How I think about position sizing in a concentrated & #39;folio

[THREAD]

My initial position size is a reflection of:

The attractiveness of the business

Risk/reward of current valuation

Cash available

New positions are usually kept below 3% if the total portfolio until confident

[THREAD]

My initial position size is a reflection of:

The attractiveness of the business

Risk/reward of current valuation

Cash available

New positions are usually kept below 3% if the total portfolio until confident

I have ~ £60,500 allocated to investments

I am happy with 9-15 positions

That would naturally suggest position sizes of £4000 to £6700

I tend to buy in stages: half positions or third of my intended positions

So ~ £2000-£3350 initially

I try to control fees/FX too

I am happy with 9-15 positions

That would naturally suggest position sizes of £4000 to £6700

I tend to buy in stages: half positions or third of my intended positions

So ~ £2000-£3350 initially

I try to control fees/FX too

I occasionally take on "nibble positions" of £1000 while I follow a stock more closely

Helpful because growth stocks are volatile

Gives a degree of "skin in the game"

But, here& #39;s the thing:

Most of my test/nibble positions are not valuable to me in the long term

Here& #39;s why:

Helpful because growth stocks are volatile

Gives a degree of "skin in the game"

But, here& #39;s the thing:

Most of my test/nibble positions are not valuable to me in the long term

Here& #39;s why:

I invest in companies ONLY where I can see a path to a

3x-5x return on my original investment in 5-10 years if my thesis is correct.

3x on a £1000 investment is £3,000: nice but not portfolio changing

3x on a £6700 investment is £20,000: now we& #39;re talking!

3x-5x return on my original investment in 5-10 years if my thesis is correct.

3x on a £1000 investment is £3,000: nice but not portfolio changing

3x on a £6700 investment is £20,000: now we& #39;re talking!

You have to consider the downside risk too

I am psychologically able to handle a ~50% drop in stock price AS LONG AS THE THESIS REMAINS INTACT

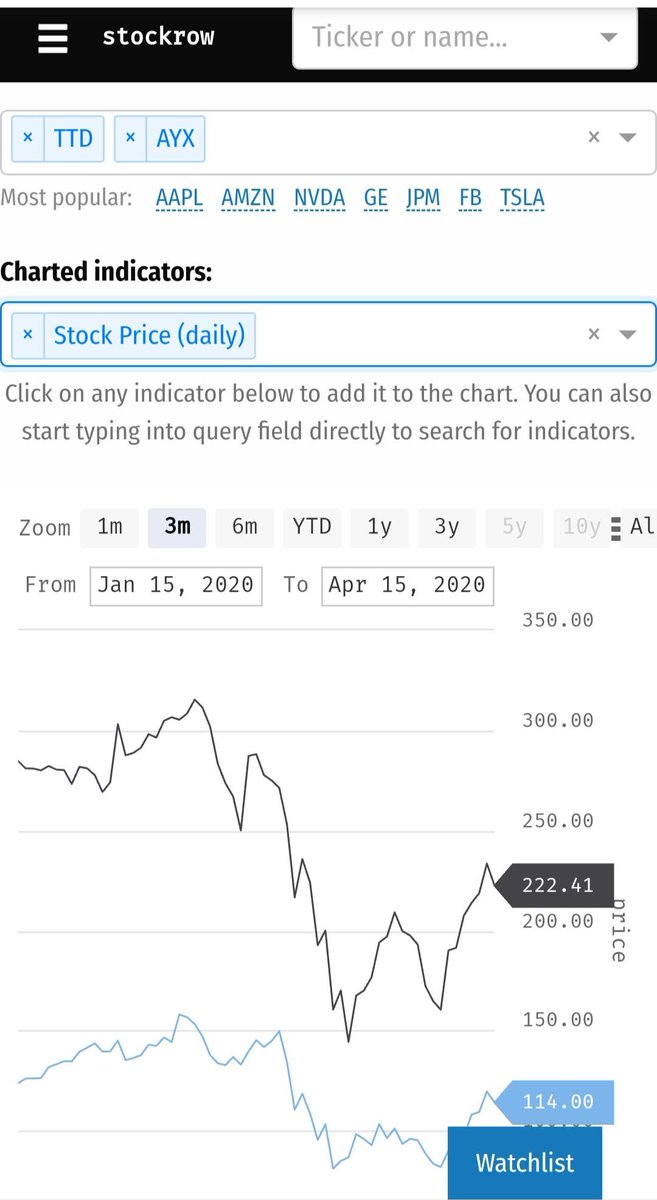

This was tested recently (pic)

I don& #39;t do a lot of trading: this would be a terrible trading strategy

https://twitter.com/adventuresinfi/status/1249082431799463939?s=20">https://twitter.com/adventure...

I am psychologically able to handle a ~50% drop in stock price AS LONG AS THE THESIS REMAINS INTACT

This was tested recently (pic)

I don& #39;t do a lot of trading: this would be a terrible trading strategy

https://twitter.com/adventuresinfi/status/1249082431799463939?s=20">https://twitter.com/adventure...

Valuation plays an important part in capital allocation

Short term, valuation (typically on an Enterprise Value/Sales) can drastically change within a relatively short period of time depending on company performance and market sentiment

3 year range for my companies in pic

Short term, valuation (typically on an Enterprise Value/Sales) can drastically change within a relatively short period of time depending on company performance and market sentiment

3 year range for my companies in pic

I tend to think in Tiers

and allocate higher capital to my Tier 1 picks - these have up to ~ £8700 ($11,000) allocated to them - I will try to opportunistically add to my "overfunding limit" when possible but won& #39;t go over the limit

Tier 2 picks have typically £3500-£5000

and allocate higher capital to my Tier 1 picks - these have up to ~ £8700 ($11,000) allocated to them - I will try to opportunistically add to my "overfunding limit" when possible but won& #39;t go over the limit

Tier 2 picks have typically £3500-£5000

I& #39;ll consider adding to a Tier 2 pick more slowly over time as appropriate

Current Tier 2 picks

$CRWD, $TWLO, $ZS

Questions on investing in security

https://softwarestackinvesting.com/why-i-wont-invest-in-security-stocks/

https://softwarestackinvesting.com/why-i-won... href="https://twitter.com/search?q=%24ZS&src=ctag">$ZS: valuation limited my position size, sales exec

$TWLO: size, deceleration of growth, gross margin

Current Tier 2 picks

$CRWD, $TWLO, $ZS

Questions on investing in security

https://softwarestackinvesting.com/why-i-wont-invest-in-security-stocks/

$TWLO: size, deceleration of growth, gross margin

Tier 3 picks may be more speculative or have a question mark over them. I have lower confidence in them

but they still have the opportunity for asymmetrical upside if the thesis works over the long term

$NVTA, $BZUN

I typically won& #39;t add to these beyond my initial allocation

but they still have the opportunity for asymmetrical upside if the thesis works over the long term

$NVTA, $BZUN

I typically won& #39;t add to these beyond my initial allocation

Current tryout positions for me are $LSPD.CA and $ROKU

both interesting, but $ROKU plays on the same thematic as $TTD

and $LSPD looks great but is facing recession-related headwinds - my position got cleaved to 1/3 of its value between Feb and March

but was lowish in overall £

both interesting, but $ROKU plays on the same thematic as $TTD

and $LSPD looks great but is facing recession-related headwinds - my position got cleaved to 1/3 of its value between Feb and March

but was lowish in overall £

This is still a work in progress for me

How do you allocate capital in a concentrated (20 companies or less) portfolio?

How do you allocate capital in a concentrated (20 companies or less) portfolio?

Curious to hear how you think about allocation and position size as a %

@dhaval_kotecha @7AustinL @cperruna @saxena_puru @7Innovator @StockNovice @reshoftc @mujimu @TMFStoffel @Matt_Cochrane7

@dhaval_kotecha @7AustinL @cperruna @saxena_puru @7Innovator @StockNovice @reshoftc @mujimu @TMFStoffel @Matt_Cochrane7

@trevmuchedzi how do you approach this?

Read on Twitter

Read on Twitter