1/ A quick glance at the valuations & R/R setup.

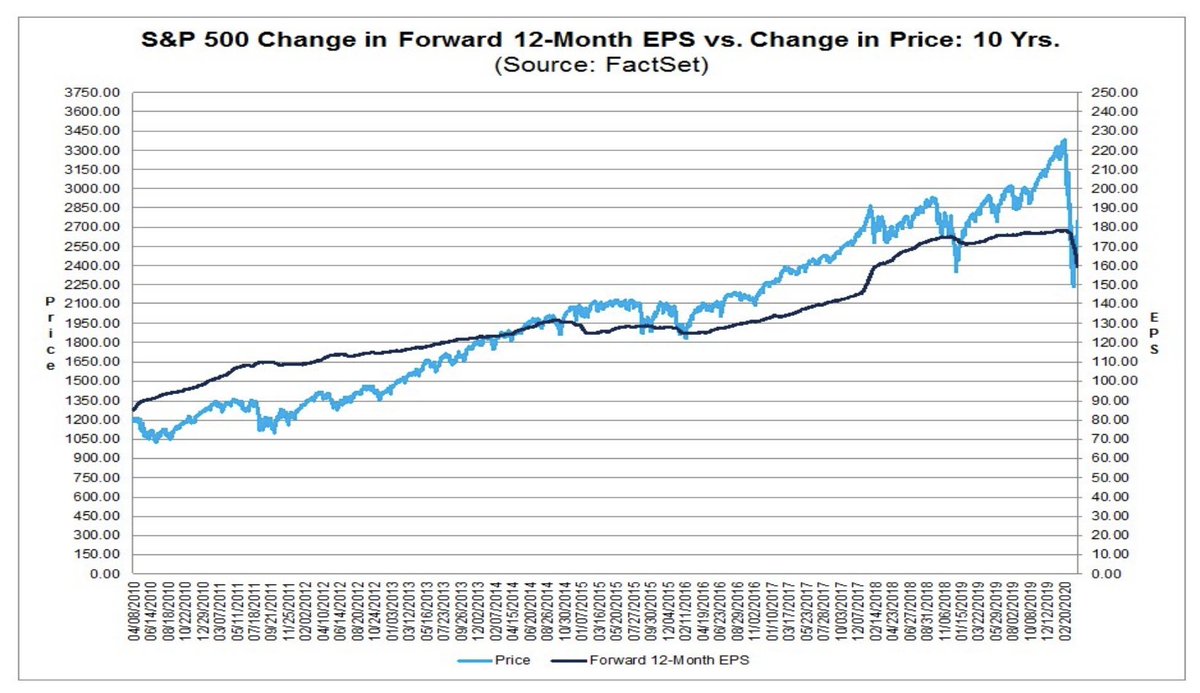

S&P has rallied back to 2800 level, while forward EPS is falling towards $160.

Has the market rallied too far too fast?

Could the earnings disappoint far beyond what Wall Street thinks?

What is the current risk to reward setup?

S&P has rallied back to 2800 level, while forward EPS is falling towards $160.

Has the market rallied too far too fast?

Could the earnings disappoint far beyond what Wall Street thinks?

What is the current risk to reward setup?

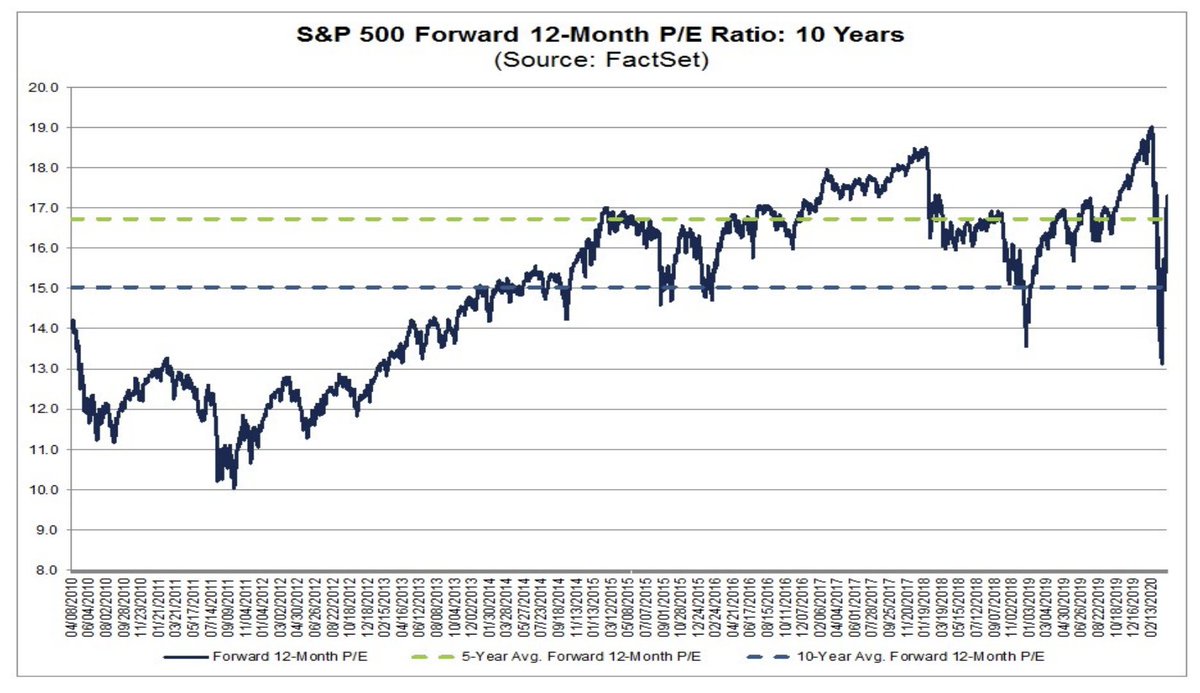

2/ The bull market had 3 important peaks, two which resulted in a major correction and the final one which ended the decade-long bull run.

The 1st came in mid-2015 @ 17X forward earnings.

The 2nd in early 2018 @ 18.5X and the recent peak in early 2020 @ 19X.

The 1st came in mid-2015 @ 17X forward earnings.

The 2nd in early 2018 @ 18.5X and the recent peak in early 2020 @ 19X.

3/ If you& #39;ve made money over the last 3-4 weeks, well done to you.

Returns of 20-50% were up for grabs in different indices & different sectors.

Usually, one needs to stay invested for a period of 24 to 48 months to achieve those kinds of returns — not just 20 days.

Returns of 20-50% were up for grabs in different indices & different sectors.

Usually, one needs to stay invested for a period of 24 to 48 months to achieve those kinds of returns — not just 20 days.

4/ Having said that the S&P valuations are now approaching forward 17.5X as we go through a rebound rally.

If one assumes further upside towards, say 3,000, which is up only 7% from here... together with disappointing earnings...

S&P could easily be trading at 20X forward P/E!

If one assumes further upside towards, say 3,000, which is up only 7% from here... together with disappointing earnings...

S&P could easily be trading at 20X forward P/E!

5/ Either the market thinks (knows?) the economy is about to come roaring back & earnings will recover swiftly...

Or the current risk-reward setup is about as bad as it was in Jan/Feb of 2020 — when we decided to sell out of stocks & raise cash (thread below).

Pick your side.

Or the current risk-reward setup is about as bad as it was in Jan/Feb of 2020 — when we decided to sell out of stocks & raise cash (thread below).

Pick your side.

6/ https://twitter.com/TihoBrkan/status/1230154971858993154?s=20">https://twitter.com/TihoBrkan...

Read on Twitter

Read on Twitter