1/39

3 Reasons Why $DAI is DeFi& #39;s Biggest Risk:

I was huge into MKR when in first launched.

It made sense - a project where we could use ETH, the asset that all chain participants believed in, to back a stablecoin.

But, for the last 8~ months, I& #39;ve taken a lot of flack for

3 Reasons Why $DAI is DeFi& #39;s Biggest Risk:

I was huge into MKR when in first launched.

It made sense - a project where we could use ETH, the asset that all chain participants believed in, to back a stablecoin.

But, for the last 8~ months, I& #39;ve taken a lot of flack for

2/39

my view that $DAI shouldn& #39;t be the DeFi Darling that it is. #DAIDoubts

As the events have continued to unfold over the past year it is pretty clear that $DAI has gone astray and run down the paths I warned about, and now I think it is not only problematic, but,

my view that $DAI shouldn& #39;t be the DeFi Darling that it is. #DAIDoubts

As the events have continued to unfold over the past year it is pretty clear that $DAI has gone astray and run down the paths I warned about, and now I think it is not only problematic, but,

3/39

that $DAI represents the *BIGGEST* existential threat to DeFi.

There are three key reasons that drive this:

Reason #1 - A Financial House of Cards:

You may or may not realize, but, chances are that your favorite DeFi protocols rely somewhat on all the tokens

that $DAI represents the *BIGGEST* existential threat to DeFi.

There are three key reasons that drive this:

Reason #1 - A Financial House of Cards:

You may or may not realize, but, chances are that your favorite DeFi protocols rely somewhat on all the tokens

4/39

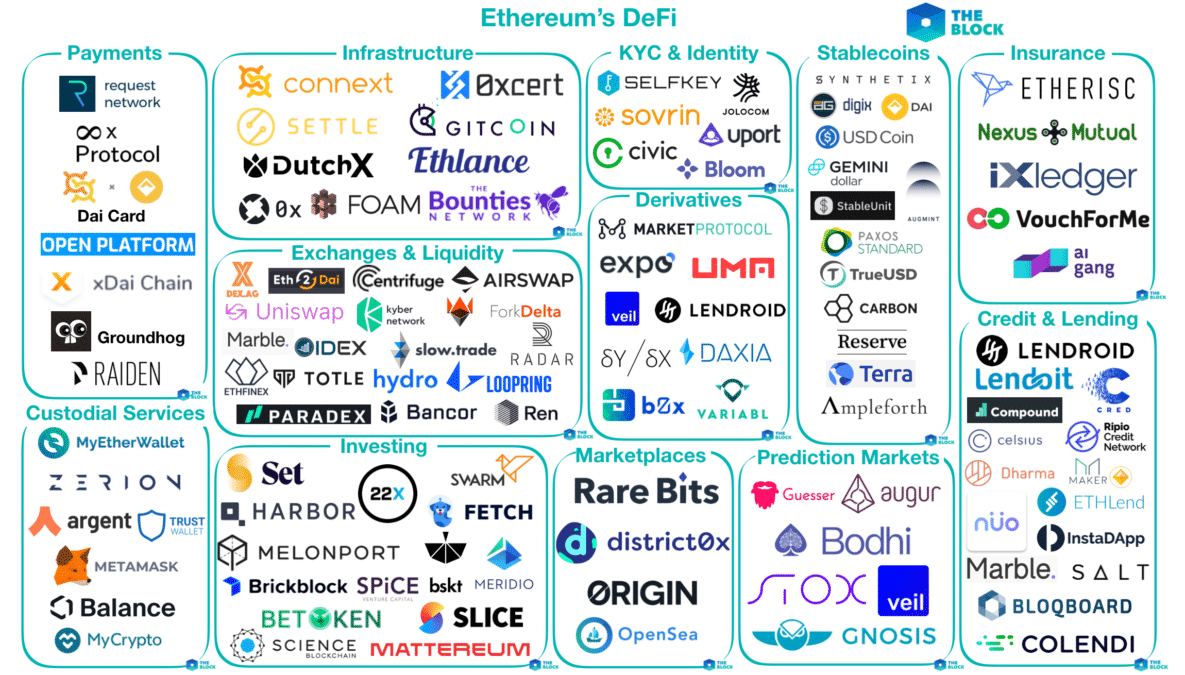

in their system not breaking.

Compound, Fulcrum, SET, Aave, Uniswap and any other product that relies on collateralization or liquidity pooling have one thing in common - they NEED to be able to trust that all the tokens in their system are function properly.

in their system not breaking.

Compound, Fulcrum, SET, Aave, Uniswap and any other product that relies on collateralization or liquidity pooling have one thing in common - they NEED to be able to trust that all the tokens in their system are function properly.

5/39

this means that they must:

A) Transfer properly.

B) Be worth the set value.

C) Actually have, hold and represent any underlying assets.

D) Have no reentry.

E) Come from a trusted origin.

F) And, that all of the above is true, not only on their platform, but all platforms.

this means that they must:

A) Transfer properly.

B) Be worth the set value.

C) Actually have, hold and represent any underlying assets.

D) Have no reentry.

E) Come from a trusted origin.

F) And, that all of the above is true, not only on their platform, but all platforms.

6/39

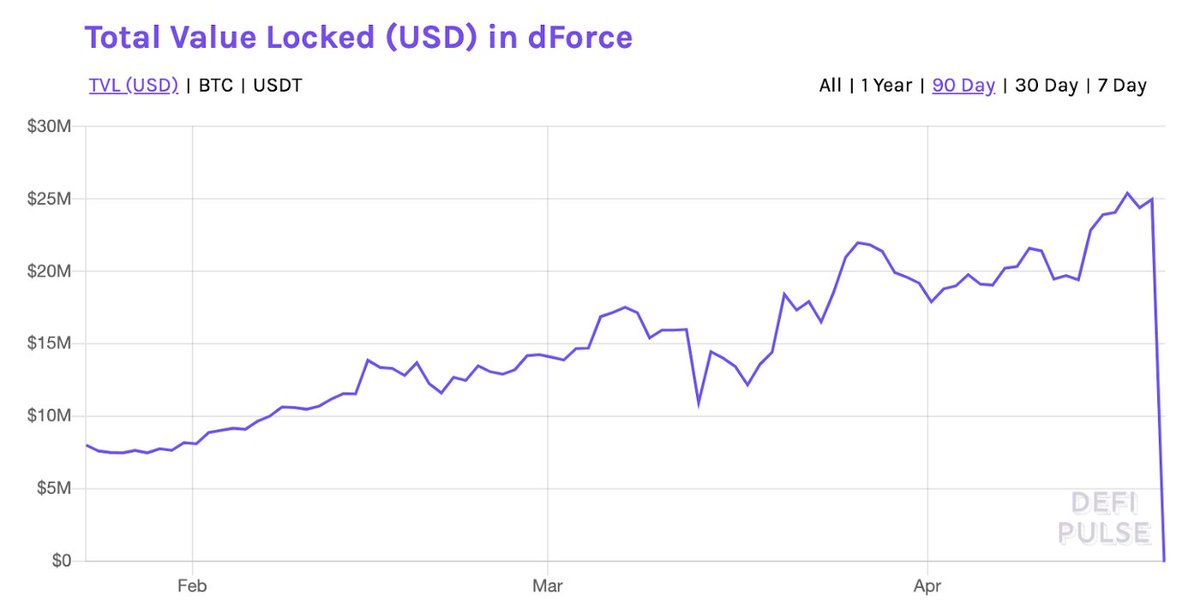

For example, just the other day we saw the catastrophe that is the http://Lendf.me"> http://Lendf.me debacle where imBTC was exploited in their contract and balances were drained.

As we build up our & #39;DeFi money lego& #39; layer ontop of layer, they stop acting like lego and start

For example, just the other day we saw the catastrophe that is the http://Lendf.me"> http://Lendf.me debacle where imBTC was exploited in their contract and balances were drained.

As we build up our & #39;DeFi money lego& #39; layer ontop of layer, they stop acting like lego and start

7/39

to instead behave as a house of cards, where each card placed is only as sturdy as the one beneath it.

Unlike most industries, DeFi& #39;s success is deeply connected to all the products in the space that platform adopts.

This connectivity is our biggest benefit and

to instead behave as a house of cards, where each card placed is only as sturdy as the one beneath it.

Unlike most industries, DeFi& #39;s success is deeply connected to all the products in the space that platform adopts.

This connectivity is our biggest benefit and

8/39

our greatest risk.

But, it& #39;s clear, there is no card that appears in more DeFi products than $DAI - as it sits as the base of most of the ecosystem.

Allowing it to be the highest point of vulnerability.

Many of us thought that was ok - until recent events

our greatest risk.

But, it& #39;s clear, there is no card that appears in more DeFi products than $DAI - as it sits as the base of most of the ecosystem.

Allowing it to be the highest point of vulnerability.

Many of us thought that was ok - until recent events

9/39

displayed the shortcomings of $DAI. Which are reasons #2/3 of why $DAI is our greatest risk.

Reason #2 - A Non-Invisible Hand:

Markets that are left to their own accord are often referred to as being guided by "an invisible hand" but, with $DAI that isn& #39;t the case.

displayed the shortcomings of $DAI. Which are reasons #2/3 of why $DAI is our greatest risk.

Reason #2 - A Non-Invisible Hand:

Markets that are left to their own accord are often referred to as being guided by "an invisible hand" but, with $DAI that isn& #39;t the case.

10/39

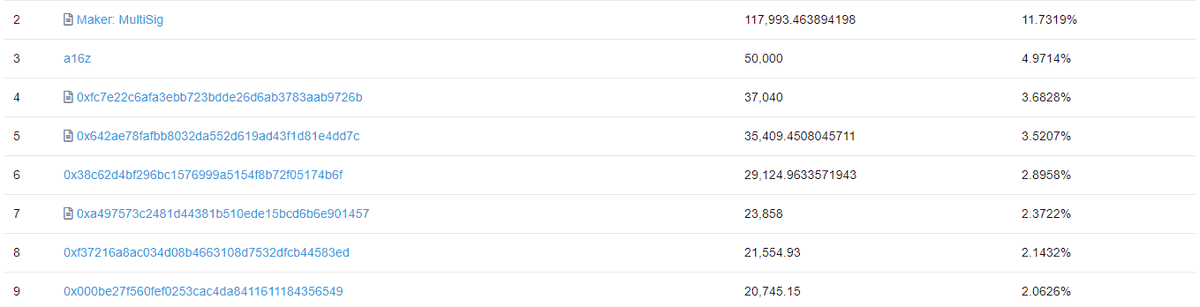

$DAI is governed by $MKR token holders, the largest holders of which are the MakerDAO team, Maker the company, A16z (VC), and a number of other investment groups.

The top 50 wallet addresses have more than 50% of all voting authority in the protocol.

$DAI is governed by $MKR token holders, the largest holders of which are the MakerDAO team, Maker the company, A16z (VC), and a number of other investment groups.

The top 50 wallet addresses have more than 50% of all voting authority in the protocol.

11/39

Unlike a truly decentralized system which is supposed to do what is best for the common good of the system, Maker will always do what is best for Maker and its investors.

Now we might assume that the Maker team& #39;s interests align with that of the community, but,

Unlike a truly decentralized system which is supposed to do what is best for the common good of the system, Maker will always do what is best for Maker and its investors.

Now we might assume that the Maker team& #39;s interests align with that of the community, but,

12/39

that means trusting the MakerDAO team, and sadly the team keeps giving us reasons to not trust their governance ability.

This is the team that:

-Wouldn& #39;t reveal its board who controlled 27% of the voting rights ( https://www.coindesk.com/tensions-flare-during-makerdao-community-call-over-transparency-issues)">https://www.coindesk.com/tensions-...

that means trusting the MakerDAO team, and sadly the team keeps giving us reasons to not trust their governance ability.

This is the team that:

-Wouldn& #39;t reveal its board who controlled 27% of the voting rights ( https://www.coindesk.com/tensions-flare-during-makerdao-community-call-over-transparency-issues)">https://www.coindesk.com/tensions-...

13/39

-Forced many of their own executives to resign over directional differences. ( https://www.coindesk.com/leaked-letter-exposes-infighting-atop-flagship-ethereum-project-makerdao)

-Forced">https://www.coindesk.com/leaked-le... out a CTO and had a history of splitting up the company ( https://www.coindesk.com/darkest-days-yet-purple-pill-tell-all-details-years-long-rift-at-heart-of-makerdao-stablecoin-project)

-Tried">https://www.coindesk.com/darkest-d... to sneakily trademark the word "DeFi" ( https://www.coindesk.com/decentralized-maker-foundation-tried-and-failed-to-register-defi-trademark)">https://www.coindesk.com/decentral...

-Forced many of their own executives to resign over directional differences. ( https://www.coindesk.com/leaked-letter-exposes-infighting-atop-flagship-ethereum-project-makerdao)

-Forced">https://www.coindesk.com/leaked-le... out a CTO and had a history of splitting up the company ( https://www.coindesk.com/darkest-days-yet-purple-pill-tell-all-details-years-long-rift-at-heart-of-makerdao-stablecoin-project)

-Tried">https://www.coindesk.com/darkest-d... to sneakily trademark the word "DeFi" ( https://www.coindesk.com/decentralized-maker-foundation-tried-and-failed-to-register-defi-trademark)">https://www.coindesk.com/decentral...

14/39

-Has continued governance failures and centralization that seem to have lead to major financial losses for users ( https://www.coindesk.com/makerdaos-problems-are-a-textbook-case-of-governance-failure)

-Had">https://www.coindesk.com/makerdaos... major protocol changes like SCD -> MCD approved by only 54 unique voters ( https://vote.makerdao.com/polling-proposal/qmba2hpv3kcbjgzvlnv7xsogs3jenqdiqo3ffnktgqtepn)">https://vote.makerdao.com/polling-p...

-Has continued governance failures and centralization that seem to have lead to major financial losses for users ( https://www.coindesk.com/makerdaos-problems-are-a-textbook-case-of-governance-failure)

-Had">https://www.coindesk.com/makerdaos... major protocol changes like SCD -> MCD approved by only 54 unique voters ( https://vote.makerdao.com/polling-proposal/qmba2hpv3kcbjgzvlnv7xsogs3jenqdiqo3ffnktgqtepn)">https://vote.makerdao.com/polling-p...

15/39

$DAI is not decentralized, because $MKR is not decentralized. MakerDAO makes the decisions, and it& #39;s clear they have a history of making bad ones.

56 people decided that all DeFi users who hold $DAI would switch to a basket of coins; and those 56 people only

$DAI is not decentralized, because $MKR is not decentralized. MakerDAO makes the decisions, and it& #39;s clear they have a history of making bad ones.

56 people decided that all DeFi users who hold $DAI would switch to a basket of coins; and those 56 people only

16/39

represented 7.56% of the total $MKR.

DeFi is about decentralizing trust. Not trusting a16z and MakerDAO.

Lastly, we have the largest problem with $DAI - and that is the shift to MCD.

Reason #3 - The Broken Basket:

represented 7.56% of the total $MKR.

DeFi is about decentralizing trust. Not trusting a16z and MakerDAO.

Lastly, we have the largest problem with $DAI - and that is the shift to MCD.

Reason #3 - The Broken Basket:

17/39

When it comes to building in DeFi - it makes sense that we trust Ethereum.

We& #39;re all in this space because we have faith in Ethereum.

And, if Ethereum ever flopped, then any of the protocols on it would go down anyway.

When it comes to building in DeFi - it makes sense that we trust Ethereum.

We& #39;re all in this space because we have faith in Ethereum.

And, if Ethereum ever flopped, then any of the protocols on it would go down anyway.

18/39

So it isn& #39;t adding any new risk to tie the health of a DeFi product to $ETH as an underlying asset. It is already implicitly tied that way.

So in that sense SCD (single collateral DAI) made sense. We also implicitly agreed to it just by using ETH.

So it isn& #39;t adding any new risk to tie the health of a DeFi product to $ETH as an underlying asset. It is already implicitly tied that way.

So in that sense SCD (single collateral DAI) made sense. We also implicitly agreed to it just by using ETH.

19/39

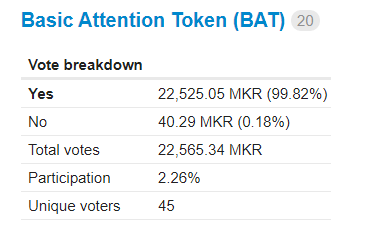

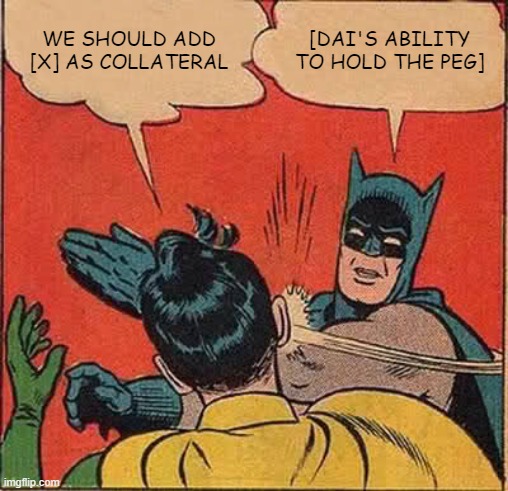

But, somewhere along the like 54 people decided that anyone who uses $DAI should believe in more than just ETH. In fact, they should now trust an ever growing list of assets as part of MCD (multi-collateral DAI)

But, somewhere along the like 54 people decided that anyone who uses $DAI should believe in more than just ETH. In fact, they should now trust an ever growing list of assets as part of MCD (multi-collateral DAI)

20/39

Right now that list includes $BAT and $USDC that were chosen by only around 40 voters and just 2% of MKR held. ( https://forum.makerdao.com/t/results-collateral-asset-priority-poll-august-19-2019/278)

But,">https://forum.makerdao.com/t/results... those same voters can vote on any asset brought forward by MakerDAO& #39;s internal risk team (and how they screen those assets is

Right now that list includes $BAT and $USDC that were chosen by only around 40 voters and just 2% of MKR held. ( https://forum.makerdao.com/t/results-collateral-asset-priority-poll-august-19-2019/278)

But,">https://forum.makerdao.com/t/results... those same voters can vote on any asset brought forward by MakerDAO& #39;s internal risk team (and how they screen those assets is

21/39

not fully transparent.)

All this means, that at anytime, Maker& #39;s team could bring forward assets they think are fine and put them to a vote, and 40 or so people would decide what makes financial sense for $DAI.

not fully transparent.)

All this means, that at anytime, Maker& #39;s team could bring forward assets they think are fine and put them to a vote, and 40 or so people would decide what makes financial sense for $DAI.

22/39

This is a HUGE problem - because MakerDAO has already suggested assets like DigixDAO and Golem, both interesting projects in their own rights, but, ones with huge volatility that could still fail.

This is a HUGE problem - because MakerDAO has already suggested assets like DigixDAO and Golem, both interesting projects in their own rights, but, ones with huge volatility that could still fail.

23/39

But, no matter the quality of the projects chosen, a project like $DAI should simply **NEVER** be tied to a basket of assets that are not the default currency of a chain.

Now, instead of banking on the success of ETH, something that all

But, no matter the quality of the projects chosen, a project like $DAI should simply **NEVER** be tied to a basket of assets that are not the default currency of a chain.

Now, instead of banking on the success of ETH, something that all

24/39

DeFi builders and users are able to agree on, $DAI is instead asking you to bank on the success of all projects that a cabal of 40ish users select.

Maybe you are new to crypto and think "hey as long as they pick top projects that& #39;s fine" but

DeFi builders and users are able to agree on, $DAI is instead asking you to bank on the success of all projects that a cabal of 40ish users select.

Maybe you are new to crypto and think "hey as long as they pick top projects that& #39;s fine" but

25/39

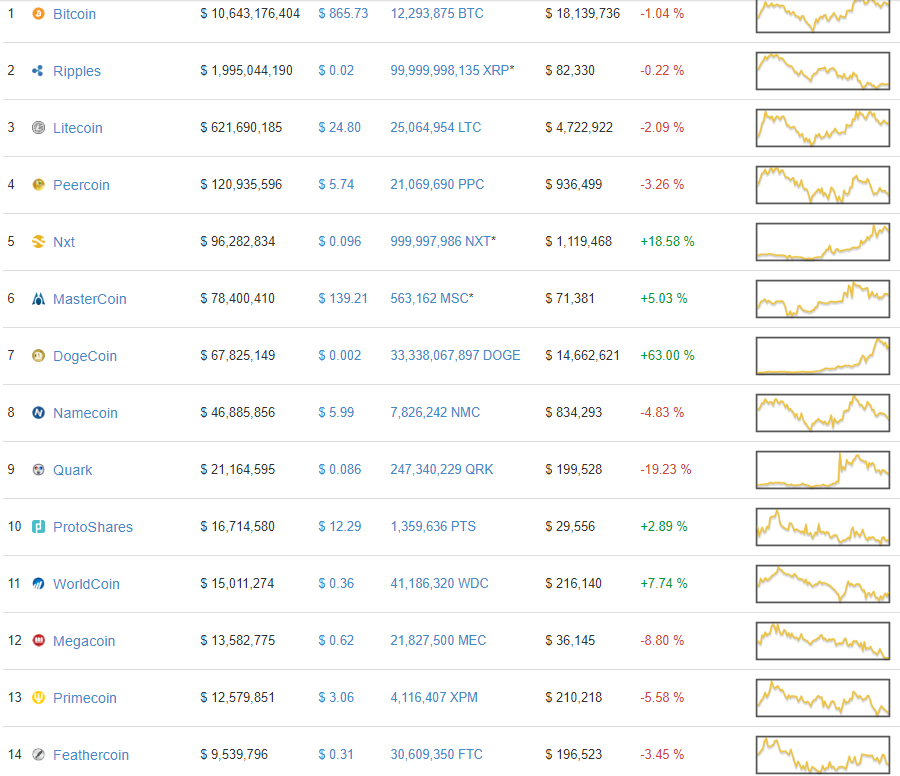

projects in this space fail all the time.

Consider this screenshot I took back when I worked for an exchange in 2014.

Peercoin, NXT, Mastercoin, Quark, Megacoin, Primecoin and Feathercoin were all consider top brass projects. But, now, in hindsight

projects in this space fail all the time.

Consider this screenshot I took back when I worked for an exchange in 2014.

Peercoin, NXT, Mastercoin, Quark, Megacoin, Primecoin and Feathercoin were all consider top brass projects. But, now, in hindsight

26/39

how would you feel about any of those coins being the backer for your digital dollar?

Proponents of MCD argue that this is fine "because the risk is diversified" but, even if a non-ETH asset only represented 10% of the chain, if it failed that still means

how would you feel about any of those coins being the backer for your digital dollar?

Proponents of MCD argue that this is fine "because the risk is diversified" but, even if a non-ETH asset only represented 10% of the chain, if it failed that still means

27/39

a 10% hit to the asset, and in turn devastation to any DeFi product that requires their stablecoin assets to be stable within a certain bounds.

You have no choice but to take on this risk

a 10% hit to the asset, and in turn devastation to any DeFi product that requires their stablecoin assets to be stable within a certain bounds.

You have no choice but to take on this risk

28/39

And, even with only $BAT and $USDC in the mix we are already seeing growing issues of $DAI being able to maintain its $1 peg.

These assets were added without big wallets voting, but what happens when a16z decides that one of the projects they& #39;ve invested in should

And, even with only $BAT and $USDC in the mix we are already seeing growing issues of $DAI being able to maintain its $1 peg.

These assets were added without big wallets voting, but what happens when a16z decides that one of the projects they& #39;ve invested in should

29/39

become part of the MCD? They vote for it, they put pressure on MKR to vote for, and other investors follow suit.

Suddenly, the protocol is backed by some token the community has no faith in.

become part of the MCD? They vote for it, they put pressure on MKR to vote for, and other investors follow suit.

Suddenly, the protocol is backed by some token the community has no faith in.

30/39

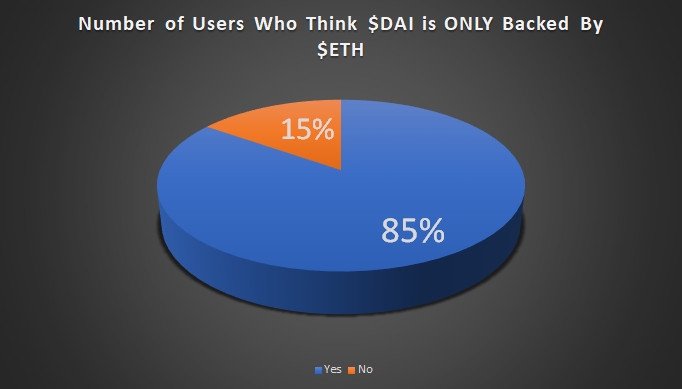

Given how removed users are from the $DAI governance, many users who use $DAI in other products have no idea that other assets are underpinning it.

In my most recent poll (n = 105), 84.8% of users (±1.472% MOE) said "$DAI is only backed by $ETH"

Given how removed users are from the $DAI governance, many users who use $DAI in other products have no idea that other assets are underpinning it.

In my most recent poll (n = 105), 84.8% of users (±1.472% MOE) said "$DAI is only backed by $ETH"

31/39

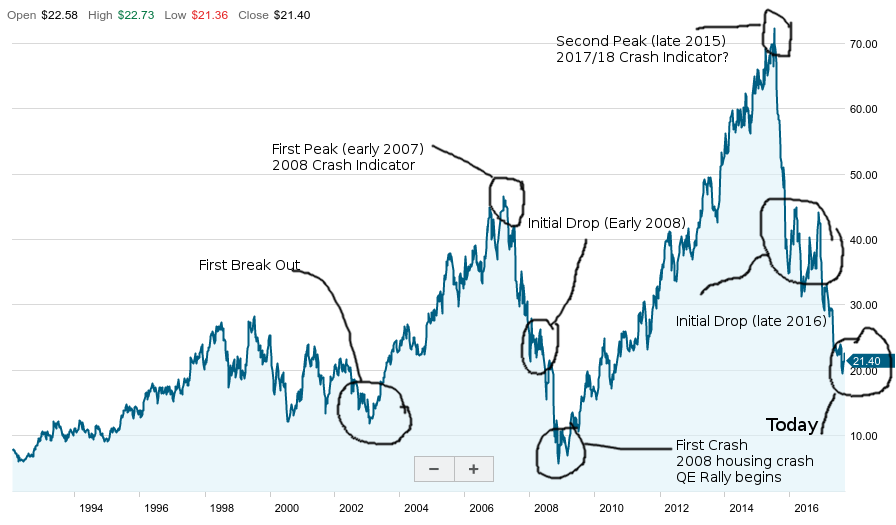

$DAI has the potential to become a riskier and riskier basket of assets, that most users are unaware of until it implodes and takes the market with it.

If that sounds familiar, it& #39;s because that& #39;s the same issues that caused the junk bond crash of 2008.

$DAI has the potential to become a riskier and riskier basket of assets, that most users are unaware of until it implodes and takes the market with it.

If that sounds familiar, it& #39;s because that& #39;s the same issues that caused the junk bond crash of 2008.

32/39

$DAI has become the biggest liability to DeFi, and most users don& #39;t have a clue, because they don& #39;t need to.

It is the responsibility now, of developers and platform teams to ensure that the assets they use are secure and viable.

$DAI has become the biggest liability to DeFi, and most users don& #39;t have a clue, because they don& #39;t need to.

It is the responsibility now, of developers and platform teams to ensure that the assets they use are secure and viable.

33/39

And to this end, developers must begin to lessen their dependence on $DAI, because MakerDAO has shown to be an unstable and irresponsible entity.

We do need a $DAI-like entity in the space, but, it should be tied to the asset we all believe in ($ETH)

And to this end, developers must begin to lessen their dependence on $DAI, because MakerDAO has shown to be an unstable and irresponsible entity.

We do need a $DAI-like entity in the space, but, it should be tied to the asset we all believe in ($ETH)

34/39

And we as a community need to do a better job of holding projects accountable at early stages when they have centralized behaviors. We can& #39;t just say "this will go away once they grow" - that& #39;s the same mentality that iOTA had. (We know how that turned out)

And we as a community need to do a better job of holding projects accountable at early stages when they have centralized behaviors. We can& #39;t just say "this will go away once they grow" - that& #39;s the same mentality that iOTA had. (We know how that turned out)

35/39

This is partly a failing on all of us, who were excited by Maker and assumed it would get better as it started to integrate.

While it may be ok for platforms to have some centralization or to migrate overtime, we need to ensure that protocols and building blocks like

This is partly a failing on all of us, who were excited by Maker and assumed it would get better as it started to integrate.

While it may be ok for platforms to have some centralization or to migrate overtime, we need to ensure that protocols and building blocks like

36/39

like stablecoins pursue a minimal-governance-first approach.

If we fail to do that, and continue to reward the behavior of poorly run teams, we will see a team make poor decisions that put an essential building block adjacent to the best interests of the entire space.

like stablecoins pursue a minimal-governance-first approach.

If we fail to do that, and continue to reward the behavior of poorly run teams, we will see a team make poor decisions that put an essential building block adjacent to the best interests of the entire space.

37/39

When that happens, it will implode, and in turn deal a devastating blow to DeFi that will wipe out years of trust and progress the space has built.

The glitches so far have been mild compared to the systematic issues that we could face.

When that happens, it will implode, and in turn deal a devastating blow to DeFi that will wipe out years of trust and progress the space has built.

The glitches so far have been mild compared to the systematic issues that we could face.

38/39

Make no mistake. Right now, MakerDAO has most DeFi products on a short-leash and will one day yank the chain.

It& #39;s time for us to start looking to other options before it is too late. #DoubtDAI

Make no mistake. Right now, MakerDAO has most DeFi products on a short-leash and will one day yank the chain.

It& #39;s time for us to start looking to other options before it is too late. #DoubtDAI

39/39

Medium Version for the Anti-Tweet Folks: https://medium.com/@adamscochran/3-reasons-why-dai-is-defis-biggest-risk-64f1bc7e6109">https://medium.com/@adamscoc...

Medium Version for the Anti-Tweet Folks: https://medium.com/@adamscochran/3-reasons-why-dai-is-defis-biggest-risk-64f1bc7e6109">https://medium.com/@adamscoc...

@VitalikButerin & @VladZamfir you& #39;ve probably both thought a fair bit about the decentralized stablecoin problem in regards to governance models.

Any thoughts on what is a good approach to minimal governance?

Any thoughts on what is a good approach to minimal governance?

Read on Twitter

Read on Twitter