/1

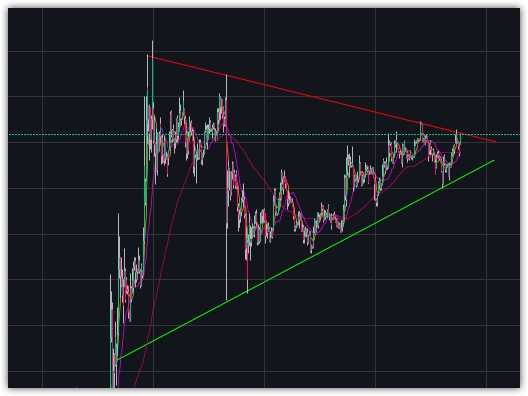

Currently short hedged $BTC as we have a rising weekly wedge and decreasing volume. Looking for a $6.8 dip to close short/open scalp longs ($6.6 wick would be awesome). Expect push toward weekly close downtrend line. Close above means continuation & rejection means pull back.

Currently short hedged $BTC as we have a rising weekly wedge and decreasing volume. Looking for a $6.8 dip to close short/open scalp longs ($6.6 wick would be awesome). Expect push toward weekly close downtrend line. Close above means continuation & rejection means pull back.

/2

Breaking through the current supply zone and holding support above it ($7400) would invalidate my current short hedge bias. Until then I will add to this short on and pumps we get. Monday is important. Expect the move down to start if we lose the uptrend on this LTF pennant.

Breaking through the current supply zone and holding support above it ($7400) would invalidate my current short hedge bias. Until then I will add to this short on and pumps we get. Monday is important. Expect the move down to start if we lose the uptrend on this LTF pennant.

/3

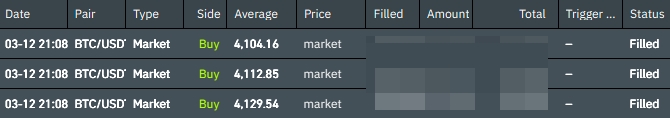

I& #39;ve been ALL IN $BTC spot long since $4k and my leverage shorts and longs are only for hedges and scalps. I& #39;ve shared almost all my futures entries with you along the way and my strike rate has been ~90%. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Fire" aria-label="Emoji: Fire">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Fire" aria-label="Emoji: Fire">

I& #39;ve closed all futures $ALT positions in profit except $BAT.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag">

I& #39;ve been ALL IN $BTC spot long since $4k and my leverage shorts and longs are only for hedges and scalps. I& #39;ve shared almost all my futures entries with you along the way and my strike rate has been ~90%.

I& #39;ve closed all futures $ALT positions in profit except $BAT.

Read on Twitter

Read on Twitter

I& #39;ve closed all futures $ALT positions in profit except $BAT.https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag">" title="/3I& #39;ve been ALL IN $BTC spot long since $4k and my leverage shorts and longs are only for hedges and scalps. I& #39;ve shared almost all my futures entries with you along the way and my strike rate has been ~90%. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Fire" aria-label="Emoji: Fire">I& #39;ve closed all futures $ALT positions in profit except $BAT.https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag">" class="img-responsive" style="max-width:100%;"/>

I& #39;ve closed all futures $ALT positions in profit except $BAT.https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag">" title="/3I& #39;ve been ALL IN $BTC spot long since $4k and my leverage shorts and longs are only for hedges and scalps. I& #39;ve shared almost all my futures entries with you along the way and my strike rate has been ~90%. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Fire" aria-label="Emoji: Fire">I& #39;ve closed all futures $ALT positions in profit except $BAT.https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag">" class="img-responsive" style="max-width:100%;"/>