THREAD ON OIL PRICES...

Does the American WTI Crude Oil price that collapsed affect me as a South African?

The short answer is NO and YES.

Here is why…

Firstly, you need to understand the differences between WTI Crude Oil and Brent Crude Oil.

Does the American WTI Crude Oil price that collapsed affect me as a South African?

The short answer is NO and YES.

Here is why…

Firstly, you need to understand the differences between WTI Crude Oil and Brent Crude Oil.

1. Western Texas Intermediate (WTI) is extracted from oil fields in the United States. It is primarily extracted in Texas, Louisiana and North Dakota and is then transported.

This is the American oil futures price that has dropped to negative $35 per barrel.

This is the American oil futures price that has dropped to negative $35 per barrel.

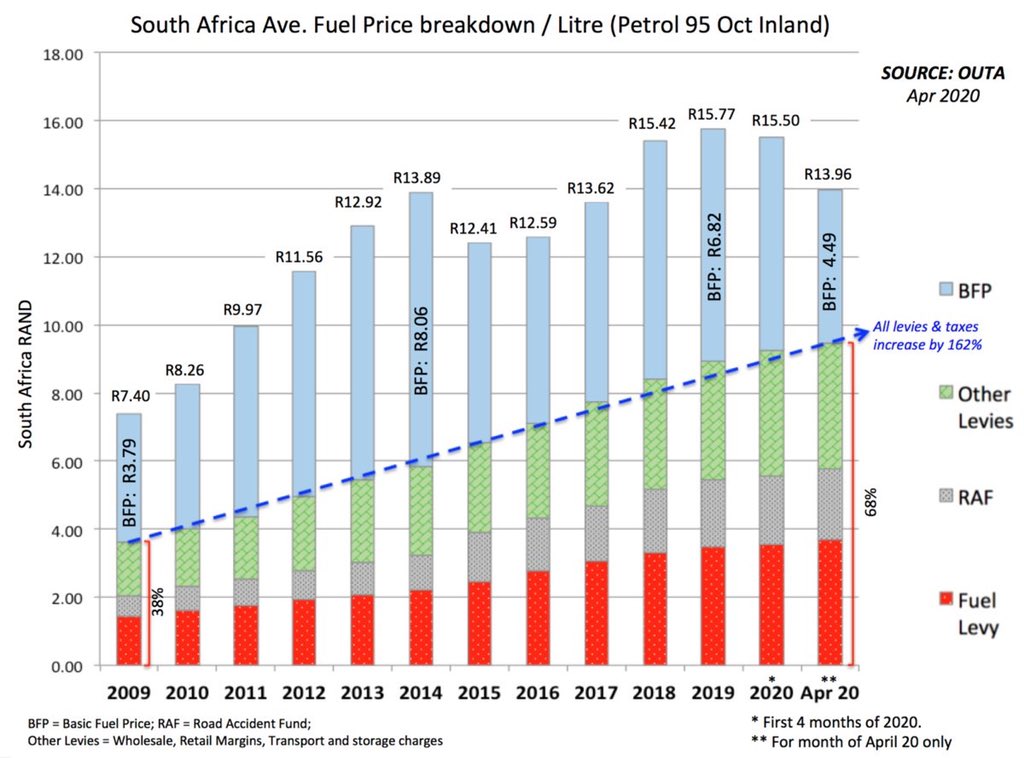

5. The Basic Fuel Price (BFP) component of the overall price of petrol in SA, is directly impacted by international crude oil price, combined with Rand/USD rate. Sadly taxes/levies have resulted in the BFP now comprising +-30% of the total price of petrol in SA.

5.1. The Basic Fuel Price (BFP) component of the overall price of petrol in SA.

The price of fuel in SA includes the following:

-Fuel Levy (Taxes)

-Road Accident Fund

- Other levies (Wholesale, retail margins, transport and storage charges)

-Purchase Price

The price of fuel in SA includes the following:

-Fuel Levy (Taxes)

-Road Accident Fund

- Other levies (Wholesale, retail margins, transport and storage charges)

-Purchase Price

3. The WTI crude contract that fell more than to negative prices yesterday is for May delivery, & it expires TODAY.

It& #39;s the Futures Oil Prices for the month of May 2020 that has dropped. Meaning there& #39;s is no demand for oil due to the lockdown around the world.

It& #39;s the Futures Oil Prices for the month of May 2020 that has dropped. Meaning there& #39;s is no demand for oil due to the lockdown around the world.

With the Covid-19 pandemic leading to unprecedented demand loss, and with storage tanks quickly filling up.

That& #39;s why it turned negative,meaning producers would pay to get this oil off their hands because there is no one that needs that crude this week with the country shutdown.

That& #39;s why it turned negative,meaning producers would pay to get this oil off their hands because there is no one that needs that crude this week with the country shutdown.

6. The negative WTI Crude oil will have a knock-on effect to drive the price of Brent Crude Oil down that we purchase as SA. Due to surplus oil in the US, there will less shipment of oil from OPEC countries meaning the demand will decrease.

6.1. There will less shipment of oil from OPEC countries to the US meaning the demand will decrease therefore ultimately there price of the Brent Crude Oil will decrease that we purchase as South Africa.

Trump has already indicated he will buy less from OPEC.

Trump has already indicated he will buy less from OPEC.

2. In South Africa we use Brent crude that extracted from oil fields in the North Sea. The OPEC key members include Saudi Arabia, Iran, Iraq, Venezuela & Nigeria.

The Brent Crude Oil that we use in SA is currently trading at $25.40 per barrel.

The Brent Crude Oil that we use in SA is currently trading at $25.40 per barrel.

7. In short in the long run the price of petrol for me and you will also decrease and we will benefit from the decrease as South Africans provided our Rand/USD rate holds up and doesn’t drop.

The Rand is currently at R18.88 to the USD and need to be strong!

The Rand is currently at R18.88 to the USD and need to be strong!

What happened yesterday is that the WTI Crude Oil Futures are used to bet on future price of oil.

These contracts were ending today.

People who trade them use them to "hedge" future costs (like airlines and refineries) etc

These contracts were ending today.

People who trade them use them to "hedge" future costs (like airlines and refineries) etc

Read on Twitter

Read on Twitter