THREAD ALERT  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">

Fasten your seatbelts, it’s time to put an end to blaming the revolution on the dollar crisis.

The following scenes take place from the beginning of 2019 till today.

[Exchange rates are based on wholesalers’ rates.]

Fasten your seatbelts, it’s time to put an end to blaming the revolution on the dollar crisis.

The following scenes take place from the beginning of 2019 till today.

[Exchange rates are based on wholesalers’ rates.]

During the 21st century, the USD/LBP 1507.5 rate witnessed considerable fluctuations on 3 occasions only:

1- In November 2017, the high demand for the dollar was linked to notable developments, the most important of which was the detention of PM Saad Hariri in Saudi Arabia.

1- In November 2017, the high demand for the dollar was linked to notable developments, the most important of which was the detention of PM Saad Hariri in Saudi Arabia.

2- In 2018, following the parliamentary elections, the demand of cash $ was very high due to political uncertainty resulting from the failure to form a government.

3- And in 2019, the beginning of Ponzi’s end.

The first 2 events lasted for weeks, the 3rd one was bound to last.

3- And in 2019, the beginning of Ponzi’s end.

The first 2 events lasted for weeks, the 3rd one was bound to last.

Entering 2019, BDL $ position was deteriorating, & the financial engineering magical tricks to maintain the peg were under pressure. Riad Salameh was in desperate need to keep the Ponzi scheme alive, increase BDL’s dollar position & keep the Lira بخير

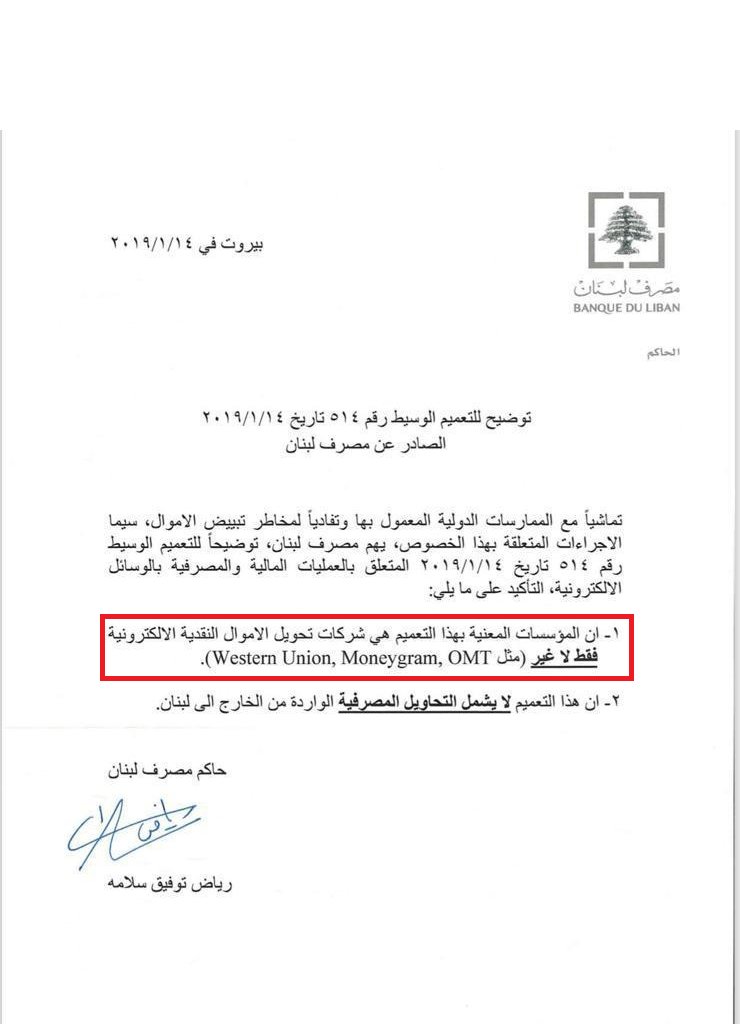

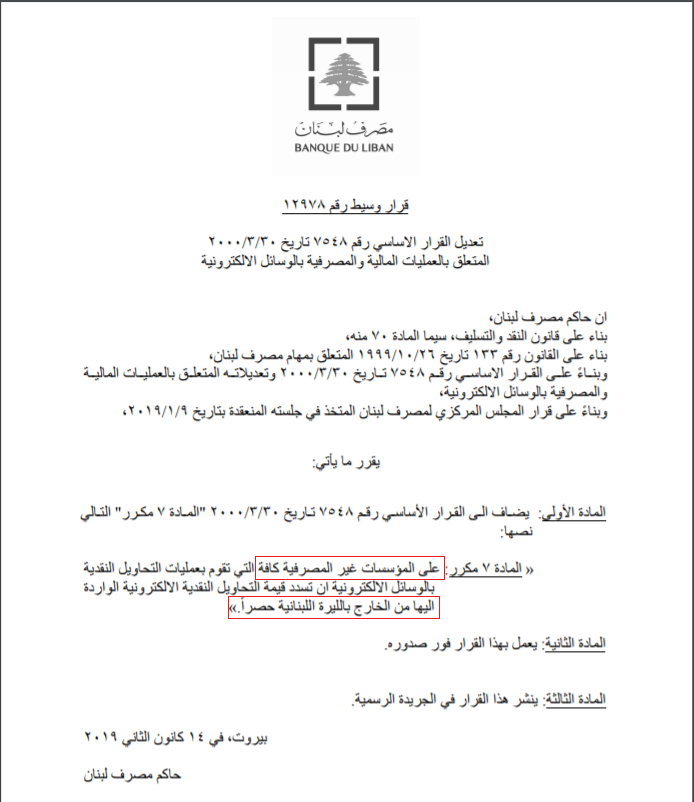

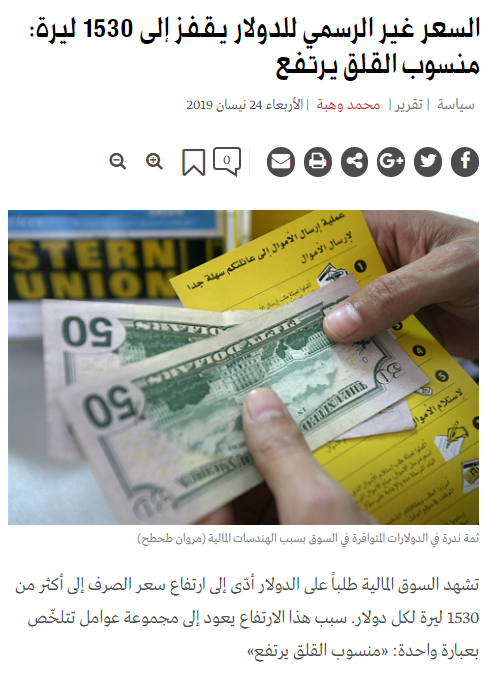

14 January 2019: BDL issued a circular calling for all money transfer offices (Western Union) to only pay out cash in Lira rather than dollars, even if the transfer was made in US currency.

This was the most worrying sign of Lebanon’s deteriorating currency situation.

This was the most worrying sign of Lebanon’s deteriorating currency situation.

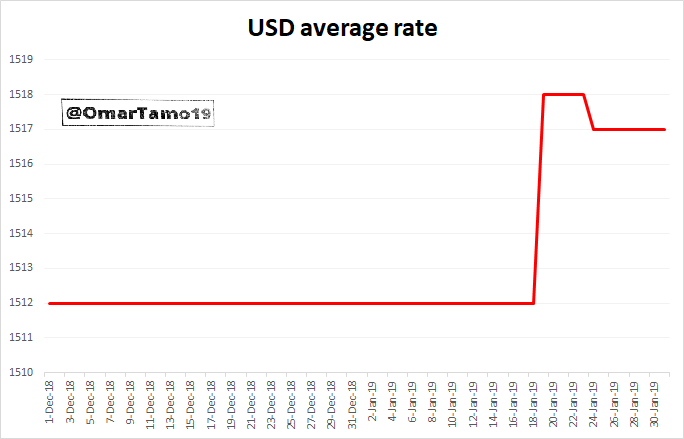

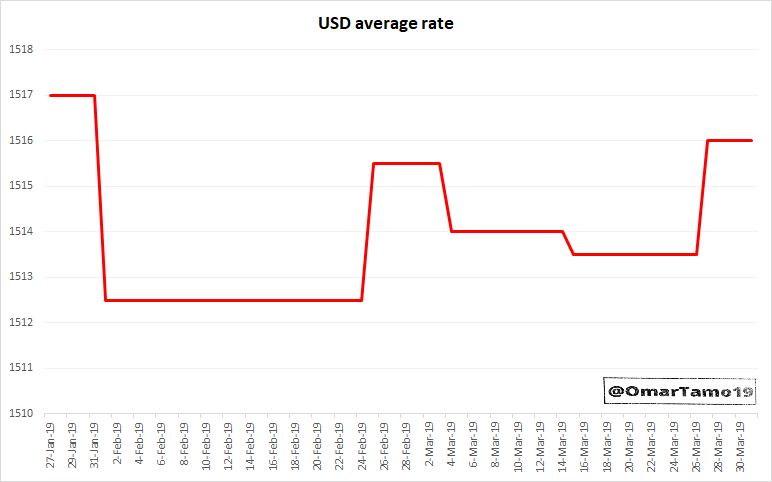

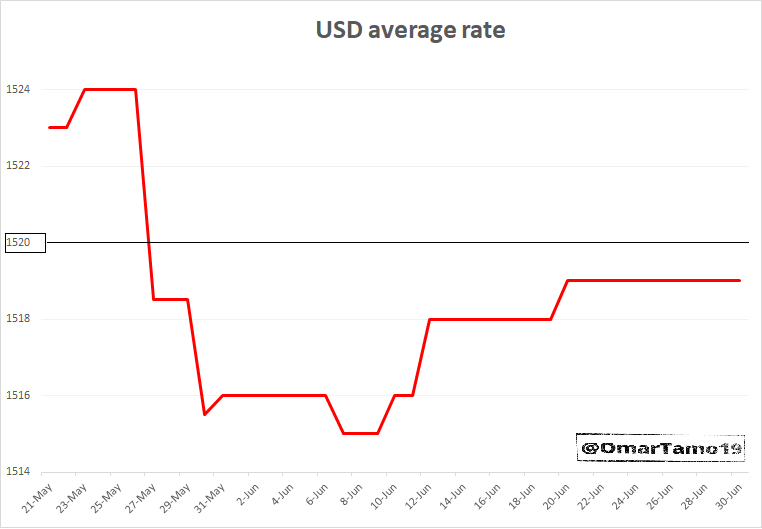

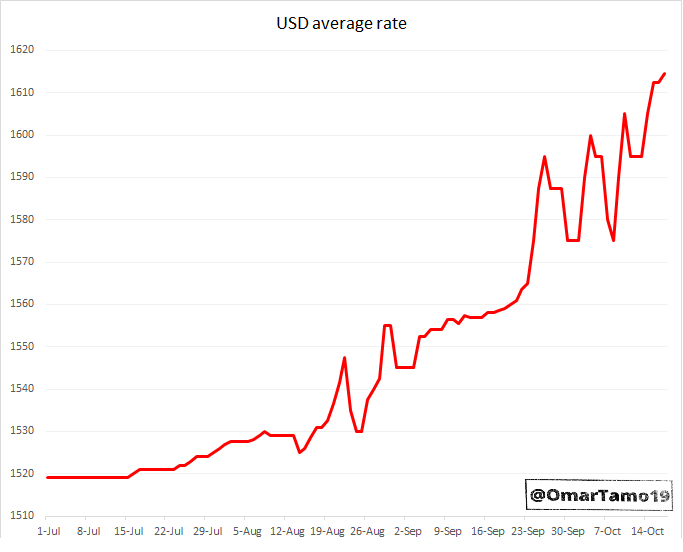

5 days later, on the 19th of January, the average USD exchange rate increased by 6 liras (from 1512 to 1518) after being stable since the government was formed.

The Lebanese currency’s long-standing peg to the US dollar was under threat.

The Lebanese currency’s long-standing peg to the US dollar was under threat.

On the 30th of January, Riad Salameh reassured the safety of the economic and financial conditions in Lebanon. Few days later, the USD market rate dropped back to 1512.5 & remained stable during February. Then, minimal fluctuations took place in March.

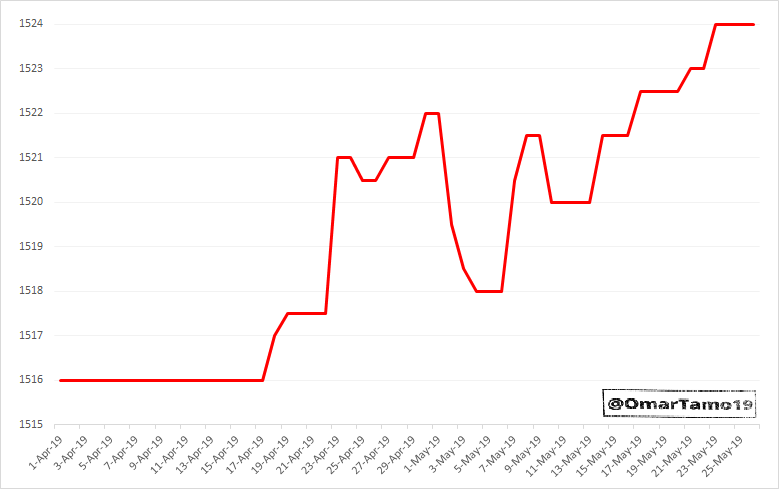

Entering April 2019, the demand for dollars at exchange offices didn’t just include their regular customers.

Exchange offices saw a massive influx of retailers & individuals who were facing delays from banks to convert their lira into dollars.

Exchange offices saw a massive influx of retailers & individuals who were facing delays from banks to convert their lira into dollars.

Major merchants needed to exchange large quantities to cover their imports, while individuals required modest amounts. The pressure on the peg is back.

Reminder: The sarrafin rate follows the law of supply & demand: the higher the demand for $, the higher the exchange rate.

Reminder: The sarrafin rate follows the law of supply & demand: the higher the demand for $, the higher the exchange rate.

May 2019 was ending, the exchange rate just reached a new peak, and someone was needed to put an end to this. "Riad Salameh the Prudent" interfered by injecting more USD in the market; decreasing & stabilizing the rate below 1520 for weeks.

The calm before the storm.

The calm before the storm.

Half a year had passed by; the peg was questioned several times but still surviving. BDL dollar position was worsening, banks weren’t covering merchants’ imports. Retailers had no other choice but to head to exchange offices. Worrying signs.

We enter August, Fitch ratings downgraded Lebanon long-term foreign currency issuer default rating from B- to CCC with a negative outlook. لا داعي للهلع comments started to appear, everything was under control.

On the other hand, Jammal Trust Bank was under US sanctions threats.

On the other hand, Jammal Trust Bank was under US sanctions threats.

September 19th: Jammal Trust Bank was forced to liquidate itself after being hit by US sanctions for allegedly helping to fund Hezbollah. The bank had 25 branches in Lebanon and representative offices in Nigeria, Ivory Coast and Britain. Huge blow to the Lebanese banking sector.

Banks weren’t able to cover the huge USD demand from retailers. Merchants had no other choice but to withdraw lira & head to sarrafin to buy USD to import new products.

Operation PRINT BABY PRINT was in progress. Many weren’t noticing yet.

Operation PRINT BABY PRINT was in progress. Many weren’t noticing yet.

BDL $ position was going from bad to worse. Individuals started accumulating losses, prices were increasing considerably, and many started exchanging their Lira savings.

The USD rate was increasing non-stop. The rate went from 1518 in July & reached 1600 on October 10th.

The USD rate was increasing non-stop. The rate went from 1518 in July & reached 1600 on October 10th.

On October 17th, the Lebanese government announced the famous “WhatsApp tax”. Thousands went to the streets, the government scrapped the plans hours later amid clashes between security forces and protesters.

People were starting to notice.

People were starting to notice.

The USD was trading at 1610 one day prior to the revolution.

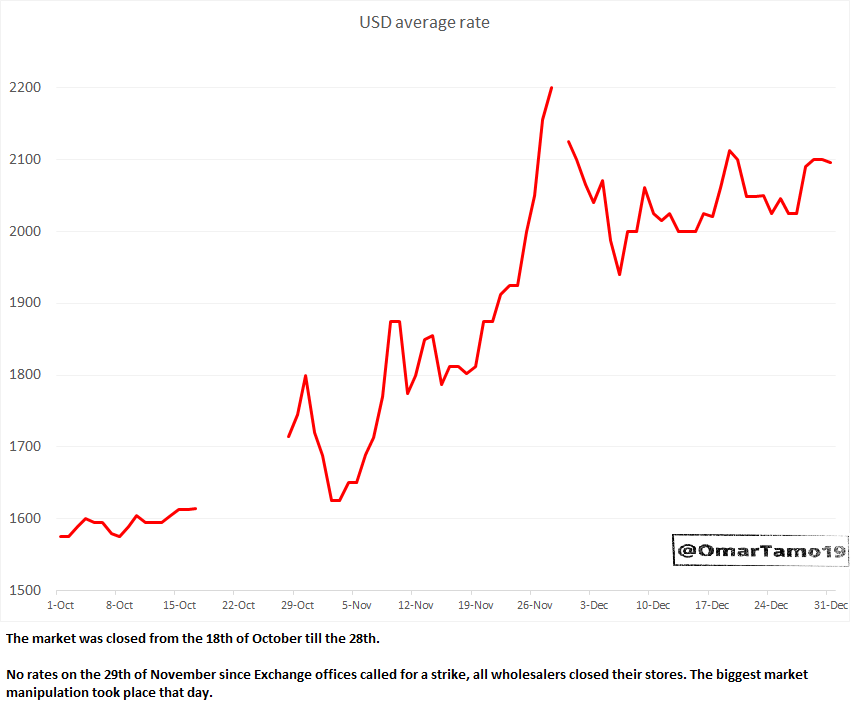

During the revolution, exchange wholesalers closed their doors for a week. Many sarrafin started to exchange at random rates (1750-1800).

The market re-opened on the 28th of October at 1700 per $.

During the revolution, exchange wholesalers closed their doors for a week. Many sarrafin started to exchange at random rates (1750-1800).

The market re-opened on the 28th of October at 1700 per $.

The 1700 rate didn’t last much as the rate went down to the starting point before the revolution (1600/$) since the market was low on Lira due to banks closure.

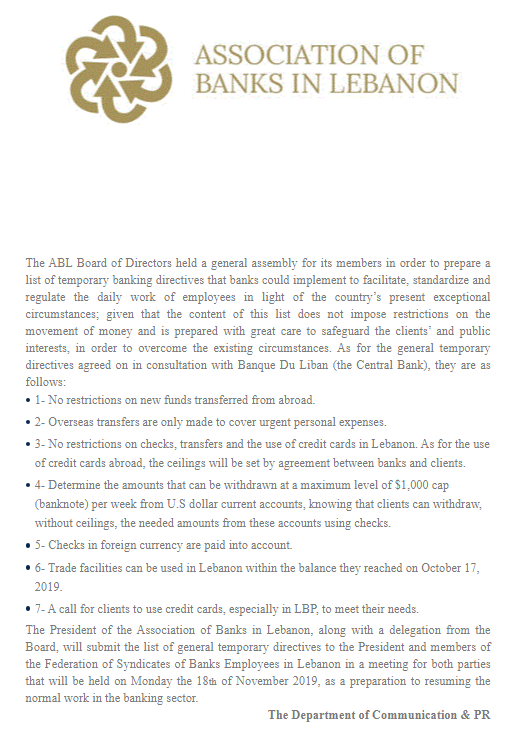

What made it drop later on? Banks re-opened their doors with “temporary and exceptional” limits on USD withdrawals.

What made it drop later on? Banks re-opened their doors with “temporary and exceptional” limits on USD withdrawals.

Stricter capital control, huge need of $ for imports & the risk of further depreciation of our local currency lead to an excessive demand of dollars.

Everyone rushed to buy the hard currency from Sarrafin.

The USD rate boomed & reached 2100 by the end of the year.

Everyone rushed to buy the hard currency from Sarrafin.

The USD rate boomed & reached 2100 by the end of the year.

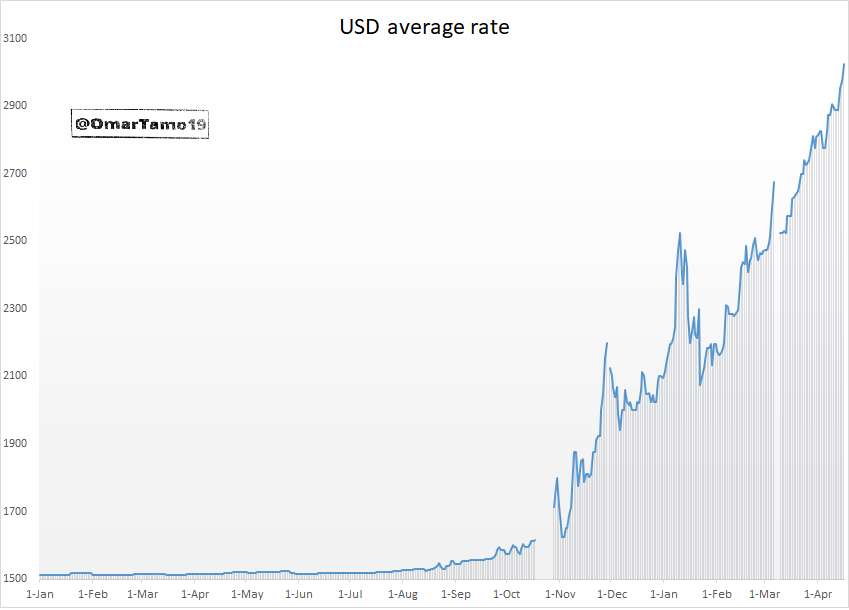

Few months later, on the 26th of March 2020, the exchange rate reached a new peak, breaking 2800 per 1$; a record set in August 1992.

Let’s have a look at the exchange rate from the beginning of 2019 till today, frightening figures.

Let’s have a look at the exchange rate from the beginning of 2019 till today, frightening figures.

The last 4 months witnessed the biggest market manipulation, two 2000/$ circulars, operations from مكافحة الجرائم المالية, the issuance of the new 20,000 & 50,000 LBP banknotes, BDL circulars for micro-depositors & more lira printing. I will discuss their effects on a later stage

Read on Twitter

Read on Twitter