Debt As A Leverage: The Tale Of Two Balance Sheets

Earlier I made this comment ( https://twitter.com/DavidAlade__/status/1249767110529691650?s=19)">https://twitter.com/DavidAlad... on a tweet and since then I& #39;ve gotten a spur enough to compel me to share what I meant.

I have designed 2 wealth tables and I will explain my point via its lenses.

Earlier I made this comment ( https://twitter.com/DavidAlade__/status/1249767110529691650?s=19)">https://twitter.com/DavidAlad... on a tweet and since then I& #39;ve gotten a spur enough to compel me to share what I meant.

I have designed 2 wealth tables and I will explain my point via its lenses.

Wealth is created by returns on investment, investment can be in anything, including education, business, skill and so on.

A multiplier effect can be used on this investment to get outsized returns. This multiplier is called leverage.

A multiplier effect can be used on this investment to get outsized returns. This multiplier is called leverage.

Leverage in education can be sitting under an acclaimed professor that others don& #39;t have opportunity to.

In skill acquisition, it could be the brand name under which such skill is gotten.

And in business, it can be borrowing.

In skill acquisition, it could be the brand name under which such skill is gotten.

And in business, it can be borrowing.

My focus here will be business and borrowing as a leverage.

Let& #39;s take a look at what your wealth creation process will look like as an individual who chooses not to allow borrowing in their life.

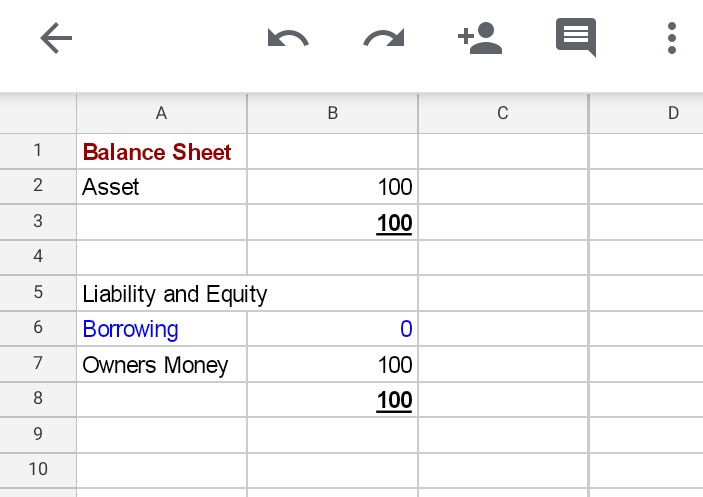

In the image is a balance sheet that shows your net worth.

Your equity (owners money) is 100$ and all you could do is purchase asset of 100$.

In the image is a balance sheet that shows your net worth.

Your equity (owners money) is 100$ and all you could do is purchase asset of 100$.

Let& #39;s assume you make a 20% return on your asset in the period under review.

That implies your worth will increase to 120$. Amazing that is, don& #39;t you think? You are getting better but by what magnitude (multiplier)?

That implies your worth will increase to 120$. Amazing that is, don& #39;t you think? You are getting better but by what magnitude (multiplier)?

You can only grow as much as the capital under which you operate, capital is the constraints, the limiting factor.

But what if you could increase that capital? Absolutely, do. But the reality of life has it that you can only have as much to yourself.

But what if you could increase that capital? Absolutely, do. But the reality of life has it that you can only have as much to yourself.

So even if you are to increase capital, it may not be increasing your equity. But we know if your capital increases, you can double up on your multiplier and grow wealth faster.

That brings us to the next point and the next type of balance sheet.

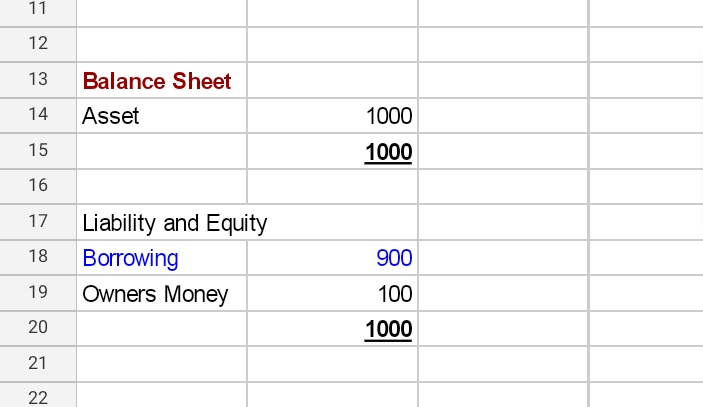

This is the balance sheet (image) of someone who employs leverage to build wealth. To start with, from the first line item (asset) you could spot a vast difference:

A wealth table more robust @ 1,000$

This is the balance sheet (image) of someone who employs leverage to build wealth. To start with, from the first line item (asset) you could spot a vast difference:

A wealth table more robust @ 1,000$

How did this 1,000$ come about?

When you look that the liability and equity part of the wealth table, you will realize that the individual who owns this table is not particularly richer than the former individual.

They both have 100$ in owners money. Same level of wealth.

When you look that the liability and equity part of the wealth table, you will realize that the individual who owns this table is not particularly richer than the former individual.

They both have 100$ in owners money. Same level of wealth.

But just as the other went into business this person also went into business and made 20% return.

A vast difference will soon be noticed here just because this individual has another source of financing on the wealth table called "borrowing".

A vast difference will soon be noticed here just because this individual has another source of financing on the wealth table called "borrowing".

What borrowing additional 900$ has done for this individual is to increase his capital. And remember we agreed earlier that wealth growing is a factor of how much capital you have as a base to operate with.

With a 20% return similar to that of earlier individual, this person makes 200$.

Yes, 200$.

And assuming the borrowing in free, this individual& #39;s new wealth will skyrocket to $300.

Oh my gosh let me run and take on more borrowing you said? Please wait for the full gist.

Yes, 200$.

And assuming the borrowing in free, this individual& #39;s new wealth will skyrocket to $300.

Oh my gosh let me run and take on more borrowing you said? Please wait for the full gist.

Just by employing leverage, this individual& #39;s wealth as increased in order of magnitude 10x more than one without borrowing.

New wealth level:

Person A = 120$ from 100$

Person B = 300$ from 100$

Remember the borrowing is still there and can be returned anytime.

New wealth level:

Person A = 120$ from 100$

Person B = 300$ from 100$

Remember the borrowing is still there and can be returned anytime.

Well my friend, that& #39;s how wealth is built on other people& #39;s money and how wealth is multiplied by leverage.

What you must note:

I& #39;ve made some assumptions in order to make this simple. In reality those assumptions don& #39;t hold. I will let you in on a couple of the assumptions.

What you must note:

I& #39;ve made some assumptions in order to make this simple. In reality those assumptions don& #39;t hold. I will let you in on a couple of the assumptions.

1.

Free Borrowing.

In reality, this is usually not the case. And because it is usually not the case, it opens up a risk issue and the need for optimization.

Just as a 20% return on capital can increase your wealth by 300%, a loss of 10% is all you need to wipe out...

Free Borrowing.

In reality, this is usually not the case. And because it is usually not the case, it opens up a risk issue and the need for optimization.

Just as a 20% return on capital can increase your wealth by 300%, a loss of 10% is all you need to wipe out...

your wealth. Yes, 10%.

If you did business with the 1,000$ asset and lost 10%, the implication is that your wealth reduced by 100$ and that is just equal to your total wealth.

It can& #39;t be a reduction in borrowing because you have an obligation to return all money borrowed.

If you did business with the 1,000$ asset and lost 10%, the implication is that your wealth reduced by 100$ and that is just equal to your total wealth.

It can& #39;t be a reduction in borrowing because you have an obligation to return all money borrowed.

It is this risk that you need to balance and take care of while borrowing money.

So that you don& #39;t lose everything overnight. Now you have a caution.

So that you don& #39;t lose everything overnight. Now you have a caution.

2.

Unlimited borrowing opportunity.

Truth is, with a wealth of 100$, hardly will you get any institution to borrow you anything above your wealth of 100$.

That means at best you would have a 50:50 split between your fund and borrowed fund. No unlimited money anywhere.

Unlimited borrowing opportunity.

Truth is, with a wealth of 100$, hardly will you get any institution to borrow you anything above your wealth of 100$.

That means at best you would have a 50:50 split between your fund and borrowed fund. No unlimited money anywhere.

These troubles of how much to borrow and at what interest rate is optimal has led to a lot philosophies & science & theories & more that troubles the finance professionals.

While I& #39;ve tried to simplify the concept, it can be much more difficult depending on context.

Cheers. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥂" title="Clinking glasses" aria-label="Emoji: Clinking glasses">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥂" title="Clinking glasses" aria-label="Emoji: Clinking glasses">

While I& #39;ve tried to simplify the concept, it can be much more difficult depending on context.

Cheers.

Read on Twitter

Read on Twitter