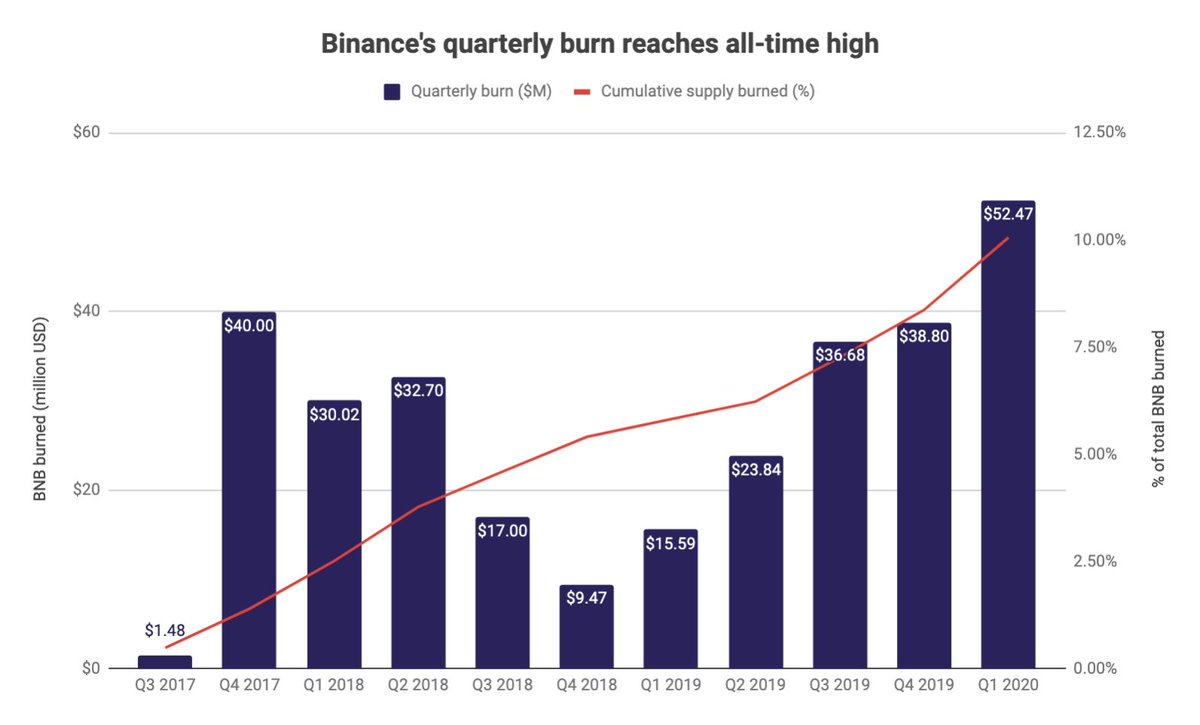

1/ Binance has just finished its 11th burned and has now cumulatively burned more than 10% of BNB& #39;s supply. It was the largest burn both in terms of BNB and in terms of USD. Let& #39;s look at the data and why it& #39;s not as significant as you might think.

2/ Why not as significant - two things. The main one is that unlike some other tokens (like LEO), Binance doesn& #39;t buy and burn on the open market but rather burns uncirculated supply that it already has in its own treasury. They are burning something they created themselves

3/ Another reason, and few people still know about this, is that Binance no longer burns based on profit like promised in the original whitepaper. The whitepaper was quietly changed a year ago without any announcement. Now says that it "destroys BNB based on the trading volume"

4/ The issue with these two things is that Binance can basically choose any number of BNB they want because basing something on traded volume is super ambiguous. We don& #39;t know the formula and we will never know. On top of that, they are just burning uncirculated supply

5/ With that being said, let& #39;s actually look at the data. Binance did have one of the best quarters on record based on many metrics that I track. Binance is head to head with Coinbase for the most popular exchange in terms of web traffic.

6/ In fact, 42% of total cryptocurrency exchange traffic is coming from Binance and Coinbase combined. In Q1, Binance recorded 66.59 million visits, according to data from SimilarWeb, which marks a 28% increase from Q4.

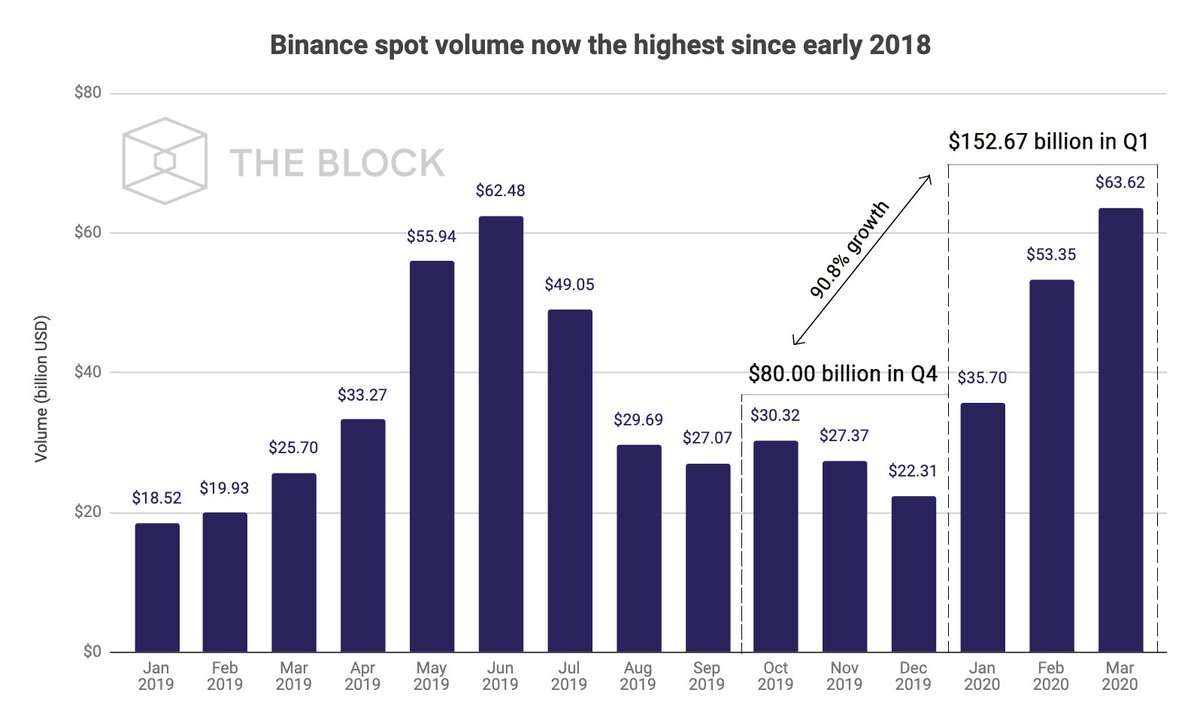

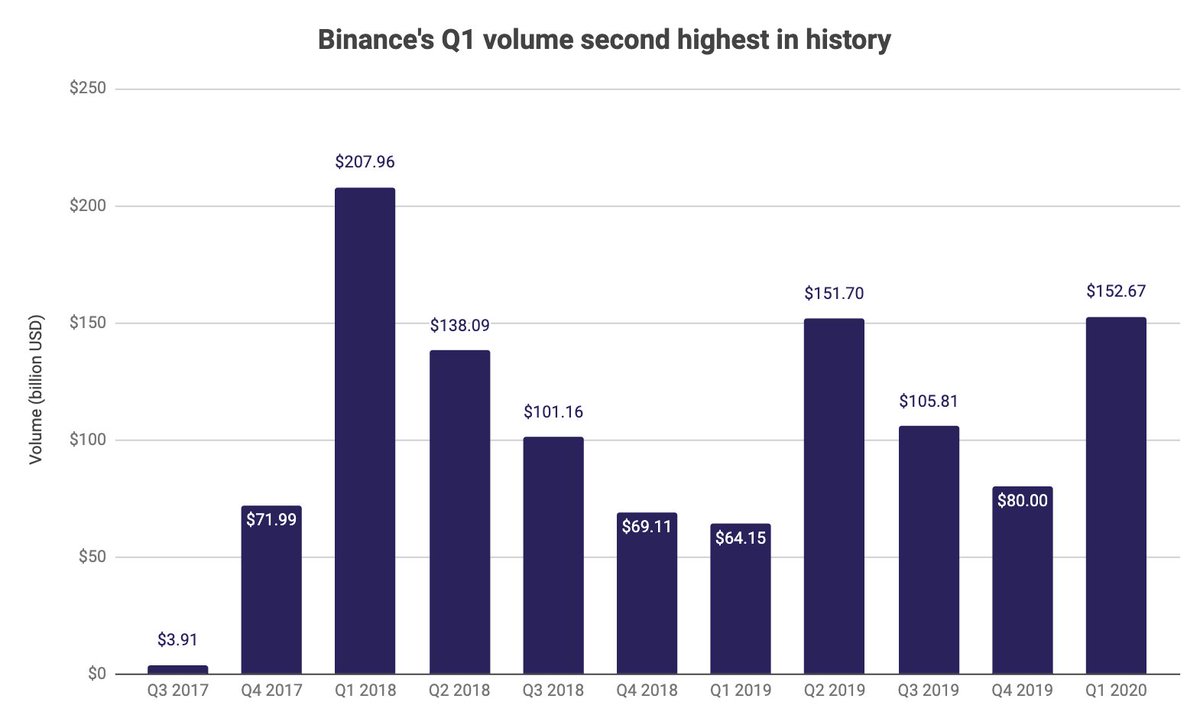

7/ In terms of the spot exchange, Binance has recorded its second-best quarter yet. The (self-reported) spot volume has grown by nearly 91% from the last quarter - from $80 billion to more than $150 billion.

8/ Binance& #39;s only other quarter that had higher volume was Q1 2018 during the speculative mania that saw Bitcoin briefly surpass $20,000.

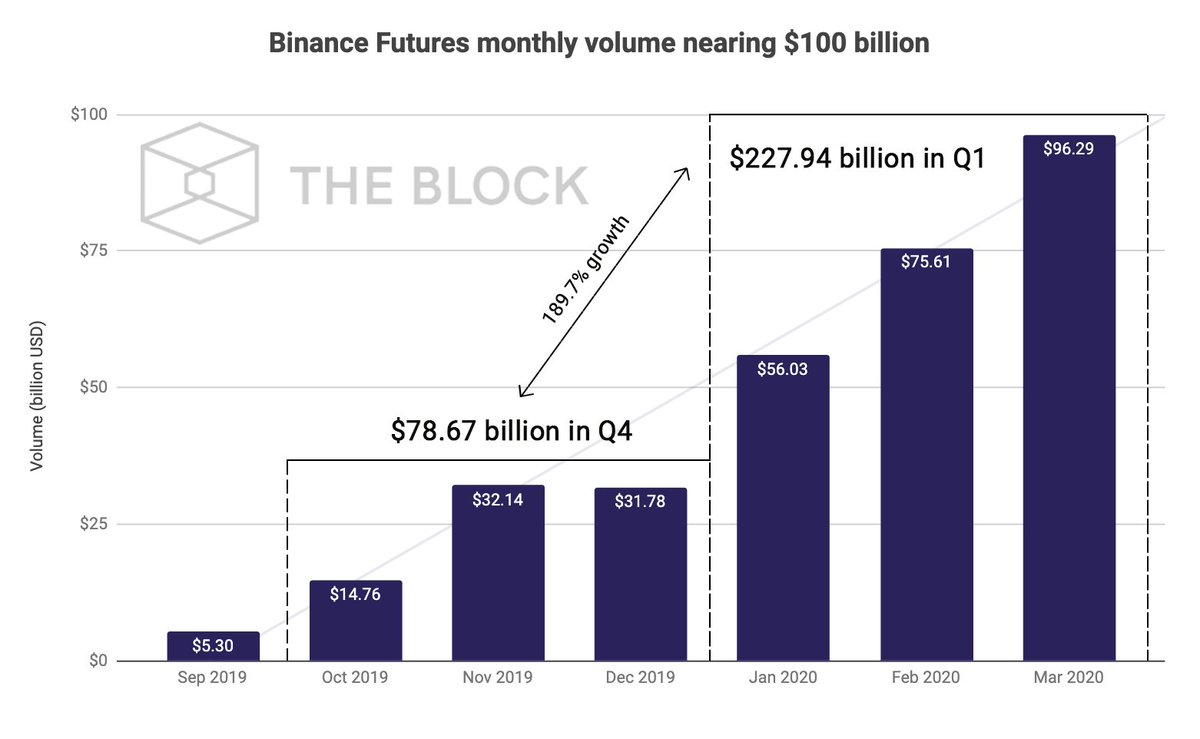

9/ Binance launched its futures platform in Q3 last year. Since then, its volume has constantly grown month-to-month. The futures volume has grown by nearly 190% since Q4.

10/ Binance has also started to bring in a significant amount of revenue from its margin trading product. However, the exchange has yet to release any data on how much it& #39;s been lending out or how much it earns in interest.

11/ My point with this thread is that Binance did have a really good quarter by most of the metrics that I track. If you don& #39;t trust their self-reported volume, even traffic was up. But the burn is from their own treasury, overblown for attention and no longer based on profit.

12/ I used my model and estimated the burn to be 4.3M BNB. But Binance uses an undisclosed formula "based on volume" and can burn anything it wants. If the burns were proportional to volume, retrofitted by last quarter, Binance would have to burn more. https://twitter.com/lawmaster/status/1250405436811022336">https://twitter.com/lawmaster...

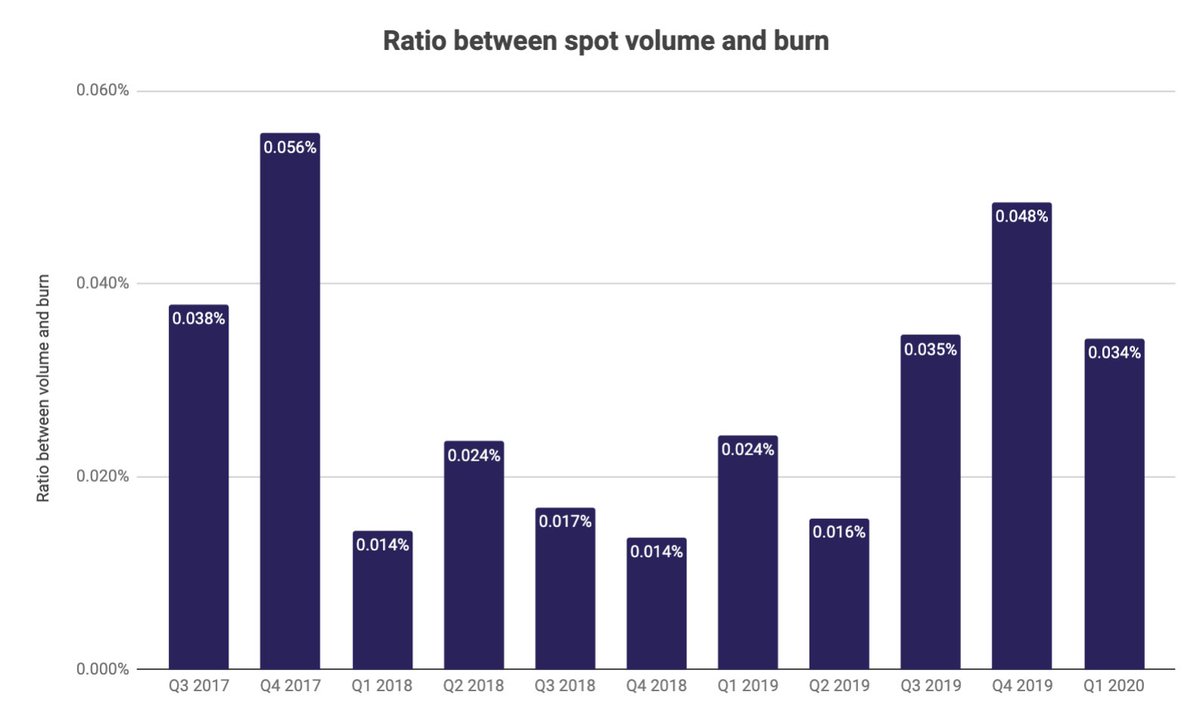

13/ This can be nicely seen from the ratio between spot volume and burn, which has declined significantly from last quarter and on par with 3Q19. That is very counterintuitive because futures volume was also up from last Q so if anything, the ratio should have increased

Read on Twitter

Read on Twitter