I& #39;m seeing a lot of folks saying oil is now at sub $2 per barrel. I think we need to understand what it means.

#Thread

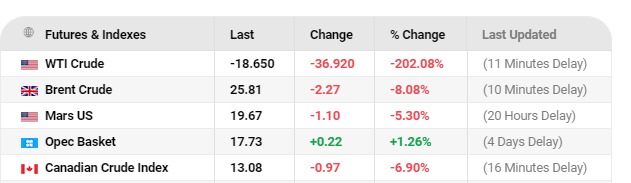

1. We have different pricing grade for crude oil based on the API and Sulphur content. We have the WTI, Brent, Bonny light etc. High API +low sulphur is good

#Thread

1. We have different pricing grade for crude oil based on the API and Sulphur content. We have the WTI, Brent, Bonny light etc. High API +low sulphur is good

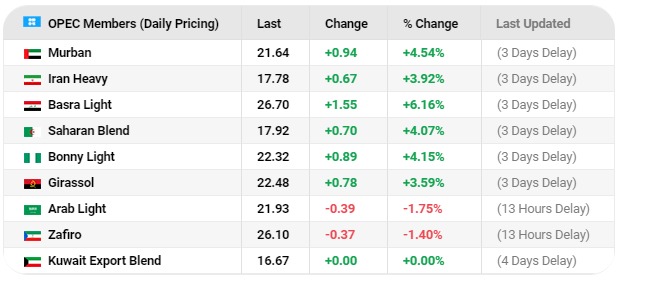

2. Nigeria& #39;s crude is Bonny night which has a different price under the OPEC basket pricing. Although, OPEC also mark to Brent.

3. The major focus right now is the WTI which is oil grade for US (Texas). Often call sweet oil because of its lightness and low sulphur content.

3. The major focus right now is the WTI which is oil grade for US (Texas). Often call sweet oil because of its lightness and low sulphur content.

4. Commodity trading has 2 market. The underlying commodity (physical) market where the actual commodities are being traded and the futures market. The physical commodity is usually being traded based on the various pricing benchmarks. The spot price reference the pricing grades

5. The price that is being quoted at sub $2 is the 1 month May future price for WTI. The future price is the expected price market players are positioning the price would be in some time in the future.The settlement and delivery of the contract will occur in the future.

6. Spot price is the current price the commodity is being traded and immediately settled and delivered.

7. As the contract on a commodity approaches maturity, the diff between the spot and future price converges to zero. At maturity, the spot price is the same as future price.

7. As the contract on a commodity approaches maturity, the diff between the spot and future price converges to zero. At maturity, the spot price is the same as future price.

8. The future price should basically be higher than the spot price because of the cost of carry ( the storage/transport and other costs of holding the commodity) adjusted for the convenience yield ( implied return earned as a result of holding the commodity).

9. Back to our current situation with WTI, the future price is excessively higher than the spot price. When this happens, the market is said to have entered & #39;a steep contango& #39;. This means that there is pressure on the near months due to the oil glut (Oversupply) in the market.

10. Future prices are determined when demand (buyers) and supply (sellers) interact and settle at a future spot price informed by the fundamentals such as the cost of carry, convenience yield, interest rate, market sentiments and spot price.

11. When the futures market is in contango, traders (buyers) enter into a long position, they expect prices to be higher in the future so they lock the future price down today. However, as the contract nears maturity and spot price remain low, the position becomes worthless.

12. WTI May 2020 futures price is tanking because the contract is near settlement and traders are unwilling to settle the position and take delivery of the physical oil (cost of carry implication) therefore they are offloading the futures contract at a premium.

13. Also, when the commodity market enters backwardation, traders will sell the future contracts. I.e they will sell as a higher price now and offset at a lower price in the future.

14. In summary, The plunged in May 2020 futures market is triggered by the excess supply floating the physical market and the depressed demand caused by the lockdown triggered by Covid 19 which is keeping the spot price making the open positions worthless.

15. Also, When a trader buys a future contract for speculative reasons and doesn& #39;t intend to actually take delivery of the commodity on expiration, as the contract nears expiration and cost of carry is high, the trader will count his loses and dump the position.

16. Finally, Nigeria isn& #39;t directly affected by the crash in the futures market the way we are taking it. The government trades in physical oil (Bonny light) which is marked to Brent oil. The crash is in WTI May 2020 futures which Nigerian government might not be trading.

Composition of OPEC pricing basket which includes Nigeria& #39;s Bonny Light

Read on Twitter

Read on Twitter