This image has caused severe outrage. How is it possible for stocks to soar and have their best week since 1938 while common people suffer and fundamentals worsen?

The answer is simple.

The outrage stems from misunderstanding the link between the economy and financial markets.

The answer is simple.

The outrage stems from misunderstanding the link between the economy and financial markets.

Unemployment numbers describe a single point in time, while financial markets are discounting mechanisms that attempt to price in *present and future events*.

Unemployment numbers are data, while prices are driven by emotions, perceptions and other variables.

Unemployment numbers are data, while prices are driven by emotions, perceptions and other variables.

Prices often overshoot. Both ways. Drop beyond fundamentals on the way down, and increase beyond fundamentals on the way up.

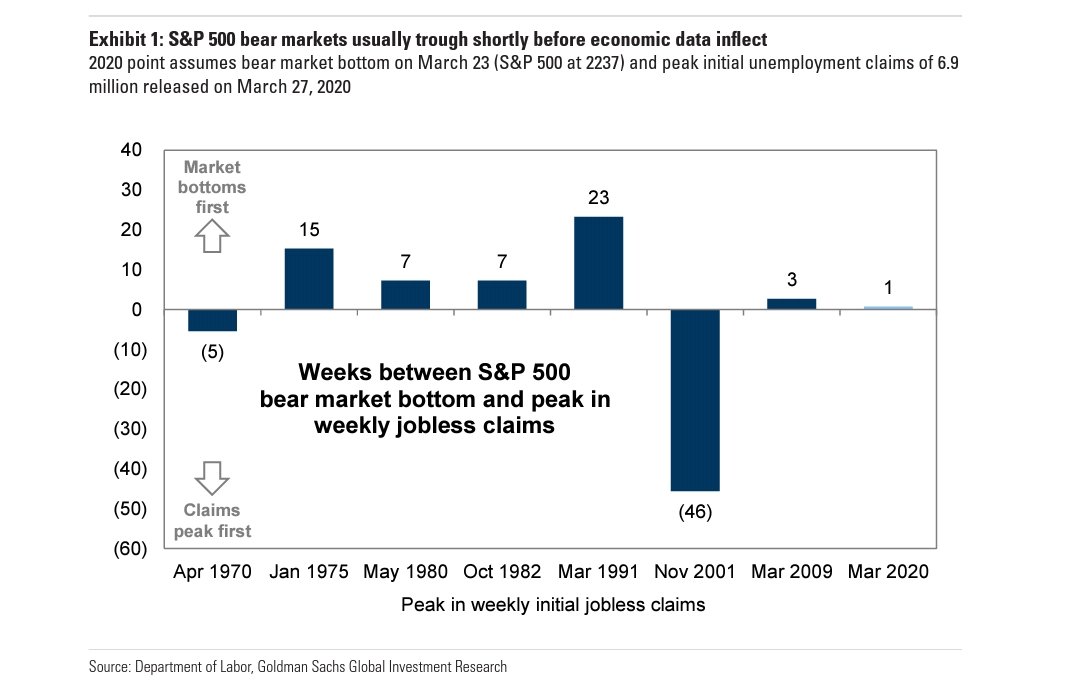

Historically, markets bottom before the economy bottoms. The economy could have bottomed last week. US weekly jobless claims likely already peaked.

Historically, markets bottom before the economy bottoms. The economy could have bottomed last week. US weekly jobless claims likely already peaked.

The same applies to earnings.

Earnings are about last quarter& #39;s performance, while stock prices are about last quarter& #39;s performance and more importantly all future performance.

Stock price = most recent earnings (vs expectations) + present value of all future earnings.

Earnings are about last quarter& #39;s performance, while stock prices are about last quarter& #39;s performance and more importantly all future performance.

Stock price = most recent earnings (vs expectations) + present value of all future earnings.

If most people expect a deep yet short recession followed by a strong recovery, it should not be surprising for stocks to perform well while the economy is still in the doldrums.

That said, the stocks bounce is just as extraordinary as the preceding crash.

That said, the stocks bounce is just as extraordinary as the preceding crash.

Read on Twitter

Read on Twitter