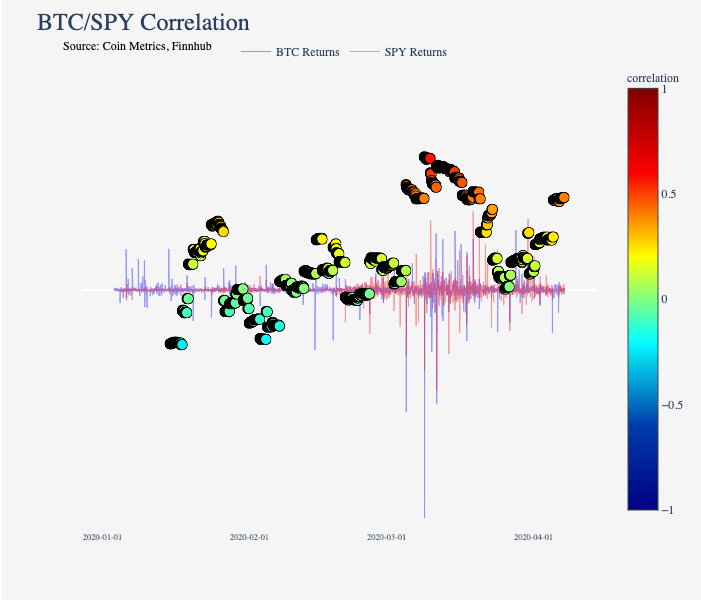

1/ On Black Thursday (March 12th), BTC and S&P 500 correlation shot up to historically high levels after when the crypto markets and equity markets both experienced large, sudden losses. Correlation then decreased back to relatively normal levels by the end of March.

2/ Does this signal that Bitcoin and the S&P 500 are now suddenly correlated?

3/ Probably not. Although short-term correlation shot up, it was under very unique market circumstances. As news about COVID-19 began to grow more and more dire on March 12th, investors across the world suddenly began rushing to cash and selling off assets en masse.

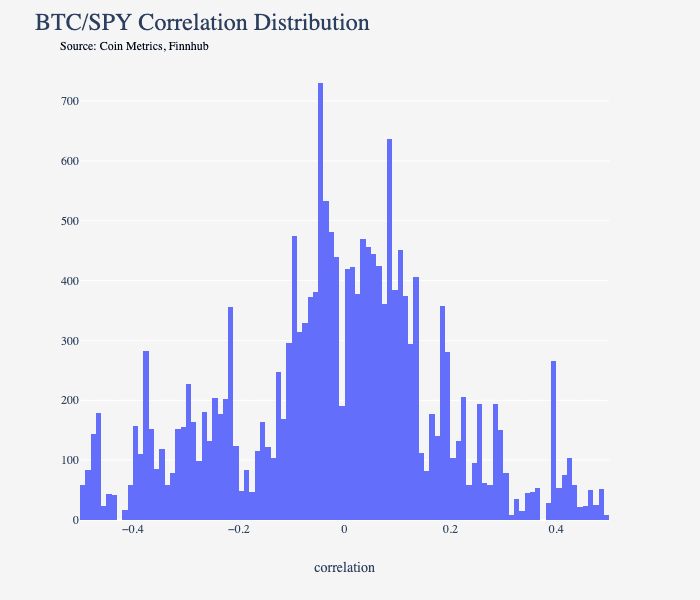

4/ Over the last year, Bitcoin and the S&P 500 have had a correlation close to zero. This chart shows distribution of intraday correlation (5 min returns, 60 hour rolling correlation) over the last 365 days. It’s relatively centrally distributed around 0, with a mean of -.0075.

5/ This shows that under normal market conditions, Bitcoin and the S&P 500 are not significantly correlated.

6/ Read more in the piece by @natemaddrey in this week’s State of the Network:

Investigating Bitcoin’s Changing Correlations https://coinmetrics.substack.com/p/coin-metrics-state-of-the-network-7c4">https://coinmetrics.substack.com/p/coin-me...

Investigating Bitcoin’s Changing Correlations https://coinmetrics.substack.com/p/coin-metrics-state-of-the-network-7c4">https://coinmetrics.substack.com/p/coin-me...

Read on Twitter

Read on Twitter