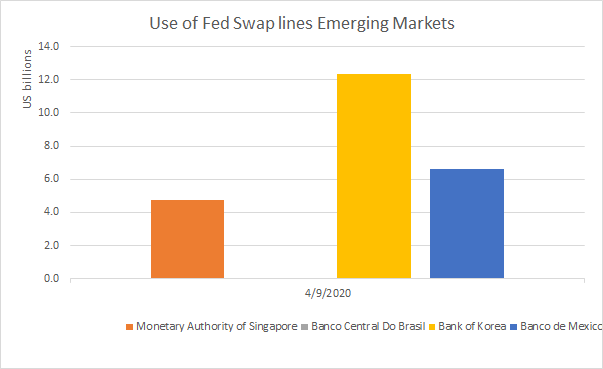

1/ IMF as lender of last resort @KGeorgieva commented today that "we are discussing a new short-term liquidity line for countries with strong policies." Some of emerging economies already have access to Fed& #39;s swap lines including Brazil and Mexico. Most others don& #39;t

2/ This leaves room for the IMF to act as a lender of last resort in FX as the Fed might not want to take on more credit risk via swaps ($ for local currency) and for repos need to have USTs (reserves), possibly issue with pricing https://twitter.com/elinaribakova/status/1250432968574656513?s=20">https://twitter.com/elinariba...

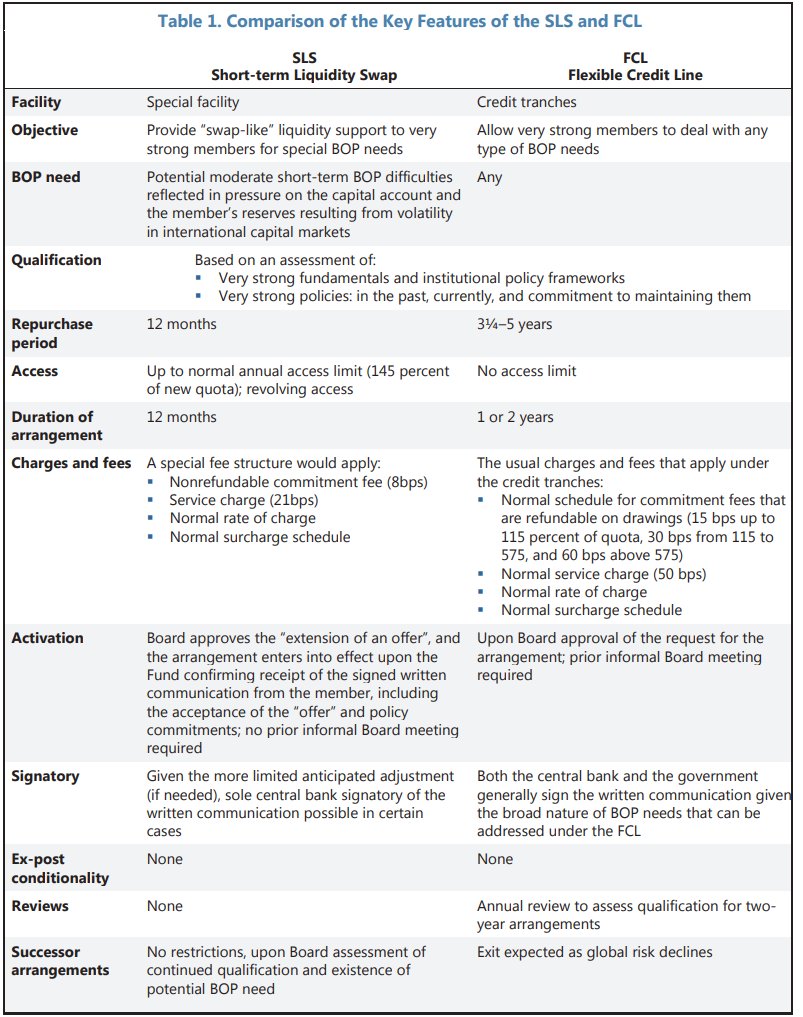

3/ What does the @IMFNews have already?

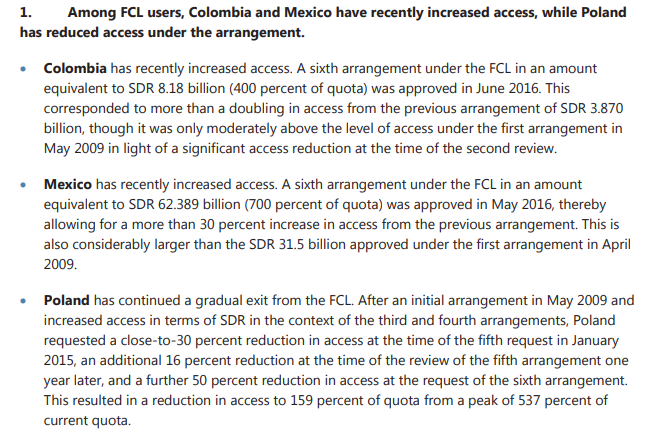

a. Flexible Credit Line, unlimited, but countries need to pre-qualify. So far Mexico, Poland, Colombia (just applied again to re-open) have used it.

a. Flexible Credit Line, unlimited, but countries need to pre-qualify. So far Mexico, Poland, Colombia (just applied again to re-open) have used it.

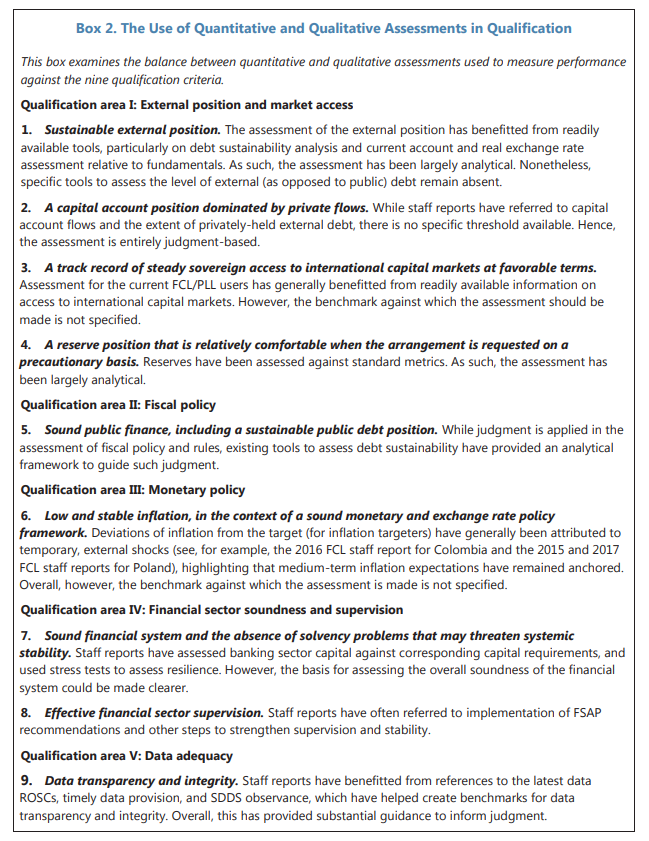

4/ pre-qualification criteria for the Flexible Credit Line are numerous and I find hart to follow, likely because of the IMF& #39;s need to safeguard resources as it is unlimited.

5/ b. Precautionary and Liquidity line. up 125% of quota for 6 months, cumulative 500% of quota after 12 month of good progress. Some assessment/conditionality.

Only one country has ever used it -- Morocco.

Only one country has ever used it -- Morocco.

6/ The key issue with FCL (unlimited, hard to qualify) and PLL (limited, easier to qualify, but why not a program then) countries either do not want them, or do not seem to be able to qualify for them. The facilities didn& #39;t fully remove stigma attached to the IMF borrowing.

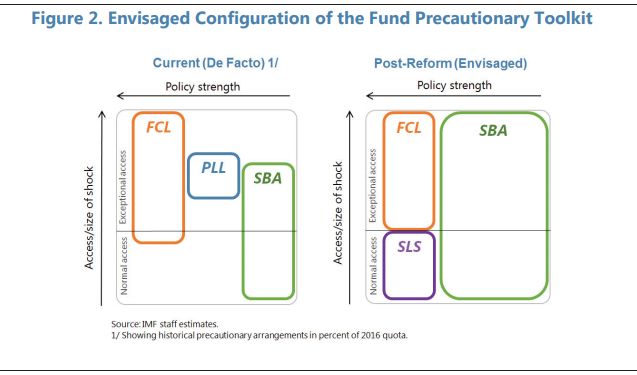

7/ There was a proposal not approved by the IMF board to replace the facilities with a new one. New SLS would be still capped at 145% of quota to provide support against medium-sized BOP shocks of a special nature.

https://www.imf.org/en/Publications/Policy-Papers/Issues/2017/12/19/pp121917-adequacyofgfsn-proposalsfortoolkitreform">https://www.imf.org/en/Public...

https://www.imf.org/en/Publications/Policy-Papers/Issues/2017/12/19/pp121917-adequacyofgfsn-proposalsfortoolkitreform">https://www.imf.org/en/Public...

9/ Key question: does it resolve anything at all? I do not think so. This version of the SLS appears too small to matter, doesn& #39;t remove the stigma of borrowing from the IMF, and is unlikely to be processed fast enough.

Looking forward to comments!

Looking forward to comments!

10/ Recent suggestion by @RaminToloui.

My key concern that many #EmergingMarkets and most FMs don& #39;t have reliable liquid CDS, especially in times of stress.

- allocation $100-$200bn.

- CDS spreads as criteria

- best borrowers 250 of quota

https://siepr.stanford.edu/research/publications/what-imf-can-do-now-confront-covid-19">https://siepr.stanford.edu/research/...

My key concern that many #EmergingMarkets and most FMs don& #39;t have reliable liquid CDS, especially in times of stress.

- allocation $100-$200bn.

- CDS spreads as criteria

- best borrowers 250 of quota

https://siepr.stanford.edu/research/publications/what-imf-can-do-now-confront-covid-19">https://siepr.stanford.edu/research/...

Read on Twitter

Read on Twitter