DCEP thread in advance of our 10 AM EST Twitter AMA

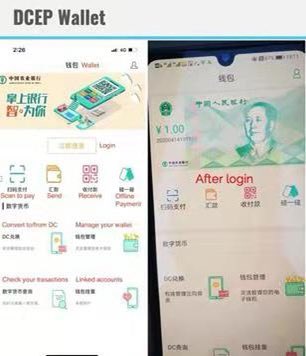

1) A DCEP wallet application from a test that included the Agricultural Bank of China was inadvertently published. It’s important as it’s the first time we’ve seen pictures of the working DCEP wallet application, which is rumored to have a targeted late 2020 release date.

2) The pictures show that progress on DCEP is being made and clarified some key details about the development process, players, geographies, and functionality of the system. Let’s go through what we learned…

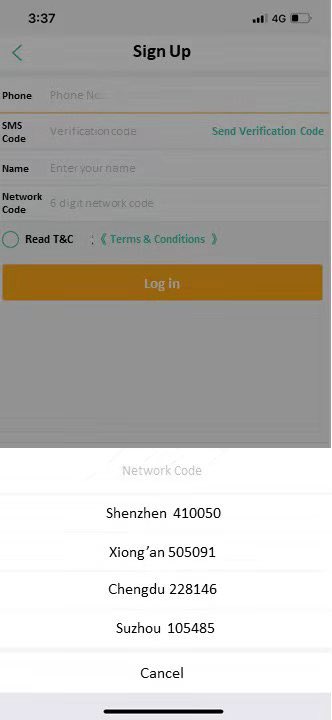

3) Geographies: The login interface shows four cities which represent test geographies: Shenzhen 深圳, Xiong’an 雄安, Chengdu 成都, and Suzhou 苏州. Pic is a translation.

4a) Why these cities? These cities are in separate areas of China, are considered to be tier 1 or 2 (larger cities) and are home to tech talent. Xiong’an is interesting as it’s the newly established development hub for the Beijing – Tianjin – Hebei economic triangle.

4b) Testing in geographically diverse areas will ensure that feedback from all types of potential users is incorporated.

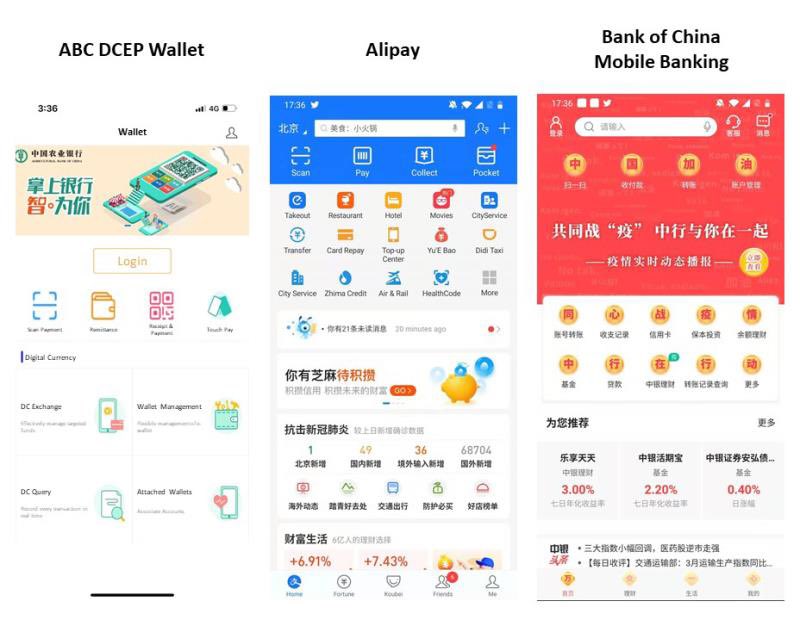

5) Functionality: The interface looks to have many of the same functions as Alipay or TenPay (Tencent’s WeChat Pay) with a few caveats.

6) “Scan” and “receive” buttons allow for easy payment. The “transfer” functionality can be used when users are not in proximity. However, the “touch/offline payment” function is worth discussing. This function allows users to complete a transaction via NFC even when offline.

7) “Convert to DC” will likely allow customers to convert bank currency into the digital yuan version for use within the DCEP ecosystem. Finally, “Wallet Management” points to the possibility of linking numerous accounts together.

8a) Key Players: Let’s start with the Agricultural Bank of China (ABC) - 中国农业银行 which is where the pictures originated. ABC is one of China’s “Big 4” banks with over 300 million customers.

8b) We previously knew that DCEP would be a two-tier system: tier 1 connecting People’s Bank of China (PBOC) to commercial banks and other financial intermediaries, tier 2 then connecting commercial to retail customers.

9) Behind the scenes RMB is sent to the PBOC’s “DC issuing treasury” which then issues the currency to ABC’s “commercial bank DC treasury” account at the PBOC. The commercial bank, in this case ABC, then debits the customers DCEP account, ensuring a 1:1 backing with fiat RMB.

10) This eliminates chance of over-issuance of M0 as DCEP is not so much “issued” as it is “converted”. This also makes the “issuance” of DCEP a bottom-up approach, starting from the user’s own bank wallet, as opposed to top-down from PBOC.

11) In general, the overall idea of CBDC in China is "centralized CB, distributed operation". Streamlines intermediate links, and improves the efficiency of financial currency payment circulation and settlement.

12) For many transactions the PBOC’s ledger *may* not need to be updated. Transfers between users of same bank possibly only will need to be recorded in the commercial bank’s DCEP ledger as that bank’s DCEP assets with PBOC in aggregate remain the same.

13a) Other participants facilitating connection to retail customers include the remaining “Big 4” banks as well as Alibaba (known for “Alipay”) and Tencent (known for “WeChat Pay”).

13b) Together these institutions provided almost complete coverage of the “retail” customer market (and likely cover it several times over).

14) All in all, these screenshots shows China’s focus on the fundamental building blocks of wallet exchange infrastructure. They are following best practices with test groups and look to be making firm progress.

Stay tuned for our DCEP-themed Twitter AMA at 10 am EST (just about twenty minutes from now)

Read on Twitter

Read on Twitter