today regarding the sharp fall in Crude Oil prices below $0 per barrel.

I see a lot of misconceptions around this, so some clarity

Might be a lengthy thread, but I’ll try to simplify things. #Thread

I see a lot of misconceptions around this, so some clarity

Might be a lengthy thread, but I’ll try to simplify things. #Thread

Let’s establish some basics first...

Crude Oil exists in different grades, largely a result of the location where it occurs and a few other factors. Key point is this - grades are classified based on API gravity (higher is better) and sulphur content (lower is better).

Crude Oil exists in different grades, largely a result of the location where it occurs and a few other factors. Key point is this - grades are classified based on API gravity (higher is better) and sulphur content (lower is better).

On that basis, you can categorize oil into Heavy/Light (API gravity) and Sour/Sweet (Sulphur Content). There could be variations of these too - Medium Light, Extra Light, and so on.

To put some context to this, the most attractive oil from Nigeria is Bonny Light and it is of the Light-Sweet variety (i.e High API gravity and very low sulphur content). Nigeria also has Forcados Light (the most popular, majorly produced by Shell), Brass River, Antan Blend,

... Qua Iboe, Pennington Light, etc. Most of these grades are also on the Light-Sweet spectrum.

Saudi Arabia has Arabian Light, Arabian Heavy, etc. US has Eagle Ford, West Texas Sour, UAE has Dubai Heavy, Russia has Urals. Crude has grades, so it has to be priced differently.

Saudi Arabia has Arabian Light, Arabian Heavy, etc. US has Eagle Ford, West Texas Sour, UAE has Dubai Heavy, Russia has Urals. Crude has grades, so it has to be priced differently.

The light-sweet variety is usually the more expensive for obvious reasons. Low sulphur content and high API gravity means it yields higher volumes of PMS (which we call petrol - the lifeblood of road transportation and most engines). Heavy/Sour generally yields more diesel.

With all of these varieties, you’d imagine that there should be benchmarks for pricing this all-important commodity.

Yes, 2/3 of the world’s oil is benchmarked to BRENT some to West Texas Intermediate (WTI)and most of the Middle East grades take dress-in from DUBAI HEAVY.

Yes, 2/3 of the world’s oil is benchmarked to BRENT some to West Texas Intermediate (WTI)and most of the Middle East grades take dress-in from DUBAI HEAVY.

These benchmarks speak a lot to geography. Brent for Europe/Africa, WTI for North America and DH for the Middle East. From my explanation, it is clear that Nigeria’s grades are benchmarked to Brent. So, they’d trade in the global oil markets at a Premium or Discount to Brent...

...depending on the quality (remember what I said about sulphur content and gravity?).

WTI is generally lighter and sweeter than Brent, but Brent is priced higher. This does not make a lot of sense, given my initial talk about quality.

WTI is generally lighter and sweeter than Brent, but Brent is priced higher. This does not make a lot of sense, given my initial talk about quality.

WTI is cheaper because most of the oil it tracks is produced in land-locked areas of the US (Texas, Dakota, etc) where it is quite difficult to evacuate and transport to buyers.

Brent on the other hand is largely produced in the North Sea (UK to Norway)...

Brent on the other hand is largely produced in the North Sea (UK to Norway)...

and since the major means of transportation for oil is marine, then demand for Brent is expectedly higher. Of course, this is because it will generally be cheaper to transport Brent from production sites to refineries or other buyers, compared to WTI.

Away from the basics...

I think it is pretty clear what COVID-19 has done to the global economy.

Factory shutdowns, global restrictions on movement, a synchronized economic slowdown that has led the IMF to project negative global growth for 2020 at - 3.0% (a recession).

I think it is pretty clear what COVID-19 has done to the global economy.

Factory shutdowns, global restrictions on movement, a synchronized economic slowdown that has led the IMF to project negative global growth for 2020 at - 3.0% (a recession).

Now, oil demand thrives on global economic activity. With a slowdown in activity, you can expect lower demand. In the last few years, demand used to average c. 100m barrels per day (bpd). But in the last few months, we’ve seen demand fall by 20-35m bpd to about 65m bpd.

Some market watchers speculate that this number could actually be in the region of 40m barrels, which means demand is only 60% of what we’re used to. Meanwhile, supply remained >90m bpd until OPEC+ and the G-20 signed an agreement to cut oil supply by less than 20m bpd (in total)

The agreement was unprecedented. OPEC has never at any one time cut more than 2m bpd, but it was cutting 9.7mbpd. The US has never participated in any such agreement, given its commitment to free markets, yet it technically joined the deal.

Everyone was assured that this landmark deal would push up oil prices (to at least c. $50pb) that had been battered by reduced demand and the oil price war instigated by Saudi Arabia and Russia in March (remember those widely reported events?).

However, this failed to happen https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face">

However, this failed to happen

In April, IMF published its revised growth projections for 2020, predicting a recession, and all hell was let loose. Selloffs continued.

Meanwhile, most buyers had filled up their storage tanks with cheap oil (most of them were not sure when next they’d see oil at sub-$20pb).

Meanwhile, most buyers had filled up their storage tanks with cheap oil (most of them were not sure when next they’d see oil at sub-$20pb).

So, even if a cure for COVID is found today and the lockdowns are eased, oil prices would remain low, given that buyers have as much oil as they need for a long time. Vessels on the high sea, no buyers because we’re grappling with a large-scale demand destruction.

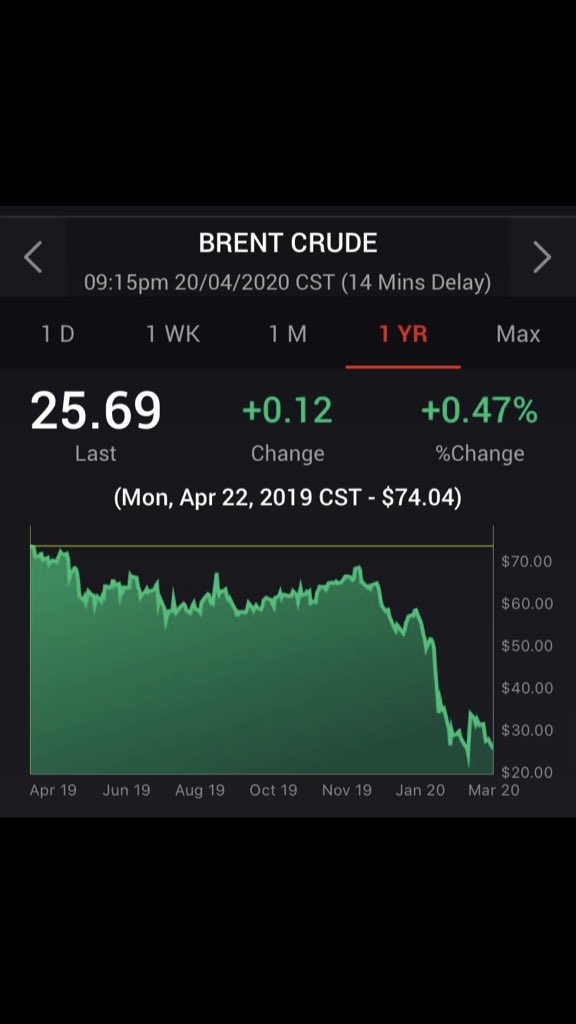

One-Year Brent Crude Performance. You’d notice that I highlighted the price exactly one year ago on 22nd April 2019 - $74.04pb. As at yesterday, it had fallen to $25.69pb.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">

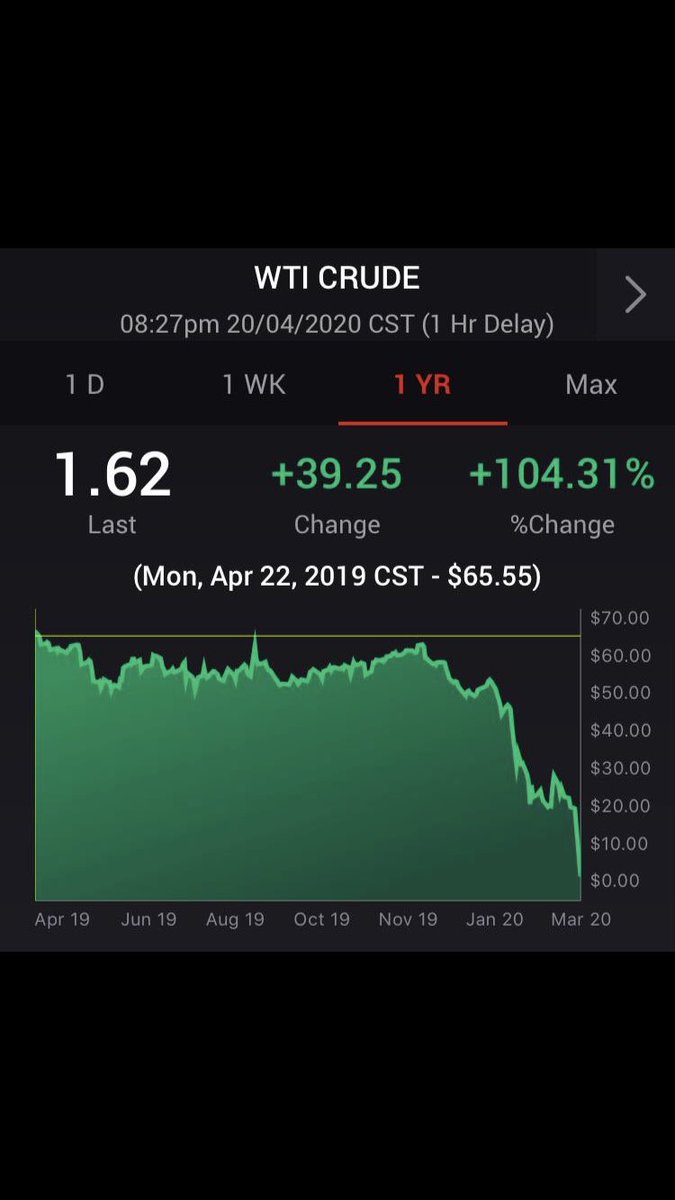

WTI Crude. 1 year ago -$65.55pb. Yesterday, $1.62pb. In intraday trading yesterday, it fell to as low as -$39pb.

Both benchmarks have fallen significantly and we admit it is due to the COVID-imposed slowdown.

However, why has WTI fallen that steeply?

How can I sell oil for less than $0 per barrel?

I suppose at this point that you’d have understood that Nigeria is in a bad place...

However, why has WTI fallen that steeply?

How can I sell oil for less than $0 per barrel?

I suppose at this point that you’d have understood that Nigeria is in a bad place...

...but not too bad because our grades are benchmarked to Brent, not WTI. So, I’d not dwell further on that. The answer is a little technical, but very simple, so I’d just try to break it into bit sizes.

Like other commodities, Oil is traded in 2 markets...

Like other commodities, Oil is traded in 2 markets...

...the physical market (where the actual trading takes place) and the futures market.

In the physical market, we have spot prices, which is the current price of the oil for settlement and delivery.

In the futures markets, there are contracts for “Future delivery” of the oil.

In the physical market, we have spot prices, which is the current price of the oil for settlement and delivery.

In the futures markets, there are contracts for “Future delivery” of the oil.

Oil traders in the US bought May 2020 WTI futures at some really high price (c. $35pb).

Per logistics, standard practice is that it has to be settled a few days earlier than actual physical delivery. That settlement should happen today, 21st April.

Per logistics, standard practice is that it has to be settled a few days earlier than actual physical delivery. That settlement should happen today, 21st April.

This is where the storage problem I highlighted earlier comes up. For WTI, delivery has to be made to a certain place in Cushing, Oklahoma. It is specified in the futures contract.

However, storage in Cushing is filled up to the brim.

However, storage in Cushing is filled up to the brim.

Meanwhile, oil is still being supplied, thus, the cost of storage has shot through the roof due to demand.

As a trader, I don’t have capacity to take the physical barrels because of zero storage and I really don’t want to anyway, so I’m selling the oil at huge discounts...

As a trader, I don’t have capacity to take the physical barrels because of zero storage and I really don’t want to anyway, so I’m selling the oil at huge discounts...

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">" title="One-Year Brent Crude Performance. You’d notice that I highlighted the price exactly one year ago on 22nd April 2019 - $74.04pb. As at yesterday, it had fallen to $25.69pb. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">" title="One-Year Brent Crude Performance. You’d notice that I highlighted the price exactly one year ago on 22nd April 2019 - $74.04pb. As at yesterday, it had fallen to $25.69pb. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🩸" title="Drop of blood" aria-label="Emoji: Drop of blood">" class="img-responsive" style="max-width:100%;"/>