Trading Concept # 1: Thread on Scalping

Hello Everyone. Thank you so much for the overwhelming response to the webinar on Scalping. A session that was meant for an hour went onto to two hours. Yes, I was little nervous in the beginning, but all’s well that ends well.

Hello Everyone. Thank you so much for the overwhelming response to the webinar on Scalping. A session that was meant for an hour went onto to two hours. Yes, I was little nervous in the beginning, but all’s well that ends well.

Hope it was worth your time. And seeing ~10k views in YouTube since Friday evening makes me believe people have found it useful.

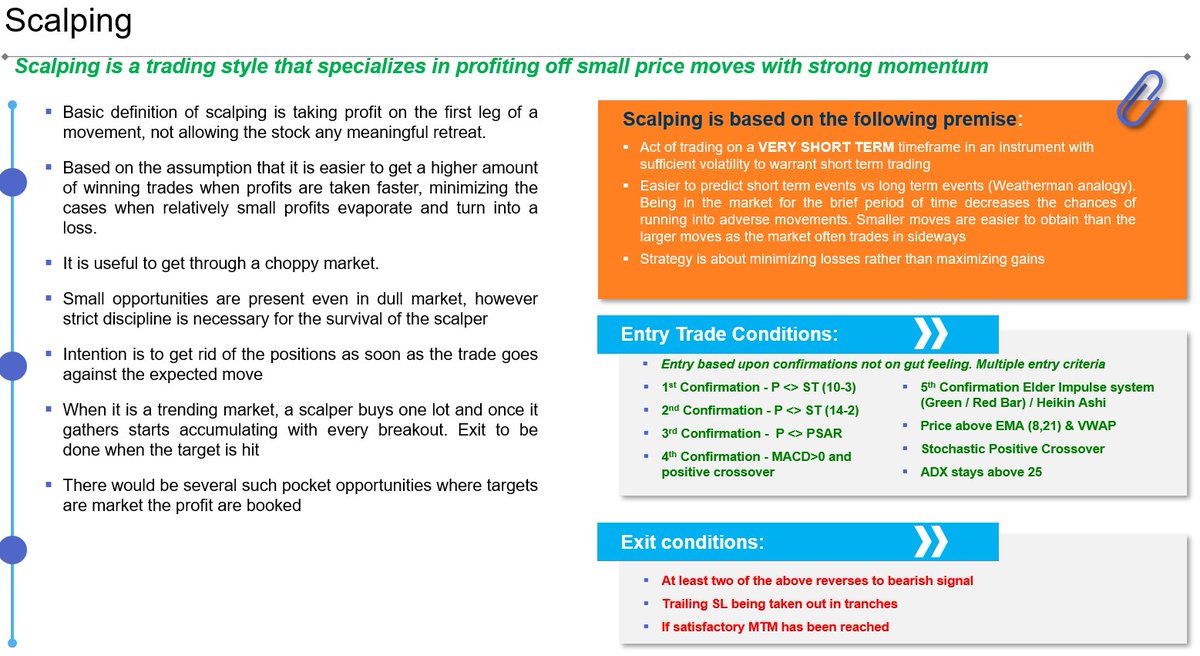

This thread is just the gist of what was shared in the webinar. And if I may say Scalping is just 5% of strategies that we use at our end,

This thread is just the gist of what was shared in the webinar. And if I may say Scalping is just 5% of strategies that we use at our end,

its not the only bread and butter strategy. So, you should have this along with your present trading strategies, it shouldn’t be the only one, if you are starting out. Be careful if you want to take as your only bread and butter. In simple analogy, if I may say

Swing Trading: Test Cricket

Day Trading: One day Cricket

Hope this would give a fair idea what you are looking at for adopting this strategy

Hope this would give a fair idea what you are looking at before adopting this strategy

Day Trading: One day Cricket

Hope this would give a fair idea what you are looking at for adopting this strategy

Hope this would give a fair idea what you are looking at before adopting this strategy

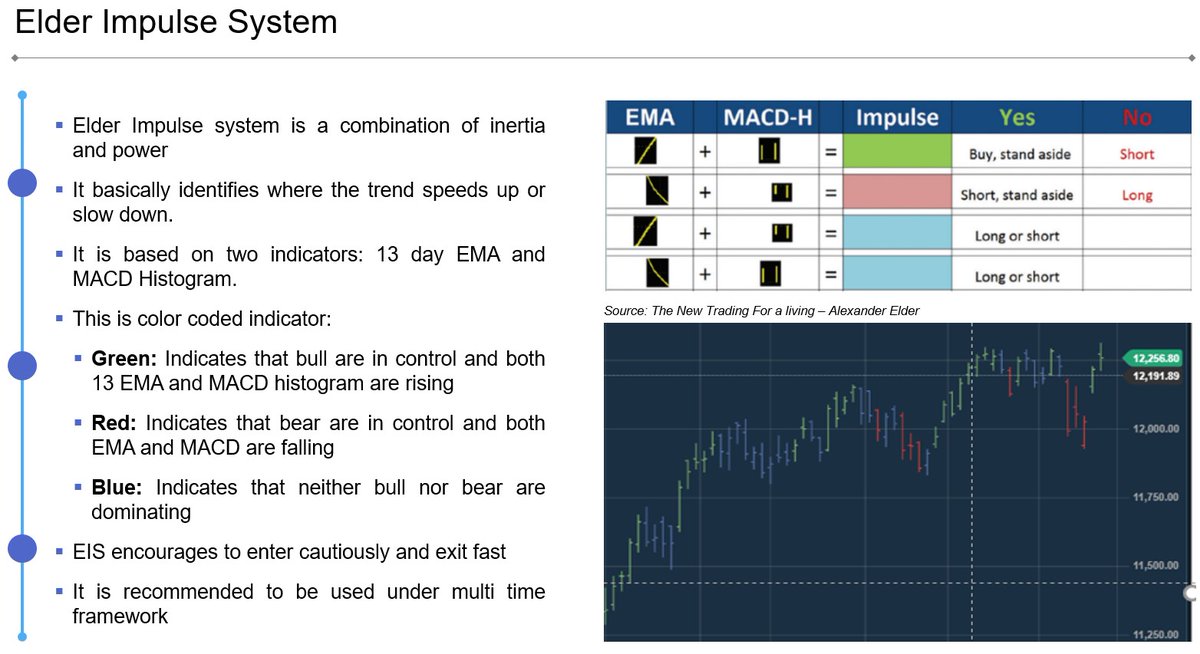

Before starting, I would like to state, l am presenting things that I& #39;ve found worthy over many years of trading, reading books, seeing videos and being influenced by other international traders and created something that works for me through back-testing.

Tried out different permutations and combinations and finally settling with these. This is not sacrosanct; you may change settings and indicators as per your comfort zone

THINGS ABOUT SCALPING THEY DON’T TALK ABOUT:

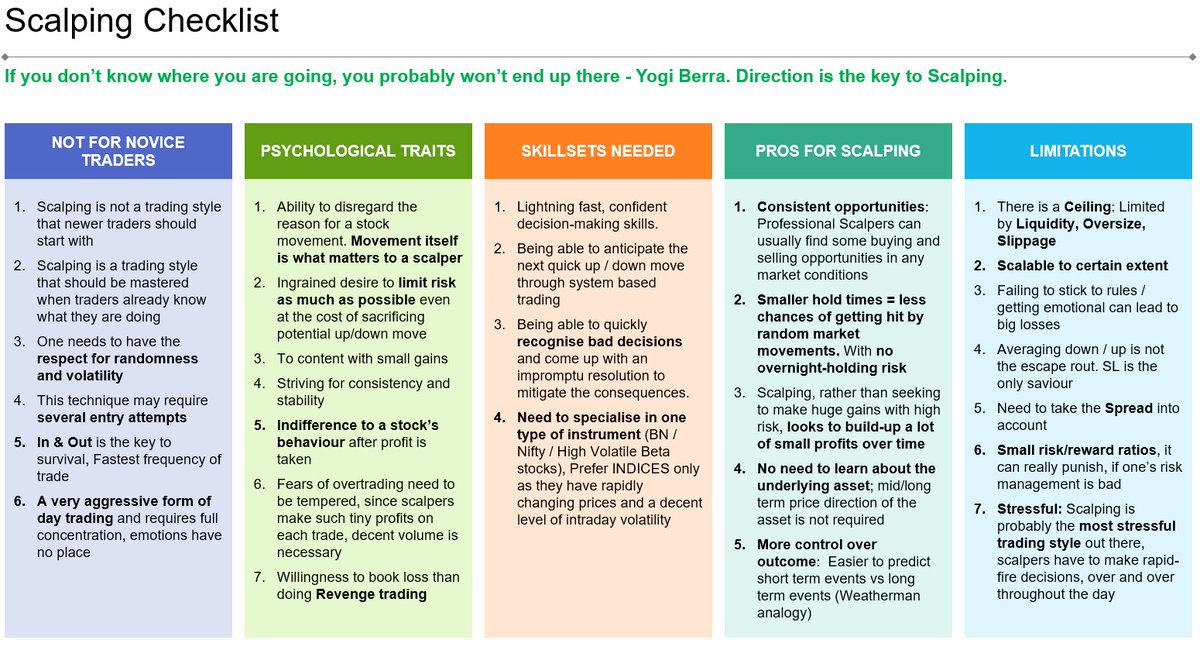

1. NOT FOR THE FAINT OF HEART: Scalping is not a trading style that newer traders should start with. Scalping is a trading style that should be mastered when traders already know what they are doing.

1. NOT FOR THE FAINT OF HEART: Scalping is not a trading style that newer traders should start with. Scalping is a trading style that should be mastered when traders already know what they are doing.

If you don’t know how to drive a Honda, don’t aspire to drive a Ferrari and that’s the truth. Please understand yourself as a trader then try this method. It doesn’t suit everyone’s trading method. So, don’t get influenced by profit snapshots through scalping (Noise)

2. Scalping is probably the most stressful trading style out there, scalpers have to make rapid-fire decisions, over and over throughout the day. If you lose money in Swing Trading and then day trading please DON’T attempt Scalping. Not meant for you. You will lose more

3. A very aggressive form of day trading and requires full concentration, emotions have no place. You should have discipline to book your losses quickly, just the way you would book your profit after possible target, and not letting any meaningful retreat by the stock

4. Indifference to a stock’s behaviour after profit is taken. Not having FOMO  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">

5. This technique may require several entry attempts. And it needs few months at least to get into the groove. Key lies in fast execution skills, and having Lightning fast decision-making skills

5. This technique may require several entry attempts. And it needs few months at least to get into the groove. Key lies in fast execution skills, and having Lightning fast decision-making skills

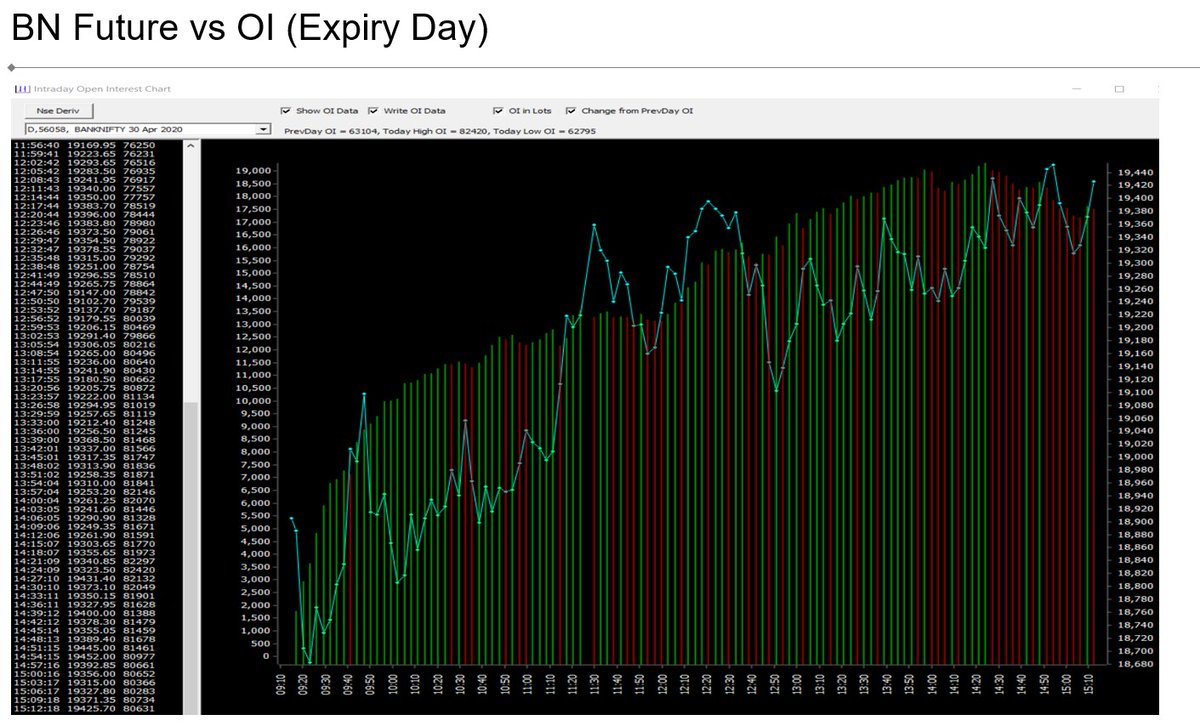

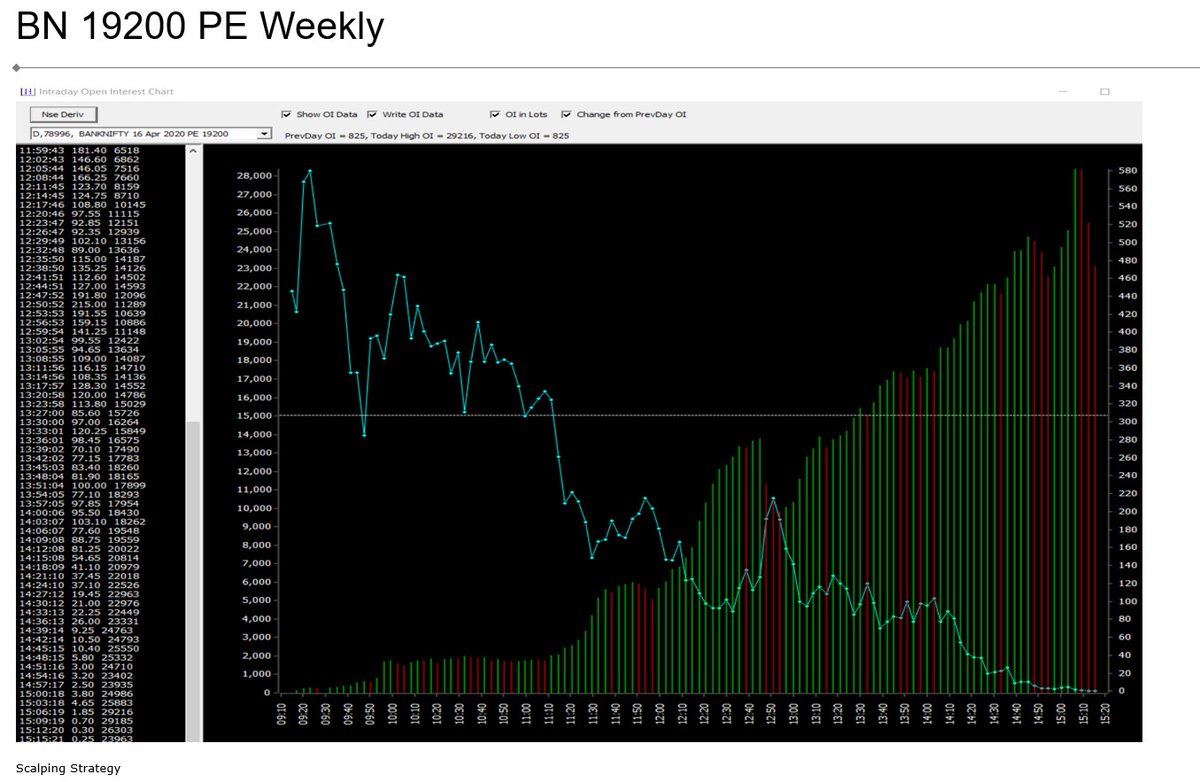

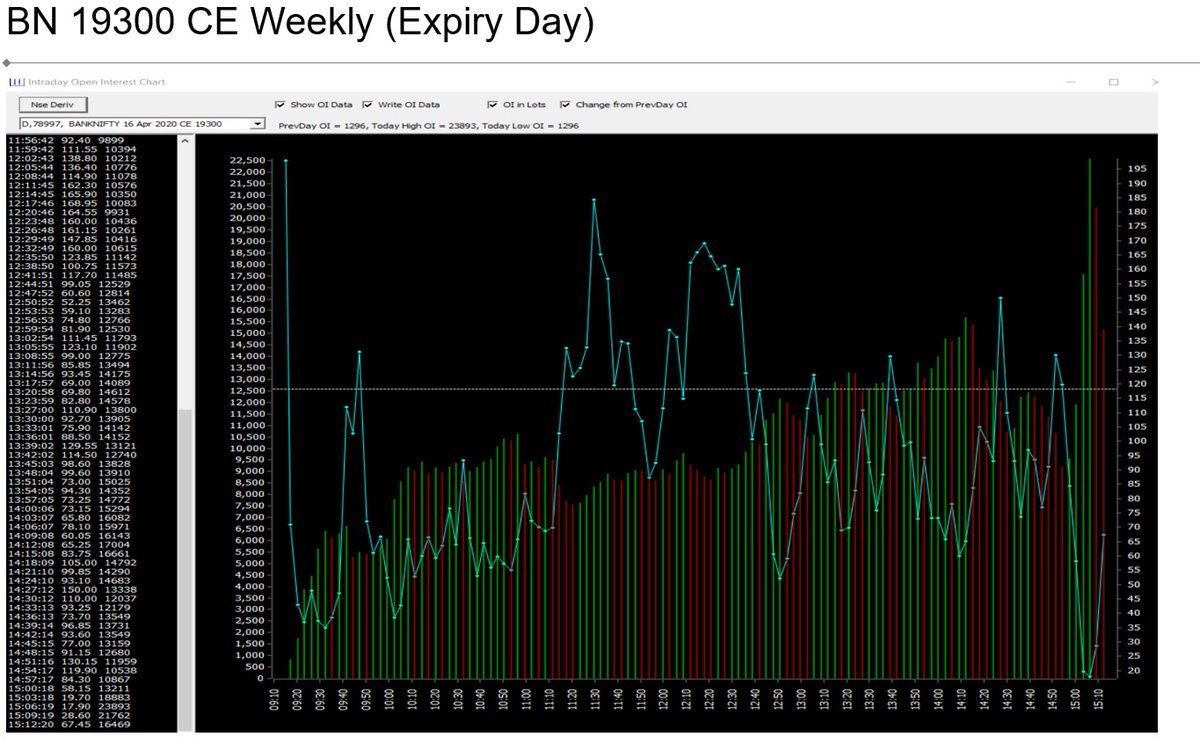

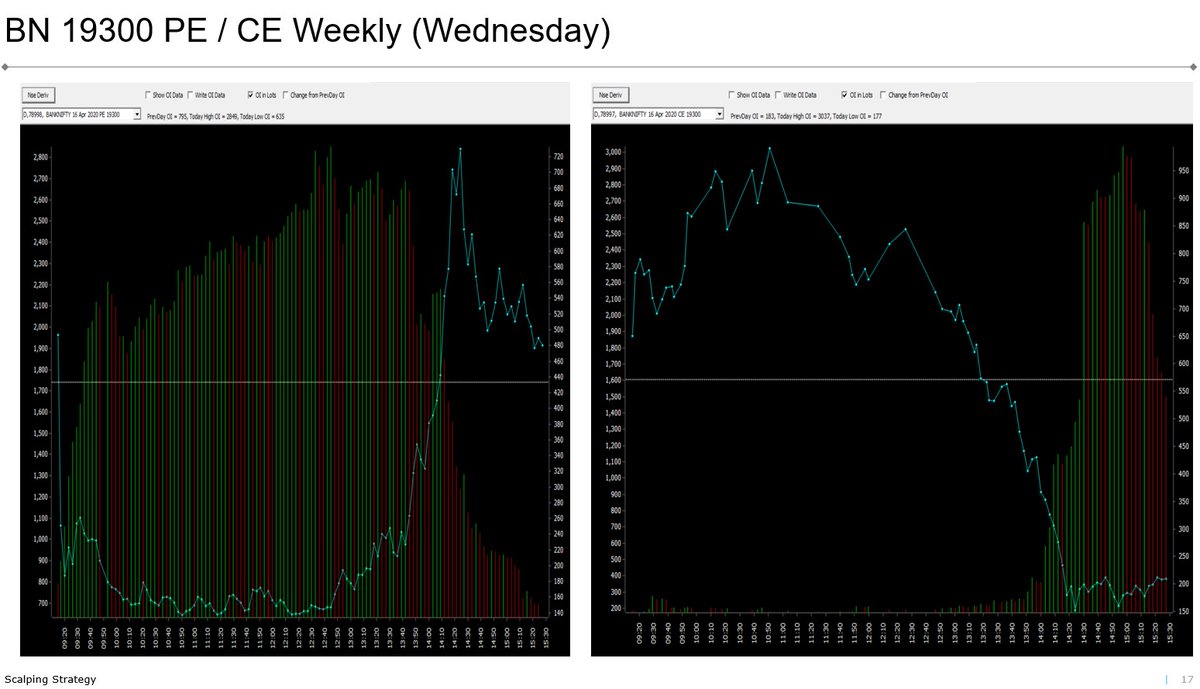

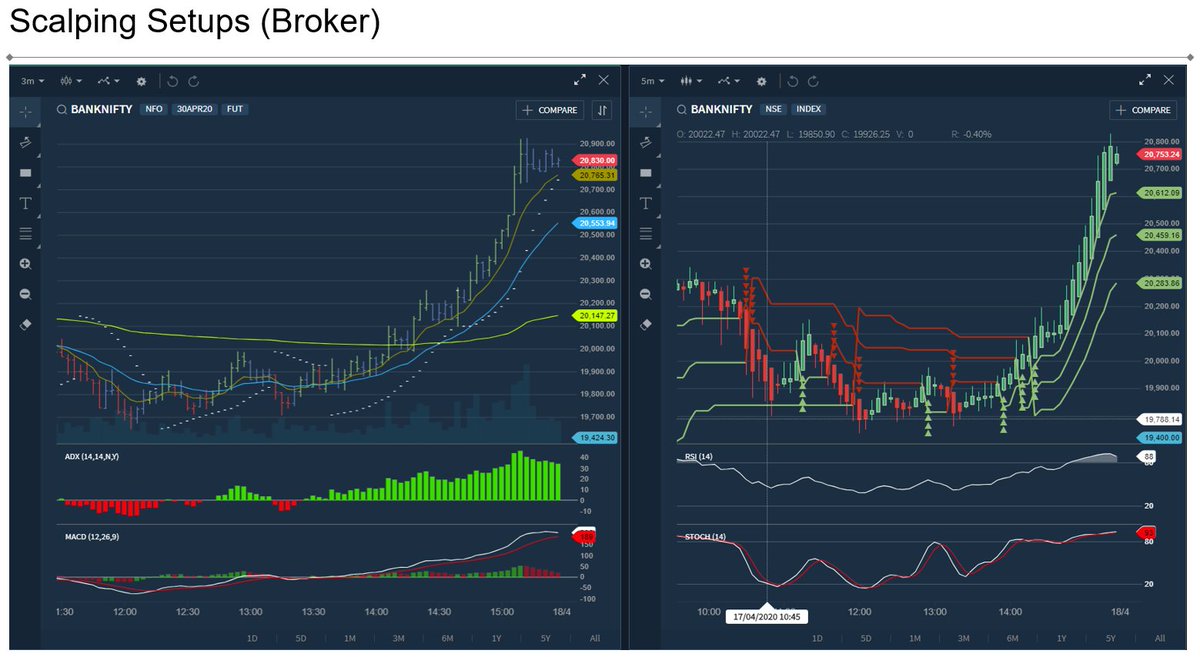

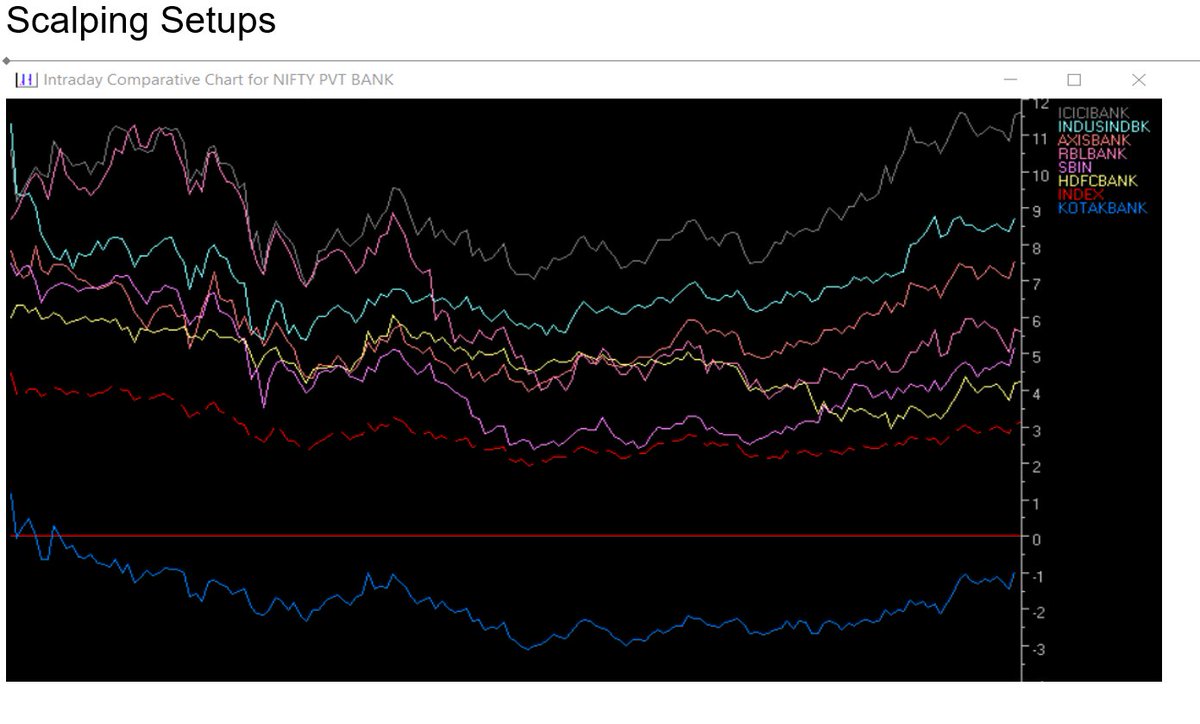

Few Slides on OI built up I keep checking. Hope this is useful. A small comment on expense on software, am not here to talk or promote any softwares. I use Spider - FoxTrader - Metastock, I find few thingsto be the best in one and few in others. F

or me if am fighting it out with the best out there, I better be prepared with best in my armory. I understand myself as a trader, hence I know what I need to do be alive in the game. And I don& #39;t mind paying for these softwares as I find lot of value in each of them.

Hope this helped. Let me know should there be any queries. Cheers..

All those who missed the webinar, here is the link to the video, should you want to watch it.. https://www.youtube.com/watch?v=YVdfZYyYRV0&t=816s">https://www.youtube.com/watch...

A tweet that captures the finer essence of the webinar very well..adding this to the thread. Thank you @tradeEQ for doing this.. https://twitter.com/tradeEQ/status/1251191269994291200?s=20">https://twitter.com/tradeEQ/s...

Read on Twitter

Read on Twitter

5. This technique may require several entry attempts. And it needs few months at least to get into the groove. Key lies in fast execution skills, and having Lightning fast decision-making skills" title="4. Indifference to a stock’s behaviour after profit is taken. Not having FOMO https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">5. This technique may require several entry attempts. And it needs few months at least to get into the groove. Key lies in fast execution skills, and having Lightning fast decision-making skills" class="img-responsive" style="max-width:100%;"/>

5. This technique may require several entry attempts. And it needs few months at least to get into the groove. Key lies in fast execution skills, and having Lightning fast decision-making skills" title="4. Indifference to a stock’s behaviour after profit is taken. Not having FOMO https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Smiling face with smiling eyes" aria-label="Emoji: Smiling face with smiling eyes">5. This technique may require several entry attempts. And it needs few months at least to get into the groove. Key lies in fast execution skills, and having Lightning fast decision-making skills" class="img-responsive" style="max-width:100%;"/>