A THREAD with preliminary calculations about the French State guarantee mechanism for new liquidity loans granted by banks between 16 March and 31 December 2020 to companies registered in France.

The planned amount is EUR 300 billion= 12% of the GDP. 1/ https://www.tresor.economie.gouv.fr/Articles/2020/04/03/covid-19-pret-garanti-par-l-etat-mode-d-emploi">https://www.tresor.economie.gouv.fr/Articles/...

The planned amount is EUR 300 billion= 12% of the GDP. 1/ https://www.tresor.economie.gouv.fr/Articles/2020/04/03/covid-19-pret-garanti-par-l-etat-mode-d-emploi">https://www.tresor.economie.gouv.fr/Articles/...

My short research question is: How will it impact firms leverage?

To answer this research question, I use Diane database that has data on French firms& #39; balance sheets and income statements. 2/

To answer this research question, I use Diane database that has data on French firms& #39; balance sheets and income statements. 2/

I use 2017 data because more recent data is incomplete. Data on small firms is often missing. I exclude insolvent firms with negative equity and sales. I also exclude firms with sales above 1.5 billion EUR, as these firms will negotiate their loan directly with the Ministry. 3/

The maximum loan is 25% of annual sales.

If I understand it correctly, since banks bear part of the risks (10% for firms with less than 5000 employees or 1.5bln of sales), they can refuse to grant a loan. 4/

If I understand it correctly, since banks bear part of the risks (10% for firms with less than 5000 employees or 1.5bln of sales), they can refuse to grant a loan. 4/

If I assume that all firms in my sample receive the max amount of the loan, the total sum of state guaranteed loans will be 497 bln EUR. In the light of the promised 300bln EUR, it seams that credit demand can be fully met by this scheme. 5/

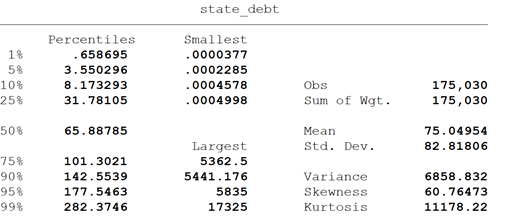

Now I can compute the ratio of max state guaranteed loan to total debt, bank debt and total assets.

Note that bank loans are only 17% of the total firm debt for an average firm and 3%! - for the median firm. 6/

Note that bank loans are only 17% of the total firm debt for an average firm and 3%! - for the median firm. 6/

Results:

State-guaranteed loan = 65% of the TOTAL DEBT (see figure) or 287% of the BANK DEBT or 35% of total assets for the median firm.

This is a lot of additional leverage! 7/

State-guaranteed loan = 65% of the TOTAL DEBT (see figure) or 287% of the BANK DEBT or 35% of total assets for the median firm.

This is a lot of additional leverage! 7/

Have I made a mistake or does the government expect firms to take on all this debt?

Will banks participate in this scheme? What will be the final amount of loans distributed? 8/

Will banks participate in this scheme? What will be the final amount of loans distributed? 8/

According to this article, the demand for guaranteed loans in France amounts to 50 bln EUR and they have a 5% rejection rate. https://bfmbusiness.bfmtv.com/entreprise/pret-garanti-par-l-etat-le-taux-de-refus-est-inferieur-a-5percent-assure-la-federation-bancaire-1894408.html">https://bfmbusiness.bfmtv.com/entrepris...

Read on Twitter

Read on Twitter