Bored in quarantine, so poking around some older articles to remember what 2009-2010 felt like. Here& #39;s one from March 9th, 2010:

"Worries Rebound on Bull& #39;s Birthday" https://www.wsj.com/articles/SB10001424052748704706304575107492632567802">https://www.wsj.com/articles/...

"Worries Rebound on Bull& #39;s Birthday" https://www.wsj.com/articles/SB10001424052748704706304575107492632567802">https://www.wsj.com/articles/...

The great Prof Shiller voicing familiar valuation worries, even then:

"One concern of pessimistic analysts such as Mr. Shiller is that despite the two bear markets, stocks have spent almost all their time since 1991 priced above historic averages."

"One concern of pessimistic analysts such as Mr. Shiller is that despite the two bear markets, stocks have spent almost all their time since 1991 priced above historic averages."

... and Rob Arnott:

"One decade& #39;s damage still hasn& #39;t brought us back down to historic norms" for stock prices, says Robert Arnott, who warned of trouble in 2000 and whose firm Research Affiliates in Newport Beach, Calif., directly manages $4 billion. "

"One decade& #39;s damage still hasn& #39;t brought us back down to historic norms" for stock prices, says Robert Arnott, who warned of trouble in 2000 and whose firm Research Affiliates in Newport Beach, Calif., directly manages $4 billion. "

"The way Mr. Shiller sees it, the problem today isn& #39;t just that the current P/E is above 20. It is that since 1991 it has spent only seven months, in late 2008 and early 2009, below the average level of 16."

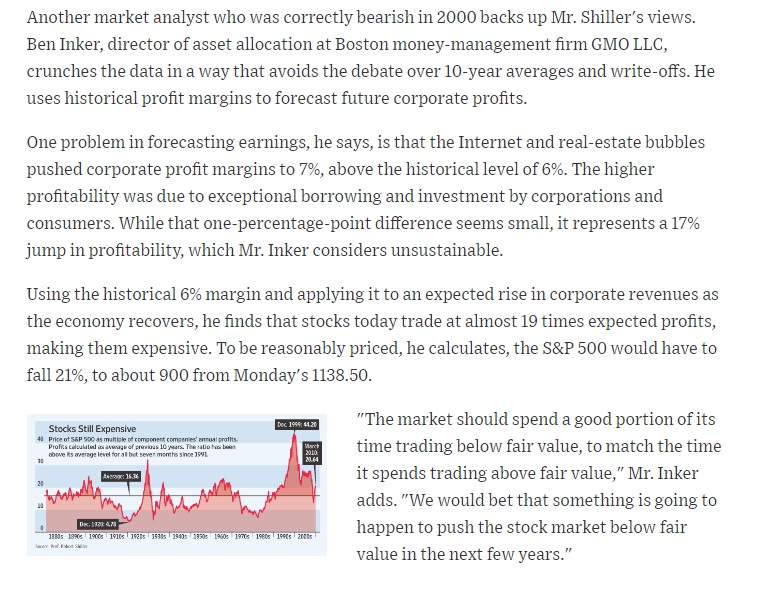

GMO basically figured margins couldn& #39;t expand enough to grow earnings

This is a front-loaded recession, so it& #39;s possible all the terrible news came at the beginning.

Read on Twitter

Read on Twitter

this is the most important takeaway, especially for those saying stocks look expensive now (assuming we& #39;ve bottomed): they always do coming out of recession" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">this is the most important takeaway, especially for those saying stocks look expensive now (assuming we& #39;ve bottomed): they always do coming out of recession" class="img-responsive" style="max-width:100%;"/>

this is the most important takeaway, especially for those saying stocks look expensive now (assuming we& #39;ve bottomed): they always do coming out of recession" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">this is the most important takeaway, especially for those saying stocks look expensive now (assuming we& #39;ve bottomed): they always do coming out of recession" class="img-responsive" style="max-width:100%;"/>