@AnuragMinance @AskMinance #Minance #MinanceWarning #MinanceScam

Minance was a scam in the making, being run by unethical bunch of wannabes, noobs, and people who falsified credentials, and blatantly lied about every fucking thing. A thread.

Minance was a scam in the making, being run by unethical bunch of wannabes, noobs, and people who falsified credentials, and blatantly lied about every fucking thing. A thread.

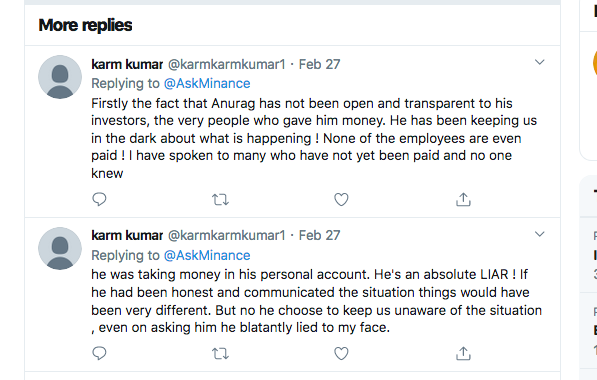

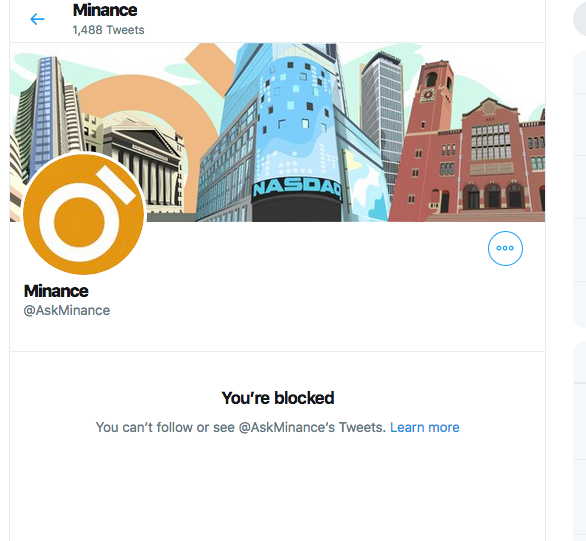

I wrote about my experience with them on Quora - vigorously reported my answers. Wrote on linkedin - blocked. Wrote on twitter - blocked.

Spoke to many former employees - the first red flag that went on for me which prompted me to exit back in feb 2018 was that these guys were APs but taking money from "PARTNERS" (clients) into the company& #39;s account (which is illegal) for some "HFT" "PROP TRADING".

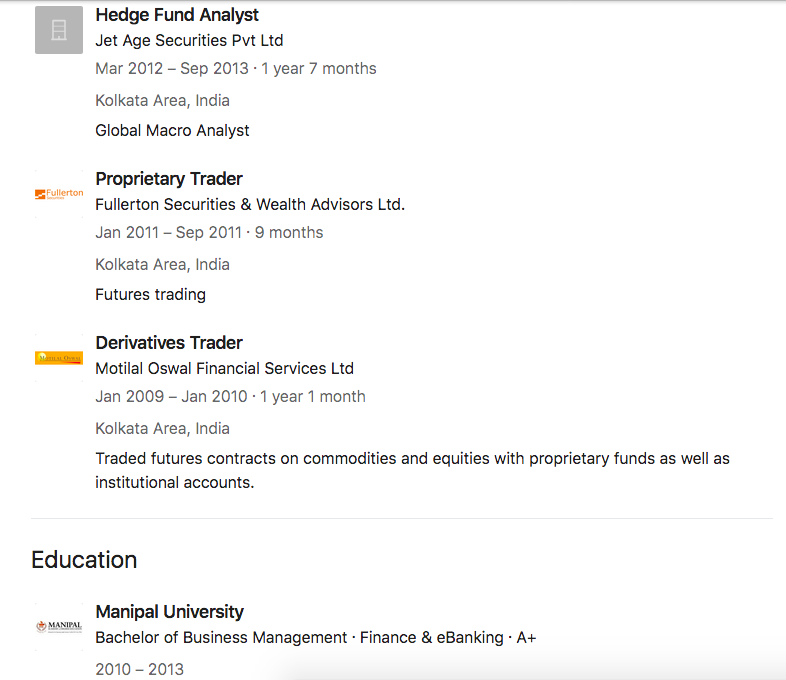

Also, for a guy (Anurag Bhatia) who claimed to have superior knowledge, been a derivatives trader with MO-OS, etc., letting 11000PE short run naked with such huge position size destroying over 30% of capital despite most people asking them to put a SL or close it, was funny.

https://qr.ae/pNrK95

https://qr.ae/pNrK95&qu... href=" https://qr.ae/T3EtMi

These">https://qr.ae/T3EtMi&qu... two answers suffice.

These">https://qr.ae/T3EtMi&qu... two answers suffice.

To sum up, if you& #39;re going to give your hard earned money to someone/anyone, get their track record (atleast 5 years), their IT Returns, their broker statement, etc., and then decide if he/she& #39;s worthy enough of investing with. MF/FD is better than giving these crooks your money.

Minance basically got their licenses cancelled by Angel Broking and IIFL because they didn& #39;t follow compliance for taking trades, and didn& #39;t get consent for placing trades. Because of this rogue trading, once the broker found out, broker cancelled their terminal access.

They were into unlisted shares, but messed up so bad thinking they are too smart. When I was a customer, they were selling HDB Financial and PayTM. HDB Financial they sold me at 870 rupees. When i did some digging, the market cost was only 720-730 rupees.

They had apparently acquired the shares for 620-645 rupees and put a 35% frickin premium on the shares and sold it to naive/innocent clients who thought it was the next best thing after bread loaf. When I and few other customers pointed out this, they took back the stock

and I got PayTM shares instead for the same amount. And, other customers who didn& #39;t raise any question were given extra shares of HDB bringing the average price to 780-ish, which still left the price at 20-25% premium for them, within just a week or two.

They apparently pulled this shady shit with some reliance group unlisted share, where they got the shares and sold it to their clients at around 900 rupees or so, and reliance group had sent a notice asking people to exchange 4 shares of reliance xyz for 1 share of Reliance Ind

Reliance Ind was about 1400 at that time, and 4 for 1 meant the share was worth only 350 rupees. A lot of clients wanted to return the stock and get back their money coz 350 is somewhere and 900 is somewhere else. This was a case of market mispricing it, but still stupid.

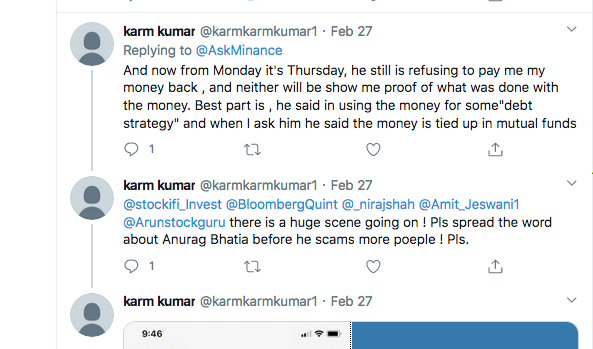

In between, after blowing all the money on costly booze and partying with his close friends, since his sub-broking thing didn& #39;t work out, and there weren& #39;t any cash inflow, employees started leaving #minance @askminance due to non-payment of salaries and dues.

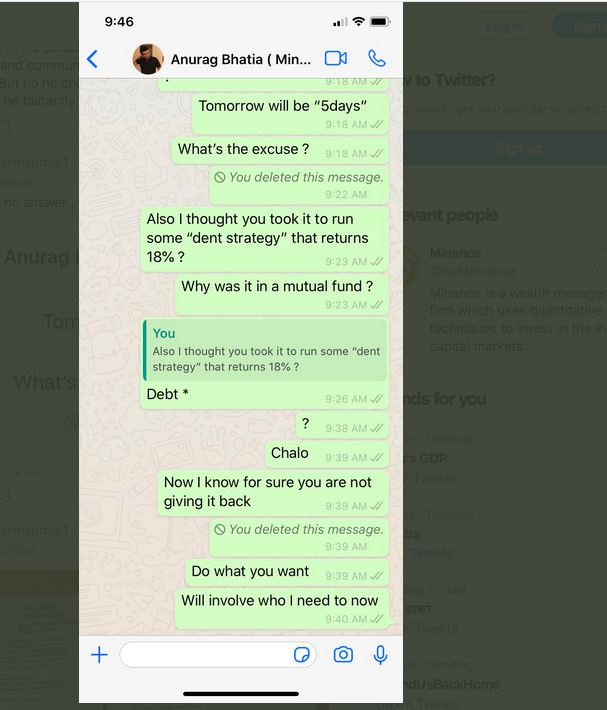

Then he came up with a brilliant idea and naive stupid clients fell for it. He got the clients into debt buying. Not just any debt. He issued DEBENTURES on MINANCE CAPITAL itself. Gave them 95% capital protection, with 20% yield. So clients thought min was 15% max 20% so why not?

http://www.vivro.net/blog/Public-Issues-of-Corporate-Bonds--An-Opportunity-For-Indian-Corporates

Read">https://www.vivro.net/blog/Publ... this for requirements to issue debt. Minimum should be atleast 100 crores. But no, people didn& #39;t do due diligence, gave him money thinking he& #39;d make good - and now that money is also stuck with him.

Read">https://www.vivro.net/blog/Publ... this for requirements to issue debt. Minimum should be atleast 100 crores. But no, people didn& #39;t do due diligence, gave him money thinking he& #39;d make good - and now that money is also stuck with him.

Now since clients have started waking up to the reality that Anurag and his team (more like ex-team) were only good marketers and with his useless BBA from Manipal Uni, and faked up profile of apparent prop/derivative trading experience, is good for nothing. So most clients left.

Now, after he& #39;s messed up unlisted shares route, debt route, he& #39;s gone into global securities route trying something there. Just don& #39;t frickin fall for it, coz by this point, it& #39;s clear he has no credibility whatsoever, and no ethics in running a business. Zilch.

He& #39;s a damn good marketer, snake-oil salesman, and a dream seller. Many people are greedy for better returns, and he and people like him capitulates on that greed. Past investors/clients and some existing ones are behind him for getting their money back without any response.

#Minance office is shut sealed because of non payment of rent. There& #39;s a criminal case against him. SEBI has issued a notice against him after complaints from many Minance clients.

Now nobody is able to get hold of him - even though he& #39;s in his Bangalore home most of the time. Doesn& #39;t pick up calls, and doesn& #39;t do much in the way of fulfilling promises. I didn& #39;t do my due diligence and first sign of red flag i cut and run. But not many investors were lucky

He sold/marketed Minance as "i ma put a hedge fund on your phone". PURE UNADULTERATE DOG SHIT. Those guys only had an AP license, not even a PMS/NBFC or Alternative Fund license, let alone have any automated systems or algo/robo trading as they advertised/promised.

Dumbfucks (including me) believed the dreams he was selling, believed in the technological aspects he said minance had in place (because it& #39;s realistically possible to do so, me being from tech background knew it was possible) without doing a background check, and put money in.

Everything he said was an eye wash. He took money from clients directly into Minance Account (illegal) saying they have a prop trading desk, doing HFT (somewhere in telangana) and caused a fake bidding war. Some clients put in upwards of 50L.

This is where things got sketchy. There was NO PROP DESK, NO HFT. He spewed some bullshit about NSE/BSE arbitrage between equity and currency - having two decimals / four decimals in the end, and kickbacks for providing liquidity. There& #39;s no liquidity rebate by exchange in india.

Clients fell for that silver foil packed catshit and invested. They were promised an assured 3% per month. And they investors were given an excel sheet showing NAV for the month (all faked up). Afterwards when people started asking money, Anurag kept dodging.

Some people did some digging, and found that the amount which went into Minance& #39;s company account, never left the account and was used to fund Anurag& #39;s costly endeavors outside of the company. There was no outflow to a prop account or anything. Coz there was no prop trading.

No HFT and it was all bullshit. He just got an unsecured loan and didn& #39;t even issue promisory notes to the customers. And he was using that money to fulfill capital protection requirements by other clients, and also to fund his partying and boozing.

He& #39;s literally broken every fucking rule in SEBI& #39;s rulebook, and SEBI also issued a complaint notice against him last year. By June 2019, most people started leaving Minance due to nonpayment of dues and also due to his unethical illegal practices.

There are some rumours that there& #39;s a case against him, and that an MLA who& #39;d invested money in minance is protecting him (coz he wants to get his money back first) from the other clients, etc. And he& #39;s all happy go lucky posting on twitter as if nothing happened.

And Minance account is talking about global securities, Greece and all that b.s. I don& #39;t know what kind of dumb moron would still invest with this guy. He has no track record. In fact the only record he has is deceiving naive gullible greedy morons.

If you were a prior #Minance customer, do leave comments about your experience. If you& #39;re with Minance still, let me know what& #39;s happening right now, in comments so that everyone can learn.

This is what his profile says. A guy studying from 2010-13, but also holding full time positions in the same time. We all believed he was some savant genius. But he& #39;s nothing but a pure unadulterated snake-oil salesman. His profile has to be taken with a heavy dose of skepticism.

Sarbashish says he worked with Goldman Sachs for 2 years. No one can verify that information. You can literally post anything on LinkedIn and the world would believe that without any proof. There& #39;s no way to verify unless you contact the company.

Adhiraj, Sarbashish and all others who started this with Anurag have all left after a fallout. Now Anurag is cooking up ways to come up with new schemes to get investors to fund his costly endeavors. He was never a good stock picker coz of which he hired external consultants.

He was never a derivatives trader or expert in derivatives. Arbor performance speaks for it. Plus ex-employees said he& #39;d subscribed to various top tips service providers and took trades based on those tips on client accounts. Do you think an experienced expert trader does that?

I mean, someone who reportedly made a lot of money in an underground trading team, and worked for @MotilalOswalLtd and such companies in derivatives trading/prop trading - wouldn& #39;t know the basics of risk management and putting a frickin stop loss on trades?

Whenever someone pointed this out, he always had a way of snarkily insulting that client saying "this is why i don& #39;t wanna have small clients and short term clients. you have to stick with me for long term in order to make such huge returns" always dodging the questions.

Read on Twitter

Read on Twitter