I came back to BTC early 2017 and discovered crypto-exchanges around mid 2017. switched from gambling to trading early 2019 and became netto profitable early 2020.

it was probably the classic story of a rookie trader: a long thread. 1/24

it was probably the classic story of a rookie trader: a long thread. 1/24

I loved btc. Full access to a real exchange (no CFD crap) and a "pure" technical asset to trade was awesome so i started using real money for the first time. Risk averse as i was i only funded the trading account with 100$ and had positionsizes of 1$ (thanks to knowing RM). 2/24

I was in and out of positions in matter of minutes. Analysing the orderflow, reading the tape and jumping to gut feelings. Shortly i was hooked and did all the things you shouldn& #39;t as a rookie. but in 2017 this was all fun and game since it was only going up anyway. 3/24

I didn& #39;t track any of it (first mistake), but i soon realised that low timeframes where full of noise, so i "went higher" to M15. Still didn& #39;t like indicators so i tried to read the naked chart. drawing lines, seeing patterns. And it worked far better than expected. 4/24

But i lost money nonetheless. I wasn& #39;t trading yet, i was gambling. Playing it as a hobby. When i saw a setup i had a defined stop and risked similar amounts each trade (again thx prior knowledge), but with no real system. no documentation, no reflection. 5/24

I saw a setup (where "setup" wasn& #39;t defined yet, i saw something and thought i knew how the price might behave) and opened the position with rough size calculations. I didn& #39;t even track profit/losses but the account definitely didn& #39;t grow. 6/24

re-funded. "this time its different". zoomed out: M30. H1. H4. traded from mobile (red flag) w/o proper analysis (huge red flag): i often didn& #39;t know why i entered in hindsight. also had big wins, lucky shots covering the losses of 6 months. nothing to build a strategy on. 7/24

To make it clear: i *knew* all the theory. i *knew* thats why beginners fail. I *knew* that emotions are your enemy and you shouldn& #39;t "trade" like that. I still did it for months. Thinking i am different. Thinking i will outsmart everyone. 8/24

Finally realised that it& #39;s not working like that and started a journal. at least i was tracking my performance and trades now so i saw the curve going down. So i started reflecting and defining a strategy. I knew i had good entries but lost a lot on the way. 9/24

I started trading my system. i made a plan to start with small risk (5$ per position) and on success double it every 2 months until i make enough for a living. First month went crazy and i made 20R that month. (i wasn& #39;t thinking in $ but R to detach from absolute returns) 10/24

and (again despite *knowing* better) i became greedy and went to 20$ per trade. and lost 12R that month. I already traded my system, documenting every decision, analysing every trade after a week. and it showed that my system wasn& #39;t strict enough. 11/24

i added clear definitions for stops, when to trail etc. I defined every part of it and was now able to backtest it manually. And it worked! The defined rules of the strategy where profitable in history and they were simple enough to follow. even made an indicator for it. 12/24

So all settled and done? lambo soon? far from it! Despite the system being profitable i lost each month ("only" between 1 and 3R but still). So i added a column to my journal "according to strategy". A simple yes/no field i had to fill before entering each trade. 13/24

a no-brainer right? who would trade (and acknowledge it) against a profitable system? Well: me. I thought i knew it better, trying to outperform the system. i made bad decisions all the way and lost while seeing the numbers in the journal how the pure system would perform. 14/24

At the beginning of each month i promised myself to stick to the system. and failed repeatedly. i got better, but failed. Learning so far: you are your worst enemy. specially when it comes to trading! It doesn& #39;t matter what you know, it doesn& #39;t matter what you plan. 15/24

You need to be able to execute that plan. every. fucking. day. And this was with a strategy based on my own mindset, risk strategy and view of the market. Can& #39;t imagine trading signals/systems from anyone else. 16/24

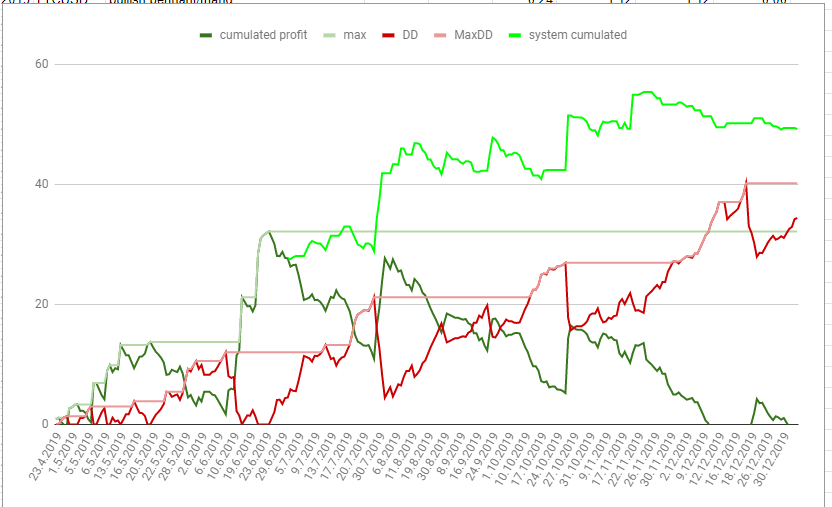

so what did i do? i went deeper. I already had written an "indicator" showing me entry and exit levels (so i only had to follow 3 simple rules. easy af) so i took the next step and wrote a TV strategy implementing the full system (as full as possible on TV). 17/24

And it was profitable. This fucking strategy i failed to execute was fully automateable with nice profits. So i spend the next months writing a python "framework" and automating the strategy fully into a bot. Deployed it to my trading account Dec. 1st 2019. 18/24

Since i still thought that the master (me) had to be better than the apprentice (the bot) i still traded my own strategy manually (and still failed to really execute it). 2 months later i added another strategy to my bot (that i developed trading manually) 19/24

the bot outperformed me like crazy (me still losing, bot making nice money per month). so last month i finally stopped trading manually and deployed the bot with full risk on multiple exchanges. 20/24

And i still look at the bots decisions and need to hold back everyday. always wanting to trail that stop closer, prevent that entry... it would nearly always reduce the performance so i learned not to do it. but it took months! 21/24

The takeaway: have enough runway for months to loose. know yourself. in trading there is only one to blame: yourself. start a journal on day 1. analyze and reflect every trade from day 1. Make it reproducable. 22/24

If you can& #39;t write down the rules of your strategy you might never be able to execute it properly. If you have a defined strategy, you can backtest it, you can analyze and tune it. You can& #39;t "tune" following your gut. 23/24

And plan your risk. When i made the plan it included the risk per position, the number of maxDD per month before i stop the month etc. So i knew the max amount i would lose over the next 12 months if everything goes south. 24/24

i learned heaps from traders on here (most probably don& #39;t know that i exist), and all of them seem to have clearly defined strategies. Systems they strictly follow cause they know it works for them.

shoutout to @scottmelker @BTC_JackSparrow @crypto_birb @KoroushAK

be like them

shoutout to @scottmelker @BTC_JackSparrow @crypto_birb @KoroushAK

be like them

Read on Twitter

Read on Twitter