Investors just chased stocks into a 131.1% market cap to GDP valuation during the largest economic crisis of our lifetimes.

And that GDP denominator will be shrinking. So the real valuation is much higher.

Markets remain historically vastly overvalued.

And that GDP denominator will be shrinking. So the real valuation is much higher.

Markets remain historically vastly overvalued.

Here& #39;s a different visual historic perspective. As of yesterday& #39;s close total market cap is roughly at $28.5 trillion.

GDP in green below.

I maintain: Constant monetary intervention continues to create a vast asset price disconnect versus the underlying size of the economy.

GDP in green below.

I maintain: Constant monetary intervention continues to create a vast asset price disconnect versus the underlying size of the economy.

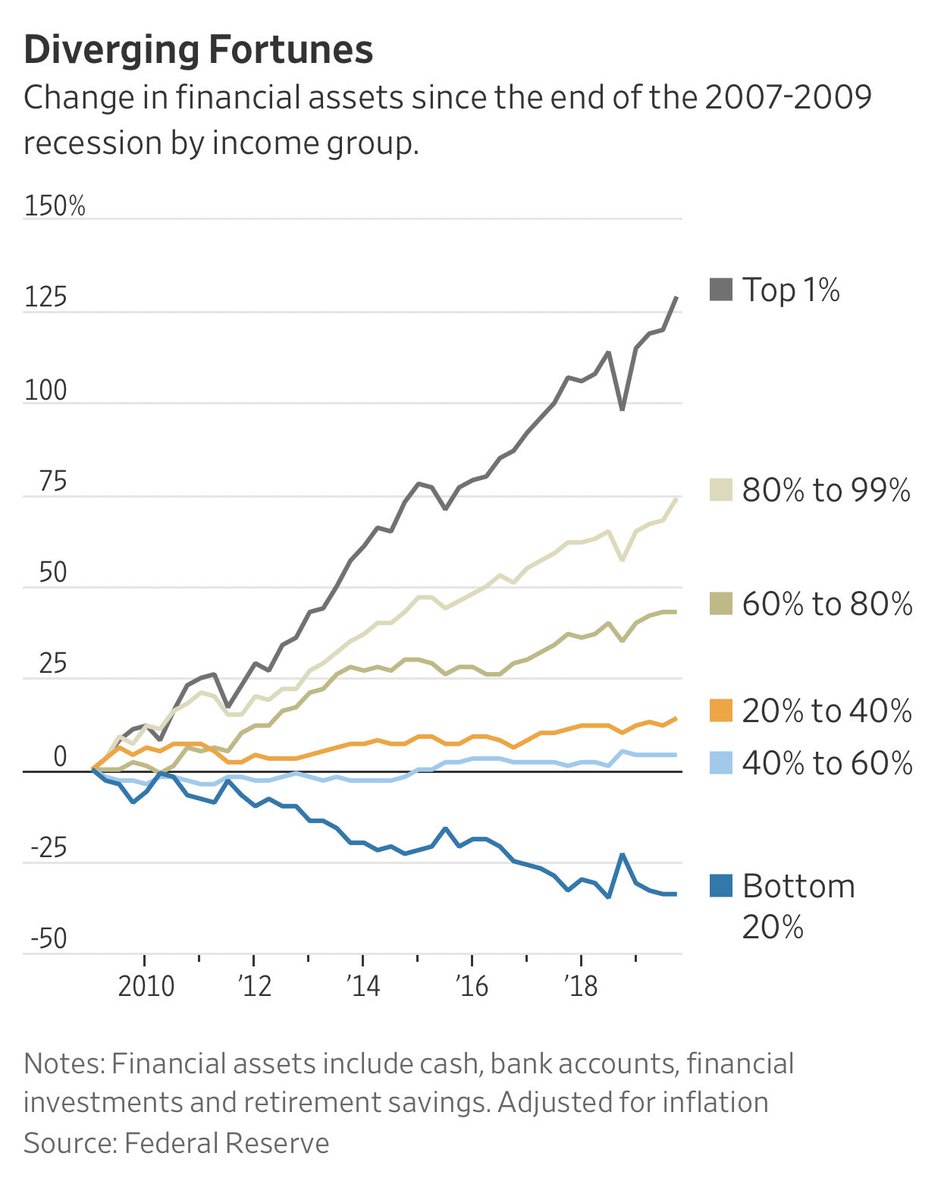

..and as a result you get vast wealth inequality as asset price inflation benefits the few and the many take a bath when the bubble pops.

It& #39;s not rocket science folks.

https://www.wsj.com/articles/lack-ofsavingsworsens-the-pain-of-coronavirus-downturn-11586943001">https://www.wsj.com/articles/...

It& #39;s not rocket science folks.

https://www.wsj.com/articles/lack-ofsavingsworsens-the-pain-of-coronavirus-downturn-11586943001">https://www.wsj.com/articles/...

Read on Twitter

Read on Twitter