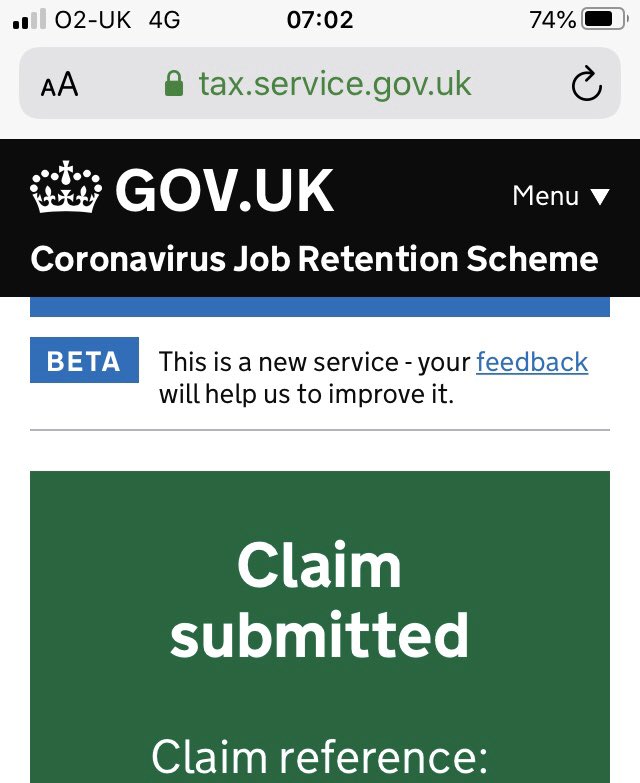

Portal now open. This thread has screenshots of what you will see when you submit a claim. https://twitter.com/hmrcgovuk/status/1251797787227947008">https://twitter.com/hmrcgovuk...

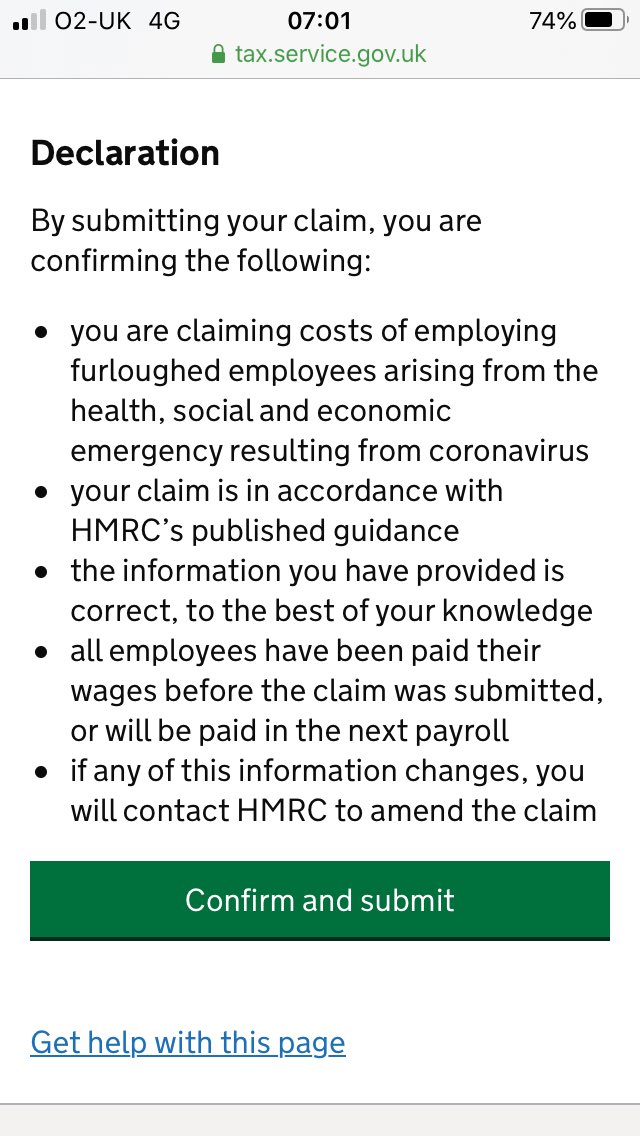

1. Declaration that you understand and will abide by the rules of the scheme.

(No screenshot for this)

(No screenshot for this)

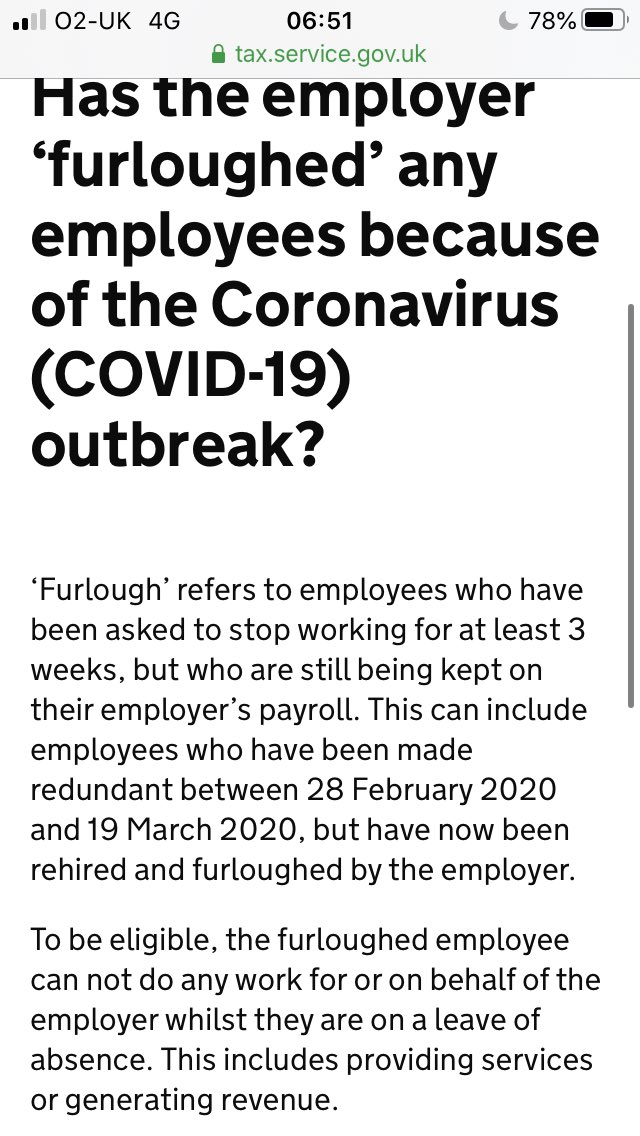

2. Has the employer furloughed any employees due to COVID-19? NB furloughed employees cannot do any work.

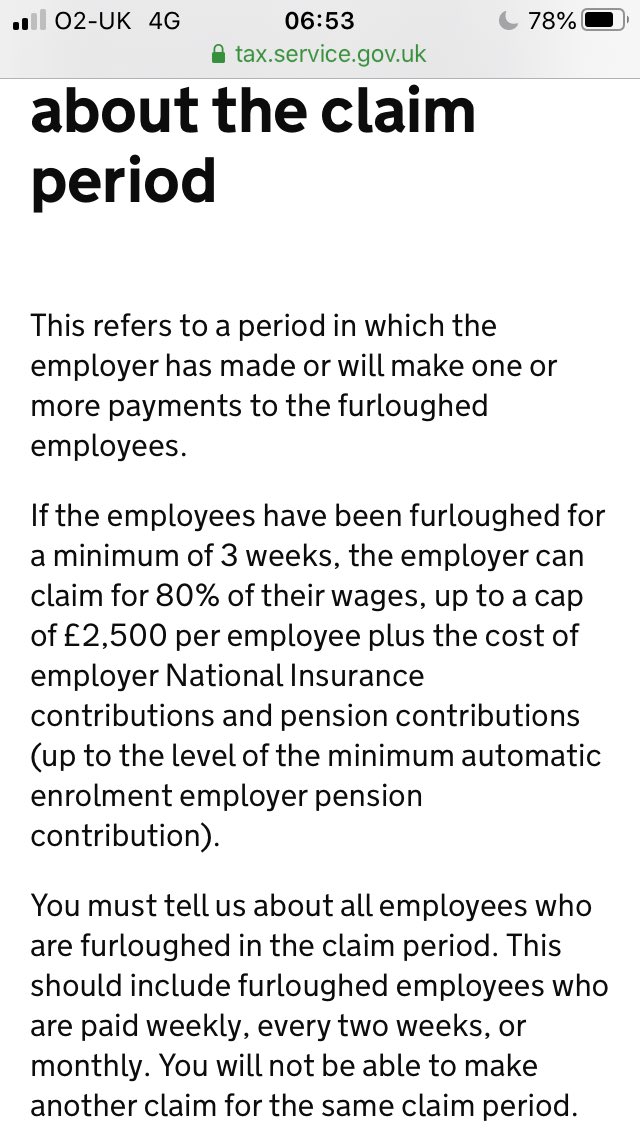

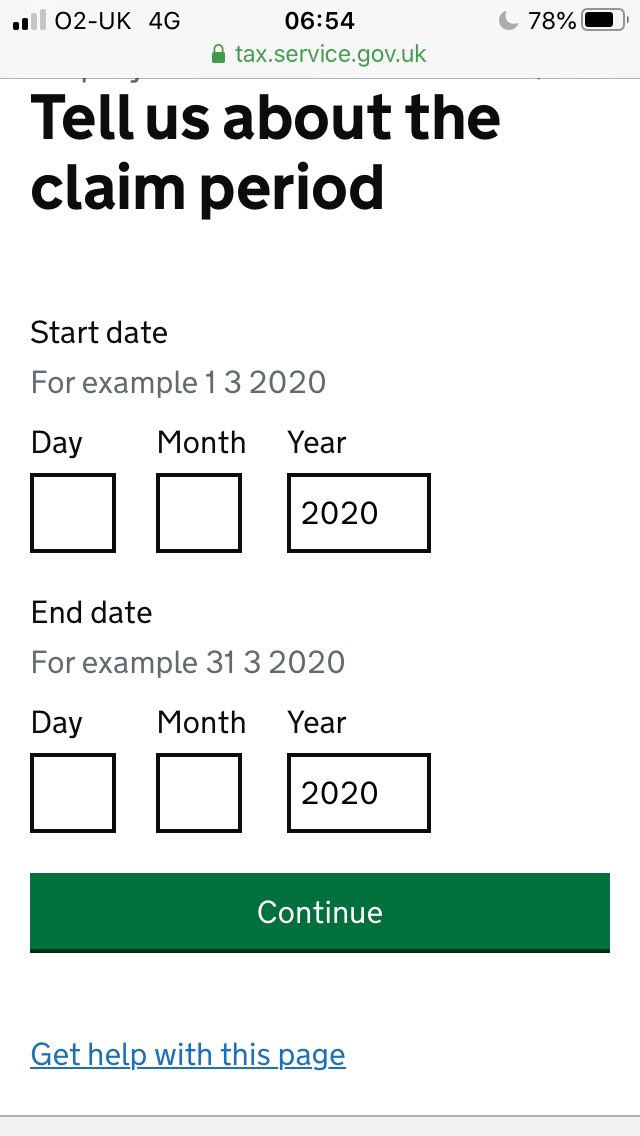

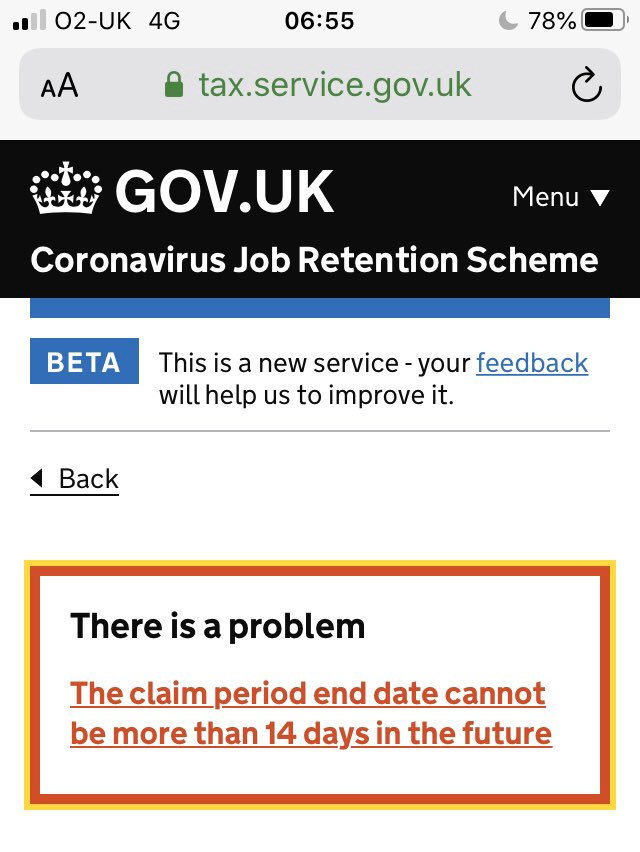

7. You can enter a date which ends up to 14 days ahead, but no more (ie if the furlough is more than a month, submit one claim per month)

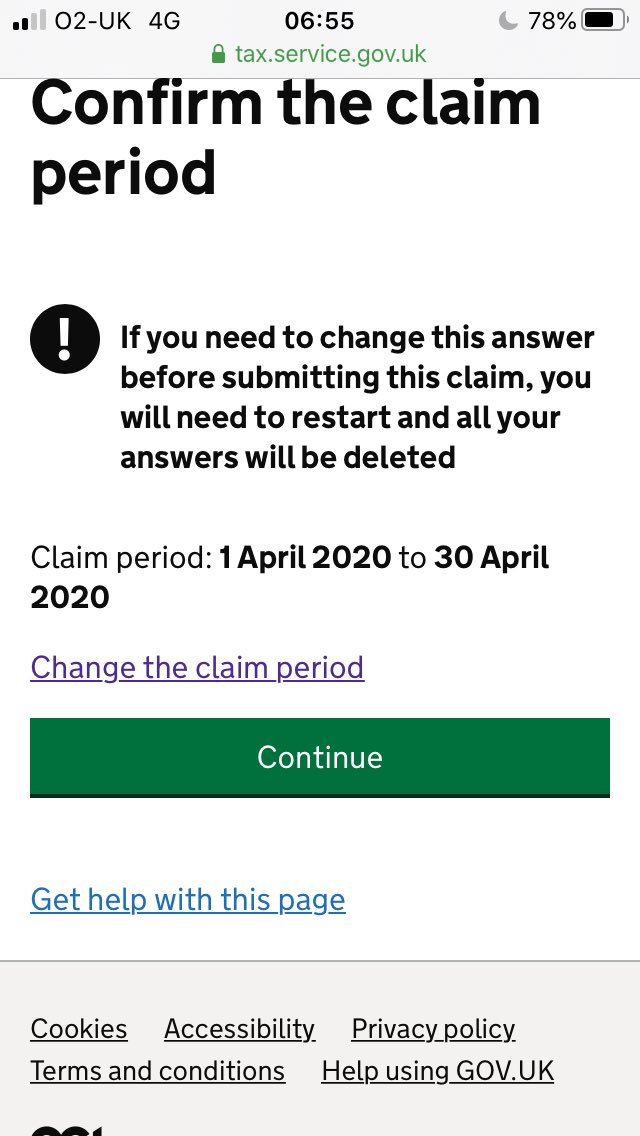

8. Confirm the claim period

(NB from now on there is a warning that any changes will mean you have to start again)

(NB from now on there is a warning that any changes will mean you have to start again)

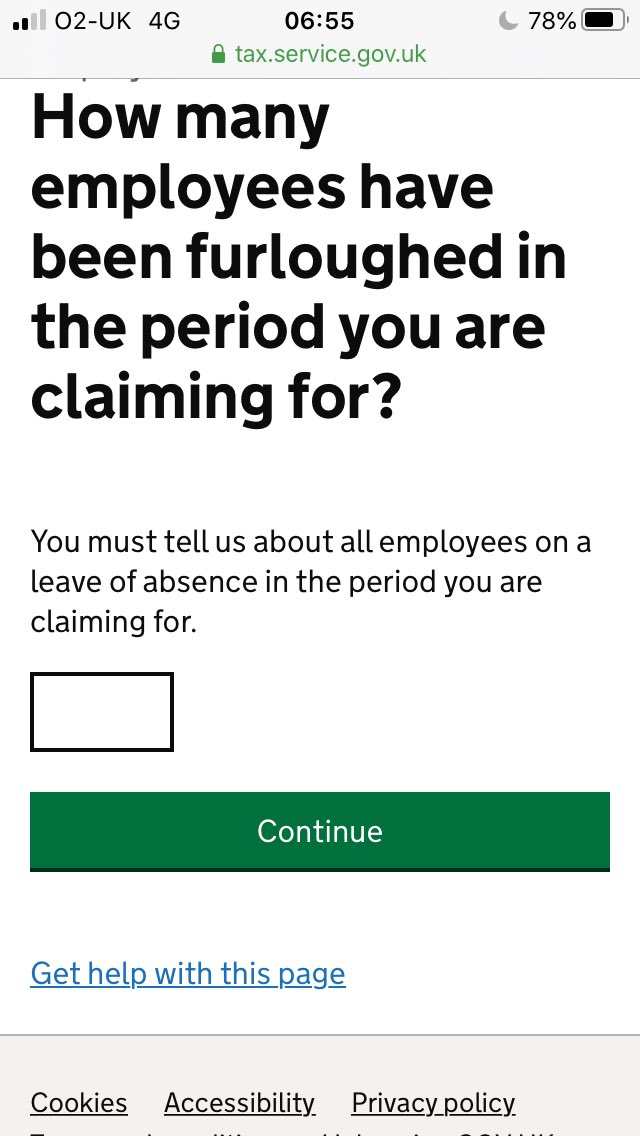

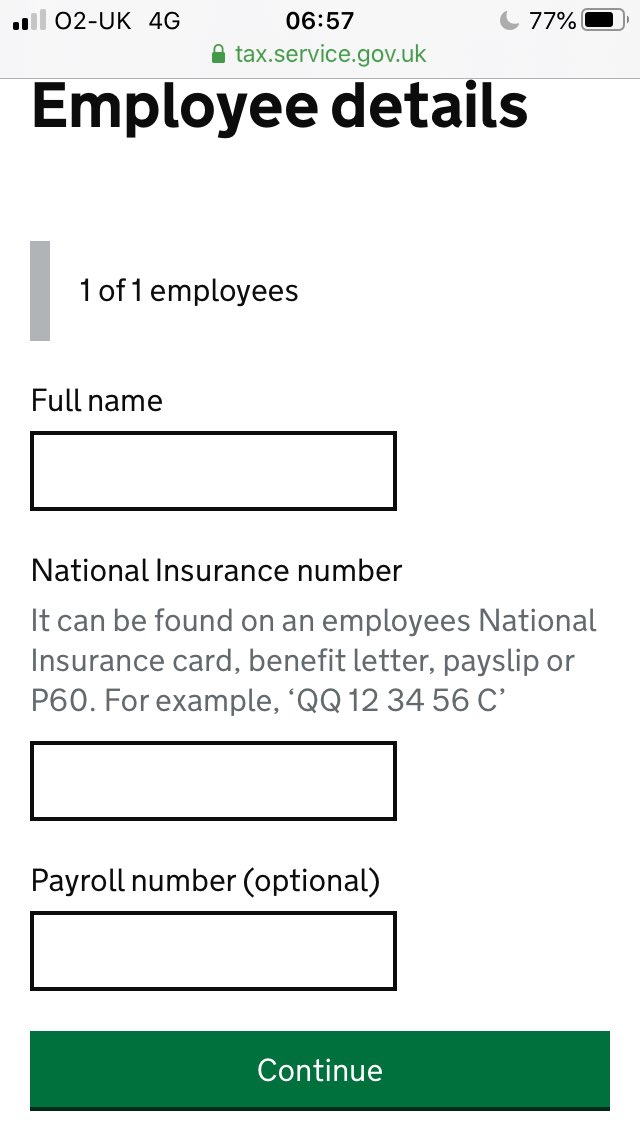

11. Details of each employee (must be entered one by one unless you are submitting 100 or more) - NINO must be entered

For further practical guidance, see the article on our @BlickRothenberg website (updated for 17 April changes to HMRC guidance) https://www.blickrothenberg.com/insights/detail/how-to-access-the-coronavirus-job-retention-scheme/">https://www.blickrothenberg.com/insights/...

Dear @threadreaderapp please unroll (if you are not too busy). Thanks

Read on Twitter

Read on Twitter