Shared this out this morning & it& #39;s so good I& #39;m sharing it again. Now is not the time to be paralyzed by the moment. There are tangible steps NJ can take to improve its tax code so that we have the resources to handle this crisis & speed our recovery. https://news.bloombergtax.com/daily-tax-report/10-ways-states-could-fortify-tax-structures-ahead-of-next-crisis">https://news.bloombergtax.com/daily-tax...

https://news.bloombergtatwitter.com/daily-tax-report/10-ways-states-could-fortify-tax-structures-ahead-of-next-crisis

The first point on Rainy Day Funds is one that we can& #39;t fix now but absolutely must make a top priority in the future once we recover from this crisis. NJ spent too long avoiding critical investments to shore up emergency surpluses & it& #39;s come back to bite us now.

The second point on diversifying revenue sources is also critical. NJ got rid of/cut various taxes that overwhelmingly benefited already wealthy families & corporations. Reversing those decisions will help increase resources & make our tax code both more equitable & sound.

When NJ eliminated the #EstateTax, sunset the #MillionairesTax, and cut the #SalesTax by an amount indistinguishable to everyday NJ& #39;ans but significant for those purchasing big ticket items, we shortchanged our budget by over $1 billion unnecessarily. https://www.njpp.org/budget/eliminating-new-jerseys-estate-tax-like-robin-hood-in-reverse">https://www.njpp.org/budget/el...

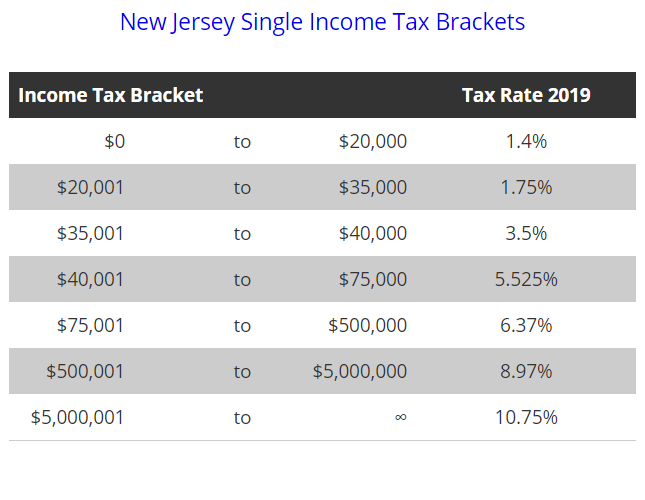

On point 4 re: graduated income tax, yes NJ does already have one, but it could be significantly improved. Right now there are more tax brackets under $75k than there are over - someone earning $75,001 pays the same tax rate as someone earning half a million dollars.

This can be fixed by adding brackets above $75k and between $500k & $5 million to recognize the disparities in wealth & income at higher ends of the scale. Not only would it make our tax code more progressive, it would help undo years of breaks for the already wealthy.

On point 5, NJ has recently implemented a well-designed corporate income tax. Still, there remain several loopholes w/in it that can be shored up by strengthening the state& #39;s combined reporting law & that should be a priority. https://www.njpp.org/budget/fixing-new-jerseys-broken-corporate-tax-code-will-help-small-businesses-boost-the-economy">https://www.njpp.org/budget/fi...

On point 6 - expansion to services - there& #39;s a lot NJ could do. The sales tax hasn& #39;t been modernized in a long time to apply to 21st century services & tech. Furthermore, services mostly used by wealthy homeowners have skirted sales tax for a long time. https://www.njpp.org/budget/modernizing-new-jerseys-sales-tax-will-level-the-playing-field-help-the-economy-thrive">https://www.njpp.org/budget/mo...

Read on Twitter

Read on Twitter