Over the past two years I& #39;ve been telling the story of how global oil demand growth would eventually flatten, decimating the industry. Today& #39;s oil gotterdammerung is a very different story; a macro crisis that will not as many hope deliver easy progress to the climate problem. 1/ https://twitter.com/GregorMacdonald/status/1082018027967664128">https://twitter.com/GregorMac...

To be sure, the massive revisions to 2020 global oil demand, if realized, will stand as a deep crater. And it& #39;ll take years for oil to slowly crawl out back to the rim. We might cautiously conclude the crisis has therefore brought the peak of demand forward, from 2025 to 2019. 2/

So in the first instance, we can pretty safely conclude that the long arc of oil& #39;s demand growth, from the first half the 20thC to the early part of the 21st, is over. It was ending anyway. For all the various reasons I and others have been writing about for years. 3/

Human thinking however is vulnerable to either/or propositions. And as soon as you begin to articulate the end of growth, or a peak, it sets the mind immediately to focusing on declines. I can see the crisis is prodding many in this direction. The declines are *finally* here. 4/

Unfortunately, the last 100 years have demonstrated that fossil fuel demand resurrections are persistently stubborn. My work continues to be focused on why those rebounds can finally be expected to weaken. Still true. The problem is the plateau. https://gregor.substack.com/p/plateau-problems">https://gregor.substack.com/p/plateau... 5/

Currently, in my newsletter, I am thrashing out the problem of what exactly happens next in global oil dependency, through the lens of my eBook Oil Fall. I& #39;m incredibly encouraged by how China and Europe are electrifying transport, thus removing future support from oil. 6/

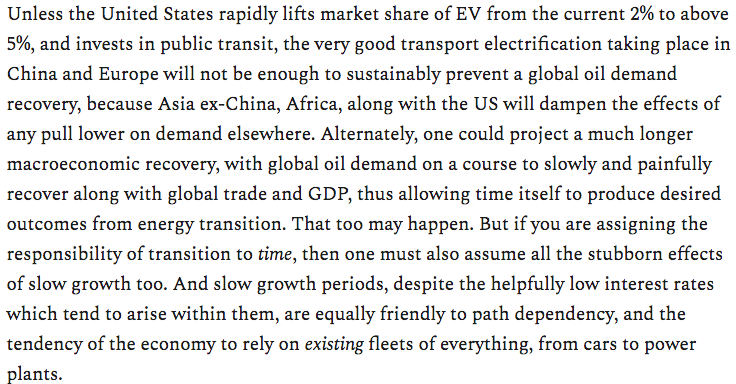

The problem child in this equation however is my own country, the US. Our topography, our infrastructure, and our EV adoption is just sluggish enough to keep oil demand from rising, but also from falling. Again, the plateau problem. From this week& #39;s letter: 7/

One of the biggest changes in my thinking this decade-- especially as someone who likes to foreground price, affordability, technology advancement, and the market--is my new respect for the power of policy. In a way, genuinely believing and reporting on the power of markets.. 8/

..will eventually lead you to see market limits appearing frequently on the horizon, the outer boundaries where the system is just completely stuck in the mud and nothing but a policy tow truck is going to free you. 9/

Path dependency is a real thing. In his important and creative report, @MCL1965 lays out in novel detail, in ways I& #39;ve not yet seen in even the most academic papers, how the existing incumbent oil system catches and keeps market share simply for this reason: it already exist. /10

It& #39;s possible also that Mark has a different view from me about the way forward, but please do read his report from BNP Paribas so that you can benefit from his masterful description of how path dependency works: https://docfinder.bnpparibas-am.com/api/files/1094E5B9-2FAA-47A3-805D-EF65EAD09A7F">https://docfinder.bnpparibas-am.com/api/files... /11

Accordingly, the world now has an exceptionally encouraging base of newly emerging clean energy which portends enormous growth ahead for wind, solar, and electrified transport. Our concern is no longer further oil or coal growth. Our concern is coal and oil dependency. /12

So to head off an oil resurrection, a recovery that further embeds not oil growth but long duration oil dependency, you& #39;re going to have to kick over some furniture. US cities all need London rules: congestion charges, day charges, low emission rules. Americans won& #39;t like it. /13

Obviously it& #39;s amazing EV share in California& #39;s auto market is pushing towards 7%. But the US is at 2%. And not a single US city dares--even in the deepest of blue states--to put in zone or congestion charges. A recipe to halt oil growth, but, will not earn you declines. /14

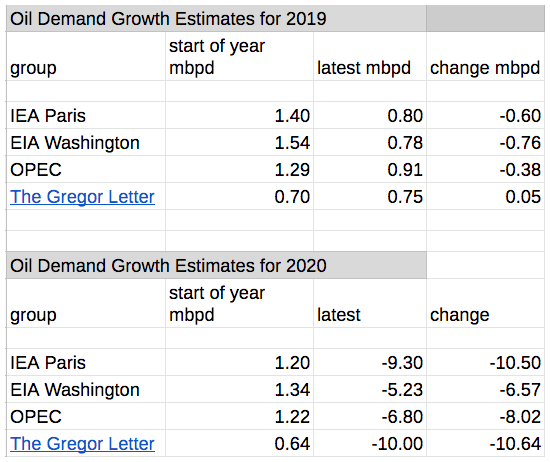

So global oil demand was 100.75 mbpd last year. This year, decline forecasts range from -5 mbpd to -10 mbpd. I keep a running tally of my own forecasts in my newsletter, along with EIA, IEA, and OPEC. You can see the latest here: /15

Here is my point: while many analysts will justifiably forecast it could take 3-4 years for global oil demand to return *towards* 100 mbpd--perhaps only getting to 97 or 98 mbpd, this analysis risks offering up a 2019 peak as a kind of brass ring. But a ring of little value. /16

They may not know it--because I spend so much time brandishing the torch of renewables and how they really will (because they are) continue killing fossil fuels--but folks like @Peters_Glen and @CoalFreeDave have really helped me appreciate the crazy resilience of fossil... /17

... fuel dependency. Like, I watched several years of wild growth in global wind and solar get wrecked in 2018 because a surge in global air conditioning (yup, because of climate) called upon spare coal capacity, totally drowning wind and solar gains in a heartless stroke. /18

Gaze upon these rental cars at Dodger Stadium. Not unlike the parked airplanes from the 2008 GFC, this is just a tiny glimpse of the existing fleet, which can also be thought of as spare capacity. Without policy, it& #39;s all going to come back. 19/ https://www.theeastsiderla.com/neighborhoods/echo_park/dodger-stadium-rental-car-lot-keeps-growing/article_d8d9bae6-781a-11ea-8fd5-b316771244e7.html">https://www.theeastsiderla.com/neighborh...

So: the current crisis creates some time in which policy, and especially smarter public investment (needed also to put people back to work) can take place. What it does not grant is a freebie to the project of getting fossil fuel consumption, and emissions, into decline. 20/

Read on Twitter

Read on Twitter