A real-life thing to remember about today& #39;s fall in oil prices is that the price for ANYTHING can go negative

If you have something you need to sell, but nobody wants to buy, then you have to pay someone to take it away. Gold, garbage, crude, coal waste, it& #39;s all the same really

If you have something you need to sell, but nobody wants to buy, then you have to pay someone to take it away. Gold, garbage, crude, coal waste, it& #39;s all the same really

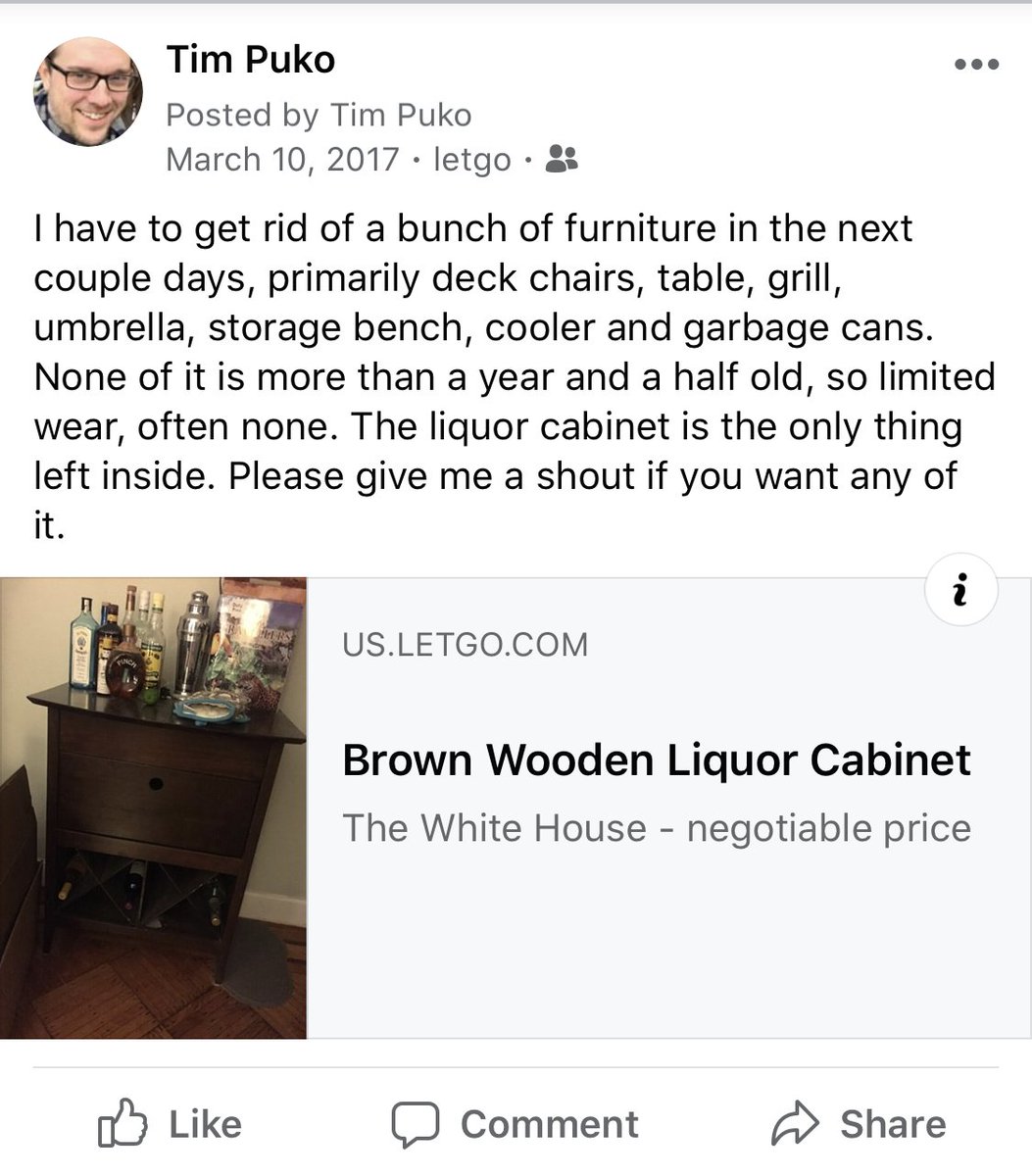

People have been asking how today& #39;s oil price crash is possible. I compare it to when I had to bail on a Brooklyn apartment after a breakup

The lease was up; I had to move. I had all this deck furniture, but no deck in the new spot. The furniture was in good shape but I didn& #39;t…

The lease was up; I had to move. I had all this deck furniture, but no deck in the new spot. The furniture was in good shape but I didn& #39;t…

but I didn& #39;t have time to find a buyer before I had to be out of the place. That meant finding a dude on Thumbtack who had a trailer. I had to pay him $50. So my deck furniture, grill, etc., fell in value from >$300 to -$50 almost as fast as WTI fell today

(no shouts were given)

(no shouts were given)

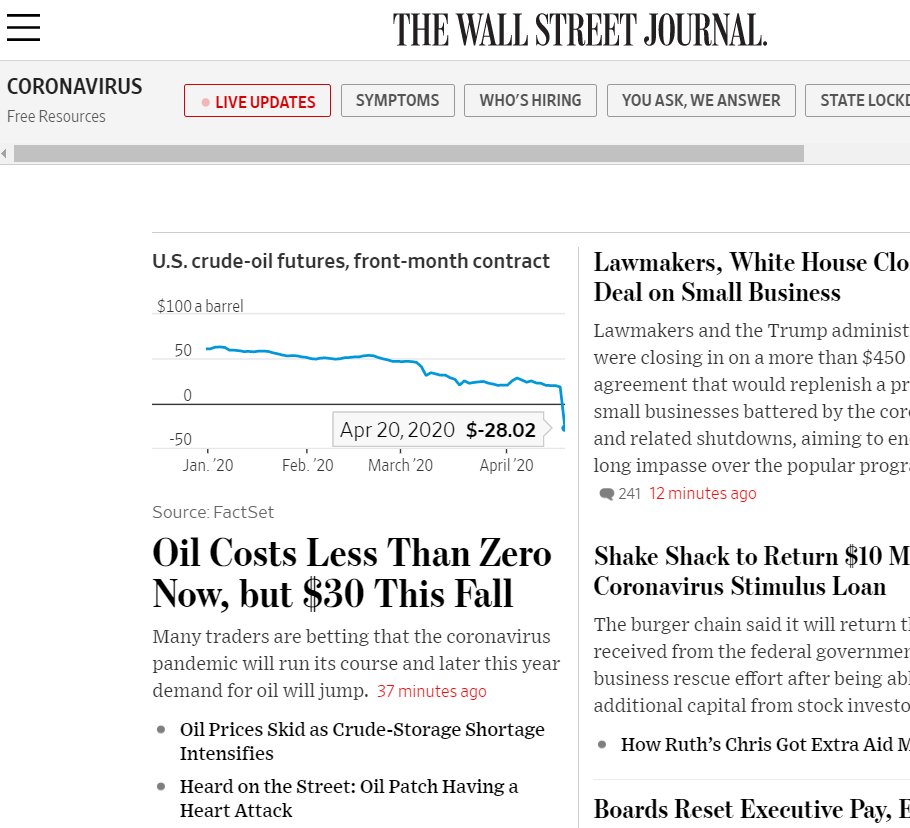

The oil market had a convergence of events: Storage space is running out there, too, plus today is the expiration of the May futures contract

All those traders and speculators who had oil, a lot had May contracts they had to sell. May oil is arriving soon and it& #39;s hard — or at least expensive — to find a place to put it

@benoitfaucon and @summer_said reported the coming storage crisis in March https://www.wsj.com/articles/overloaded-storage-facilities-likely-to-mean-even-lower-oil-prices-11584548816">https://www.wsj.com/articles/...

@benoitfaucon and @summer_said reported the coming storage crisis in March https://www.wsj.com/articles/overloaded-storage-facilities-likely-to-mean-even-lower-oil-prices-11584548816">https://www.wsj.com/articles/...

Now, what about the OPEC+ deal that Trump helped orchestrate, wasn& #39;t it supposed to help?

Yes, it is a historic cutback to address the glut; but it doesn& #39;t SOLVE it. The sudden drop in demand from the pandemic is beyond what industry can quickly adapt to https://www.wsj.com/articles/opec-allies-look-to-resolve-saudi-mexico-standoff-and-seal-broader-oil-deal-11586695794">https://www.wsj.com/articles/...

Yes, it is a historic cutback to address the glut; but it doesn& #39;t SOLVE it. The sudden drop in demand from the pandemic is beyond what industry can quickly adapt to https://www.wsj.com/articles/opec-allies-look-to-resolve-saudi-mexico-standoff-and-seal-broader-oil-deal-11586695794">https://www.wsj.com/articles/...

That flaw was obvious at the time

@ColumbiaUEnergy’s Jon Elkind pointed out the deal cuts output by about 10 million barrels a day. Maybe 15 if things go well; maybe 20 if a galaxy of stars align

But demand is expected to fall AT LEAST 25 million day https://www.wsj.com/articles/trump-says-opec-is-looking-to-cut-oil-production-by-20-million-barrels-a-day-11586787950">https://www.wsj.com/articles/...

@ColumbiaUEnergy’s Jon Elkind pointed out the deal cuts output by about 10 million barrels a day. Maybe 15 if things go well; maybe 20 if a galaxy of stars align

But demand is expected to fall AT LEAST 25 million day https://www.wsj.com/articles/trump-says-opec-is-looking-to-cut-oil-production-by-20-million-barrels-a-day-11586787950">https://www.wsj.com/articles/...

The glut is overwhelming, and the future is bleak for many U.S. oil companies. Many piled on debt in recent years; now low prices make bankruptcy a real threat for dozens of them

@AmrithRamkumar reports how the market petrifies investors right now https://www.wsj.com/articles/oil-investors-grow-desperate-for-supply-cuts-amid-glut-11586088000">https://www.wsj.com/articles/...

@AmrithRamkumar reports how the market petrifies investors right now https://www.wsj.com/articles/oil-investors-grow-desperate-for-supply-cuts-amid-glut-11586088000">https://www.wsj.com/articles/...

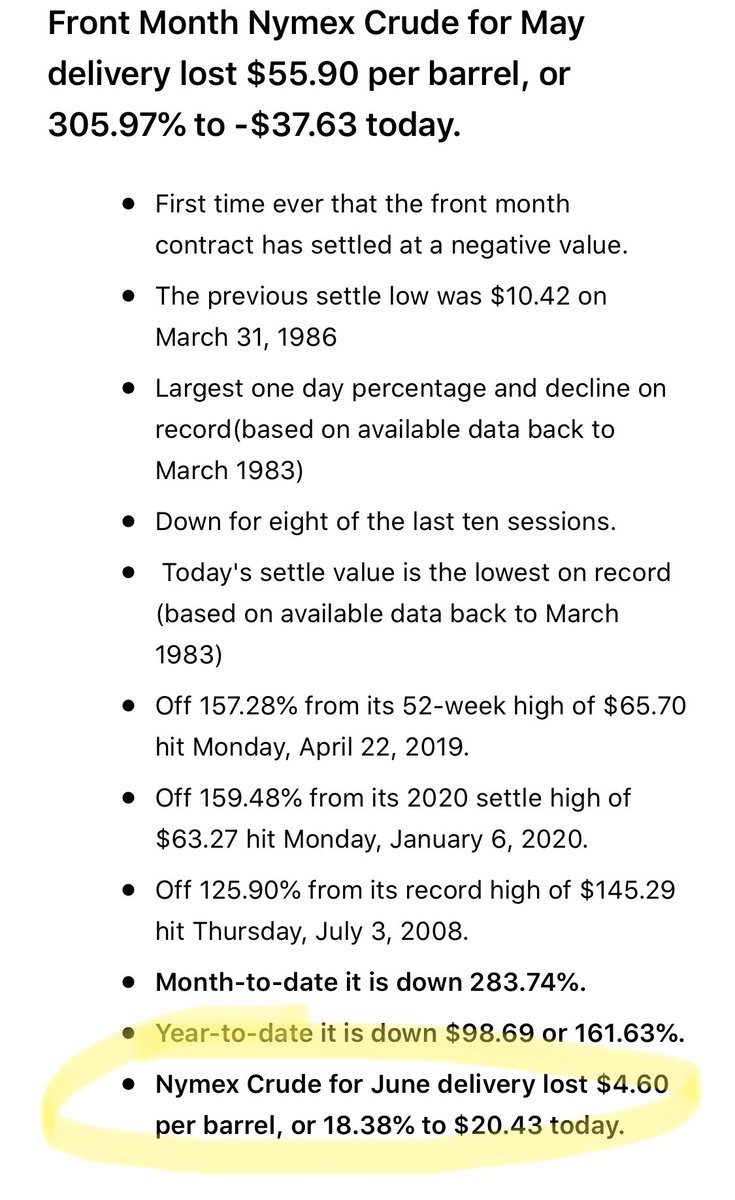

One last note: The role of the futures market and the expiration of May as the front-month contract cannot be overstated here. In some ways it& #39;s just a quirk and it won& #39;t matter tomorrow. Big volatility is common on days like this notes @RogerDiwan https://twitter.com/RogerDiwan/status/1252324706876784640?s=20">https://twitter.com/RogerDiwa...

And even purely financial traders still have to close out trades on the May contract, or at least roll it over to June. There& #39;s been a flood of retail traders into the market, often in long-only assets. That means a lot of buyers who need to cash out now https://twitter.com/JavierBlas/status/1252138654421614592?s=20">https://twitter.com/JavierBla...

As electronic trading moves on — already — to the June contract, things go back to what now passes for normal. Most activity was in that contract today and it settled above $0, at $20.43

@georgikantchev explains that that price, and the international benchmark, are more reflective of oil& #39;s actual value in the market than some wonky anomaly in the U.S. futures market around a contract expiration https://twitter.com/georgikantchev/status/1252290412200497153?s=20">https://twitter.com/georgikan...

The scary thing for US oil cos. is what today foreshadows next month and maybe the month after. This could happen again, earlier and w more severe pain. The glut is intense and likely won& #39;t end before US producers have turn off the taps, says @Spencerjakab https://www.wsj.com/articles/americas-oil-patch-is-having-a-heart-attack-11587388462">https://www.wsj.com/articles/...

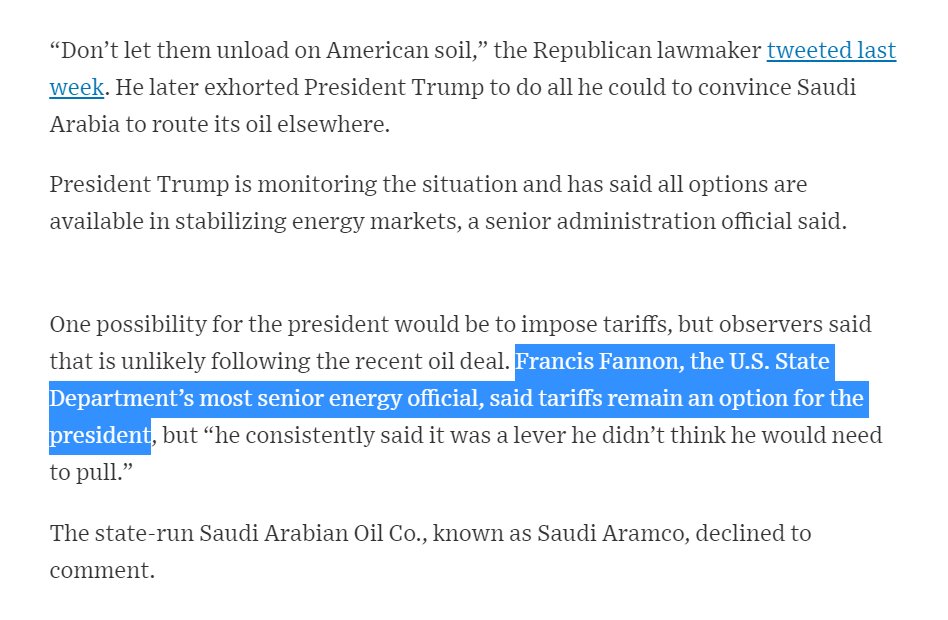

Oh, I forgot to even mention a Washington angle. I& #39;ll just leave the story @cmatthews9 and I did about oil tariffs and a bill to withdraw military support from Saudi Arabia right here. https://www.wsj.com/articles/trump-eyes-tariffs-as-tool-to-tame-oil-glut-11586367753">https://www.wsj.com/articles/...

We had heard from both inside and outside the administration that after the OPEC+ deal oil tariffs would be off the table. But the only on-the-record comments last week were in fact that they are very much still an option for the president

https://www.wsj.com/articles/flood-of-saudi-oil-looms-as-u-s-drillers-face-supply-glut-11587119400">https://www.wsj.com/articles/...

https://www.wsj.com/articles/flood-of-saudi-oil-looms-as-u-s-drillers-face-supply-glut-11587119400">https://www.wsj.com/articles/...

Read on Twitter

Read on Twitter