Stock Market Buybacks vs. Dividends. What Gets Slashed First?

-

THREAD

-

Let& #39;s dig.

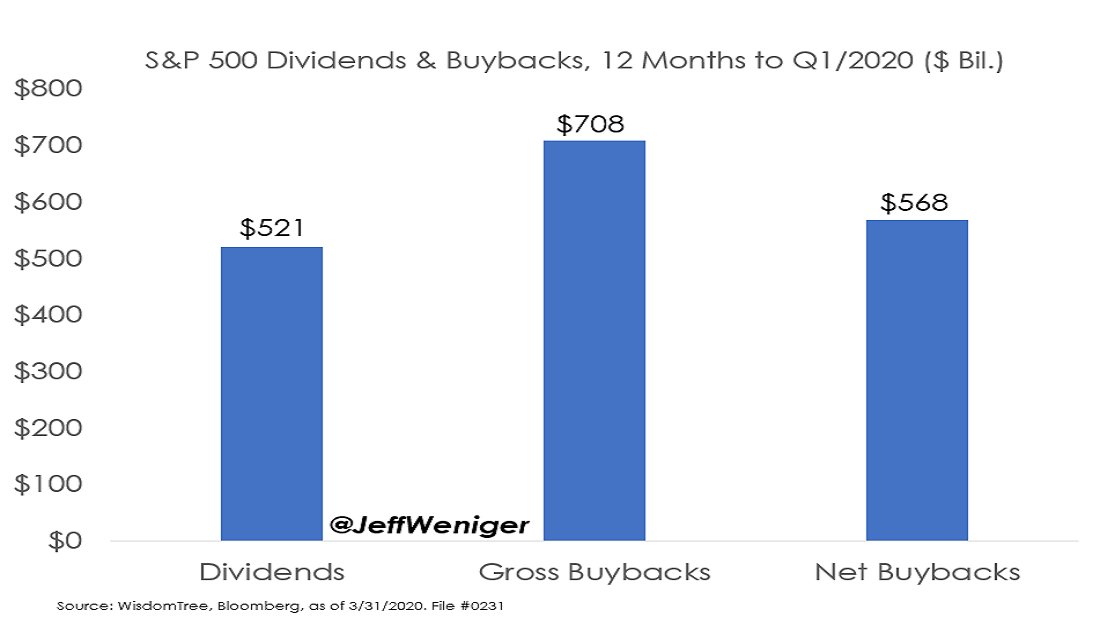

Here’s what the $24.1tn S&P 500 paid in the year to March. See those buybacks? Wave goodbye.

-

On Wednesday& #39;s call I& #39;ll be hitting this head on.

-

1/6

-

THREAD

-

Let& #39;s dig.

Here’s what the $24.1tn S&P 500 paid in the year to March. See those buybacks? Wave goodbye.

-

On Wednesday& #39;s call I& #39;ll be hitting this head on.

-

1/6

2/ Why? Because buybacks are now Public Enemy #1. Here’s a sample from an Influencer that frequently pops into the Twitter feed of Finance people. https://twitter.com/epsilontheory/status/1239603519113568264?lang=en">https://twitter.com/epsilonth...

3/ You& #39;ve probably seen some variation of the “airlines bought back shares equal to 96% of cash flow” tweets. It was so popular that I probably saw 50 tweets regurgitating it over 3-4 weeks. Buybacks right now are about as popular as Lee Harvey Oswald. https://twitter.com/business/status/1239606817317105664">https://twitter.com/business/...

4/ Don’t fight it or pick sides. You& #39;re here to play the market, and the market doesn& #39;t care about your unsolicited opinion. So adapt. Buybacks are socially unacceptable, at least for the time being. Now assess.

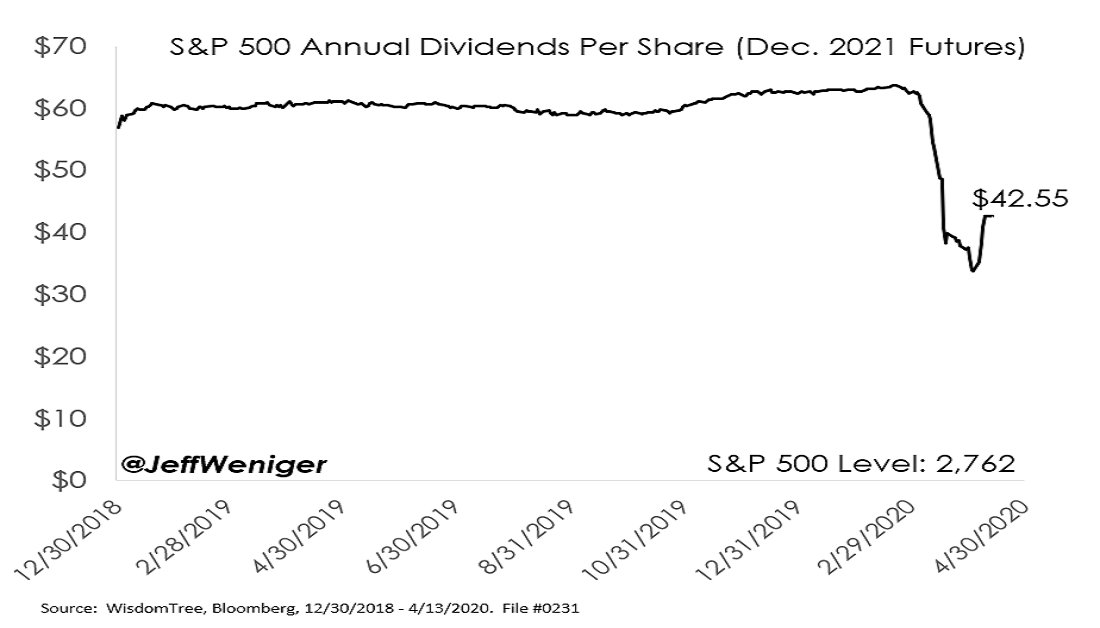

5/ How? Do the gymnastics on if this crisis is worse than Lehman or if it is instead more benign. Back then, S&P 500 buybacks were also about $700bn, slashed to ~$100bn at the bottom. Dividends were cut much less: 27%. https://twitter.com/JeffWeniger/status/1247998815501574145">https://twitter.com/JeffWenig...

Read on Twitter

Read on Twitter