1/ Thread on technical aspects of $USO crude oil ETF.

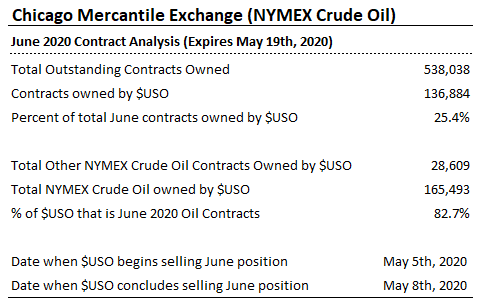

$USO has over 80% of its assets in June 2020 oil futures (that expire in May). They now hold over 25% of the total outstanding June futures.

$USO form 10-K filed with the SEC available here:

https://www.unhedged.com/companies/5c54cd4fc5c93f703be506b1/USO.PCQ/filings/5e5054216e979a00102be7c0/uso-20191231x10k9feacd.htm">https://www.unhedged.com/companies...

$USO has over 80% of its assets in June 2020 oil futures (that expire in May). They now hold over 25% of the total outstanding June futures.

$USO form 10-K filed with the SEC available here:

https://www.unhedged.com/companies/5c54cd4fc5c93f703be506b1/USO.PCQ/filings/5e5054216e979a00102be7c0/uso-20191231x10k9feacd.htm">https://www.unhedged.com/companies...

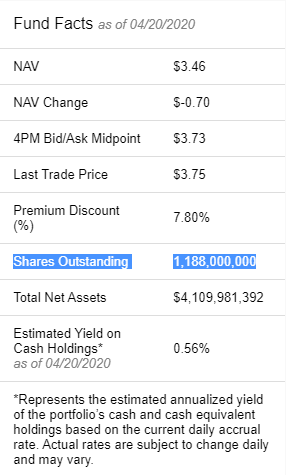

2/ $USO has grown so rapidly this year, as investors "pile in" to the long oil trade that its share count has grown from 148.5mm at 2/18/20 to nearly 1.2 billion shares today (over 7x growth)

https://www.unhedged.com/secfilings/5e5054216e979a00102be7c0/uso-20191231x10k9feacd.htm?highlight=5e9e4fa3ffa09400105a8c7e&l=5e9e4fa48e68a5001030361c">https://www.unhedged.com/secfiling...

https://www.unhedged.com/secfilings/5e5054216e979a00102be7c0/uso-20191231x10k9feacd.htm?highlight=5e9e4fa3ffa09400105a8c7e&l=5e9e4fa48e68a5001030361c">https://www.unhedged.com/secfiling...

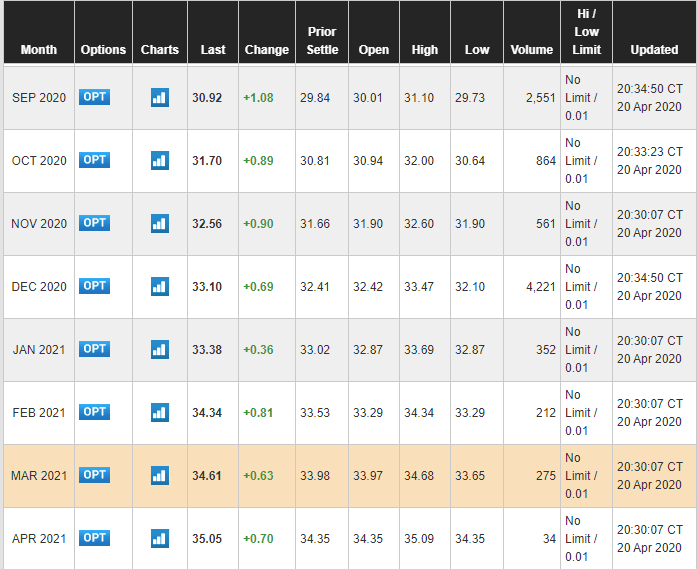

3/ Investors apparently think that "oil" trades at $1 or something. The "forward curve" of oil is actually still relatively healthy. The market is already calling for $30 oil in September, and $40 oil by 2022. So not so fast there with the "oil is $1 call":

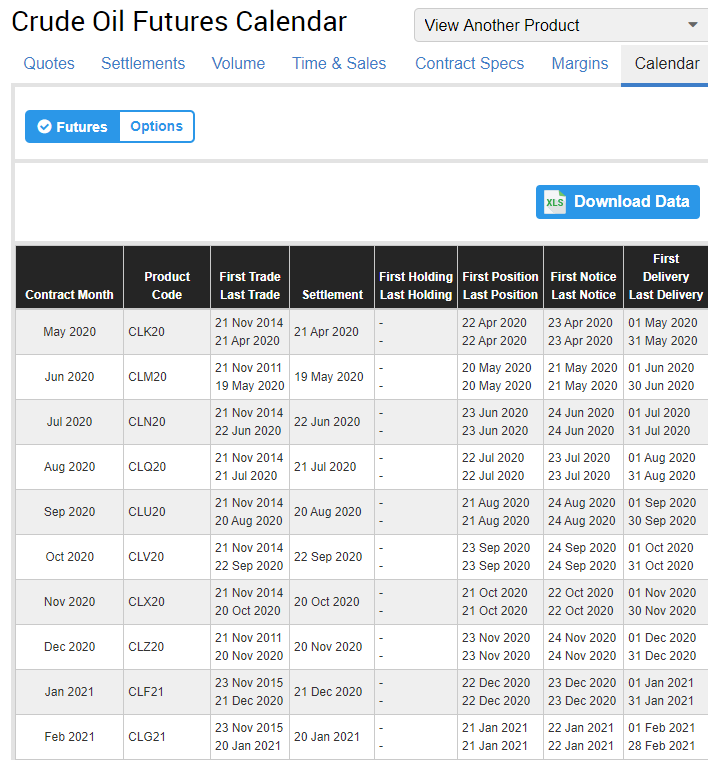

4/ May oil futures expire tomorrow. If you want to follow this, its easy and available here. Briefly, "Trading terminates 3 business day prior to the 25th calendar day of the month prior to the contract month."

https://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude_product_calendar_futures.html?ds_medium=cpc&gclid=EAIaIQobChMIoJ-qt6336AIVyf7jBx0qvg8PEAAYASAAEgLKgfD_BwE&gclsrc=aw.ds">https://www.cmegroup.com/trading/e...

https://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude_product_calendar_futures.html?ds_medium=cpc&gclid=EAIaIQobChMIoJ-qt6336AIVyf7jBx0qvg8PEAAYASAAEgLKgfD_BwE&gclsrc=aw.ds">https://www.cmegroup.com/trading/e...

5/ The May contract stops trading tomorrow. At settlement, futures owners must either sell their contract or take physical delivery (1,000 barrels per contract, in this case) at the facility in Cushing, Oklahoma:

6/ Normally, when speculators get "too long" as happened in the May contract, commercial buyers (in the case of oil, generally refiners. In the case of corn and soybeans, guys like General Mills, Kelloggs, Kraft, etc - food manufacturers), the commercial buyers will step in...

7/ and buy the expiring contract from the poor speculator who is stuck, at a discount (generally modest, rarely more than a few percent), and profit the difference, and just take delivery and possibly store it ahead of time.

8/ Unfortunately, for May oil speculators, commercial buyers (i.e. oil refiners who turn oil to gasoline) were not buyers. Storage is full, gasoline demand is down 50%, and there is no commercial use case in the immediate term. So speculators had no one to bail them out.

Read on Twitter

Read on Twitter