1/ Some observations about the impact to economic activity on Bitcoin and Ethereum over the past few months:

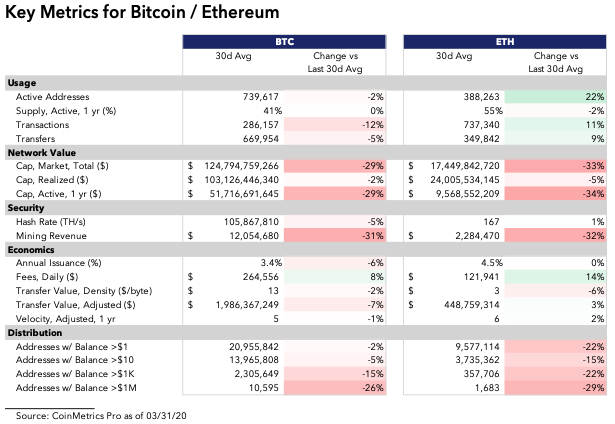

First, prices were hit significantly harder than demand variables for both Bitcoin and Ethereum, some of which actually grew.

First, prices were hit significantly harder than demand variables for both Bitcoin and Ethereum, some of which actually grew.

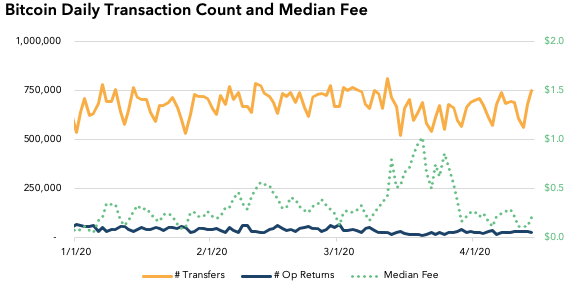

2/ Bitcoin continues to hum along, with transaction counts consistently near levels that start to trigger upwards fee pressure.

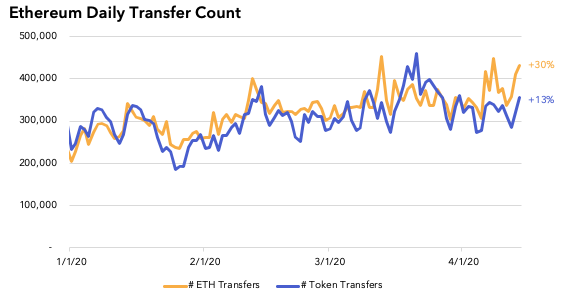

3/ Ethereum’s transaction counts have actually experienced significant growth YTD, with daily completed contract calls rising 42% based on 30-day trailing averages.

4/ Zooming in on transfer activity shows healthy increases as well, with ETH transfers up 30% and token transfers up 13%.

(note that charts show daily counts, %-change label is based on 30-day trailing avg)

(note that charts show daily counts, %-change label is based on 30-day trailing avg)

5/ The increases in transactions across the board are likely driven by spikes in on-chain DeFi activity around price volatility, increasing stablecoin usage on Ethereum, and secular growth of the Ethereum ecosystem.

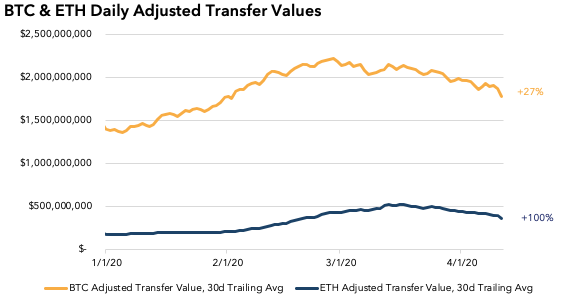

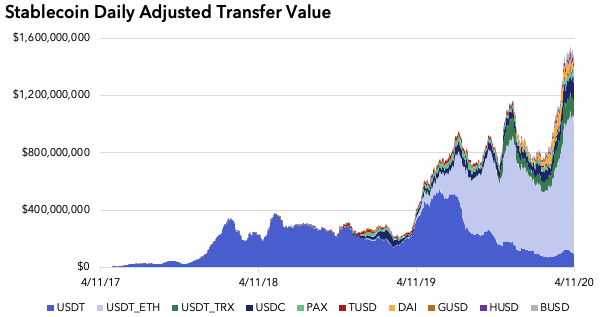

6/ Shifting to USD-equivalent transfer values -- the amount of value that these networks move per day on-chain – shows increases for both networks YTD.

7/ Exchanges see big volume increases during times of volatility, and this is reflected on-chain as traders and market makers move balances on/off/between trading venues.

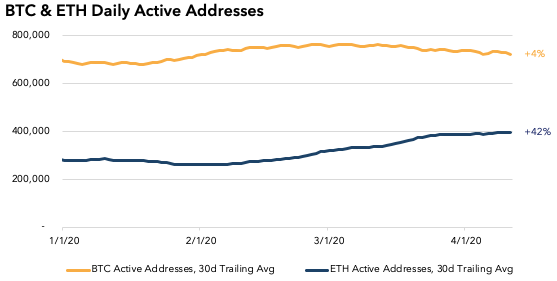

8/ Daily active addresses have also been on the rise for both major blockchains, growing 4% and 42% for Bitcoin and Ethereum respectively based on 30-day trailing averages.

9/ The increase for Bitcoin is small but healthy (also starts at a larger base than Ethereum).

Ethereum’s YTD active address growth is notable and impressive –- what’s driving it?

Ethereum’s YTD active address growth is notable and impressive –- what’s driving it?

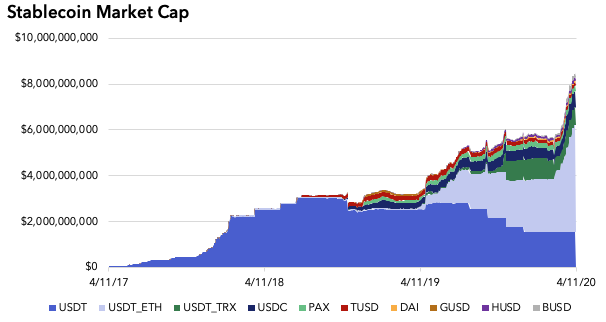

10/ The biggest contributor is increased stablecoin adoption, which grew as demand for Dollars soared in the recent flight to safety.

The aggregate market cap across stablecoins shows a >30% increase in March alone, driven almost entirely by USDT on Ethereum.

The aggregate market cap across stablecoins shows a >30% increase in March alone, driven almost entirely by USDT on Ethereum.

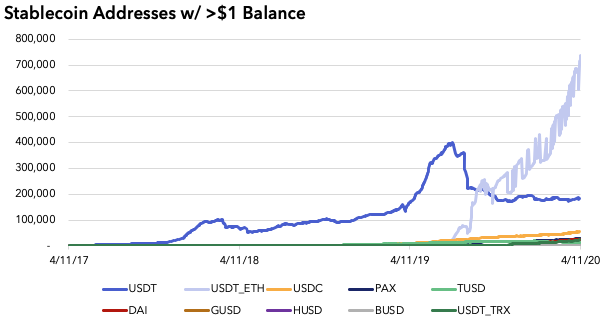

12/ Growth in the number of stablecoin addresses with >$1 balance further supports Tether’s dominance, and helps explain Ethereum’s active address growth.

13/ In sum, the economic activity that is powered by blockchains is unsurprisingly not impacted the same way the physical economy is. In the same month that the world woke up to economic paralysis, on-chain fundamentals were improved or unaffected.

14/ In addition, while crypto prices compressed in line with a broad sell-off of risk assets, the narratives for both Bitcoin and Ethereum are arguably strengthened in this environment.

15/ Right now, the world wants Dollars and at the same time, many are becoming fearful of the long-term risk that the fiat system breaks under pressure. That is both a good time for Ethereum to export Dollars and for Bitcoin to provide a long-term solution/hedge to easy money.

(data from @coinmetrics)

Read on Twitter

Read on Twitter