The SBA has released some summary statistics on the PPP loan program through April 13. A brief thread on what we know so far. /1 https://content.sba.gov/sites/default/files/2020-04/PPP%20Report%20SBA%204.14.20%20%20-%20%20Read-Only.pdf">https://content.sba.gov/sites/def...

SBA reports that there have been about 1 million small business loans "approved", amounting to $247 billion. ("Approved" here likely means that the lender--PPP is administered by private lenders--has authorized the loan, not necessarily that the proceeds are in the bank yet) /2

That means that the $350 billion appropriation for the PPP has already been 70% subscribed, in just a week and a half of operation. /3

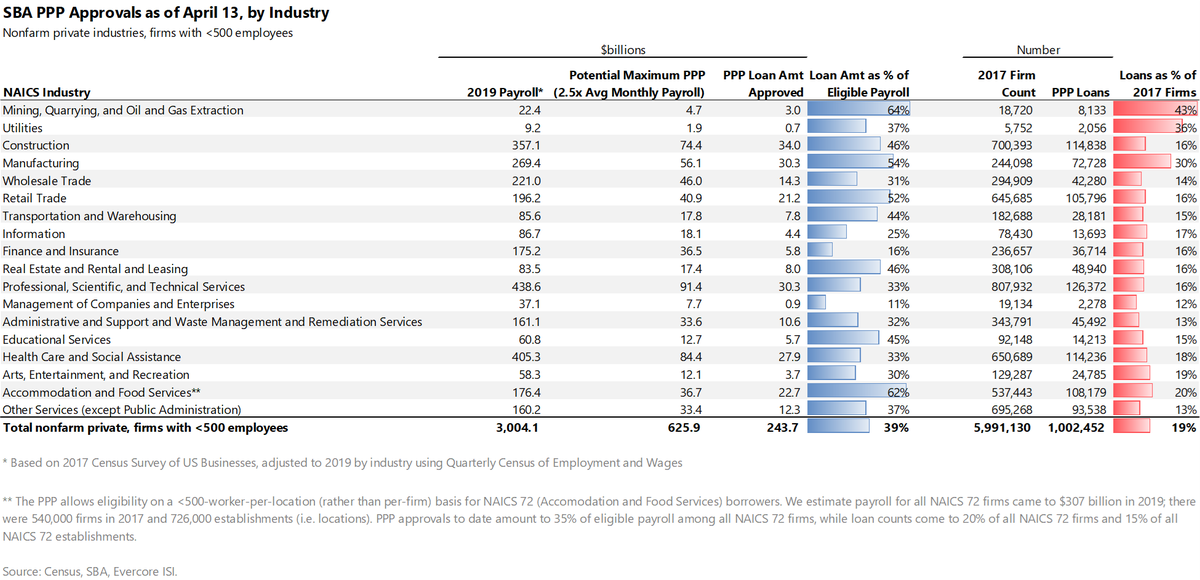

I& #39;ve used Census data and SBA& #39;s industry-level stats to try to gauge where the loan demand has been most robust so far. Judged against potential maximum loan size, oil/gas/mining and accommodation/food service appear to be showing the strongest demand. /4

Many caveats here. The latest Census payroll data for small businesses is from 2017, so I had to make some assumptions for 2019. Also, the CARES Act made PPP eligibility broader for accommodation/food service firms, so their actual potential loan capacity may be larger. /5

One could also judge loan demand using number of loans approved versus number of firms, as I illustrate on the right of that chart, but that& #39;s less reliable as I have to rely on just the original 2017 firm count data. Someone else may have fresher data on small firms by NAICS. /6

Where the SBA data get even more curious is by state. /7

Here are state approvals as a percent of eligible payroll. Given the industry data above, some of these results make sense. The Dakotas--heavy oil/mining states--are well subscribed, for example. But... /8

...others are more interesting. Some states where the virus has hit hard (NY, NJ) are low, as are some states that took early lockdown actions (CA, WA). Nevada is also curiously low given how heavily its economy relies on tourism and accommodation. /9

What could be going on is that the PPP has proven more difficult for lenders to get off the ground in the hardest-hit areas so far.

It could also be that businesses in these states, by virtue of enduring longer pain, are not finding the PPP as decisive in staying open. /10

It could also be that businesses in these states, by virtue of enduring longer pain, are not finding the PPP as decisive in staying open. /10

Or it could be that states with closer community banking relationships saw an advantage in uptake in these early stages of the program when the contours and details of the program were more uncertain. /11

So to sum up:

- the SBA PPP was already 70% subscribed after 9 days.

- It will likely need more money to meet demand for this round of 8 week forgiveness, to say nothing if a whole other round will be necessary.

- Oil/mining & accommodation/food showing strongest demand so far

- the SBA PPP was already 70% subscribed after 9 days.

- It will likely need more money to meet demand for this round of 8 week forgiveness, to say nothing if a whole other round will be necessary.

- Oil/mining & accommodation/food showing strongest demand so far

Read on Twitter

Read on Twitter