More on B2B marketplaces:

B2B marketplaces 1.0 didn& #39;t really work. Most B2B spend remains offline. Why?

- horizontal, didn& #39;t address vertical specific workflows.

- lacked integrated payments & lending

- digitized existing relationships vs facilitating new ones

Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://twitter.com/eriktorenberg/status/1239278638018654208">https://twitter.com/eriktoren...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://twitter.com/eriktorenberg/status/1239278638018654208">https://twitter.com/eriktoren...

B2B marketplaces 1.0 didn& #39;t really work. Most B2B spend remains offline. Why?

- horizontal, didn& #39;t address vertical specific workflows.

- lacked integrated payments & lending

- digitized existing relationships vs facilitating new ones

Thread

What& #39;s changed?

- Generational shift: Millennials have higher expectations.

- Integrated payments & lending

- API-driven architecture enables B2B marketplaces to build real-time multi-vendor product catalogs with accurate SKU and pricing information

- Generational shift: Millennials have higher expectations.

- Integrated payments & lending

- API-driven architecture enables B2B marketplaces to build real-time multi-vendor product catalogs with accurate SKU and pricing information

Playbook for 2.0 solutions:

- No friction to purchase, so either free/freemium/cheap, and no lengthy on-boarding & integration

- Vertical-specific

- Don& #39;t threaten intermediaries too much, at least in the beginning

- Instill trust & facilitate new buyer/seller relationships

- No friction to purchase, so either free/freemium/cheap, and no lengthy on-boarding & integration

- Vertical-specific

- Don& #39;t threaten intermediaries too much, at least in the beginning

- Instill trust & facilitate new buyer/seller relationships

Where is whitespace for B2B marketplaces? $ = GMV

- Custom manufacturing ($1T)

- Freight ($1T)

- Energy ($1T)

- Auto parts ($800B)

- Trucking ($700B)

- Grocery ($800B)

- Home appliances ($500B)

- Agriculture ($250B)

- Apparel ($150B)

- Investment banking ($150B)

- Custom manufacturing ($1T)

- Freight ($1T)

- Energy ($1T)

- Auto parts ($800B)

- Trucking ($700B)

- Grocery ($800B)

- Home appliances ($500B)

- Agriculture ($250B)

- Apparel ($150B)

- Investment banking ($150B)

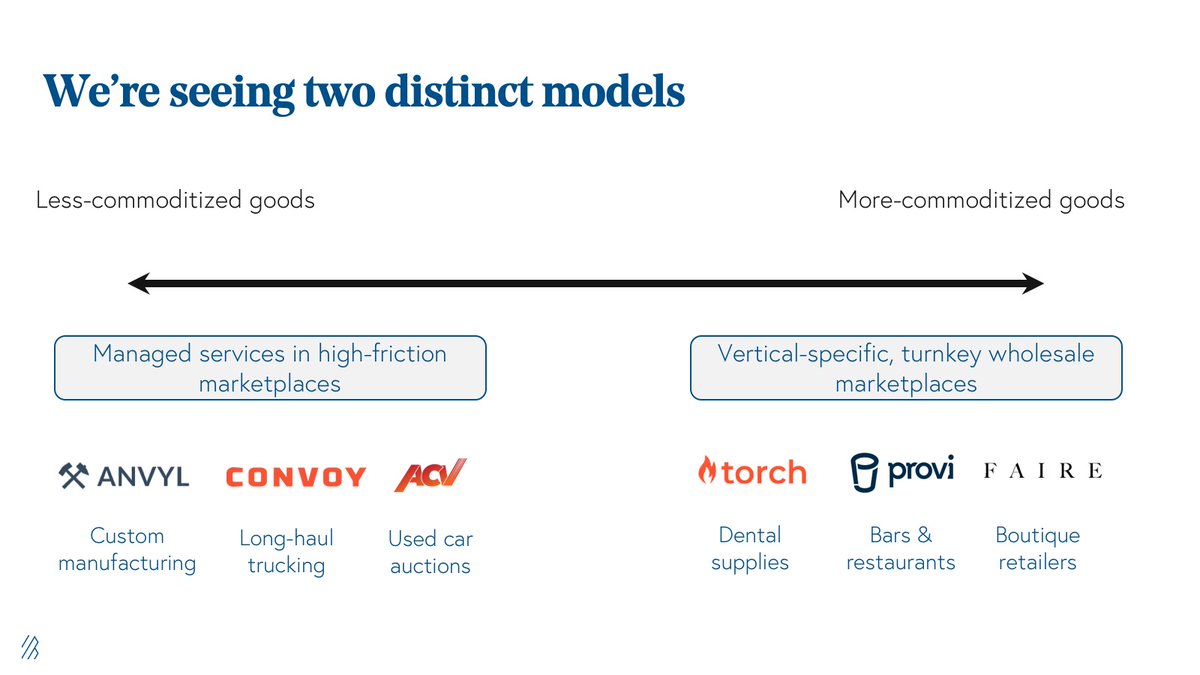

3 types of opportunities re: B2B purchasing:

1/ wholesale marketplaces which facilitate smaller, more frequent transactions (commodities like apparel)

2/ high-friction marketplaces which facilitate larger, less frequent transactions (e.g used cars)

3/ infrastructure providers

1/ wholesale marketplaces which facilitate smaller, more frequent transactions (commodities like apparel)

2/ high-friction marketplaces which facilitate larger, less frequent transactions (e.g used cars)

3/ infrastructure providers

Wholesale marketplaces:

- Enable price & vendor comparison & streamline offline ordering

- Most offer a core workflow product for free & monetize by selling ads or data, facilitating payments/lending, or by leveraging scale to negotiate volume discounts from suppliers

- Enable price & vendor comparison & streamline offline ordering

- Most offer a core workflow product for free & monetize by selling ads or data, facilitating payments/lending, or by leveraging scale to negotiate volume discounts from suppliers

High Friction marketplaces:

- SKUs are less standard and comparable across vendors.

- Examples include investment banking, bulk commodities, freight, and logistics.

- Highly managed marketplaces to ensure quality customer experience.

- Can charge high direct transaction fees.

- SKUs are less standard and comparable across vendors.

- Examples include investment banking, bulk commodities, freight, and logistics.

- Highly managed marketplaces to ensure quality customer experience.

- Can charge high direct transaction fees.

Criteria to evaluate:

- GMV TAM: how much could marketplace facilitate at scale

- Effective take rate: what % of GMV can marketplace capture as net revenue

- GTM efficiency: how much does marketplace spend to acquire a new buyer or seller

Benchmarks attacked

- GMV TAM: how much could marketplace facilitate at scale

- Effective take rate: what % of GMV can marketplace capture as net revenue

- GTM efficiency: how much does marketplace spend to acquire a new buyer or seller

Benchmarks attacked

This was summarize from this great Bessemer blog post. Thanks to Kent Bennett, Connor Watumull, Mike Droesch, and Dhruv Jain for putting this together. https://www.bvp.com/atlas/b2b-marketplaces/?from=feature">https://www.bvp.com/atlas/b2b...

Read on Twitter

Read on Twitter