If the S&P 500 is such a solid investment, then wouldn’t it be a great idea to just buy and hold one of these “leveraged ETFs” that provide you with 2x or even 3x the return of the S&P 500?

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Not so fast.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

A thread:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Not so fast.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

A thread:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

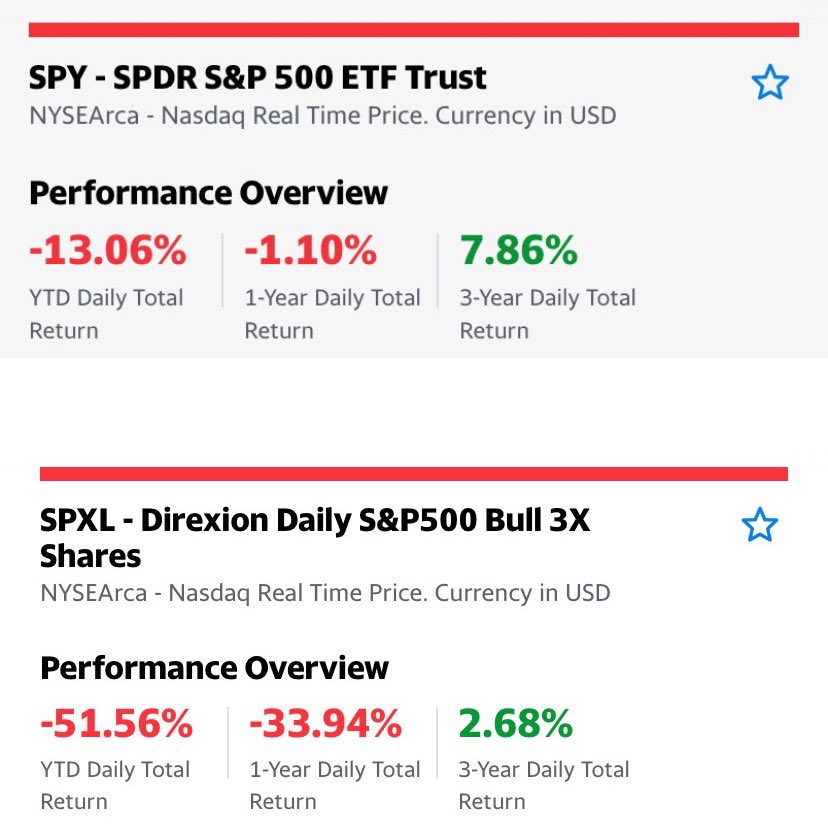

“Leveraged” ETFs are ETFs that are designed to mirror the performance of a benchmark, like the S&P 500 and then multiply the return by a certain factor (number)

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Ex: SPXL, an ETF designed to 3x the return of the S&P 500

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Ex: SPXL, an ETF designed to 3x the return of the S&P 500

Keep in mind, it’s not “3x the positive returns of the S&P 500”. It’s 3x the returns, UP OR DOWN.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

If the S&P is up 5% on the day SPXL is up 15%. If the S&P is down 5% on the day, SPXL is down 15%

⠀⠀⠀⠀⠀⠀⠀⠀⠀

If the S&P is up 5% on the day SPXL is up 15%. If the S&P is down 5% on the day, SPXL is down 15%

While the idea of “multiplied returns” on the upside sounds nice, the truth is the steep losses on the downside can harm you much more than the gains can help you.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Let’s look at an example of “volatility decay”, which is one way of describing that effect

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Let’s look at an example of “volatility decay”, which is one way of describing that effect

Let’s assume we’re looking at SPY (a “normal” S&P 500 ETF) and SPXL (the 3x leveraged S&P 500 ETF.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Let’s say you invest $1000 in each and you see the following daily returns in the S&P 500 over the next three days:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

-5%

-5%

+10%

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Let’s say you invest $1000 in each and you see the following daily returns in the S&P 500 over the next three days:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

-5%

-5%

+10%

SPY’s daily value:

(1000 x .95)= $950

(950 x .95)= $902.50

(902.5 x 1.1)= $992.75

⠀⠀⠀⠀⠀⠀⠀⠀⠀

SPXL’s daily value:

(1000 x .85)= $850

(850 x .85)= $722.50

(722.50 x 1.3)=$939.25

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Pretty significant ending values. Why? The impact of the larger losses

(1000 x .95)= $950

(950 x .95)= $902.50

(902.5 x 1.1)= $992.75

⠀⠀⠀⠀⠀⠀⠀⠀⠀

SPXL’s daily value:

(1000 x .85)= $850

(850 x .85)= $722.50

(722.50 x 1.3)=$939.25

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Pretty significant ending values. Why? The impact of the larger losses

Also, a lot of these leveraged ETFs are designed to be short term trading products only.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Many “rebalance daily”, meaning they provide with you with 2x or 3x returns one day at a time, not over a long period of time. The following slide shows that difference:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Many “rebalance daily”, meaning they provide with you with 2x or 3x returns one day at a time, not over a long period of time. The following slide shows that difference:

Downside volatility (aka losses) and leverage (amplifying those losses) can be a recipe for disaster.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

That’s why consistency + discipline > chasing crazy returns. Not enough people on social media talking about that.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Hope that helps

⠀⠀⠀⠀⠀⠀⠀⠀⠀

That’s why consistency + discipline > chasing crazy returns. Not enough people on social media talking about that.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Hope that helps

Read on Twitter

Read on Twitter