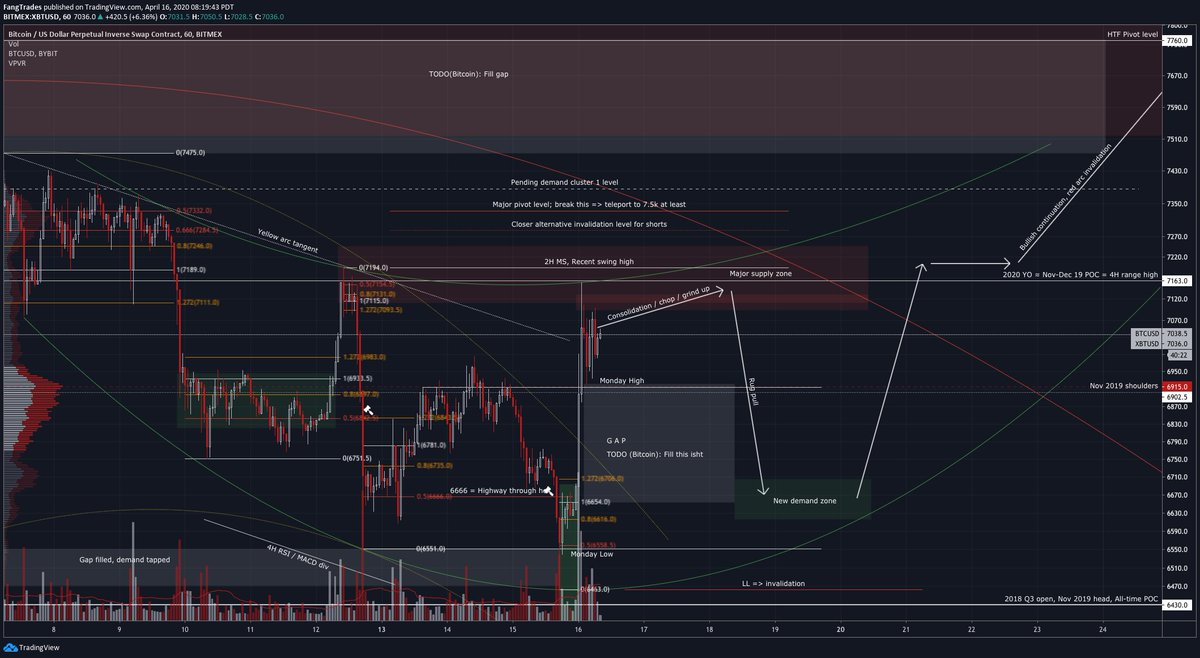

New $BTC predictions. No one buys into a drop like that except the pros (and me heh). Price pumped too fast to allow retail in - it was driven by short liqs. I expect consolidation and a slow grind up for retail to start getting excited, then pull the rug on them, like so.

1/ https://twitter.com/FangTrades/status/1249665201231687681">https://twitter.com/FangTrade...

1/ https://twitter.com/FangTrades/status/1249665201231687681">https://twitter.com/FangTrade...

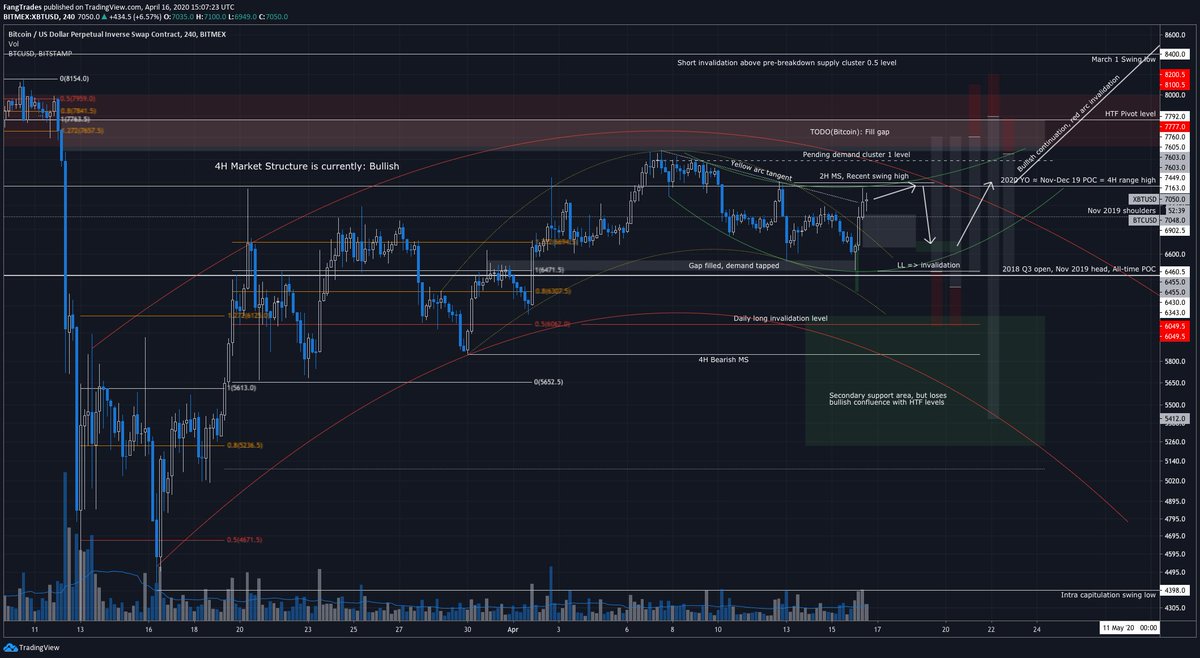

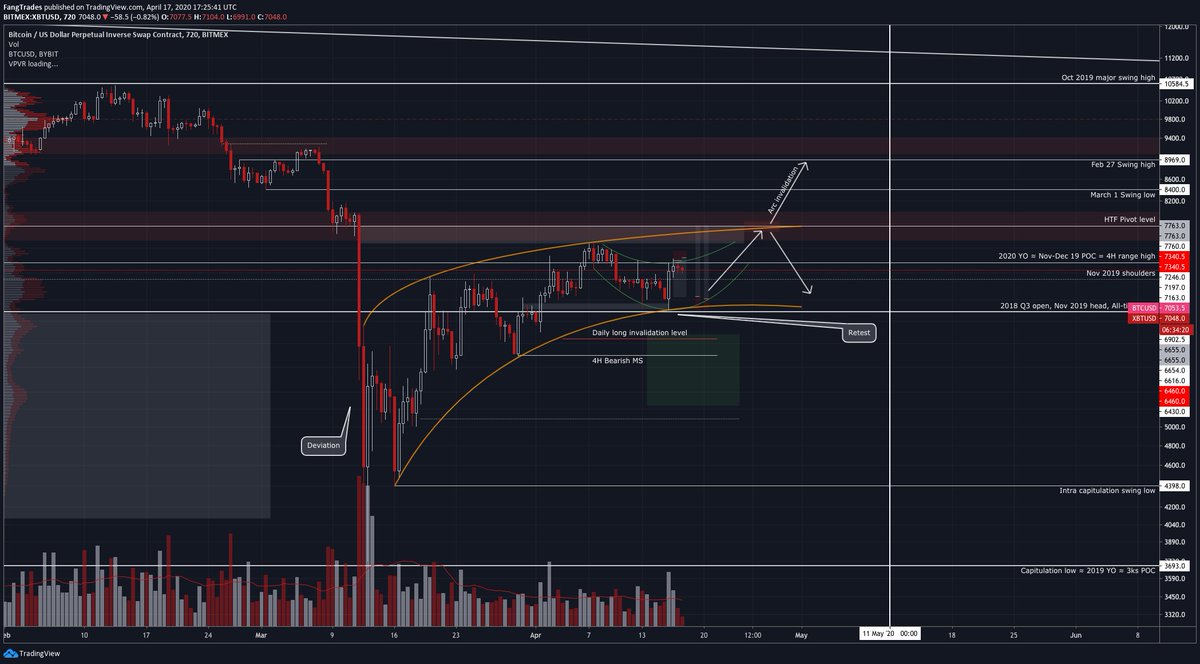

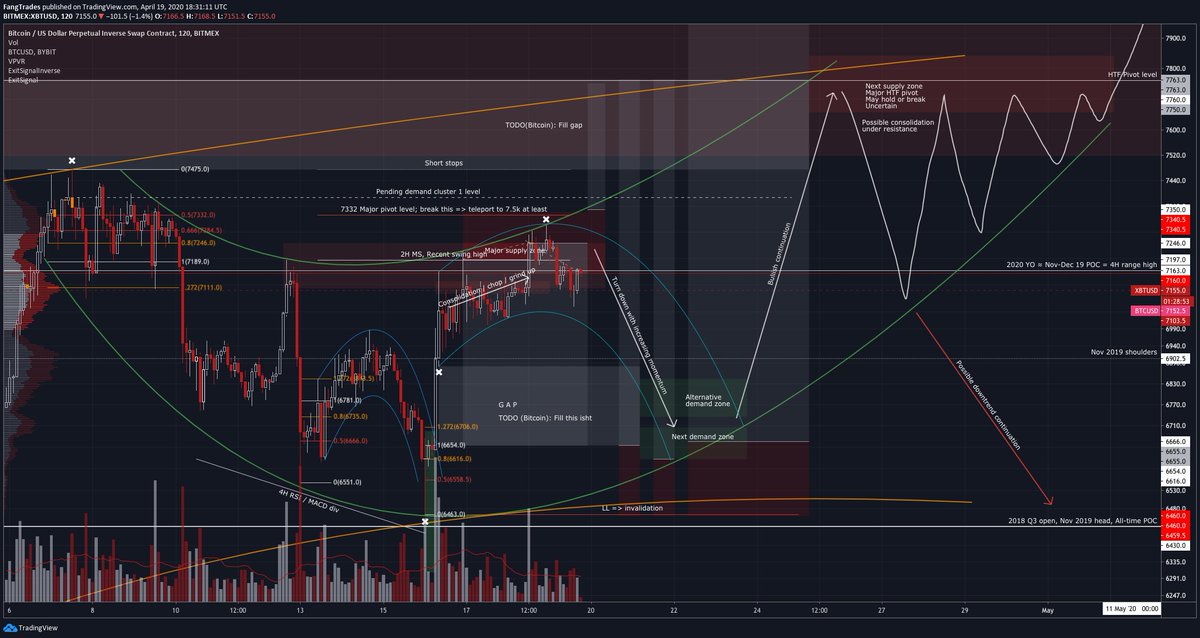

2/ $BTC 4H view.

4H MS firmly bullish but turning downwards along red arc.

Yellow arc invalidated via break of tangent line.

Prev demand tapped, bulls ready.

Expecting:

- Red arc invalidation

- Green arc to guide price through 25th

- Drop before 20th

- Breakout around 22nd-26th

4H MS firmly bullish but turning downwards along red arc.

Yellow arc invalidated via break of tangent line.

Prev demand tapped, bulls ready.

Expecting:

- Red arc invalidation

- Green arc to guide price through 25th

- Drop before 20th

- Breakout around 22nd-26th

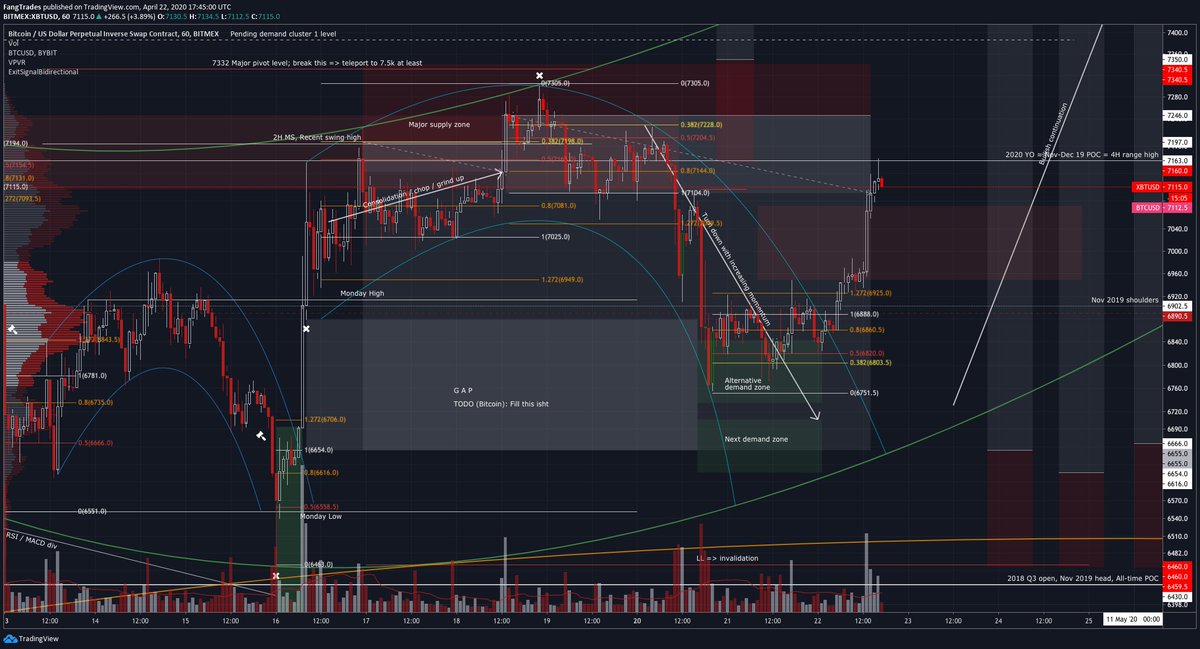

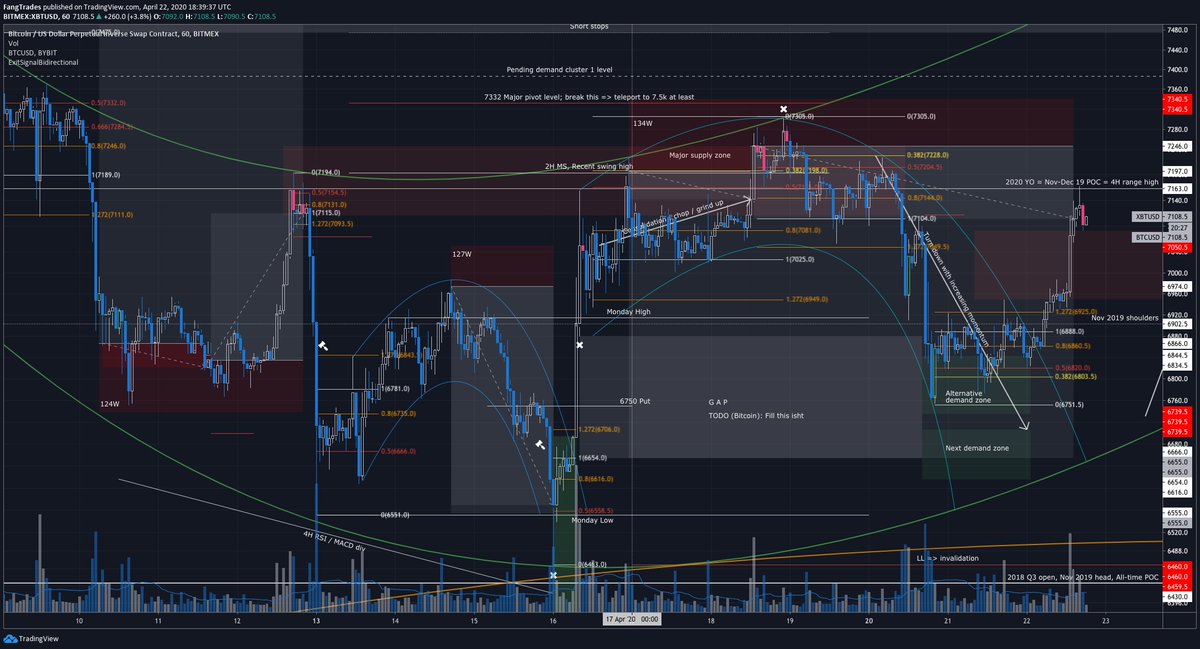

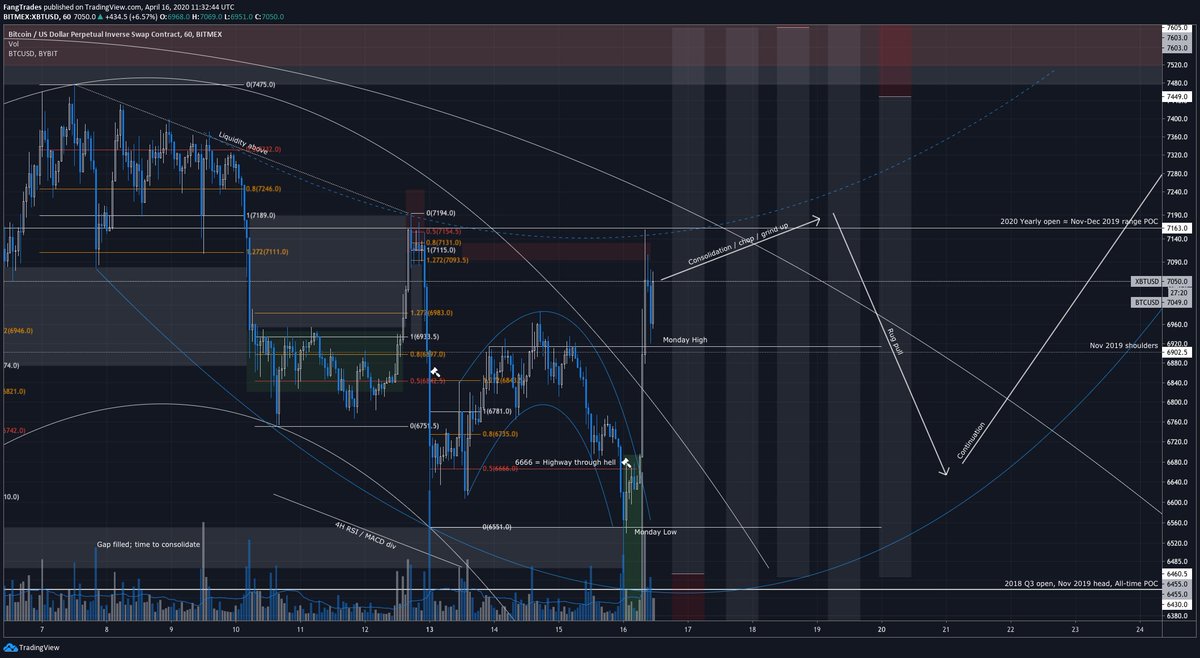

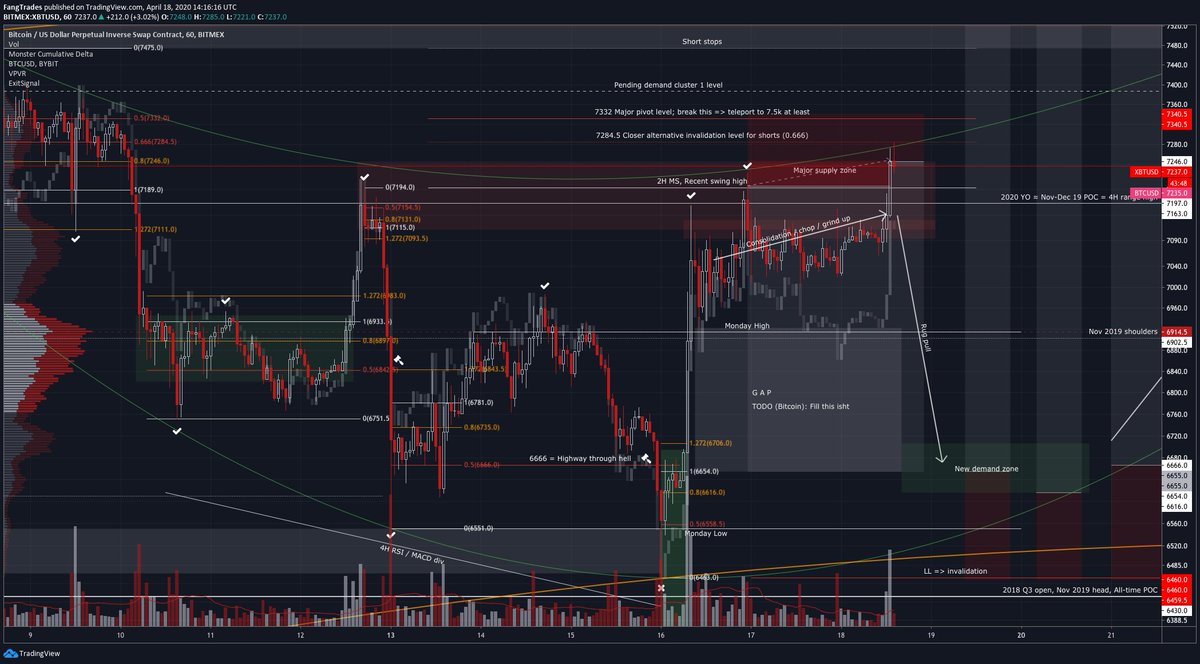

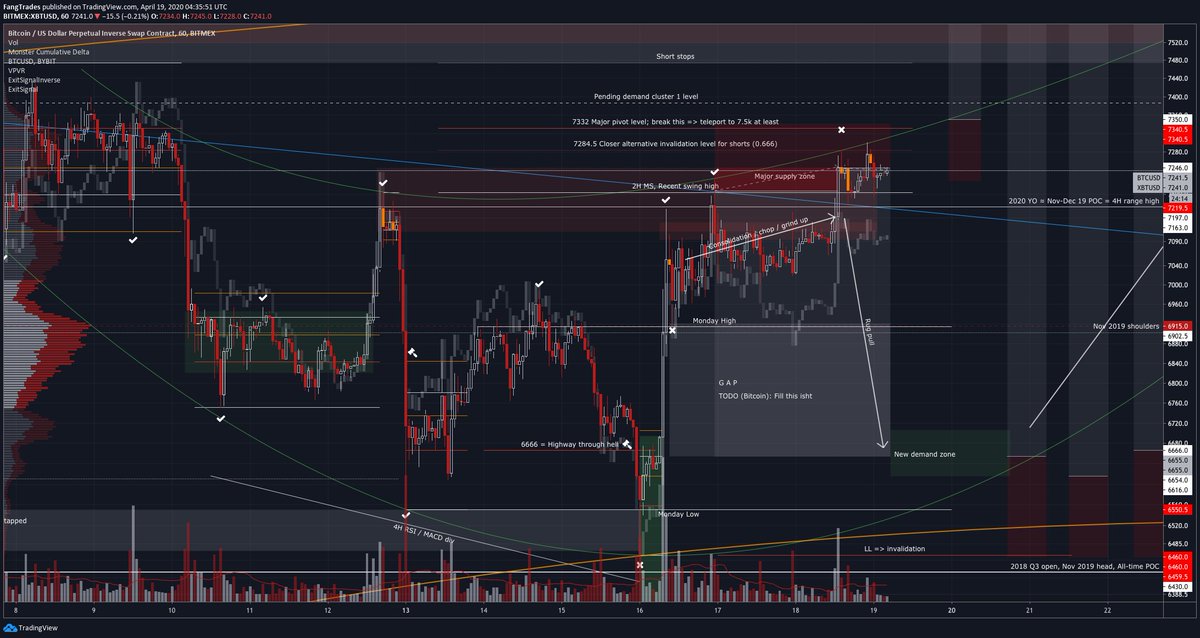

3/ $BTC 1H. Lots going on.

Expecting:

- Sweep 7194 high; break into bullish MS

- Dump to fill the massive gap @ 6650-6920

- Formation of new demand cluster around 6620-6700.

- Pump, eventually consolidate above 2020 yearly open

- Pivot through 7330 level to fill gap up to 7750+

Expecting:

- Sweep 7194 high; break into bullish MS

- Dump to fill the massive gap @ 6650-6920

- Formation of new demand cluster around 6620-6700.

- Pump, eventually consolidate above 2020 yearly open

- Pivot through 7330 level to fill gap up to 7750+

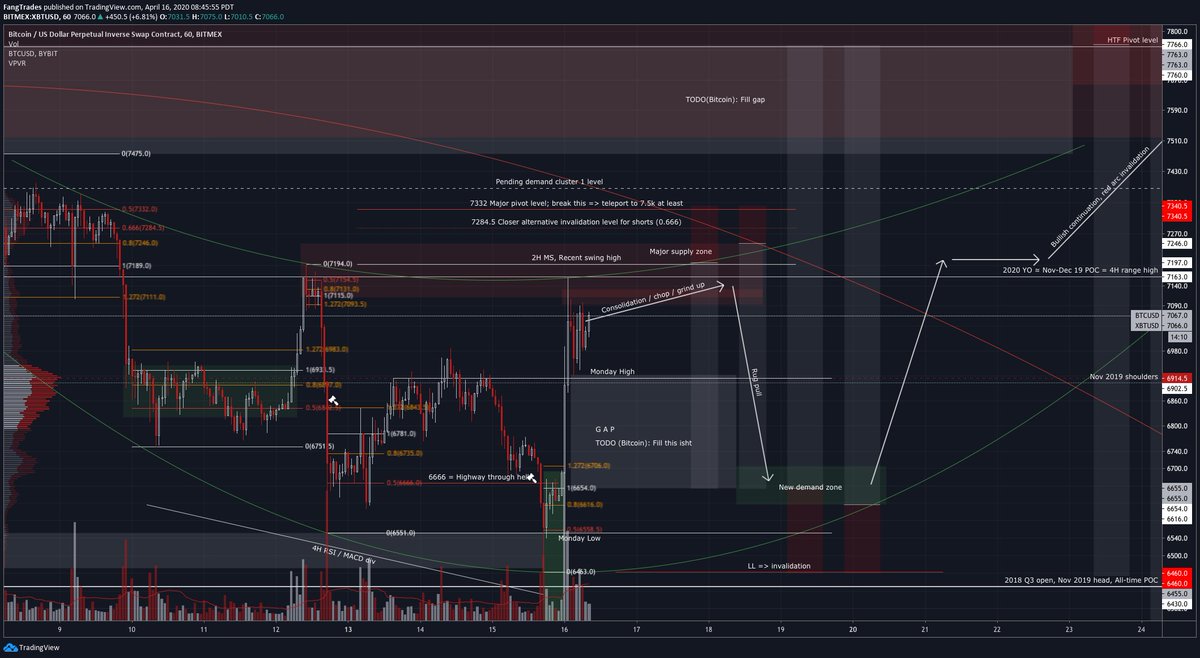

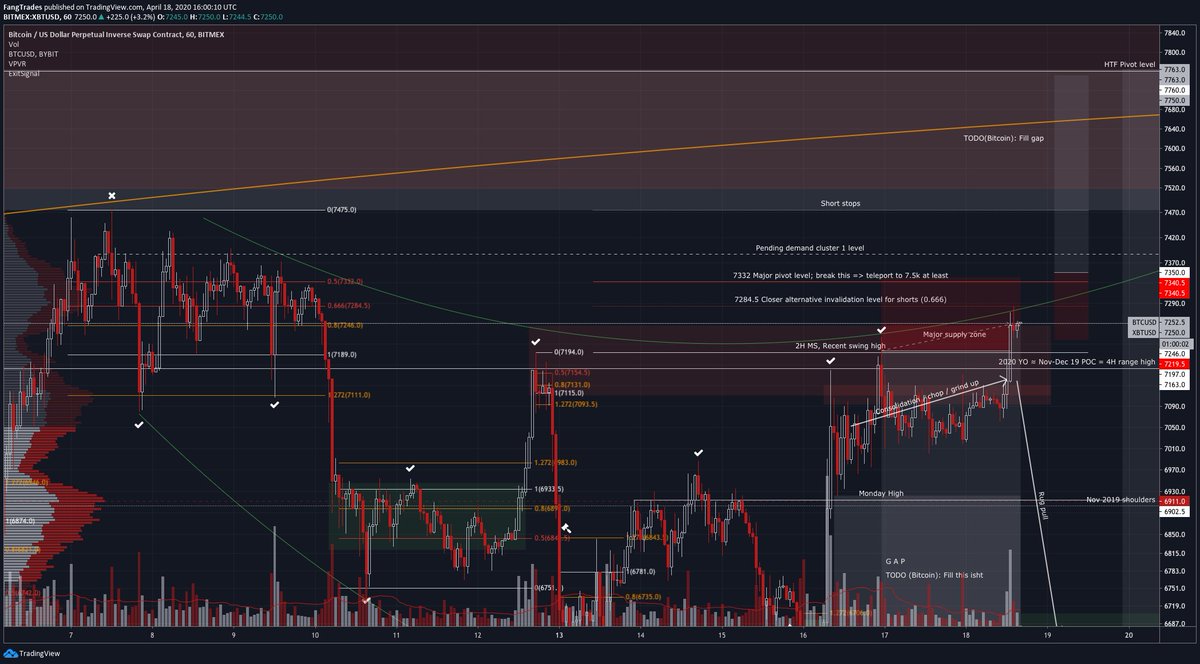

4/ $BTC Swing trade gameplan

Shorts

- Entry 7200-7250

- Invalidation > 7330

- Target 6666

3.8-6.3 RRR

Longs

- Entry 6660-6600

- Invalid < 6460

- Target 7750+

5.7-7.3 RRR

Maybe short at 7750+

6600-6700 demand zone is last place to accumulate spot BTC under 6750 for a while imo

Shorts

- Entry 7200-7250

- Invalidation > 7330

- Target 6666

3.8-6.3 RRR

Longs

- Entry 6660-6600

- Invalid < 6460

- Target 7750+

5.7-7.3 RRR

Maybe short at 7750+

6600-6700 demand zone is last place to accumulate spot BTC under 6750 for a while imo

5/ $BTC Just found medium term clarity with this orange arc. Fits a lot better than the red one, with 3-4 touch points on each side instead of 2. It suggests we& #39;ll slowly continue to make our way towards 7750. This path makes a lot of sense to me - going to play along with it.

6/ $BTC First set of asks filled at 7197. Also market sold another lot at 7169.

Might wick higher again but happy with this entry for now.

Might wick higher again but happy with this entry for now.

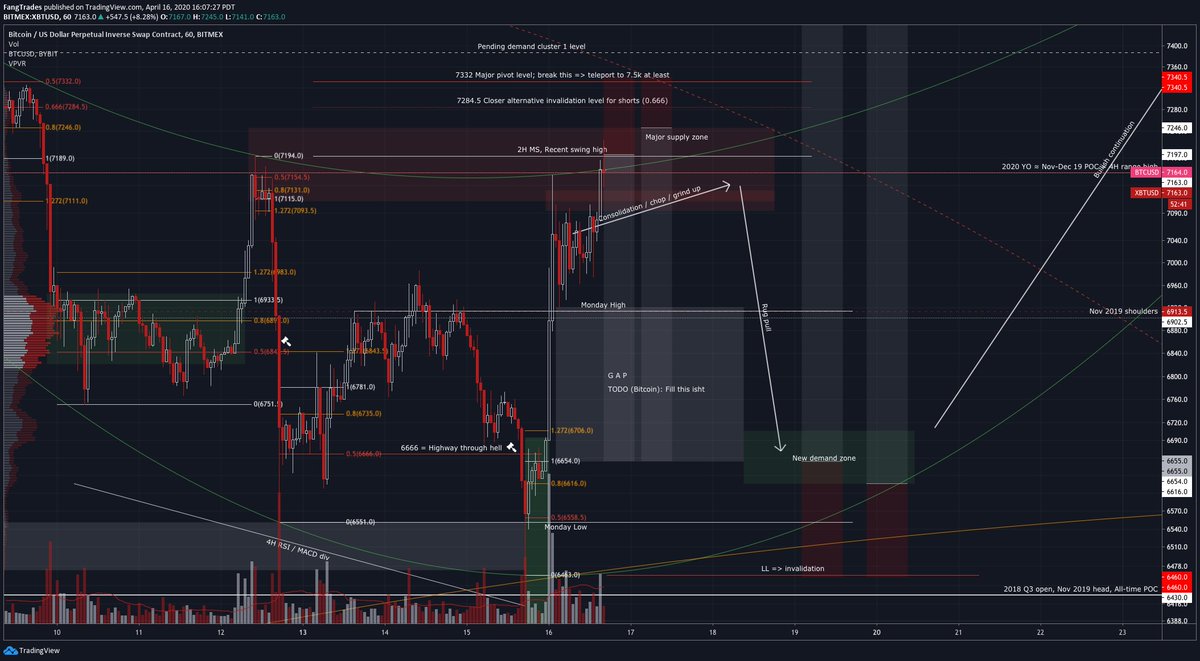

7/ $BTC That& #39;s a  https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> for "Consolidation / chop / grind up". This PA is nowhere as structured as the Apr 7-10 consolidation, and I& #39;m thus not particularly interested in scalping it.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> for "Consolidation / chop / grind up". This PA is nowhere as structured as the Apr 7-10 consolidation, and I& #39;m thus not particularly interested in scalping it.

Spending some time charting alt/btc and fx pairs while I wait for some action

Spending some time charting alt/btc and fx pairs while I wait for some action

8/ https://twitter.com/FangTrades/status/1242569576254242818?s=20

Look">https://twitter.com/FangTrade... familiar? I got burned last time trying to long this consolidation near the highs. The upward grind stopped out shorts multiple times too - you saw it all over CT.

Zoom out to set your stops. And don& #39;t buy resistance, friends

Look">https://twitter.com/FangTrade... familiar? I got burned last time trying to long this consolidation near the highs. The upward grind stopped out shorts multiple times too - you saw it all over CT.

Zoom out to set your stops. And don& #39;t buy resistance, friends

9/ @LomahCrypto said it best: https://twitter.com/LomahCrypto/status/1243693373648592896?s=20">https://twitter.com/LomahCryp...

10/ More confluence for this $BTC long:

https://twitter.com/FangTrades/status/1245774472638074882?s=20">https://twitter.com/FangTrade...

https://twitter.com/FangTrades/status/1245774472638074882?s=20">https://twitter.com/FangTrade...

12/ Placed a breakout buy at 7350 just in case we pump from here - target 7750, though price already dumped a bit before I could post

Looks like we& #39;ll see some action soon

Looks like we& #39;ll see some action soon

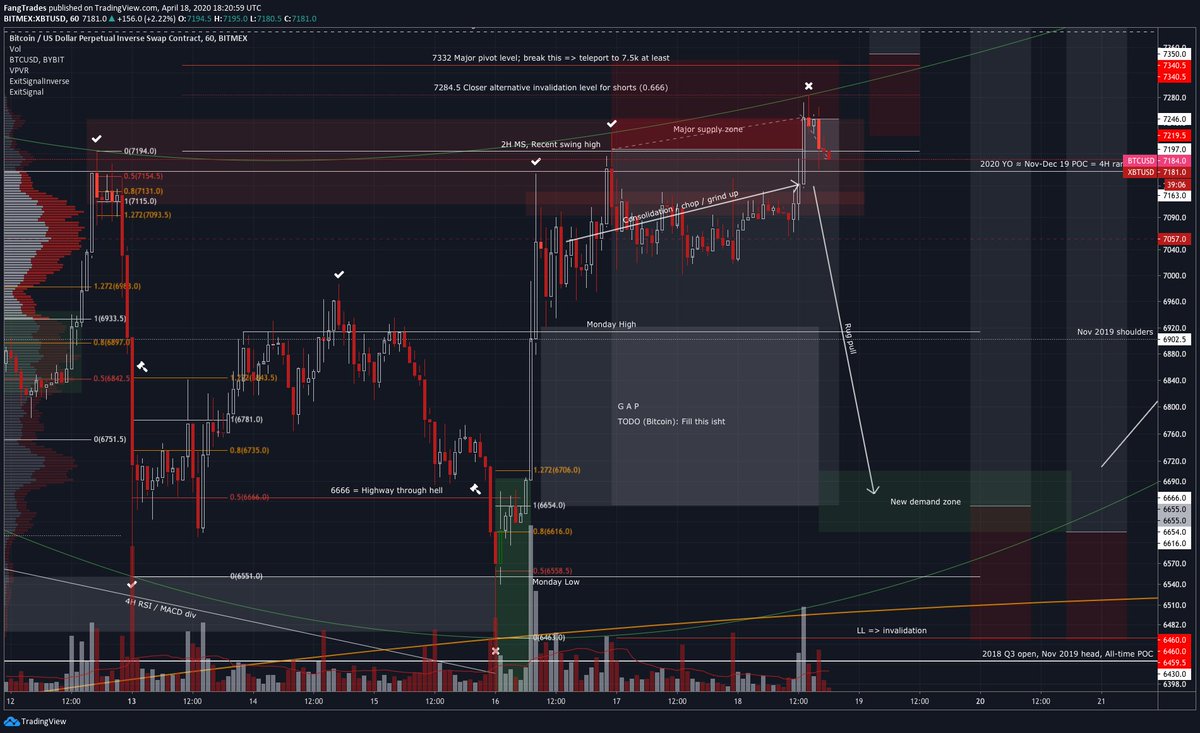

14/ Not looking good - would have liked to see price dump sooner than this, and it is consolidating a little too close for comfort. Widened my stops to tolerate another wick and reduced risk significantly.

15/ The basis for the trade is still solid though. $ETH and $SPX add confluence to this trade to the extent they influence the price of Bitcoin - they both look ready to drop any moment now. I still think a bearish bias out of this consolidation area is the correct one.

16/ Looking good again. I think $BTC will:

- Turn down with increasing momentum (blue arc instead of rug pull)

- Tap demand, rally to the 7750s, a HTF pivotal area

Then, we may consolidate under resistance or continue downwards. Hoping for the former but prepared for the latter.

- Turn down with increasing momentum (blue arc instead of rug pull)

- Tap demand, rally to the 7750s, a HTF pivotal area

Then, we may consolidate under resistance or continue downwards. Hoping for the former but prepared for the latter.

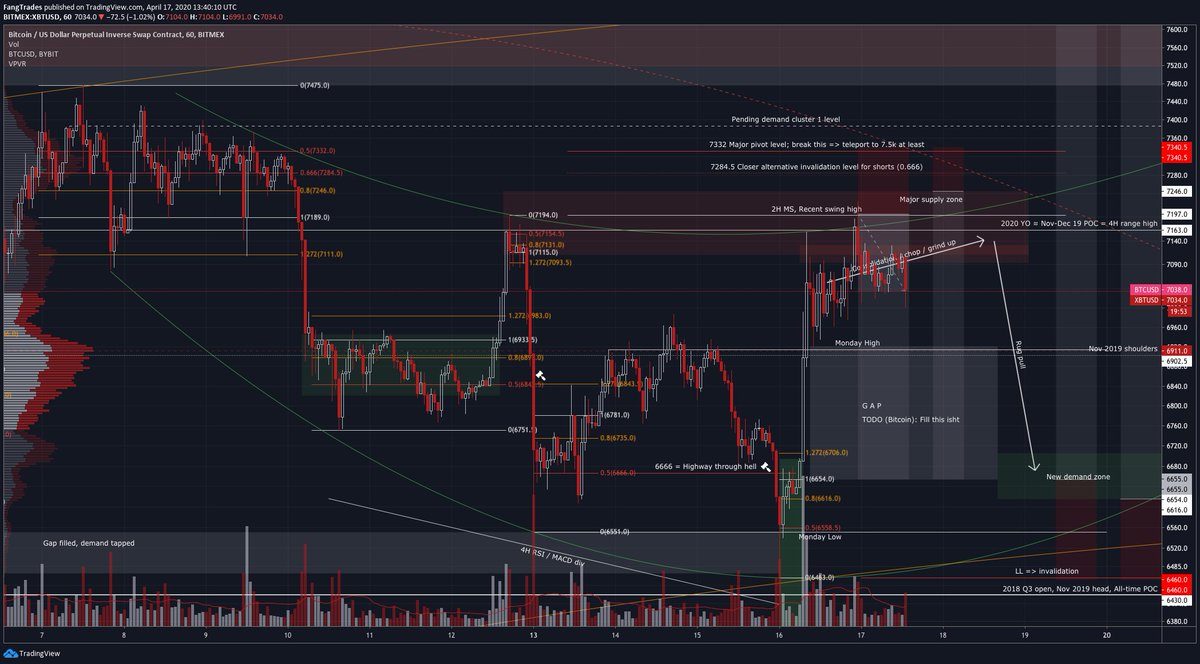

17/ Beautiful. That& #39;s a  https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> for "down with increasing momentum."

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> for "down with increasing momentum."

Looking for a tap of 6666 next

Looking for a tap of 6666 next

18/ The pump stopped me out at 7114. Although I made money on this trade and am long on another, there& #39;s lots to improve on, since I missed my target and lost significant paper profits - paper profits are money too!

19/ Overall I& #39;ve traded Bitcoin very well the last two weeks. I& #39;ve made money on the last three trade ideas I& #39;ve taken, compounding multiple times for the first and third. You can see these trades 124W, 127W, and 134W on the chart.

20/ But it& #39;s time to do some reflection, journalling, and backtesting. Bitcoin& #39;s not at a spot I want to trade anyway. I wrote 26 journal pages last Sunday to try to memorialize the insights that have led to my recent good performance - continuing that today.

21/ Some thoughts. Things that went well:

- Nailed the entry. I was underwater for <3% of the >135 hours the trade was open, made money almost based on the entry alone

- Arcs. When I realized a rug pull was unlikely I correctly predicted the path up until arc invalidation

- Nailed the entry. I was underwater for <3% of the >135 hours the trade was open, made money almost based on the entry alone

- Arcs. When I realized a rug pull was unlikely I correctly predicted the path up until arc invalidation

22/ Types of rules I& #39;ll backtest over the coming days

- Target setting: refining S/D clusters with more context

- Profit taking: Multiple targets, evolving R, indicators

- Consolidations: Investigate if intra-range PA could hint at the direction of breakout, e.g. Rule of 5 on S/R

- Target setting: refining S/D clusters with more context

- Profit taking: Multiple targets, evolving R, indicators

- Consolidations: Investigate if intra-range PA could hint at the direction of breakout, e.g. Rule of 5 on S/R

23/ And time to score the predictions from the first few tweets in the thread. Lots of tweets, sorry - trying to be transparent and verifiable

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> Red arc invalidation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> Red arc invalidation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱" title="Stopwatch" aria-label="Emoji: Stopwatch"> Green arc to guide price through 25th: Still valid

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱" title="Stopwatch" aria-label="Emoji: Stopwatch"> Green arc to guide price through 25th: Still valid

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> Drop before 20th

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> Drop before 20th

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱" title="Stopwatch" aria-label="Emoji: Stopwatch"> Breakout around 22nd-26th: Pending

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱" title="Stopwatch" aria-label="Emoji: Stopwatch"> Breakout around 22nd-26th: Pending

24/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Sweep 7194 high; break into bullish MS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">Sweep 7194 high; break into bullish MS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign"> Dump to fill the massive gap @ 6650-6920 (Halfway filled)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚠️" title="Warning sign" aria-label="Emoji: Warning sign"> Dump to fill the massive gap @ 6650-6920 (Halfway filled)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Cross mark" aria-label="Emoji: Cross mark"> Formation of new demand cluster around 6620-6700.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Cross mark" aria-label="Emoji: Cross mark"> Formation of new demand cluster around 6620-6700.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> Pump, eventually consolidate above 2020 yearly open

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> Pump, eventually consolidate above 2020 yearly open

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱" title="Stopwatch" aria-label="Emoji: Stopwatch"> Pivot through 7330 level to fill gap up to 7750+ (Not yet)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏱" title="Stopwatch" aria-label="Emoji: Stopwatch"> Pivot through 7330 level to fill gap up to 7750+ (Not yet)

FIN/ That& #39;s it, thank you for reading and following along my journey. Writing for you makes me feel like I am not alone, and it helps me clarify my thoughts, too.

Closing this thread with +1.99R.

Closing this thread with +1.99R.

Read on Twitter

Read on Twitter

for "Consolidation / chop / grind up". This PA is nowhere as structured as the Apr 7-10 consolidation, and I& #39;m thus not particularly interested in scalping it.Spending some time charting alt/btc and fx pairs while I wait for some action" title="7/ $BTC That& #39;s a https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> for "Consolidation / chop / grind up". This PA is nowhere as structured as the Apr 7-10 consolidation, and I& #39;m thus not particularly interested in scalping it.Spending some time charting alt/btc and fx pairs while I wait for some action" class="img-responsive" style="max-width:100%;"/>

for "Consolidation / chop / grind up". This PA is nowhere as structured as the Apr 7-10 consolidation, and I& #39;m thus not particularly interested in scalping it.Spending some time charting alt/btc and fx pairs while I wait for some action" title="7/ $BTC That& #39;s a https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> for "Consolidation / chop / grind up". This PA is nowhere as structured as the Apr 7-10 consolidation, and I& #39;m thus not particularly interested in scalping it.Spending some time charting alt/btc and fx pairs while I wait for some action" class="img-responsive" style="max-width:100%;"/>

for "down with increasing momentum."Looking for a tap of 6666 next" title="17/ Beautiful. That& #39;s a https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> for "down with increasing momentum."Looking for a tap of 6666 next" class="img-responsive" style="max-width:100%;"/>

for "down with increasing momentum."Looking for a tap of 6666 next" title="17/ Beautiful. That& #39;s a https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="White heavy check mark" aria-label="Emoji: White heavy check mark"> for "down with increasing momentum."Looking for a tap of 6666 next" class="img-responsive" style="max-width:100%;"/>