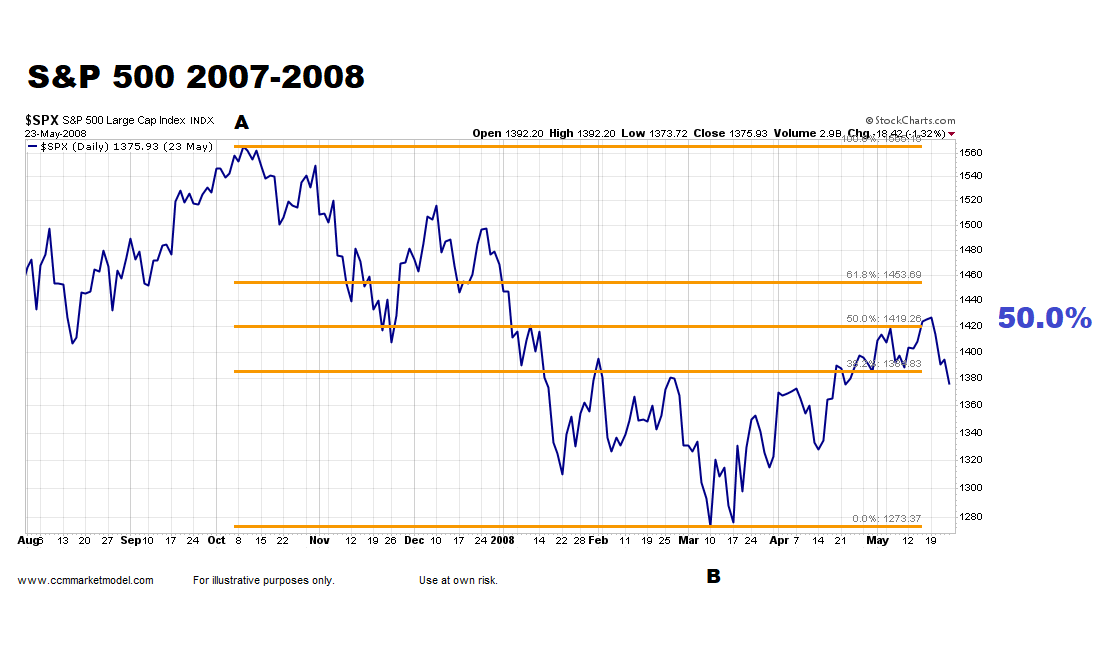

Does a 50% retracement mean a bad event has to be over?

The S&P 500 peaked in Oct 2007, dropped to March 2008 low, rallied hard into May and retraced over 50% of the A to B move.

Was the low in? No, the S&P dropped 53% before making the final low in March 2009. 2020 TBD.

The S&P 500 peaked in Oct 2007, dropped to March 2008 low, rallied hard into May and retraced over 50% of the A to B move.

Was the low in? No, the S&P dropped 53% before making the final low in March 2009. 2020 TBD.

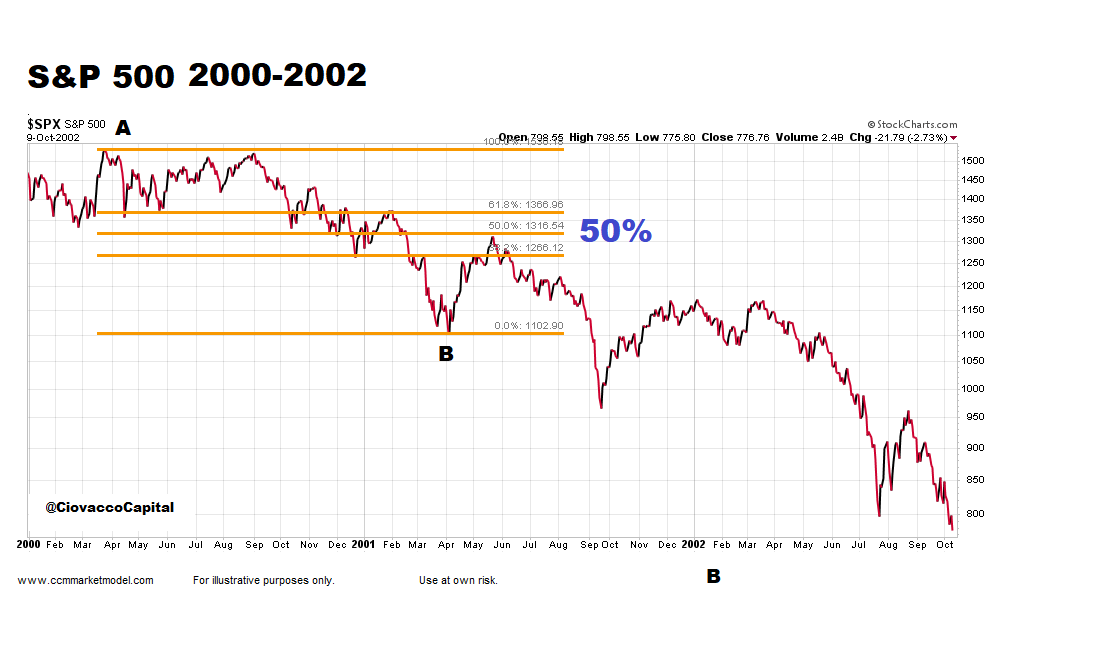

Part 2 of 2: Does a 50% retracement mean a bad event has to be over?

The S&P 500 peaked in Mar 2000, dropped to April 2001 low, rallied and reclaimed 50% of the A to B move.

Was the final low in? No, it did not come until over a year later and from much lower levels.

The S&P 500 peaked in Mar 2000, dropped to April 2001 low, rallied and reclaimed 50% of the A to B move.

Was the final low in? No, it did not come until over a year later and from much lower levels.

The 50% retracement in all three cases (2000-01, 2007-08, and 2020) does not tell us much about bullish odds, nor bearish odds; it is simply a reference point. How price acts near the reference point is more relevant, which is TBD in the 2020 case.

Read on Twitter

Read on Twitter