I sense that everyone is bearish the dollar due to the Fed actions. As you know, I am firmly in the dollar bull camp.

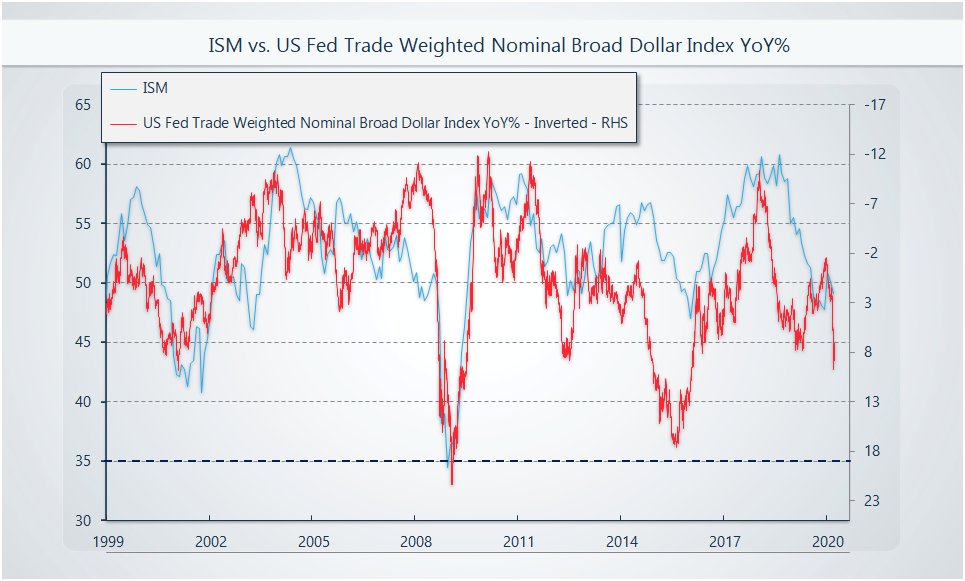

This chart helps explain my view - the dollar is cyclical and as the ISM falls to 35 or lower, the dollar should rally hard (+18%) (Dollar inverted here)

This chart helps explain my view - the dollar is cyclical and as the ISM falls to 35 or lower, the dollar should rally hard (+18%) (Dollar inverted here)

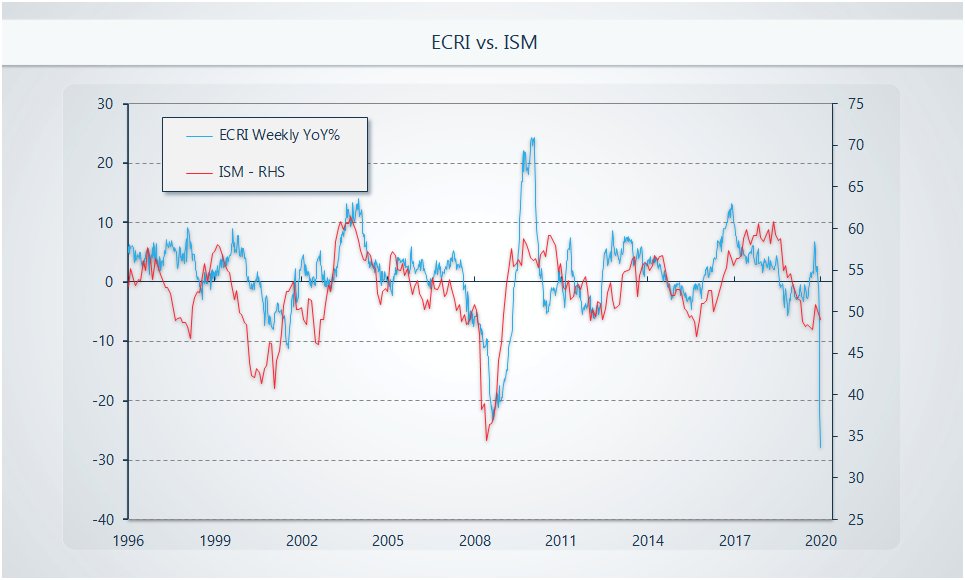

Why do I think 35 for the ISM? It& #39;s basically what the weekly ECRI is telling us...

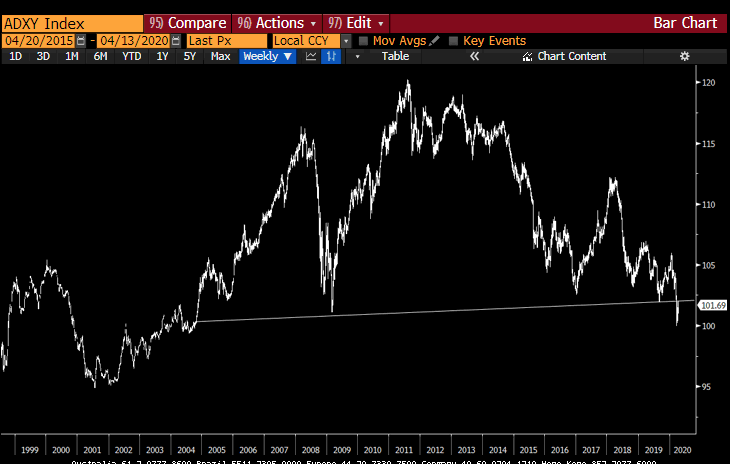

And the ADXY Index of Asian currencies would continue lower in the worlds largest head and shoulders top pattern...

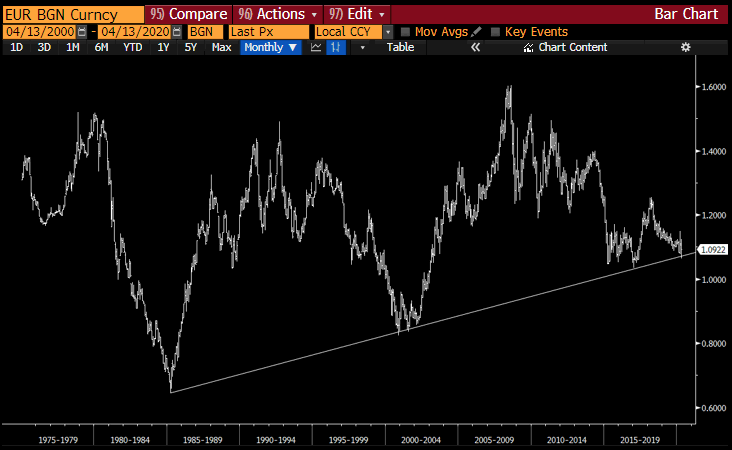

I think the market& #39;s narrative of QE = lower dollar will prove to be a false narrative as the economic fundamentals, dollar debt dynamics and negative trade flows will force the dollar ever higher.

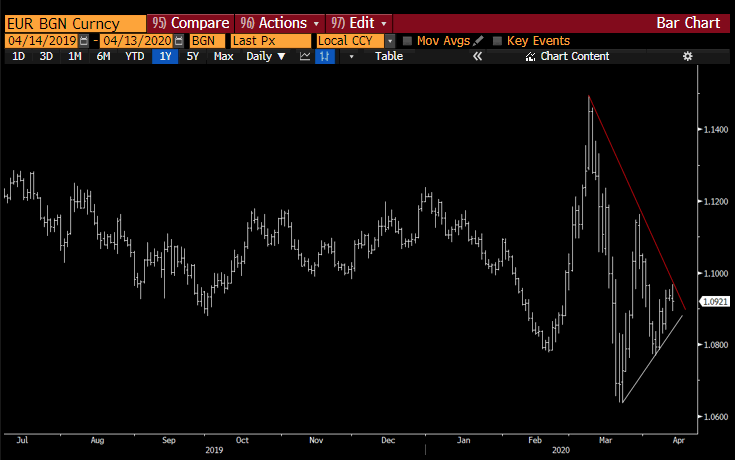

I think the Euro should be the first tell...

I think the Euro should be the first tell...

Read on Twitter

Read on Twitter