Another crackerjack piece by @ricardo_tranjan, exposing a market based on exploitation, poised to explode, and no federal emergency response.

Way to go Ricardo!

Some thoughts about how to fix it from me (based on years of @CanadaPIAC Board, which has deep roots in this file). /2 https://twitter.com/CCPA_Ont/status/1250042257648074757">https://twitter.com/CCPA_Ont/...

Way to go Ricardo!

Some thoughts about how to fix it from me (based on years of @CanadaPIAC Board, which has deep roots in this file). /2 https://twitter.com/CCPA_Ont/status/1250042257648074757">https://twitter.com/CCPA_Ont/...

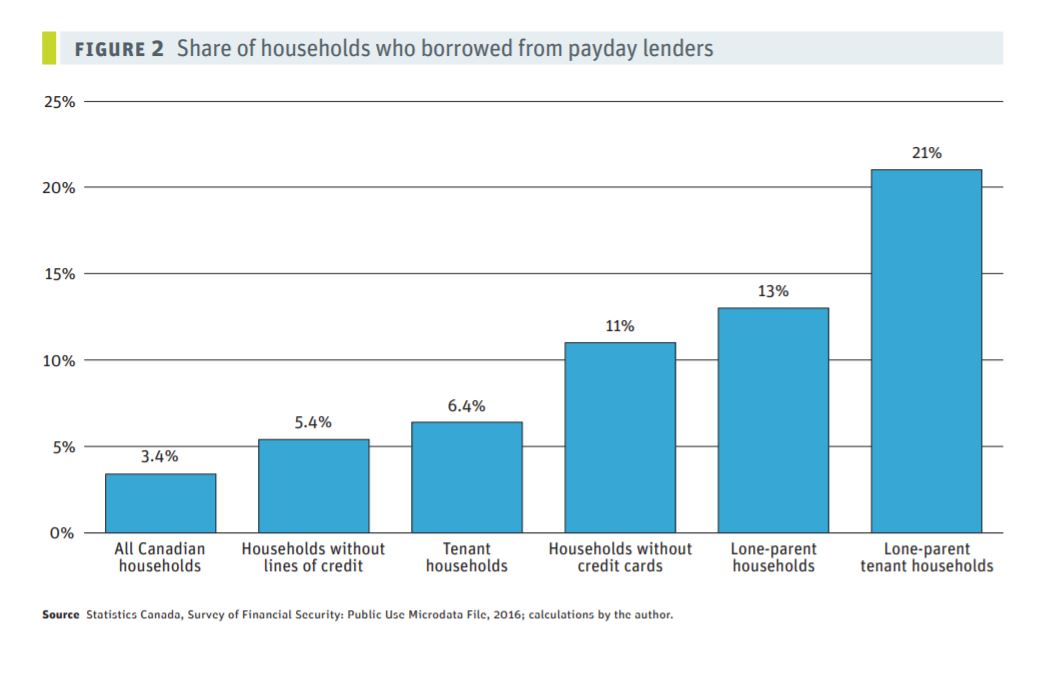

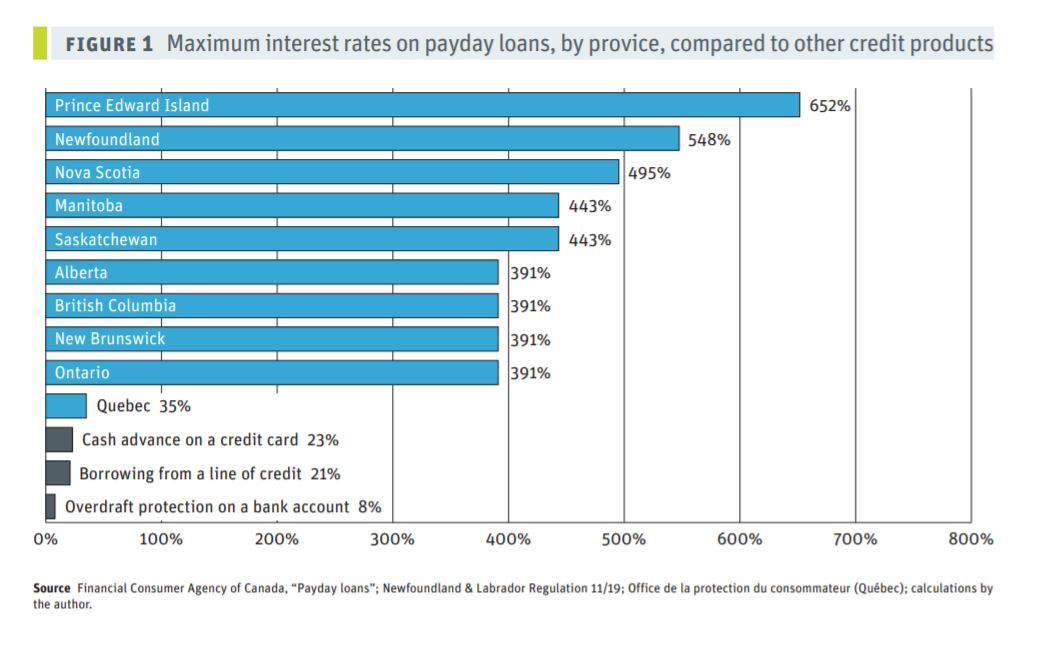

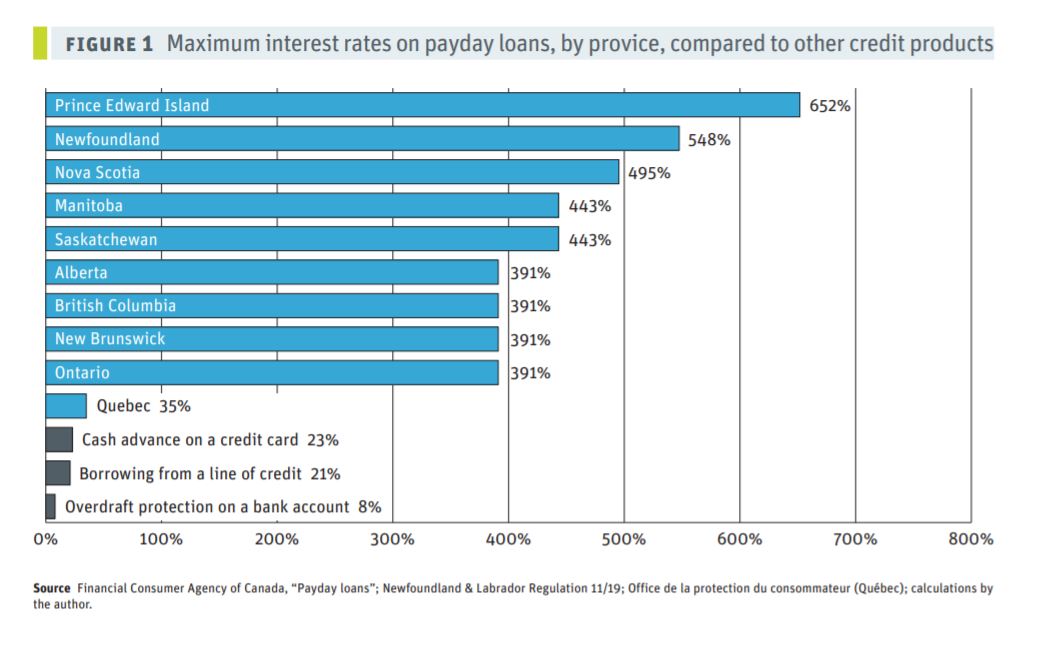

First look at these charts by @ricard_tranjan from this publication.

This sector is criminally underregulated.

Huge variation in controls between provinces.

Highly focused in low-income neighbourhoods.

Highly skewed use by people already at the end of the line. /3

This sector is criminally underregulated.

Huge variation in controls between provinces.

Highly focused in low-income neighbourhoods.

Highly skewed use by people already at the end of the line. /3

Now a reality check.

The federal government has constitutional authority for regulating banking in Canada.

But in 2007 the feds waved off advocates and punted authority for regulation to the provinces. (See https://www.hoyes.com/blog/what-is-the-maximum-amount-of-interest-i-can-be-charged-in-ontario/.">https://www.hoyes.com/blog/what... )

Cue the balkanization of rules. /4

The federal government has constitutional authority for regulating banking in Canada.

But in 2007 the feds waved off advocates and punted authority for regulation to the provinces. (See https://www.hoyes.com/blog/what-is-the-maximum-amount-of-interest-i-can-be-charged-in-ontario/.">https://www.hoyes.com/blog/what... )

Cue the balkanization of rules. /4

Remember this is the same government that, in 2006, said yes to taxpayer-backed zero down forty year mortgages, the very policy that led to the Global Financial Crisis, and kept at bay for years in Canada. That same government spent most of 2009-2012 walking that decision back./5

That was then, this is now.

The feds, as part of their emergency response package, should consider how to reclaim this jurisdiction (I& #39;m not sure if this is even possible! legal beagles??), set one law for all such lenders, and apply Criminal Code def& #39;n of usury: 60% p.a. /6

The feds, as part of their emergency response package, should consider how to reclaim this jurisdiction (I& #39;m not sure if this is even possible! legal beagles??), set one law for all such lenders, and apply Criminal Code def& #39;n of usury: 60% p.a. /6

If 60% sounds nuts to you in the light of credit card interest rates that sound unhinged in the era of near zero policy rates, consider from whence we begin: interest rates ranging from 35% (Quebec, The Distinct Society) to 652% (P.E. flippin I, I mean who& #39;s in charge there?)

Read on Twitter

Read on Twitter