Global Banks on Trial is out! The book looks at the U.S. enforcement campaign against global banks beginning in 2008, with chapters on market manipulation, tax evasion, sanctions violations, and sovereign debt.

https://www.amazon.com/Global-Banks-Trial-Prosecutions-International/dp/0190675772/ref=tmm_hrd_swatch_0?_encoding=UTF8&qid=1586877047&sr=8-1">https://www.amazon.com/Global-Ba...

https://www.amazon.com/Global-Banks-Trial-Prosecutions-International/dp/0190675772/ref=tmm_hrd_swatch_0?_encoding=UTF8&qid=1586877047&sr=8-1">https://www.amazon.com/Global-Ba...

Examples? In 2009, giant Swiss bank UBS paid $780 million to DOJ and SEC for helping tens of thousands of Americans avoid U.S. income taxes. In 2014, Credit Suisse pleaded guilty to conspiracy charges and paid $2.6 billion in fines and penalties.

https://money.cnn.com/2009/02/18/news/companies/ubs/">https://money.cnn.com/2009/02/1...

https://money.cnn.com/2009/02/18/news/companies/ubs/">https://money.cnn.com/2009/02/1...

The UBS case was based in part on the revelations of controversial former UBS banker and whistleblower Bradley Birkenfeld, who eventually went to federal prison but also got a $100+ million IRS whistleblower award. https://www.swissinfo.ch/eng/speaking-out_whistleblower-birkenfeld---i-helped-switzerland-/41410718">https://www.swissinfo.ch/eng/speak...

In June 2012, British bank Barclays paid $360 million for manipulating LIBOR, an interest rate benchmark used in financial contracts around the world worth trillions of $.

Barclays’s fine was fairly small, but it set off a huge scandal that rocked it, the Bank of England, and the U.K. Financial Services Authority. The bank’s CEO, CFO and Chairman all quit in short order. https://www.bloomberg.com/news/articles/2012-07-03/barclays-ceo-quits-after-record-libor-rigging-fine">https://www.bloomberg.com/news/arti...

The same year, HSBC famously settled charges for money laundering and sanctions evasion for $1.9 billion. In 2014, BNP Paribas, France’s largest bank, paid nearly $9 billion for helping Sudan, Iran and Cuba evade U.S. sanctions. https://www.justice.gov/opa/pr/bnp-paribas-agrees-plead-guilty-and-pay-89-billion-illegally-processing-financial">https://www.justice.gov/opa/pr/bn...

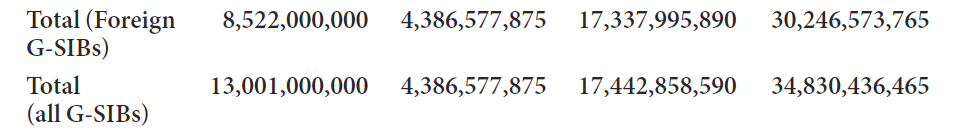

The book looks at these and many similar cases. Between 2008 and 2016, banks on the FSB’s list of globally systemically significant banks paid more than $34 billion to the U.S. government in just three areas—benchmark manipulation, tax evasion, sanctions violations.

What are the lessons here? There has been lots of criticism of U.S. corporate criminal prosecutions post-crisis, mostly because few individuals were held responsible. See, e.g., Judge Rakoff& #39;s famous essay in the New York Review of Books. https://www.nybooks.com/articles/2014/01/09/financial-crisis-why-no-executive-prosecutions/">https://www.nybooks.com/articles/...

In Global Banks on Trial, I take a different tack: the significance of global bank prosecutions lies in: (1) how they have shaken up the old model of international banking governance, centered around specialized regulatory agencies;

(2) How the United States has used its structural power over international finance to impose its law on global banks, and (3) how unilateral U.S. enforcement has led to widely beneficial reforms in crucial areas where international cooperation had stalled

(1) In case after case, prosecutors tackled misconduct in global banks that had not been handled effectively by regulators, in a big departure from the traditional model in which prosecutors usually stepped in on a referral by regulators

The book examines the differences in capabilities and motivations between bank regulatory agencies and prosecutors, and argues that a shift in enforcement authority from the former to the latter has taken place, with big implications

(2) Why were U.S. authorities able to extract tens of billions of dollars in fines from these foreign banks, many of which are central to their home state’s economies? Couldn’t these banks threaten to leave the U.S. market? Couldn’t their home states threaten retaliation?

The answer, I argue, is that the United States controls access to vital elements of the international financial infrastructure—especially payment systems—that global banks need access to in order to conduct their worldwide business.

This “chokepoint effect” and the power it generates is discussed in Abe Newman and Henry Farrell’s excellent article, Weaponized Interdependence. https://www.mitpressjournals.org/doi/full/10.1162/isec_a_00351">https://www.mitpressjournals.org/doi/full/...

(3) Is this, then, just a case of the United States flexing its muscles and imposing its policies on others, against their will and for its own benefit? Is it, in Anthony Barkow and Anne Cortina Perry’s words, “American Prosecutorial Imperialism”?

https://jenner.com/system/assets/publications/13593/original/barkow_perry_ABA_litigation_fall_2014.pdf?1414588333">https://jenner.com/system/as...

https://jenner.com/system/assets/publications/13593/original/barkow_perry_ABA_litigation_fall_2014.pdf?1414588333">https://jenner.com/system/as...

Well, yes and no. In some areas, like financial sanctions, the United States has used its power to impose compliance with its policies on banks and entire countries that disagreed—witness the impact of the Iran sanctions on European banks and businesses.

But in other areas, U.S. actions have led to widely beneficial reforms that had seemed impossible only a decade ago.

The U.S. case against UBS begat a Swiss-U.S. agreement to disclose thousands of customer names, the limitations of which begat the U.S. Foreign Accounts Tax Compliance Act,

which begat the OECD’s Common Reporting Standard under which dozens of countries, including notorious tax havens, automatically share information to fight offshore tax evasion. http://www.oecd.org/tax/automatic-exchange/">https://www.oecd.org/tax/autom...

The LIBOR and foreign exchange manipulation cases led to major reforms of these benchmarks, many of which were known to be flawed and vulnerable to manipulation. https://www.bloomberg.com/news/articles/2017-07-27/libor-to-end-in-2021-as-fca-says-bank-benchmark-is-untenable-j5m5fepe">https://www.bloomberg.com/news/arti...

Can this go too far? Will U.S. unilateralism push other countries to develop alternatives to U.S.-dominated financial infrastructure? Many have argued as much, looking at foreign responses to U.S. sanctions. https://www.foreignaffairs.com/articles/world/2018-10-15/use-and-misuse-economic-statecraft">https://www.foreignaffairs.com/articles/...

But there is another side to the story: where the U.S. uses its power to advance broadly beneficial reforms, such as tax information exchange and more robust benchmarks, it makes the current system more rather than less attractive for others.

OK, enough for now. The book covers these and many other questions, and I’ve tried hard to keep it concise and make it a reasonably enjoyable read -- for a book about banking. Order your copy now! Hardcopies may be shipping slowly these days but it& #39;s also an e-book.

Also, for the researchers here, I created a companion website with a database of enforcement actions against global banks by U.S. and foreign governments.

http://legaldatalab.law.virginia.edu/global-bank-prosecutions/index.php">https://legaldatalab.law.virginia.edu/global-ba...

http://legaldatalab.law.virginia.edu/global-bank-prosecutions/index.php">https://legaldatalab.law.virginia.edu/global-ba...

Hat tip to my awesome research assistants Joseph Betteley, Brendan Hanley, and Will Christ, who worked tirelessly on compiling these cases; and to Jon Ashley and Sarah New of the UVA Law Library who turned it into this great website.

Read on Twitter

Read on Twitter