ICYMI

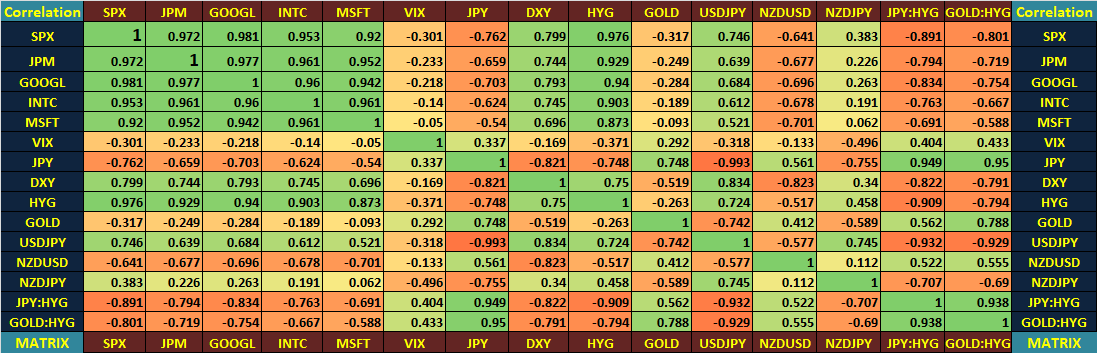

Refresher: cross-asset "Correlation Matrix" for year 2019 - one year correlation

update & review this matrix every week for different time frames would help one to spot some great opportunities on cross-asset correlations; uncovering some good emerging leading indicators https://twitter.com/kerberos007/status/1212532772344147974">https://twitter.com/kerberos0...

Refresher: cross-asset "Correlation Matrix" for year 2019 - one year correlation

update & review this matrix every week for different time frames would help one to spot some great opportunities on cross-asset correlations; uncovering some good emerging leading indicators https://twitter.com/kerberos007/status/1212532772344147974">https://twitter.com/kerberos0...

Some new notable correlations emerging: from 500x500 matrix.

Updated on 10-year correlation matrix - from 2010 to 2020 as of Friday.

SPX

HYG

GOLD:HYG ratio

JPY:HYG ratio

JPY index

VIX

etc.

Updated on 10-year correlation matrix - from 2010 to 2020 as of Friday.

SPX

HYG

GOLD:HYG ratio

JPY:HYG ratio

JPY index

VIX

etc.

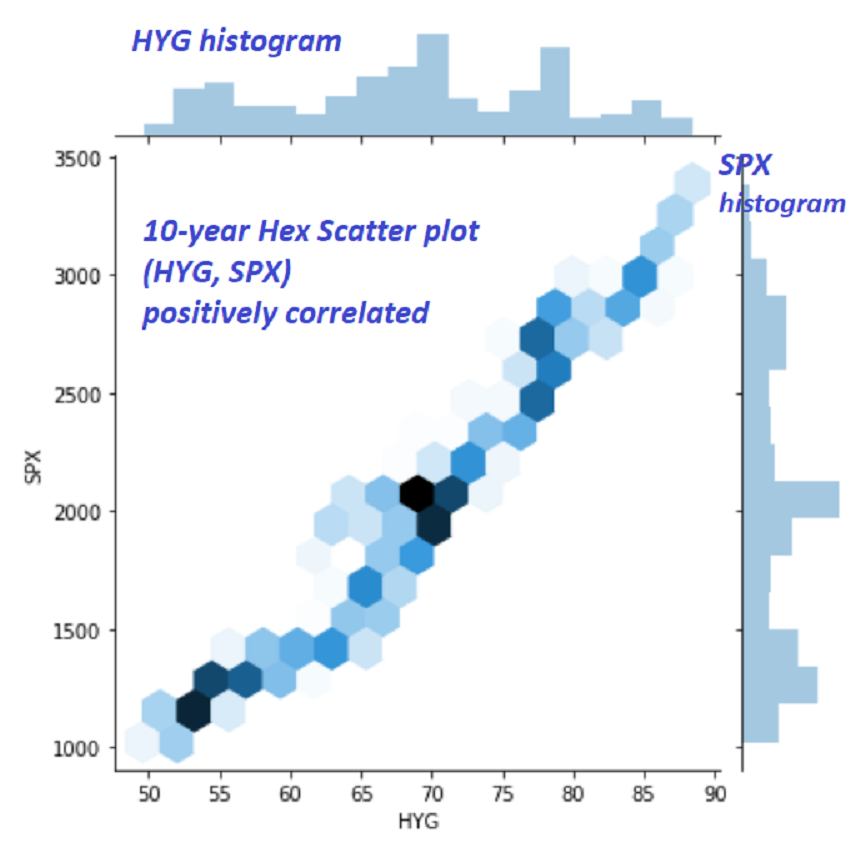

Amazing positive correlation between

$HYG and $SPX in the last 10 years.

10-year Hex ScatterPlot (HYG, SPX)

$HYG and $SPX in the last 10 years.

10-year Hex ScatterPlot (HYG, SPX)

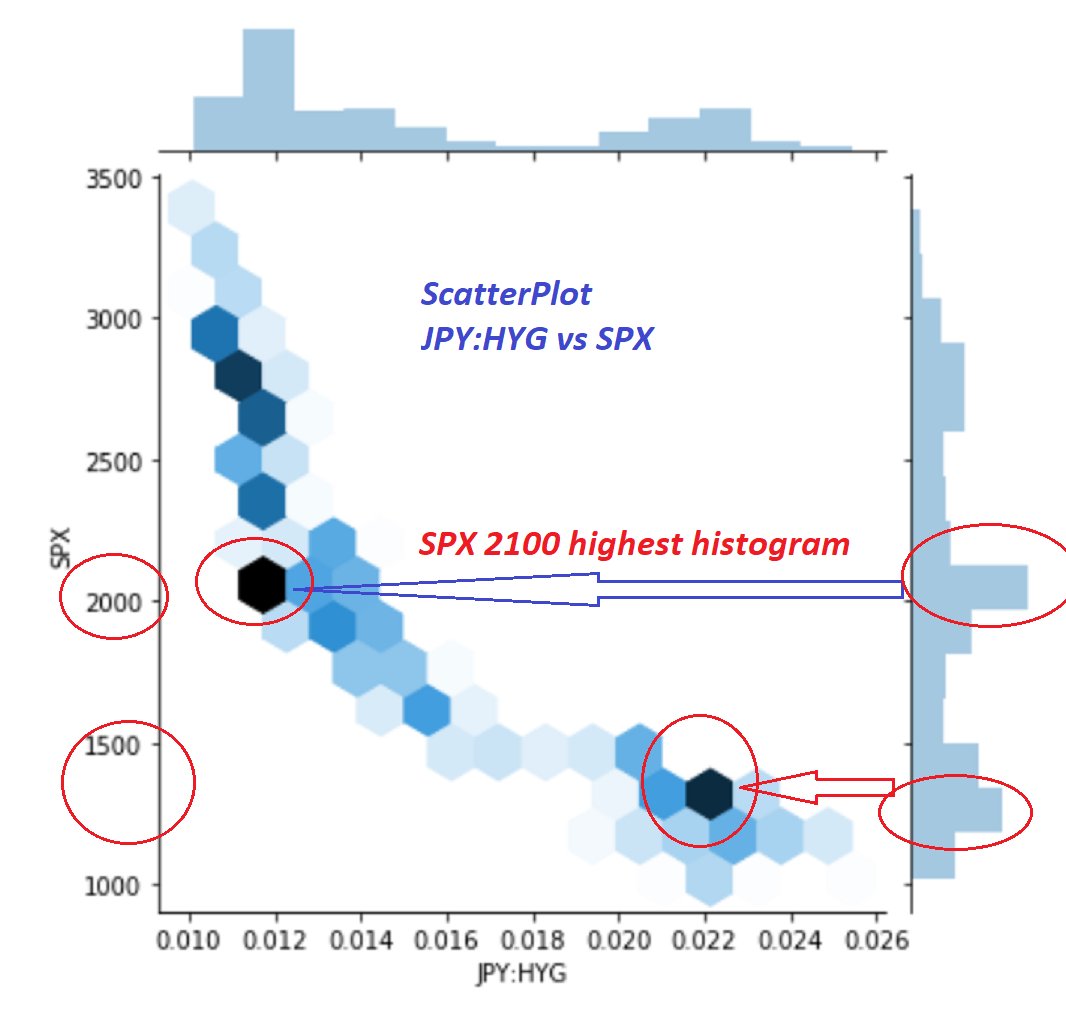

Amazing negative correlation between

JPY:HYG ratio and $SPX in the last 10 years.

10-year Hex ScatterPlot (JPY:HYG, SPX)

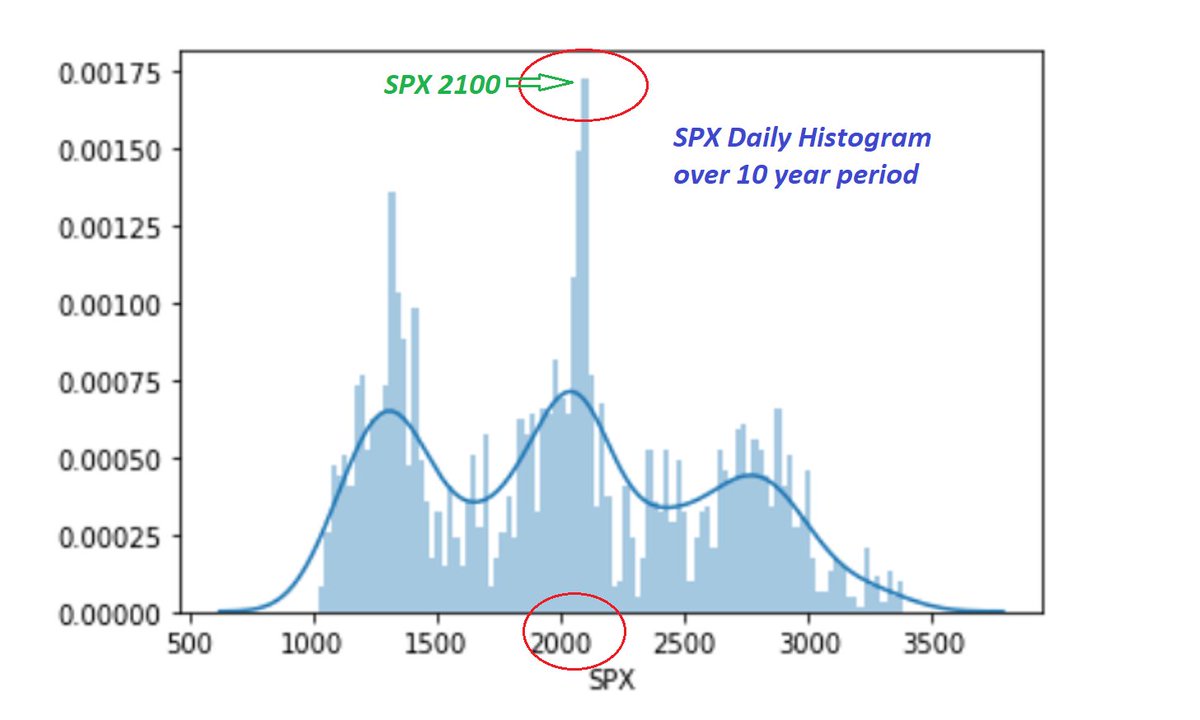

Notice the histogram: $SPX = 2100

JPY:HYG ratio and $SPX in the last 10 years.

10-year Hex ScatterPlot (JPY:HYG, SPX)

Notice the histogram: $SPX = 2100

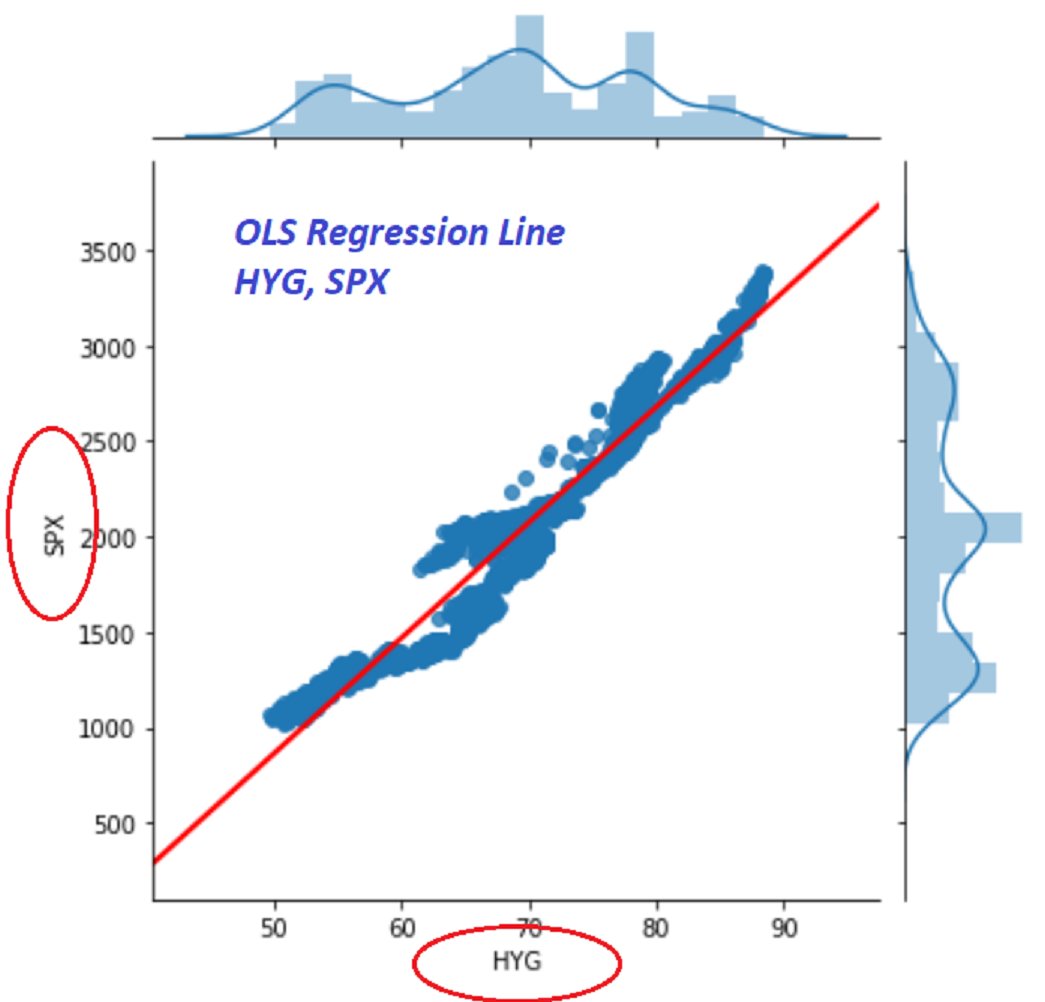

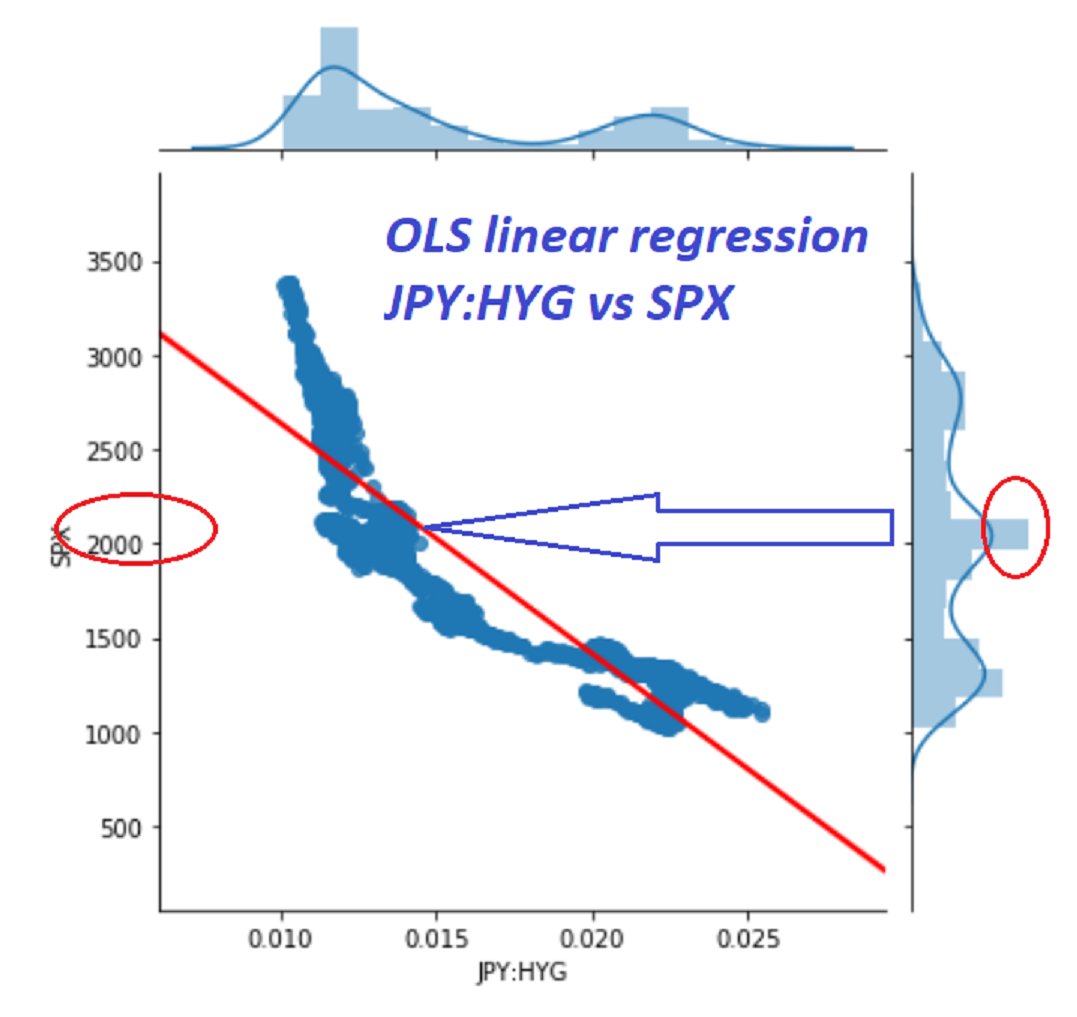

JPY:HYG and $SPX scatterplot

Perfect OLS regression line (red line) - 10 year period

negatively correlated over the last 10 year period

SPX 2100?

Perfect OLS regression line (red line) - 10 year period

negatively correlated over the last 10 year period

SPX 2100?

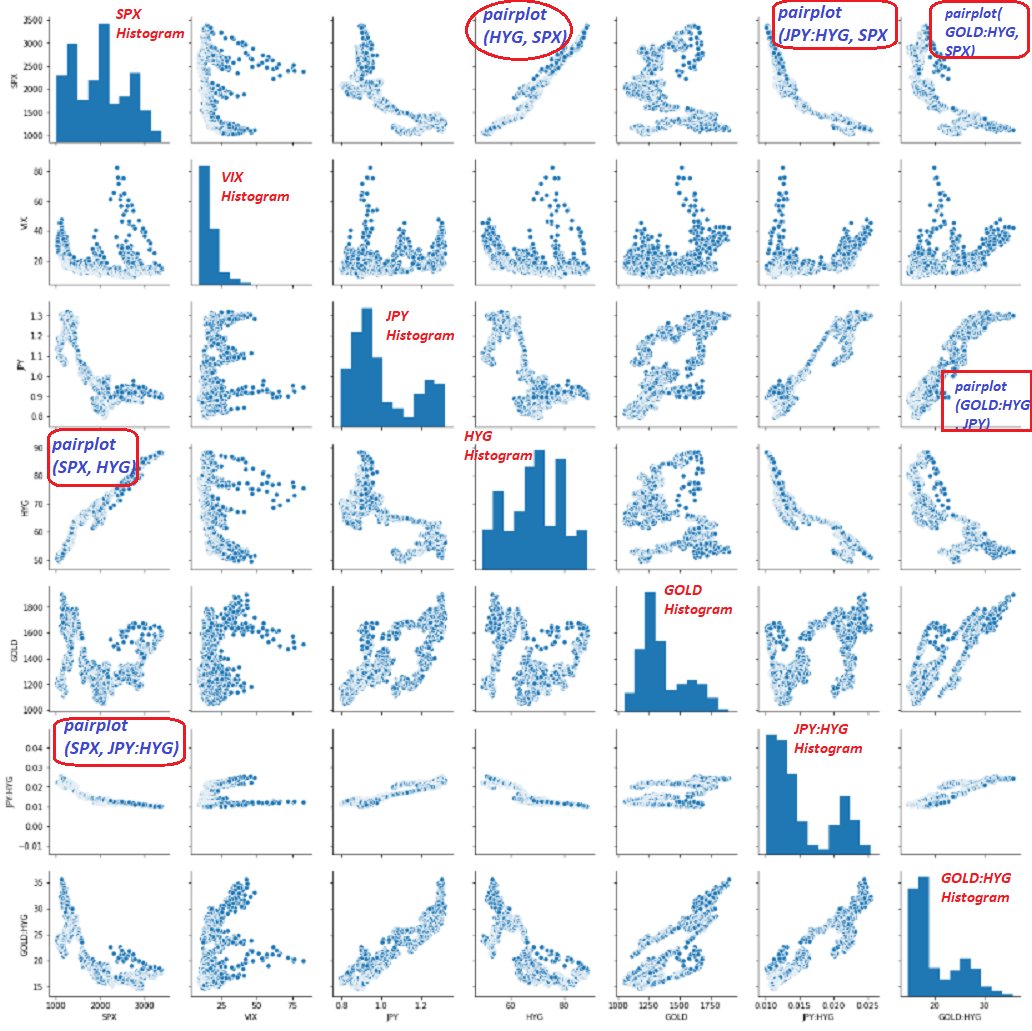

A quick glance of all correlations & scatterplots among cross assets

It is a quick& #39;n dirty way to spot some good correlations

If one monitor these charts everyday, he would become an expert on cross-asset correlations in no time, discovering some good leading indicators https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Face with monocle" aria-label="Emoji: Face with monocle">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Face with monocle" aria-label="Emoji: Face with monocle">

It is a quick& #39;n dirty way to spot some good correlations

If one monitor these charts everyday, he would become an expert on cross-asset correlations in no time, discovering some good leading indicators

$SPX daily histogram plot - zoomed view

Since April 2010, 10 year period

That huge spike @ 2100 = Magnet

most traded zone and a Magnet in he last 10 years.

Since April 2010, 10 year period

That huge spike @ 2100 = Magnet

most traded zone and a Magnet in he last 10 years.

Read on Twitter

Read on Twitter

" title="A quick glance of all correlations & scatterplots among cross assetsIt is a quick& #39;n dirty way to spot some good correlationsIf one monitor these charts everyday, he would become an expert on cross-asset correlations in no time, discovering some good leading indicatorshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Face with monocle" aria-label="Emoji: Face with monocle">" class="img-responsive" style="max-width:100%;"/>

" title="A quick glance of all correlations & scatterplots among cross assetsIt is a quick& #39;n dirty way to spot some good correlationsIf one monitor these charts everyday, he would become an expert on cross-asset correlations in no time, discovering some good leading indicatorshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Face with monocle" aria-label="Emoji: Face with monocle">" class="img-responsive" style="max-width:100%;"/>