Due to structural inequality, Black-owned businesses are finding it very difficult to tap into relief for small businesses provided in the #CARESAct. A thread https://www.nytimes.com/2020/04/10/business/minority-business-coronavirus-loans.html">https://www.nytimes.com/2020/04/1...

The #SBAloans provided in the #CARESAct are available via banks that already offer SBA loan products. Due to redlining, lending discrimination, systemic racism, and structural inequality, communities/people of color do not have access to credit. 2/

This means that banks are sparsely located in communities of color as research conducted by @Trulia (with input from NFHA @zillow & @KirwanInstitute) reveals. 3/

It gets worse. Banks are closing branches in Black areas at higher rates than in non-Black areas. Moreover, banks are closing branches in high-income Black areas at higher rates than in low-income non-Black areas. It& #39;s not about economics. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/52872925">https://www.spglobal.com/marketint...

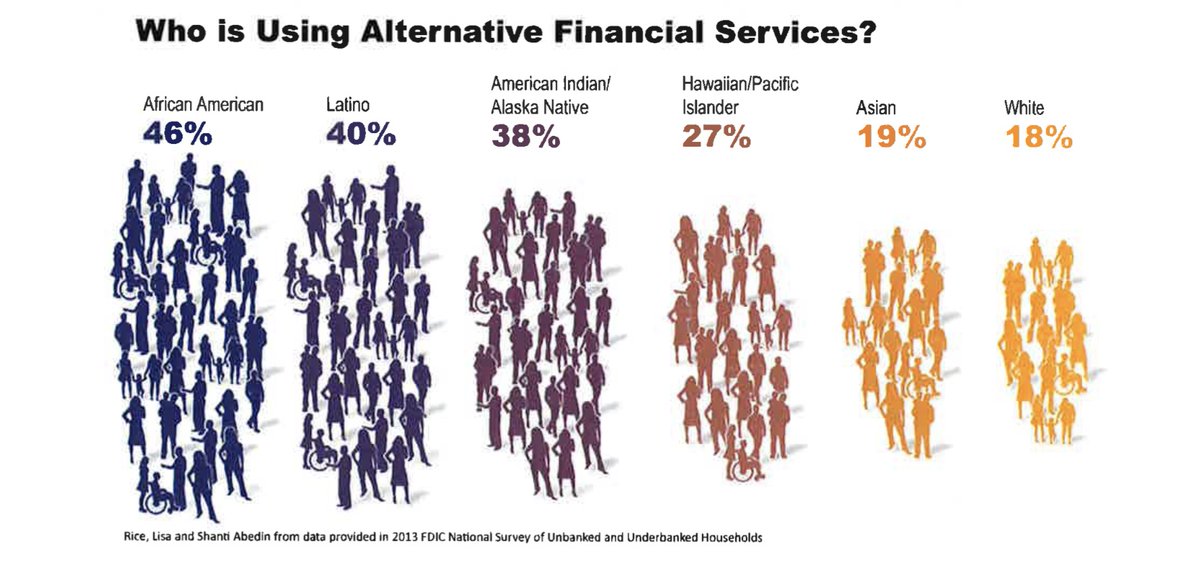

Meanwhile, alternative financial services providers like payday lenders, subprime lenders, check cashers, etc., are concentrated in communities of color. But, of course, these are not depository, regulated entities and they don& #39;t offer SBA products. 5/6

Read on Twitter

Read on Twitter