Grayscale& #39;s quarterly report has just hit the wire:

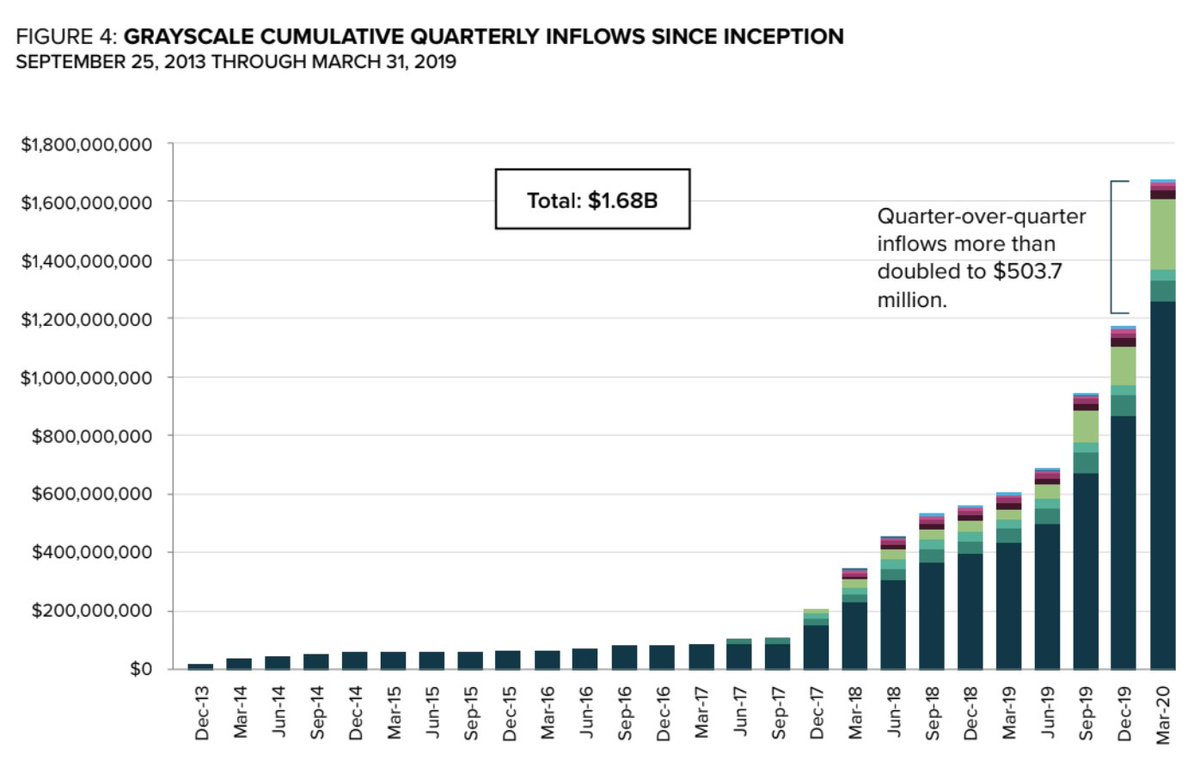

- Inflows into its various cryptocurrency funds soared to an all-time high of $503.7 million.

-More than $1 billion was raised in last 12 months.

- 88% of investors were institutions

- Inflows into its various cryptocurrency funds soared to an all-time high of $503.7 million.

-More than $1 billion was raised in last 12 months.

- 88% of investors were institutions

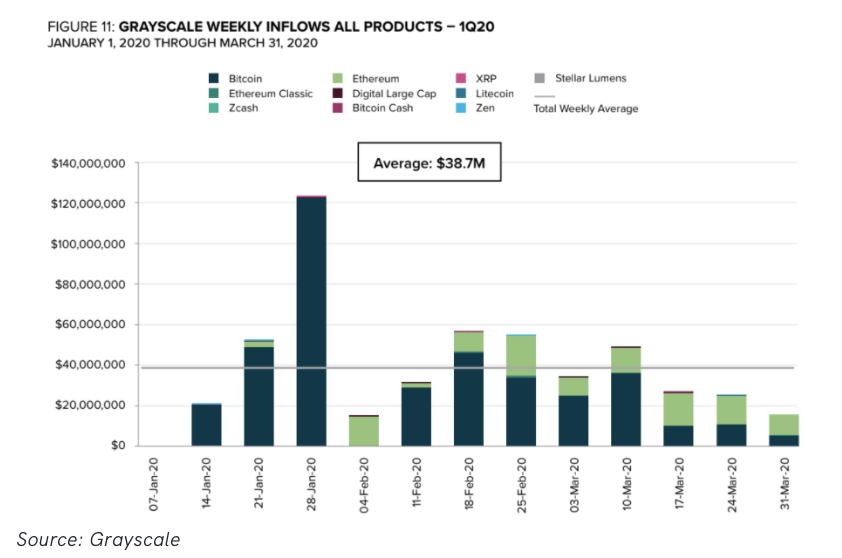

What& #39;s interesting is that investors continued to steadily pour money into its funds up until the week ending in March 20. Momentum then appeared to lose some steam + ETH has flipped BTC in recent weeks

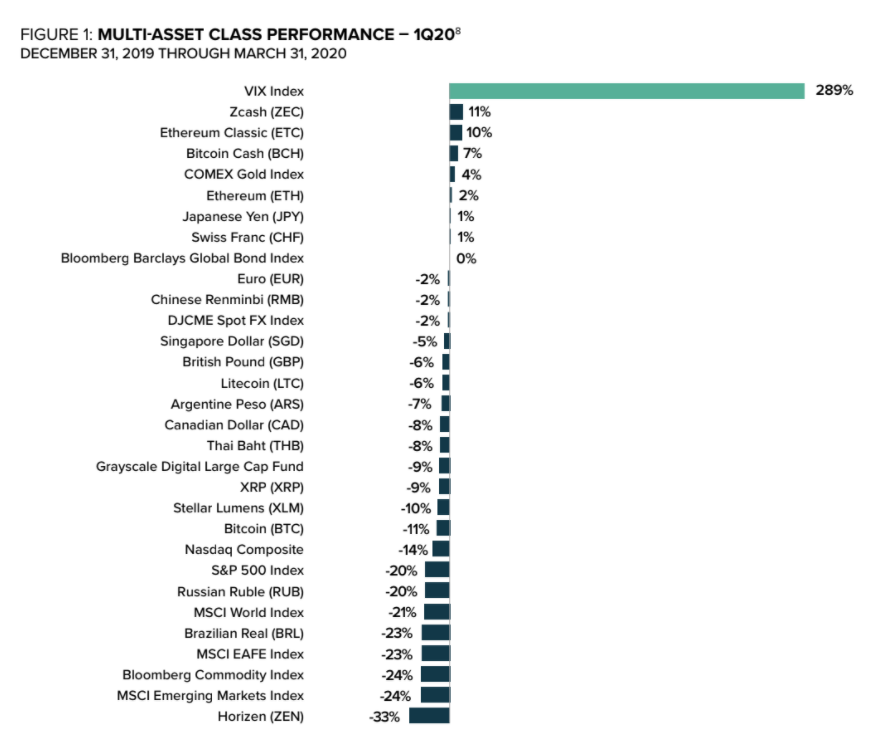

There& #39;s a chance that institutional investors have lost faith in bitcoin& #39;s safe-haven/hedge value prop following the March 12-13 sell-off. But it could be too early to tell and @Sonnenshein says the firm will "look to continue to build off the momentum."

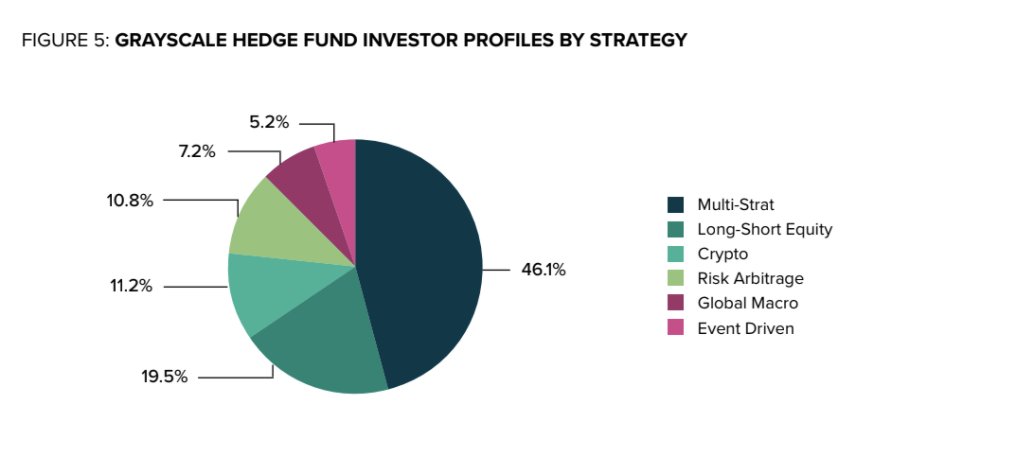

Another interesting chart is the breakdown of Grayscale& #39;s hedge fund clients by strategy type. They range from large "multi billion dollar funds" to "global macro funds" to "multi-strat," according to the firm. Not just crypto-native investors.

I was pretty surprised about the strength of this quarter as I would have expected most investors to flee to cash, but Grayscale isn& #39;t the only firm seeing steady inflows. @BitwiseInvest said they have seen seen an uptick in flows and interest.

Full post for you to read here: https://www.theblockcrypto.com/post/62032/grayscale-quarter-report-record-inflows-crypto">https://www.theblockcrypto.com/post/6203...

Read on Twitter

Read on Twitter