People underestimate the importance of REMORTGAGES when being homeowner

Hopefully this may be useful for someone

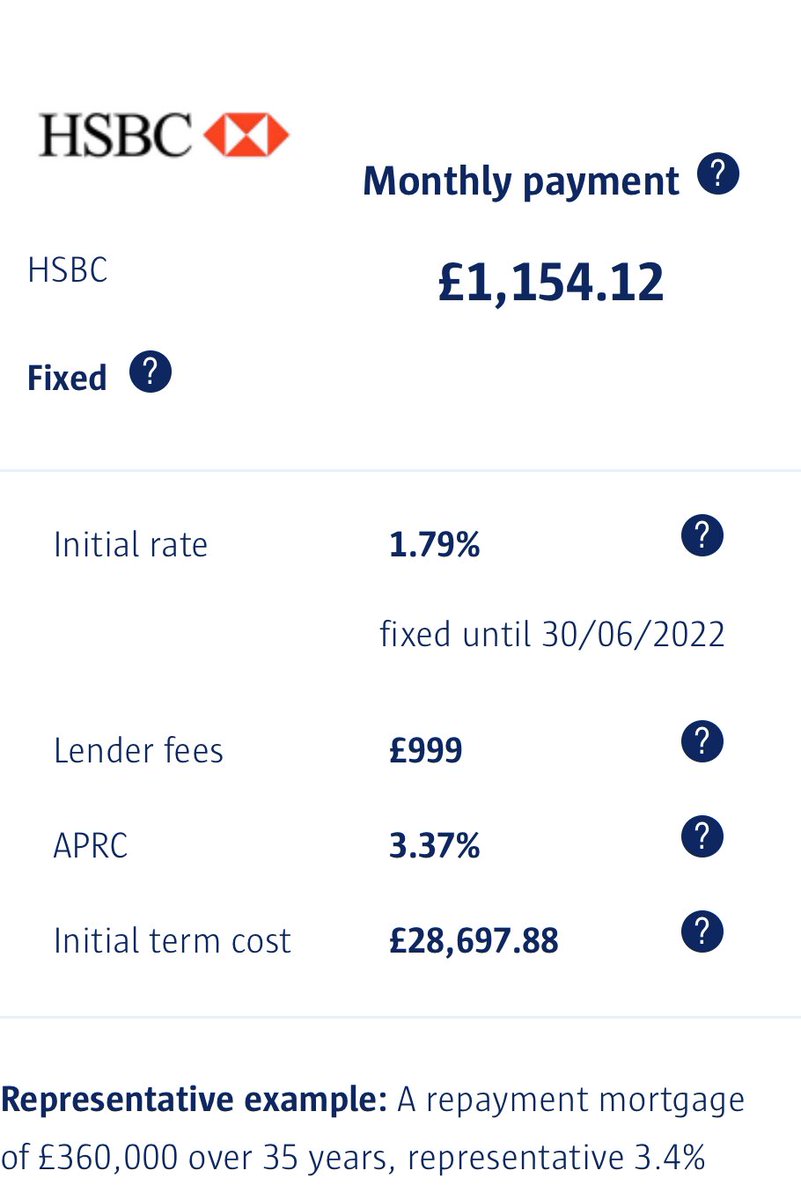

To begin, let’s say Emmanuel has a 360K mortgage with HSBC at 1.79% for 35 years on a house that’s worth 400K. He’s currently paying £1,154 per month

Hopefully this may be useful for someone

To begin, let’s say Emmanuel has a 360K mortgage with HSBC at 1.79% for 35 years on a house that’s worth 400K. He’s currently paying £1,154 per month

SCENARIO 1 - Simple remortgage

2 years pass

House Value - 405k

Mortgage Outstanding - £344k

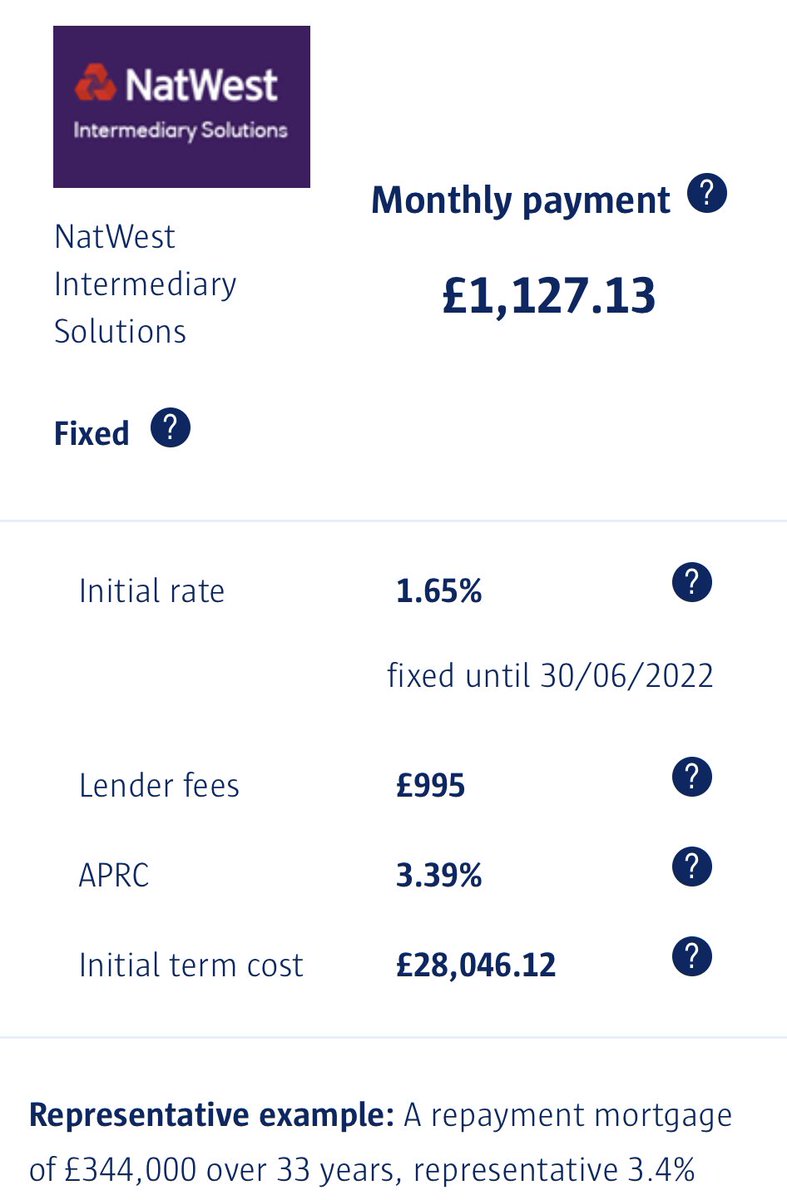

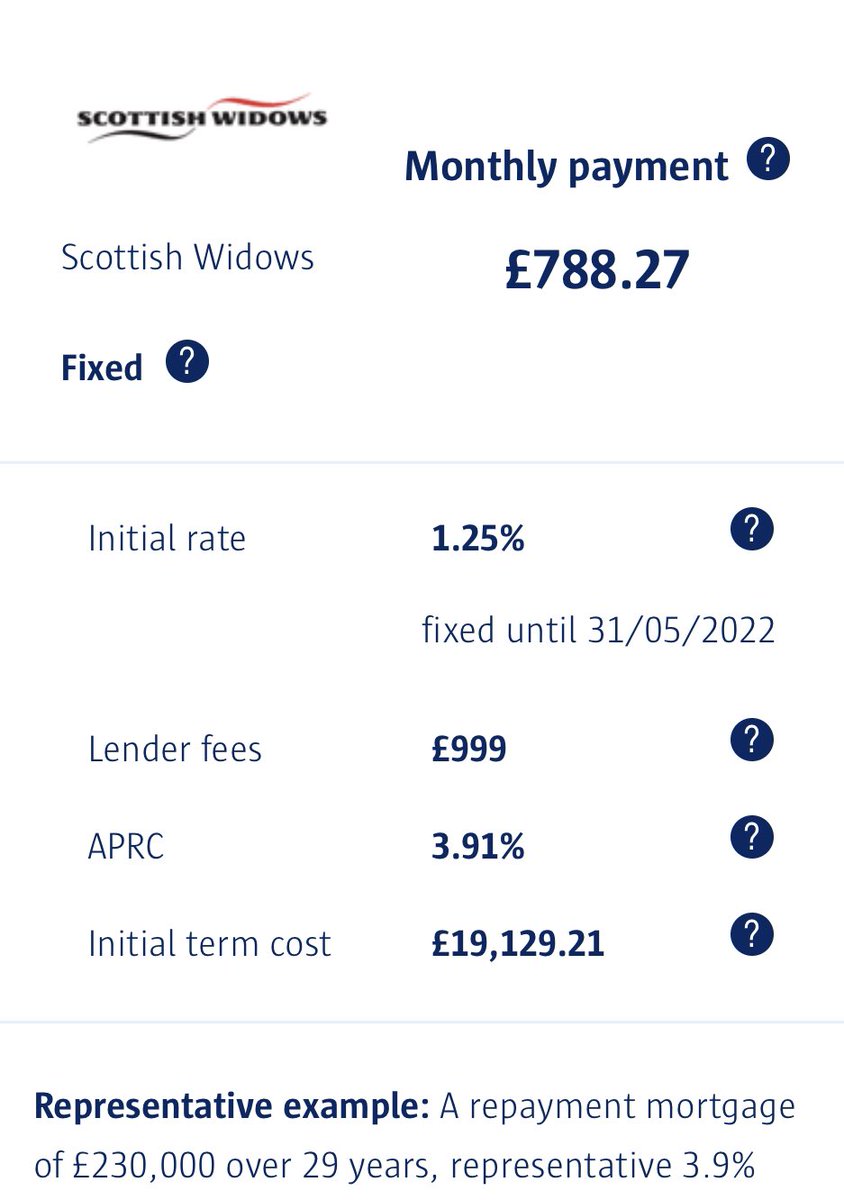

Emmanuel’s Loan to Value is now 85% so he can access lower rates such as this one with Natwest making his monthly payments £1,127 now

He kept his mortgage term at 33yrs

2 years pass

House Value - 405k

Mortgage Outstanding - £344k

Emmanuel’s Loan to Value is now 85% so he can access lower rates such as this one with Natwest making his monthly payments £1,127 now

He kept his mortgage term at 33yrs

SCENARIO 2 - Keeping payments the same but reducing term

2 years pass

House Value - 406k

Mortgage Outstanding - £323k

LTV 80%

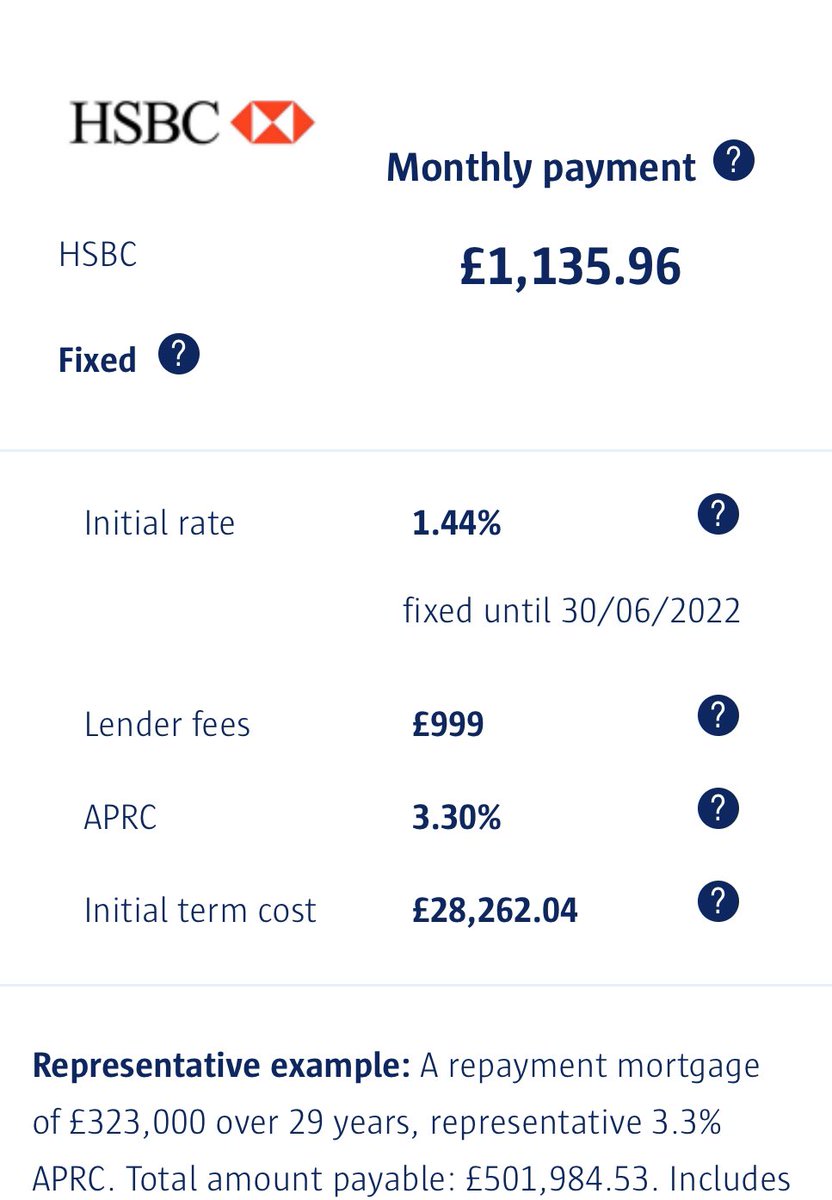

Emmanuel is comfy with his monthly payments so will keep them similar and knock an ADDITIONAL 2 yrs off his now 31 yr mortgage

Now only 29 years left

2 years pass

House Value - 406k

Mortgage Outstanding - £323k

LTV 80%

Emmanuel is comfy with his monthly payments so will keep them similar and knock an ADDITIONAL 2 yrs off his now 31 yr mortgage

Now only 29 years left

SCENARIO 3 - Extending the Term

2years pass

House Value - 394K

Mortgage Outstanding - 305K

80% LTV

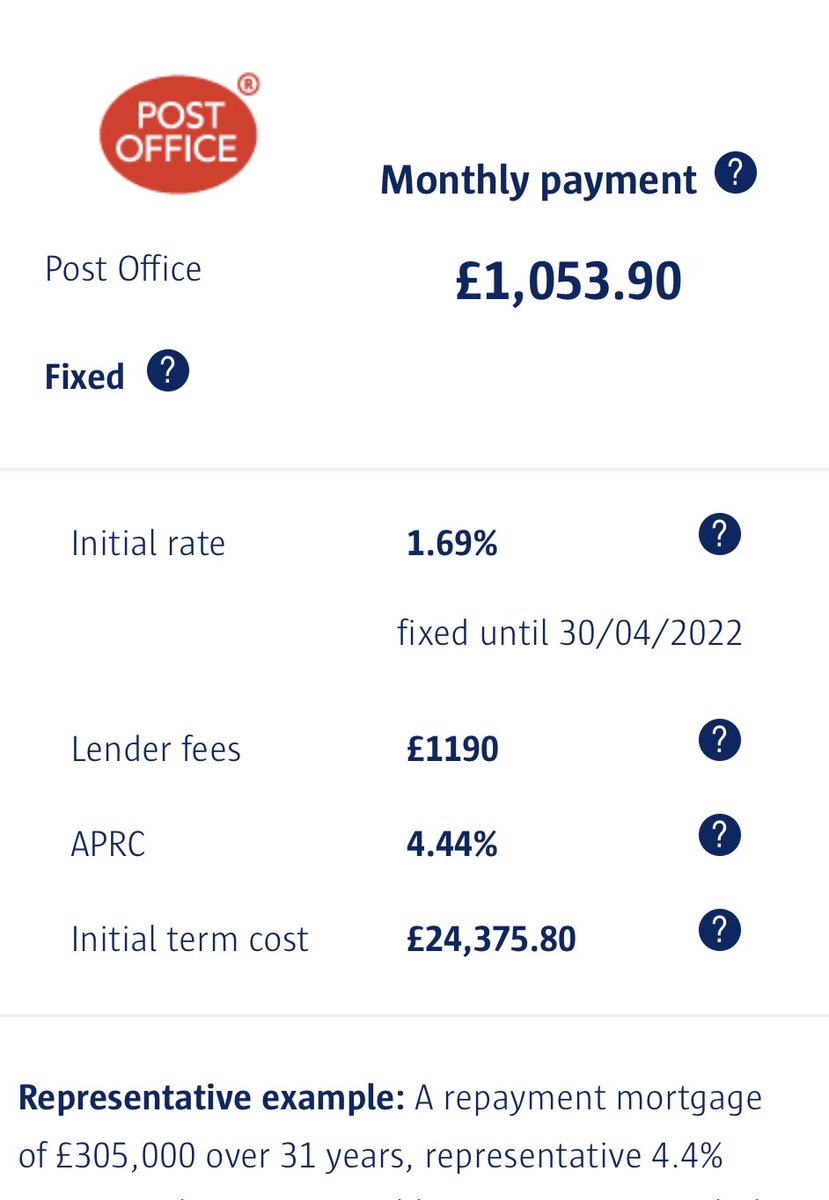

House prices have fallen meaning LTV has stayed consistent, emannuel is also expecting his first child, he adds 4 years onto his now 27 year mortgage to make payments manageable

2years pass

House Value - 394K

Mortgage Outstanding - 305K

80% LTV

House prices have fallen meaning LTV has stayed consistent, emannuel is also expecting his first child, he adds 4 years onto his now 27 year mortgage to make payments manageable

QUICK RECAP SO FAR

Emmanuel currently has a 305K mortgage for 31 years with Post office paying £1,053

We go again

Emmanuel currently has a 305K mortgage for 31 years with Post office paying £1,053

We go again

SCENARIO 4 - Paying off a lump sum

2years pass

House Value - 402k

Mortgage Outstanding - 280k

70% LTV

Emmanuel received an inheritance and wants to pay 50k off his mortgage making the mortgage now 230k and LTV 60%. He will keep his term consistent at 29 yrs

2years pass

House Value - 402k

Mortgage Outstanding - 280k

70% LTV

Emmanuel received an inheritance and wants to pay 50k off his mortgage making the mortgage now 230k and LTV 60%. He will keep his term consistent at 29 yrs

SCENARIO 5 - Reducing term to meet a goal

2years pass

House Value - 416k

Mortgage Outstanding - 208k

50% LTV

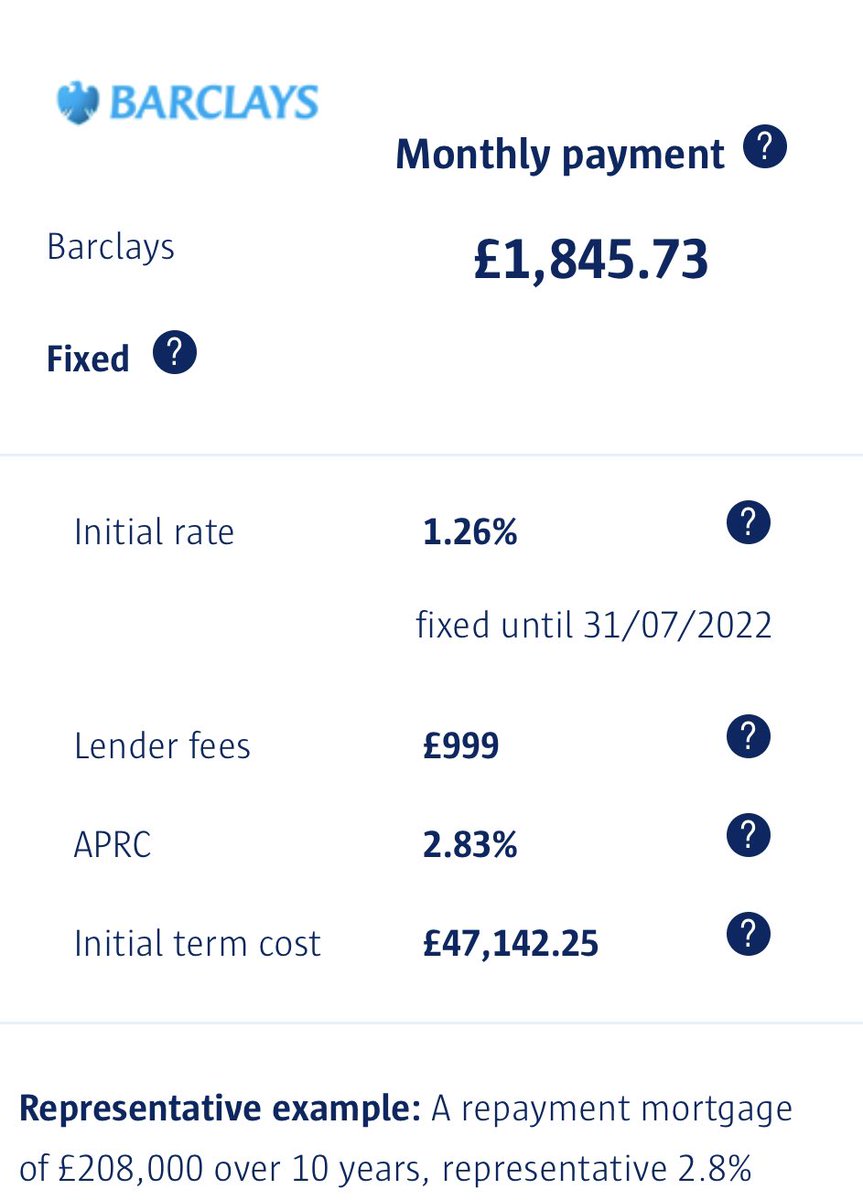

Emmanuel decided he wants to pay his mortgage off in 10 years and will remortgage to whatever deal will allow him to do so

10 years now remaining

2years pass

House Value - 416k

Mortgage Outstanding - 208k

50% LTV

Emmanuel decided he wants to pay his mortgage off in 10 years and will remortgage to whatever deal will allow him to do so

10 years now remaining

SCENARIO 6 - Borrowing more and increasing term simultaneously

2 years pass

House value - 416k

Mortgage outstanding - 168k

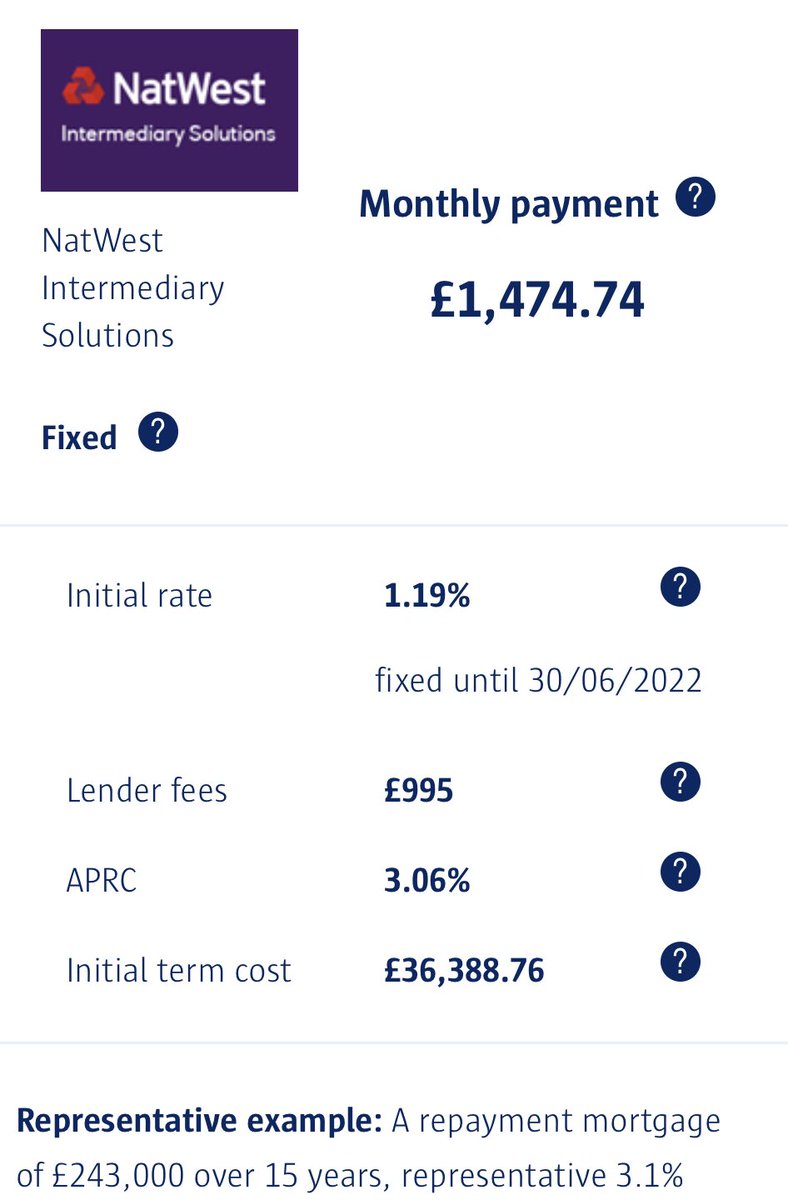

Emmanuel decides to invest in a BTL property and needs 75k. He will borrow more with a new lender but select a longer term of 15yrs to keep payments down

2 years pass

House value - 416k

Mortgage outstanding - 168k

Emmanuel decides to invest in a BTL property and needs 75k. He will borrow more with a new lender but select a longer term of 15yrs to keep payments down

LOAN TO VALUES EXPLAINED https://twitter.com/brickzwithtipz/status/1219584682335010816?s=21">https://twitter.com/brickzwit... https://twitter.com/BrickzwithTipz/status/1219584682335010816">https://twitter.com/Brickzwit...

It’s also important to note that each remortgages arent always a given

Its another mortgage application that will be assessed in a similar way as a first time buyers considering equity rather than deposit but still assessing credit scores and affordability

Its another mortgage application that will be assessed in a similar way as a first time buyers considering equity rather than deposit but still assessing credit scores and affordability

Check out my YouTube channel for similar content!

Make sure you subscribe and turn on notifications, new content out this week! http://www.youtube.com/c/brickzwithtipz">https://www.youtube.com/c/brickzw...

Make sure you subscribe and turn on notifications, new content out this week! http://www.youtube.com/c/brickzwithtipz">https://www.youtube.com/c/brickzw...

Read on Twitter

Read on Twitter