Short answer: about 136k using Flex naira, 130k on Autosave if you do nothing with the returns or 136k if you do what I’d do with the returns or 169k if you use Safelock

Longer answer (that you frankly didn’t ask for but I like oversabi and this answer is better so here goes): https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)"> https://twitter.com/ezxmuoh/status/1250365613912055809">https://twitter.com/ezxmuoh/s...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)"> https://twitter.com/ezxmuoh/status/1250365613912055809">https://twitter.com/ezxmuoh/s...

Longer answer (that you frankly didn’t ask for but I like oversabi and this answer is better so here goes):

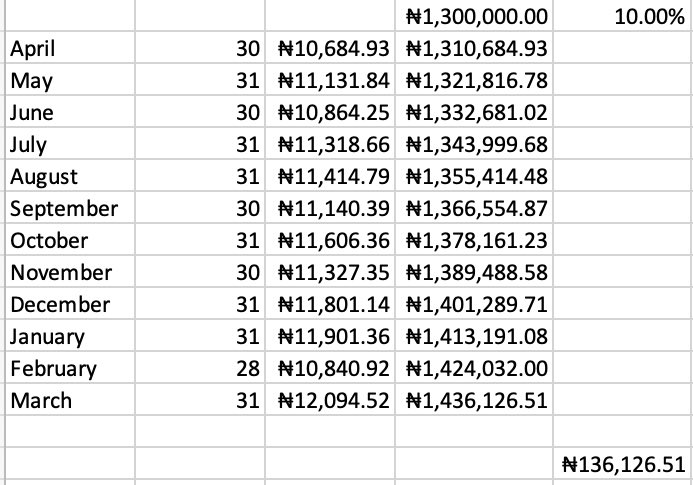

with flex naira, your returns are calculated daily AND you can withdraw anytime you want with NO penalty. So everyday, you would get N356.16 interest. On the 1st day of every month, the returns for that month will be added to the flex naira account. For example, if you funded

your flex naira account with N1.3m on the 1st of April, by May 1st, N10,684.93 would be added to your flex naira account which would now take up your flex naira balance to N1,310,864 which would then attract daily interest for 31 days in May and generate an interest of N11,131.84

and then take your flex naira balance to N1,321,816.78 and so on. I’ve attached a screenshot of the excel sheet I used to calculate this so you can check out the workings (because I’m extra like that and I really like math and turns out I’m pretty good at it  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">). By the end of 1

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">). By the end of 1

year, you would have N1,436,126.51 which means a return of N136,126.51 (as seen in the screenshot).

With autosave, your returns are also calculated daily BUT you can only withdraw it once every quarter. So if you invest today, you can only withdraw on the 30th of June, 30th of

With autosave, your returns are also calculated daily BUT you can only withdraw it once every quarter. So if you invest today, you can only withdraw on the 30th of June, 30th of

September and so on. If you want to withdraw on any other day of the year, you would pay a 2.5% penalty (previously 5% penalty) for breaking your savings prematurely. So you don’t get as much flexibility as the Flex naira option. If you just put your money in autosave and leave

it there, in 12 months, you’ll get 130k.

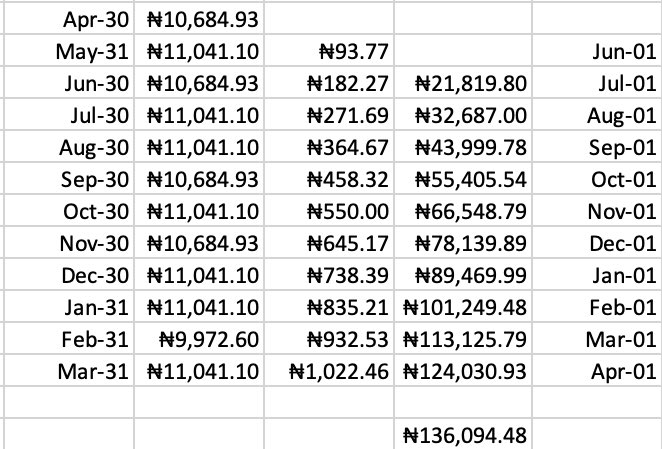

But if you’re like me and you’re always looking for a way to maximize returns at minimum risk, you’ll do this. Your autosave returns are also calculated daily and you can move it to flex naira at the end of every month. So here’s what I’d

But if you’re like me and you’re always looking for a way to maximize returns at minimum risk, you’ll do this. Your autosave returns are also calculated daily and you can move it to flex naira at the end of every month. So here’s what I’d

do: at the end of every month, move the month’s returns to flex naira and leave it. No work, just open the Piggyvest app every 28th/30th/31st of the month and move the interest to flex naira. Why?

Another example: if you started your autosave plan on the 1st of April, by April

Another example: if you started your autosave plan on the 1st of April, by April

30th you would have N10,684.93 interest. If you move that amount to your flex naira account on the 1st of June, that amount would have generated N93.77 in flex naira daily interest accumulated over the month of May. If you go again on the 31st May and move the monthly returns of

N11,041.10 from autosave to flex naira, then on the 1st of June, the total balance in your flex naira would be N21,819.80 which is (10,684.93+93.77+11,041.10) that is, autosave interest for April + flex naira interest in May + autosave interest for May that you moved on May 31st

You might want to read that again, I know it’s a lot  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">.

I’ve also attached a screenshot of the excel sheet I used to calculate this so you can check out the workings (because again, I’m extra like that https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">). By the end of 1 year, you would have a return of N136,094.48. See

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">). By the end of 1 year, you would have a return of N136,094.48. See  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">

I’ve also attached a screenshot of the excel sheet I used to calculate this so you can check out the workings (because again, I’m extra like that

Now to safelock, the real G  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Smiling face with sunglasses" aria-label="Emoji: Smiling face with sunglasses">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Smiling face with sunglasses" aria-label="Emoji: Smiling face with sunglasses"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">. This one, you just put your money and at the end of 12 months receive the highest interest of them all, 169k. The only drawback is, you CANNOT under any circumstance take your money till the set maturity date. So there’s no flexibility here, no

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">. This one, you just put your money and at the end of 12 months receive the highest interest of them all, 169k. The only drawback is, you CANNOT under any circumstance take your money till the set maturity date. So there’s no flexibility here, no

penalty or anything; you just can’t get your money till the date you agreed with PiggyVest to get your money. While this gives the highest returns, you have to really think and be sure that you’d not have any need for the money in 12 months because you won’t be able to get it.

I didn’t even include other things like the points you can get from saving.

If you just invest the N1.3m at once, you’ll get 55 points which is just N550 BUT break the 1.3m into 13 pieces of 100k and save that, you’ll get 55*13 points, which is 715 points and converted to cash

If you just invest the N1.3m at once, you’ll get 55 points which is just N550 BUT break the 1.3m into 13 pieces of 100k and save that, you’ll get 55*13 points, which is 715 points and converted to cash

is N7,150. You can also invest that in flex naira or autosave or safelock or you can just take the money and buy something or do giveaway online or give to me for giving pretty good advice for free  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Smirking face" aria-label="Emoji: Smirking face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Smirking face" aria-label="Emoji: Smirking face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">.

Don’t worry I won’t bore you with the stressful calculations of how much

Don’t worry I won’t bore you with the stressful calculations of how much

that N7,150; by now you already get the logic behind how Savings on @PiggyBankNG works from this long thread  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">.

If this thread inspired you to check out PiggyVest: you can get a ₦1,000 signup bonus on PiggyVest with this link - http://piggyvest.com/l/2ad02ec ">https://piggyvest.com/l/2ad02ec...

If this thread inspired you to check out PiggyVest: you can get a ₦1,000 signup bonus on PiggyVest with this link - http://piggyvest.com/l/2ad02ec ">https://piggyvest.com/l/2ad02ec...

Personally, I’m more of an investment gal so if it were me, I’d look for investments where the 1.3m can get a much higher return over that 1 year period but that’s not what you asked for so... but if you want to discuss more, my DMs are always open.

End of “oversabi” thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">

End of “oversabi” thread

Read on Twitter

Read on Twitter

.I’ve also attached a screenshot of the excel sheet I used to calculate this so you can check out the workings (because again, I’m extra like that https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">). By the end of 1 year, you would have a return of N136,094.48. See https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">" title="You might want to read that again, I know it’s a lot https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">.I’ve also attached a screenshot of the excel sheet I used to calculate this so you can check out the workings (because again, I’m extra like that https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">). By the end of 1 year, you would have a return of N136,094.48. See https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">" class="img-responsive" style="max-width:100%;"/>

.I’ve also attached a screenshot of the excel sheet I used to calculate this so you can check out the workings (because again, I’m extra like that https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">). By the end of 1 year, you would have a return of N136,094.48. See https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">" title="You might want to read that again, I know it’s a lot https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">.I’ve also attached a screenshot of the excel sheet I used to calculate this so you can check out the workings (because again, I’m extra like that https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Smiling face with open mouth and cold sweat" aria-label="Emoji: Smiling face with open mouth and cold sweat">). By the end of 1 year, you would have a return of N136,094.48. See https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏾" title="Down pointing backhand index (medium dark skin tone)" aria-label="Emoji: Down pointing backhand index (medium dark skin tone)">" class="img-responsive" style="max-width:100%;"/>