Check out our new paper on bank geographic complexity and bank risk. 1/ https://twitter.com/BIS_org/status/1252142987762716673">https://twitter.com/BIS_org/s...

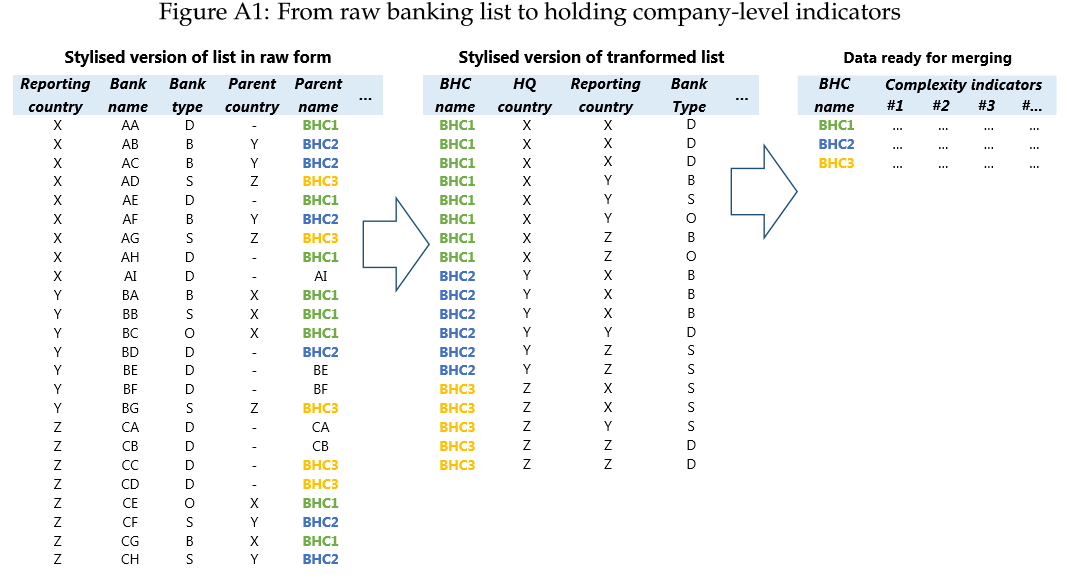

We use the BIS banking list to construct a Herfindahl-Hirschman(*) measure of geographic representation and complexity at the Bank Holding Company-year level, for 96 large internationally active BHCs. The banking list collects info on the banking entities reporting to BIS stats

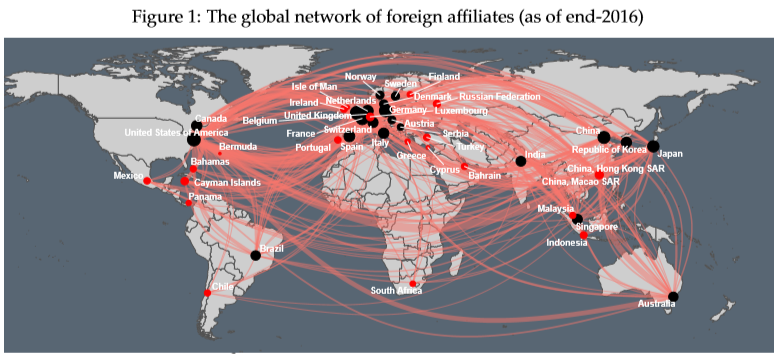

This figure shows the global network of foreign affiliates. Node size = # of incoming and outgoing connections. Black nodes = jurisdictions where 1+ BHCs are headquartered, red = countries where only affiliates of BHCs headquartered in the black node jurisdictions are located 3/

Geographic complexity can affect bank risk through 3 channels acting in opposite directions. First, it can provide diversification value to financial institutions and can thus be beneficial for bank risk and financial stability. 4/

We document that a higher degree of geographic complexity helps banks dampen the adverse impact of local economic shocks (i.e. in the country of headquarters) on their riskiness 5/

Second, just as a wider geographic footprint enhances diversification potential, it also increases exposure. We find that banks with a higher degree of geographic complexity are more vulnerable to shocks to the global economy. 6/

Third, geographic complexity can also increase risk by changing the way regulation impacts the bank. Tighter regulation is associated with higher capitalization. However, if there is higher complexity, the increase in the risk-based cap ratio (reg. Tier1 capital) is smaller. 7/

This implies that a wider geographic reach can provide banks wi th a broad range of ways to respond to the regulation, potentially impacting their resilience and risk. 8/

We establish this third effect by analyzing forward-looking mkt measures of bank risk following the introduction of the GSIB framework and SSM in a diff-in-diff setting. We find that these reforms generally reduced bank risk, but less so for more geographically complex banks. 9/

Bank geographic complexity therefore has a Janus face. It helps mitigate the impact of local economic shocks and hence strengthens banks’ resilience. But it increases exposure to global shocks and can weaken the effect of regulation. 10/ https://twitter.com/BIS_org/status/1252144842420948994?s=20">https://twitter.com/BIS_org/s...

(*) The literature converged to the Herdinfahl-Hirschman name, hence I use it. But the index was invented by the amazing Albert O. Hirschman, who wrote this on the index, over 55 years ago: #metadata_info_tab_contents">https://www.jstor.org/stable/1818582?seq=1 #metadata_info_tab_contents">https://www.jstor.org/stable/18...

Read on Twitter

Read on Twitter