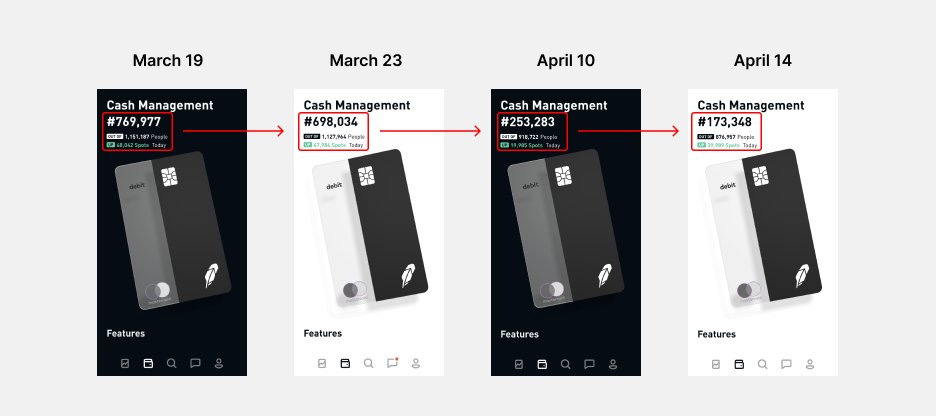

Noticing something interesting going on in @Robinhood over the last month. On the landing screen for the Cash Management high-interest debit card product, for which I’m on the huge waitlist, I’ve been moving up in the line by *big chunks every day* – as high as 50k spots/day. 1/7

As of a few months ago, it was maybe + or - 5 to 10 spots per day... 2/7

One explanation is they’re letting people off the waitlist in big cohorts. However, this doesn’t explain why my relative position in the list is changing so much: I went from the 33rd percentile of the line to the 20th percentile even as the total list only shrank by 24%. 3/7

I haven’t referred anyone to the product, I haven’t put more money in my account or bought more shares...my hunch is that Robinhood prioritizes user accounts that have assets, whether in stocks, crypto, or cash. 4/7

*So I believe this indicates is a slice of real-time churn, as users liquidate their accounts due to the COVID crisis and Robinhood de-prioritizes them in line, as they have no cash to put into a “cash management” product.* 5/7

It’s hard to say the exact daily churn/users going "inactive" (as you have a sort of reverse leaky bucket situation), and if true, this is just those users that have signed up for the cash management product. 6/7

Robinhood supposedly had 10MM users as of December, so 250K of churn over a month isn& #39;t huge - but is not insignificant - and it& #39;s pretty crazy to see retail traders cash out in real time. 7/7 https://www.cnbc.com/2019/12/04/start-up-robinhood-tops-10-million-accounts-even-as-industry-follows-in-free-trading-footsteps.html">https://www.cnbc.com/2019/12/0...

Read on Twitter

Read on Twitter