Yesterday I posted a thread about the lack of conditions attached to $1.5 trillion in new Federal Reserve private sector lending facilities. Now let’s talk about how (or whether) the public will see any details about what these facilities do. (1/9) https://twitter.com/MarcusMStanley/status/1249819595852206081">https://twitter.com/MarcusMSt...

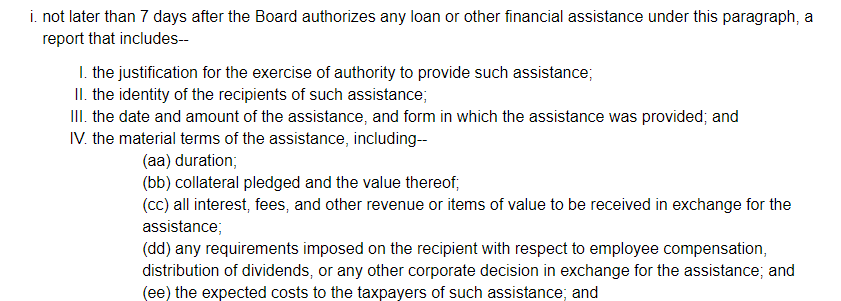

The disclosure requirements attached to these facilities are contained in Section 13(3)(C) and (D) of the Federal Reserve Act

Under a common interpretation, the 7 day disclosure described in C(i) is a one-time general disclosure made when the facility is first authorized

For an example of such a disclosure, see this document on the $500 billion Primary Corporate Credit Facility. It is just three pages long and doesn’t contain the identity of any specific borrower or the terms of any specific loan. https://www.federalreserve.gov/publications/files/primary-market-corporate-credit-facility-3-29-20.pdf">https://www.federalreserve.gov/publicati...

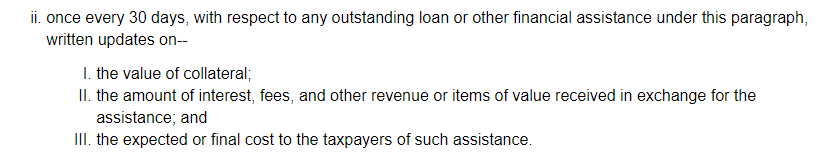

Section 3(C)(ii) requires monthly updates, but just on the total amount of lending done and interest collected -- once again, no details of specific loans or borrowers

So none of this requires the Fed to tell anyone exactly who they are lending to or on what terms. If that’s not enough, 13(3)(D) also permits them to keep any specific recipient anonymous even if disclosed to Congress.

But what you are required to do does not limit what you can do. The Fed could choose to reveal this information. Personally, I think it would be outrageous if it doesn’t.

Especially since there are very few strings on this money, the public needs to know exactly who gets this money, the stated use of proceeds, and the terms of the loan. Agree? Tell your Senator or Representative.

But expect at least some in industry to fight that. The more the public knows, the less borrowers can get away with

Read on Twitter

Read on Twitter