Here are some alternative facts.

1. British Virgin Islands (BVI) ranks #1 in the Corporate Tax Haven Index https://corporatetaxhavenindex.org/introduction/cthi-2019-results">https://corporatetaxhavenindex.org/introduct...

and #9 in the Financial Secrecy Index https://fsi.taxjustice.net/en/introduction/fsi-results

This">https://fsi.taxjustice.net/en/introd... means that it poses a major global threat of tax avoidance and of tax evasion. https://twitter.com/richardbranson/status/1252151643061313539">https://twitter.com/richardbr...

1. British Virgin Islands (BVI) ranks #1 in the Corporate Tax Haven Index https://corporatetaxhavenindex.org/introduction/cthi-2019-results">https://corporatetaxhavenindex.org/introduct...

and #9 in the Financial Secrecy Index https://fsi.taxjustice.net/en/introduction/fsi-results

This">https://fsi.taxjustice.net/en/introd... means that it poses a major global threat of tax avoidance and of tax evasion. https://twitter.com/richardbranson/status/1252151643061313539">https://twitter.com/richardbr...

2. You write: & #39;Our companies all pay tax in the countries they operate in& #39;. But BVI companies typically provide little or no transparency, and that makes it virtually impossible from the outside to assess such a claim. How much tax is paid, and where?

3. You are a leading figure in @thebteamhq. The B Team promotes tax transparency, and members including Vodafone now publish their country by country reporting data - which shows exactly what tax they pay, and where. Why doesn& #39;t Virgin?

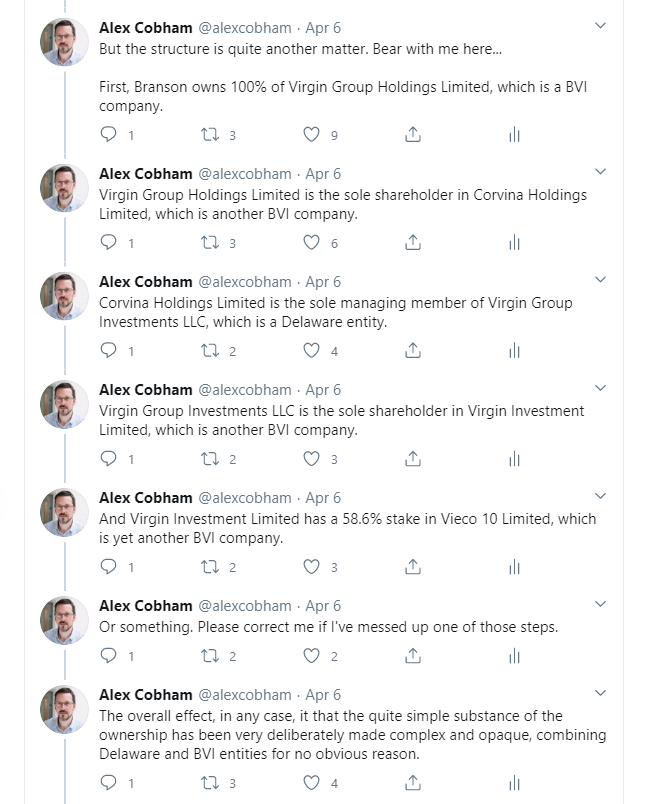

4. Instead, the corporate structures of Virgin are complex and opaque. And just this month, it was revealed that you had rearranged the BVI-Delaware structure for Virgin Galactic, even as the world entered the peak of a pandemic. Priorities? https://twitter.com/alexcobham/status/1247173097708535808?s=20">https://twitter.com/alexcobha...

5. Presumably this has a perfectly reasonable explanation, grounded in a desire to pay the right amount of tax at the right time in each jurisdiction of operation. If you published the accounts of each entity, plus country by country reporting, we could all be confident of it.

Read on Twitter

Read on Twitter