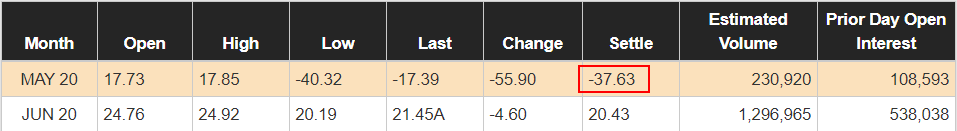

Crude oil futures at NYMEX settled at -37.63 today. How does this even work? The crude oil future is a futures contract (CL) where the expiry date happens once a month, and all buyers holding the contract on expiry must take delivery of physical crude oil at Cushing, Oklahoma.

As a buyer, you just have to take delivery, and a seller will deliver the crude to the location. To avoid this most traders will simply "rollover" to the next month, a few days before expiry.

Whoever didn& #39;t rollover and stayed in the April contract saw something horrendous.

Whoever didn& #39;t rollover and stayed in the April contract saw something horrendous.

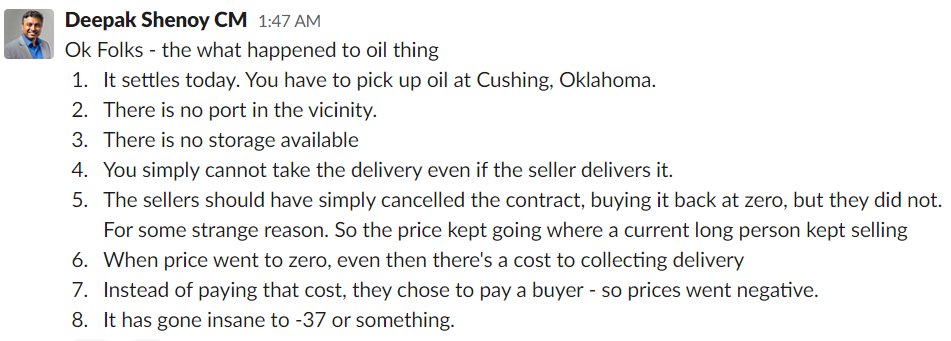

I explained, in the @capitalmind_in Premium Slack: There is no storage available, and no port for someone to send a ship over. So delivery today = simply not possible.

Why would a price go below zero? If I& #39;m a buyer and I don& #39; t have any storage, I might lose a lot in penalties/fines if I don& #39;t take delivery. So, I& #39;m willing to offer you lower and lower prices. Desperately, I offer to pay you to sell you my crude oil. Price goes negative.

This has repurcussions, but it& #39;s not like there& #39;s no demand for crude - the Brent contract is still above $20, and the June contract - the next month - is also about $20. Basically this was a problem of delivery today.

Where is the impact, though? The buyers of such contracts, on the exchanges, have to pay up. It& #39;s a fairly large sum of money, and we will see defaults or some funds hurt big time - data on this soon.

And it hurts Indian markets too. The MCX, specifically.

And it hurts Indian markets too. The MCX, specifically.

The MCX crude oil contract also expires on April 20, but the settlement will be on the NYMEX CL contract settlement. Which, in rupee terms is roughly -383,000 per lot.

Buyers at MCX will have to cough up Rs. 383,000 per lot tomorrow.

Buyers at MCX will have to cough up Rs. 383,000 per lot tomorrow.

This is weird - because a buyer pays to buy, and on expiry the contract has some value so he gets money back. Usually.

But crude oil closed negative this time, so the buyer has to pay a lot more again. There could be broker/client level defaults tomorrow. Watch out.

But crude oil closed negative this time, so the buyer has to pay a lot more again. There could be broker/client level defaults tomorrow. Watch out.

Read on Twitter

Read on Twitter