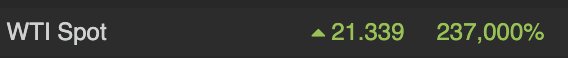

Overnight WTI Oil (West Texas Intermediate) traded at a negative $40. Yip -$40, traders were paying you to take their oil off their hands.

Totally wild and now everybody wants to be an oil trader.

But some caution before you jump in.

1/

Totally wild and now everybody wants to be an oil trader.

But some caution before you jump in.

1/

WTI is the North American oil benchmark, for the rest of the world it is really Brent and that price did not collapse nor go negative trading around $25 ..

2/

2/

More importantly is that this was the May delivery contract for WTI that expires today. The problem is a lack of demand that has resulted in full storage. Nobody wants delivery in May as they have nowhere to store it and no demand, would have to throw it away.

3/

3/

Hence the negative price.

4/

4/

The #JSE has two options for trading oil.

SBAOIL is an ETN from Standard Bank that tracks the WTI price in ZAR. It closed yesterday at R631, using R19/US$ that implies a price of some $33 for WTI. The higher price is likely because they use blended delivery dates.

6/

SBAOIL is an ETN from Standard Bank that tracks the WTI price in ZAR. It closed yesterday at R631, using R19/US$ that implies a price of some $33 for WTI. The higher price is likely because they use blended delivery dates.

6/

There is also an oil futures contract tracking Brent that closed at R609 implying a price for Brent of some $32.

So neither of these products crashed and if you& #39;re buying them you are not buying oil at zero or negative.

7/

So neither of these products crashed and if you& #39;re buying them you are not buying oil at zero or negative.

7/

I& #39;ll make that point again because it is important.

Buying oil today is NOT buying negative or zero priced oil.

8/

Buying oil today is NOT buying negative or zero priced oil.

8/

Lastly our petrol price? We do not use WTI, rather we use a blended price from supplies in "Mediterranean area, Arab Gulf, and Singapore.". Those prices are lower, but not zero nor negative.

9/end

9/end

Read on Twitter

Read on Twitter