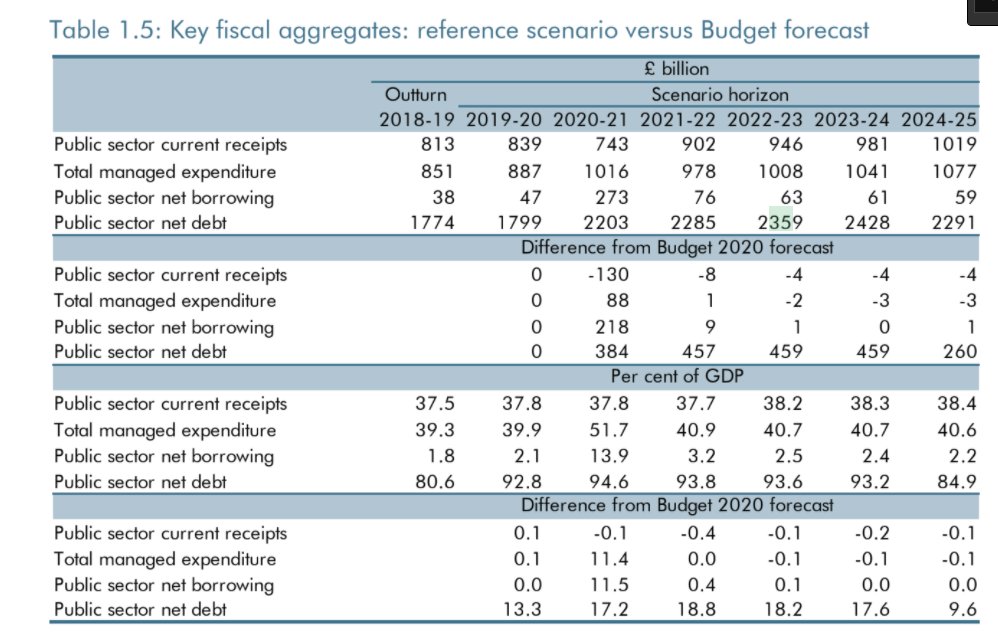

OBR lays out a scenario with its expected economic damage

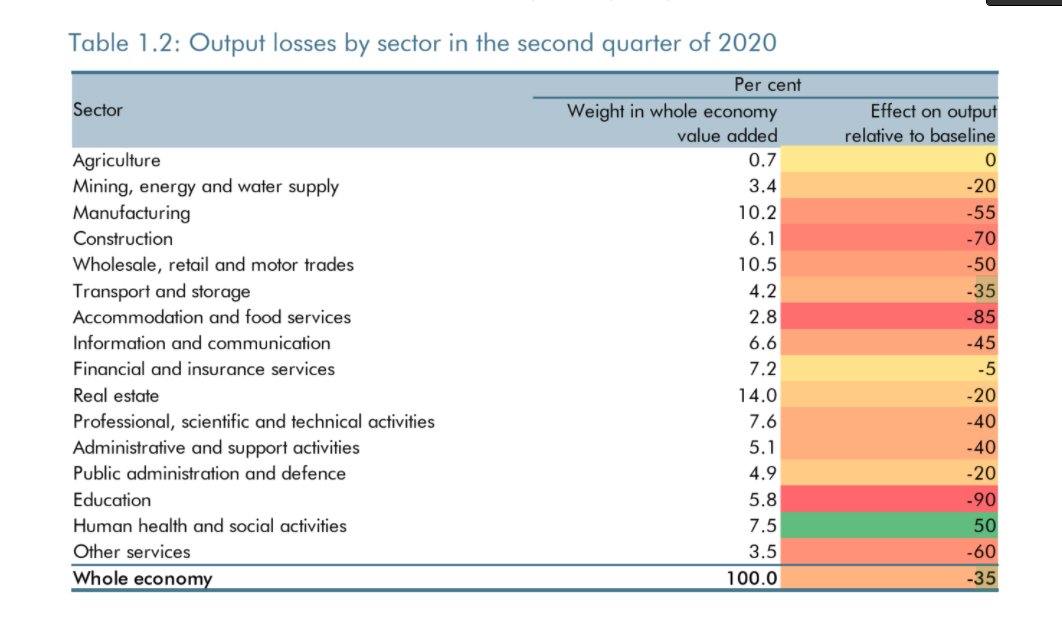

Output currently 35% down, it estiamtes

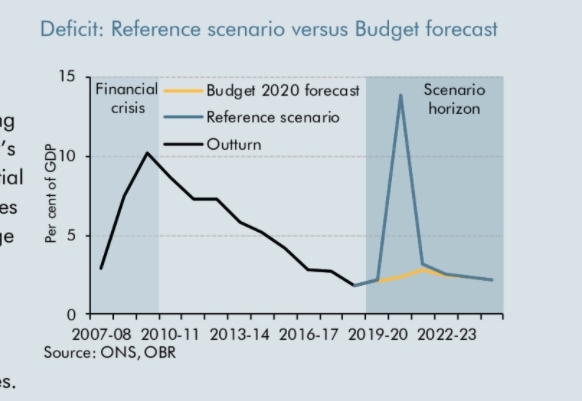

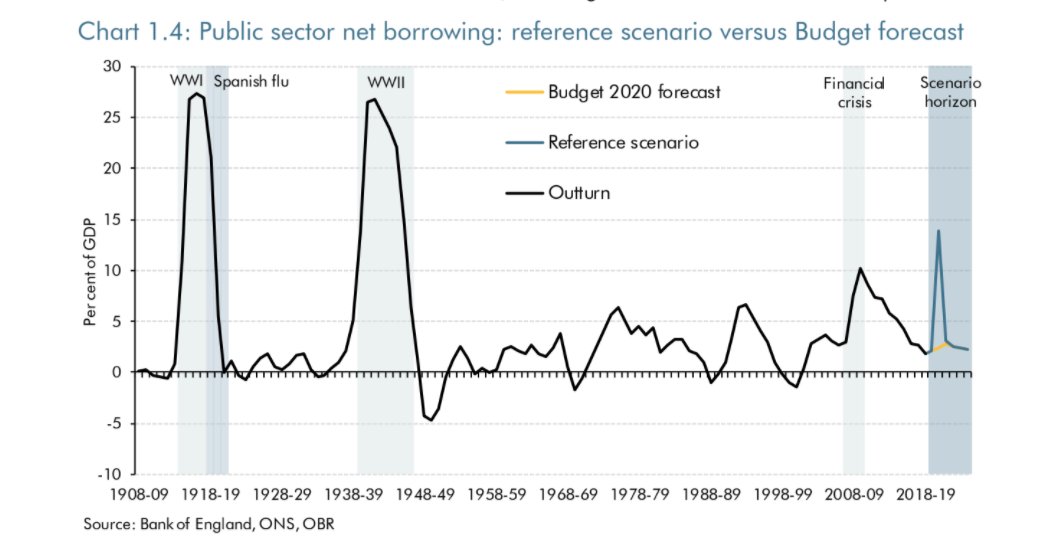

And borrowing likely to rise to 14% of GDP - far worse than finanical crisis

Output currently 35% down, it estiamtes

And borrowing likely to rise to 14% of GDP - far worse than finanical crisis

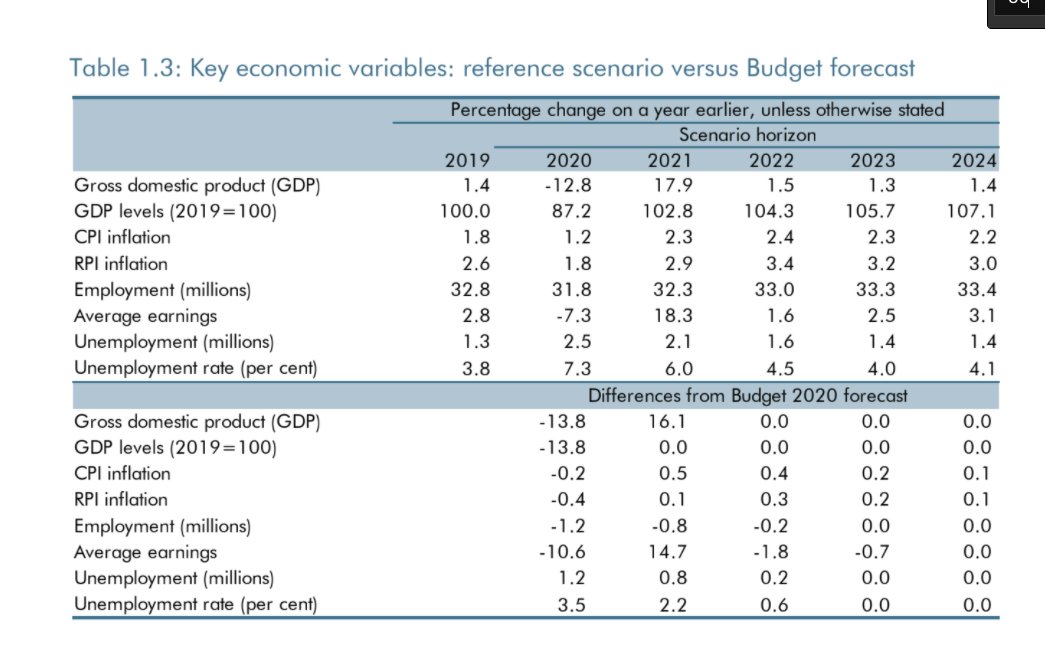

OBR scenario assumes no scarring at all. So it is a one-off hit.

That assumption will not last the test of time. The only question is how wrong is it.

Here is the 35% breakdown by sector

That assumption will not last the test of time. The only question is how wrong is it.

Here is the 35% breakdown by sector

We have little idea if the actual figures will show this because it is almost impossible to measure, despite @ONS best intentions.

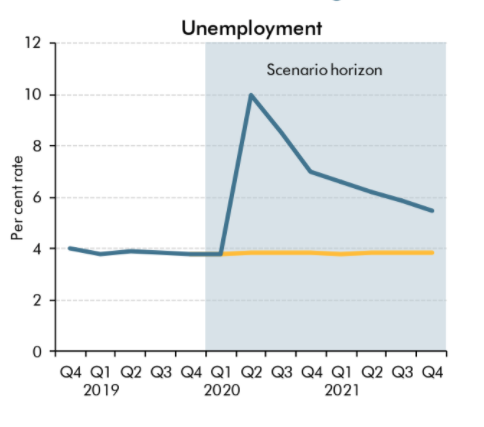

But in this scenario, unemployment gets to levels not seen since the 1990s recession

But in this scenario, unemployment gets to levels not seen since the 1990s recession

Note the optimism about the recovery - 18% growth next year

Others think there will be more scarring.

Others think there will be more scarring.

Public borrowing around 14% of GDP this year - up from about 2.5% in the Budget a month ago.

But it falls away very quickly

But it falls away very quickly

It& #39;s not like a World War for public borrowing...

... but there are not many other sensible comparators

... but there are not many other sensible comparators

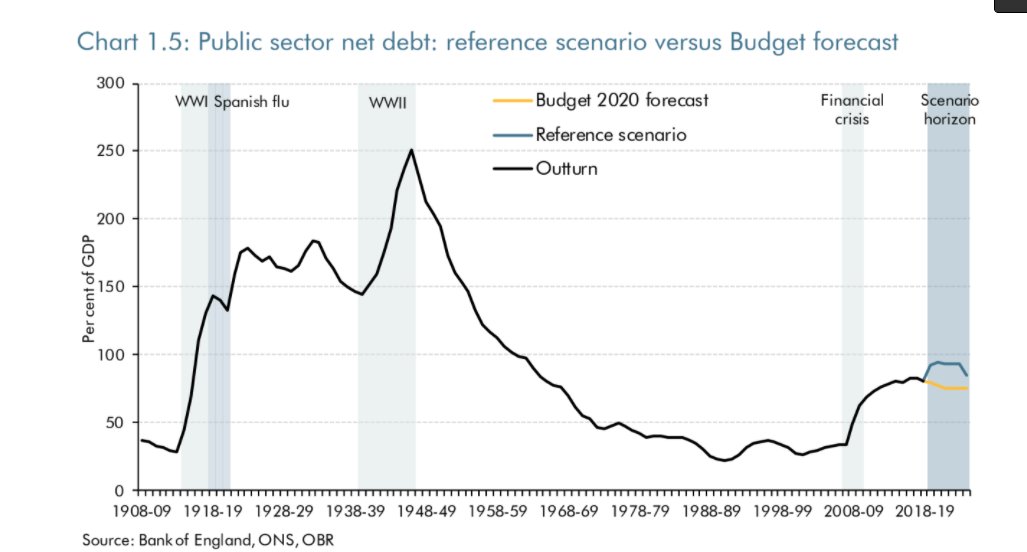

Note that if we can keep the damage down to a one year hit, the lasting effects are easy to manage and public debt does not rise much.

That is what government policy is aiming to do. If successful, it will be a remarkable achievement

That is what government policy is aiming to do. If successful, it will be a remarkable achievement

All charts and numbers from @OBR_UK

Read on Twitter

Read on Twitter