Banks are safer today, but tighter regulations have just squeezed risks into the bigger, more opaque world of asset managers, hedge funds, private equity, direct lenders and mortgage trusts. My big read on how 2020 could be the "shadow banking" crisis. https://www.ft.com/content/d9812fee-798a-11ea-9840-1b8019d9a987">https://www.ft.com/content/d...

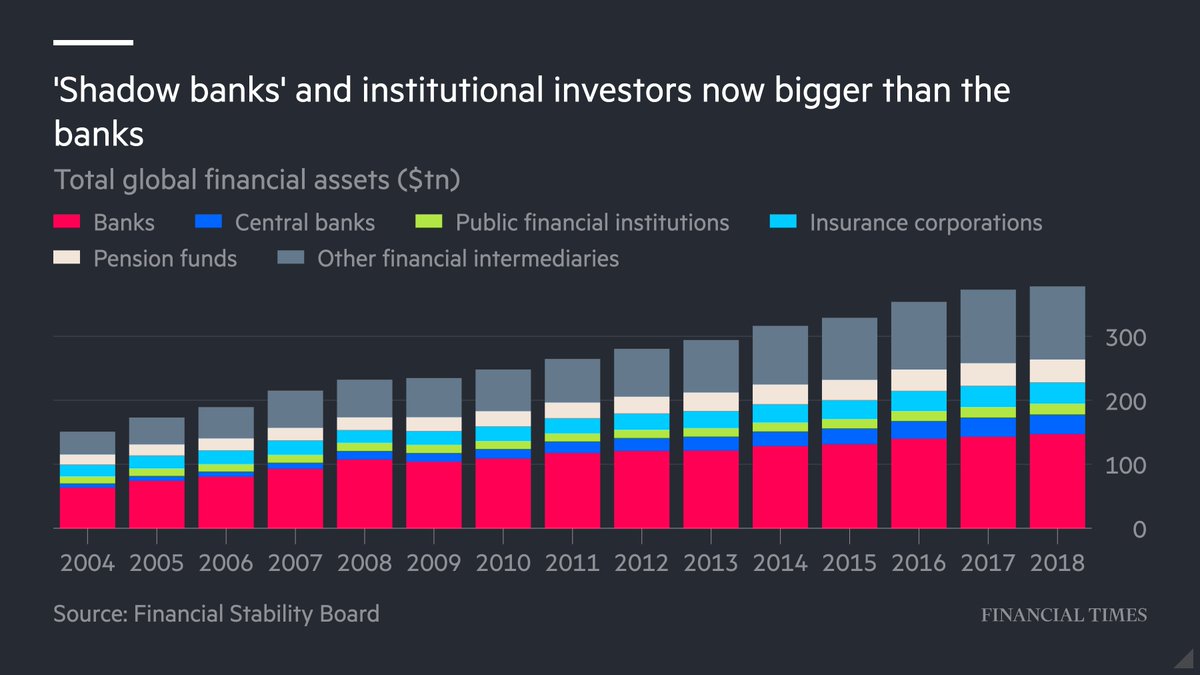

Definitions of shadow banking aren& #39;t uniform, but in 2008, asset managers, insurers, pension funds, hedge funds, CLOs, private capital vehicles etc managed about $98tn, slightly less than banks. Now they manage well over $180tn - almost a fifth higher than banks globally.

The problem is that by making banks safer through tougher regulation, it has merely shifted some of the risks into areas it is tougher to monitor.

We were heading towards a full-blown financial crisis on top health and economic crises last month, but the incredibly forceful response from central banks - especially the Fed - has calmed many of the stresses we saw.

The extraordinary response - bigger and better facilities than in all of 2008, unveiled in a matter of weeks - was easier because of the nature of the crisis, according to former NY Fed head Bill Dudley.

Read on Twitter

Read on Twitter